Setting Up Job Code Defaults

This section provides an overview of job code defaults and discusses how to:

Define distribution profiles.

Define salary defaults.

Define benefit plan defaults.

Define earnings defaults.

Define employer-paid tax defaults.

Assign defaults to job codes.

Pages Used to Set Up Job Code Defaults

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Distribution Profile |

BP_DISTR_PRFL |

|

Set up distribution profiles that include default distributions for salary, earnings, benefits, and tax costs. |

|

Salary Group |

BP_SAL_GRP |

|

Define salary default groups. |

|

Salary Grade Data |

WA_SAL_GRADE_D00 |

|

Inquire and update existing grades that are associated with a salary administration plan. |

|

Salary Step Data |

WA_SAL_STEP_D00 |

|

Inquire and update existing steps that are associated with a salary administration plan. |

|

Benefit Group |

BP_BNFT_GRP |

|

Define benefit default groups. |

|

Earnings Group |

BP_EARN_GRP |

|

Define earnings default groups. |

|

Employer Tax Group |

BP_TAX_GRP |

|

Define employer-paid tax default groups. |

|

Job Code Defaults |

BP_ASSIGN_JOBCD |

|

Assign the salary, benefits, earnings, and tax default groups to job codes, and associate distribution profile and union code defaults. |

|

Job Code - Maintain Dimension |

JOBCODE_D00 |

|

Inquire, update, or add a job code. |

Understanding Job Code Defaults

Job code defaults link in Planning and Budgeting compensation, distribution, and union code information. When you attach a job code to a position, you assign the compensation costs and define how the system distributes those costs to specific dimensions. If job code defaults are defined to allow override at the coordinator level, budget preparers can override these defaults at the position-detail level.

Use these defaults for existing positions, loaded from your human resource system, that do not have compensation costs associated with them and for new positions that are created using position budgeting activities.

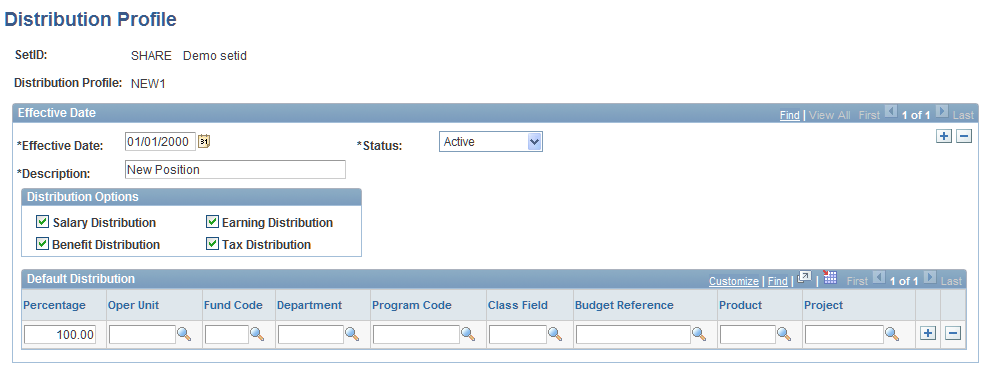

Distribution Profile Page

Use the Distribution Profile page (BP_DISTR_PRFL) to set up distribution profiles that include default distributions for salary, earnings, benefits, and tax costs.

Image: Distribution Profile page

This example illustrates the fields and controls on the Distribution Profile page. You can find definitions for the fields and controls later on this page.

Distribution Options

Default Distribution

Enter percentage values for the dimensions to define a dimension distribution.

Enter these values on each distribution row to define the portion of the compensation costs that use the defined dimension distributions. The distribution profile can contain one or multiple distribution lines. This enables you to distribute the cost of a position to multiple budgets. You can have an unlimited number of distribution lines for a distribution profile. The dimensions that appear depend on the dimensions that you use for budgeting purposes, as defined on the Dimension Configuration page.

If you leave a dimension value blank for your planning center, the system populates the dimension with the planning center value when you add a new position. In this situation, the distribution default percentage is 100 percent.

If you enter dimensions, the system uses the dimension values from the distribution profile. The coordinator can assign the distribution profile to a job code that is associated with the position to which you want to assign the default dimension values. A distribution default that is associated with a job code is global for all positions that are added by all planning centers for a job code. Leave the distribution profile default option blank on the Job Code Defaults page when your distributions are not global across job codes and planning centers.

Distributions do not include the account dimension. Assign the account defaults for salary, earnings, benefits, and tax costs for these compensation components using the salary, earnings, benefits, and employer tax group pages respectively. The preparer can override the account default at the position level if override capability is enabled in the salary, earnings, benefits, and employer tax group definitions. The account dimension values that are used are determined by the values that are assigned to salaries, benefits, earnings, or taxes at the time that the distributions are created.

Note: If your organization's labor distribution program does not support or use multiple dimension distributions for a position, define at least one distribution line with a percentage of 100.00. Assign this single distribution profile on the Position Data Defaults page for the business unit because you do not need to associate a distribution default with each job code.

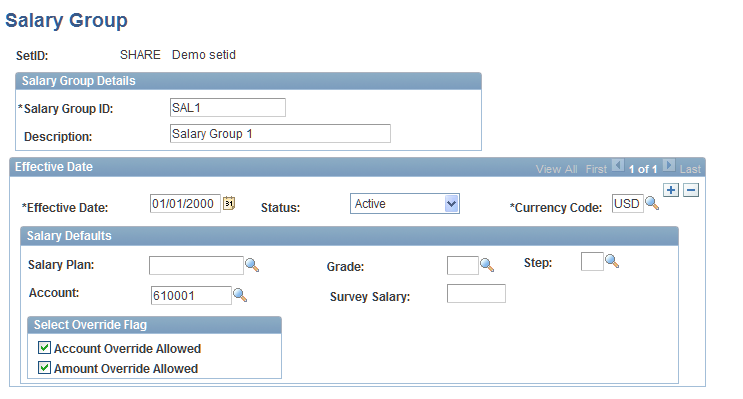

Salary Group Page

Use the Salary Group page (BP_SAL_GRP) to define salary default groups.

Image: Salary Group page

This example illustrates the fields and controls on the Salary Group page. You can find definitions for the fields and controls later on this page.

Note: Access the Salary Grade Data and Salary Step Data pages under EPM Foundation to review and update existing grades and steps that are associated with a salary plan that is imported from your human resource system.

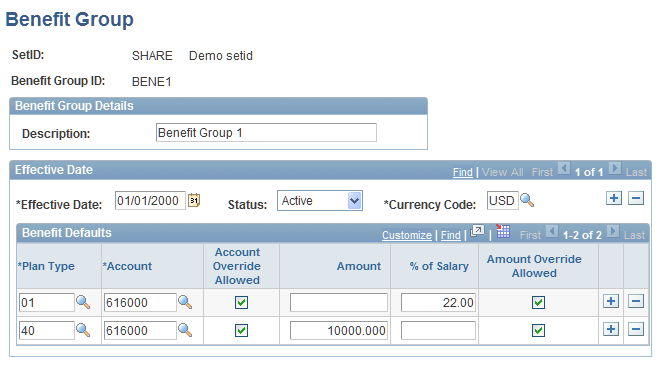

Benefit Group Page

Use the Benefit Group page (BP_BNFT_GRP) to define benefit default groups.

Image: Benefit Group page

This example illustrates the fields and controls on the Benefit Group page. You can find definitions for the fields and controls later on this page.

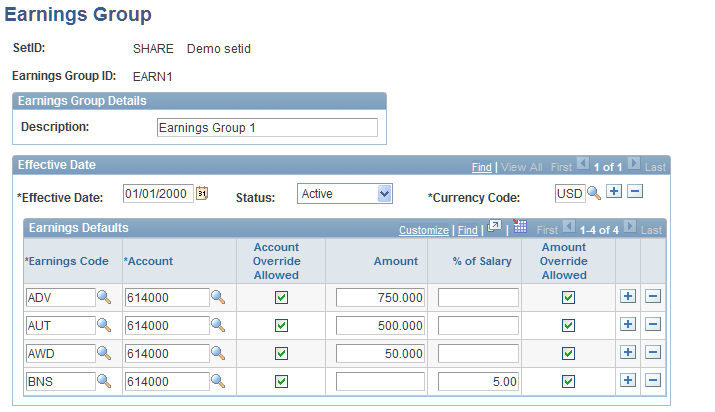

Earnings Group Page

Use the Earnings Group page (BP_EARN_GRP) to define earnings default groups.

Image: Earnings Group page

This example illustrates the fields and controls on the Earnings Group page. You can find definitions for the fields and controls later on this page.

The Amount and % of Salary fields are not required for earning codes that have the Include in OT Calculation or Calculate by Hours or Shifts option selected on the Earning Codes and Plan Types - Earning Codes page.

See Earning Codes and Plan Types - Earning Codes Page.

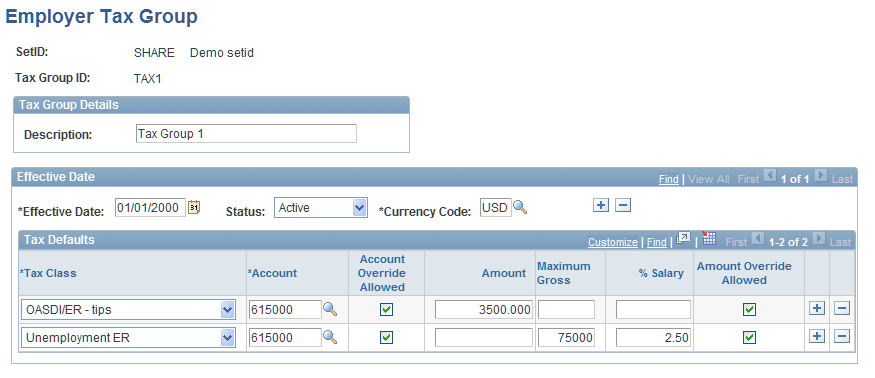

Employer Tax Group Page

Use the Employer Tax Group page (BP_TAX_GRP) to define employer-paid tax default groups.

Image: Employer Tax Group page

This example illustrates the fields and controls on the Employer Tax Group page. You can find definitions for the fields and controls later on this page.

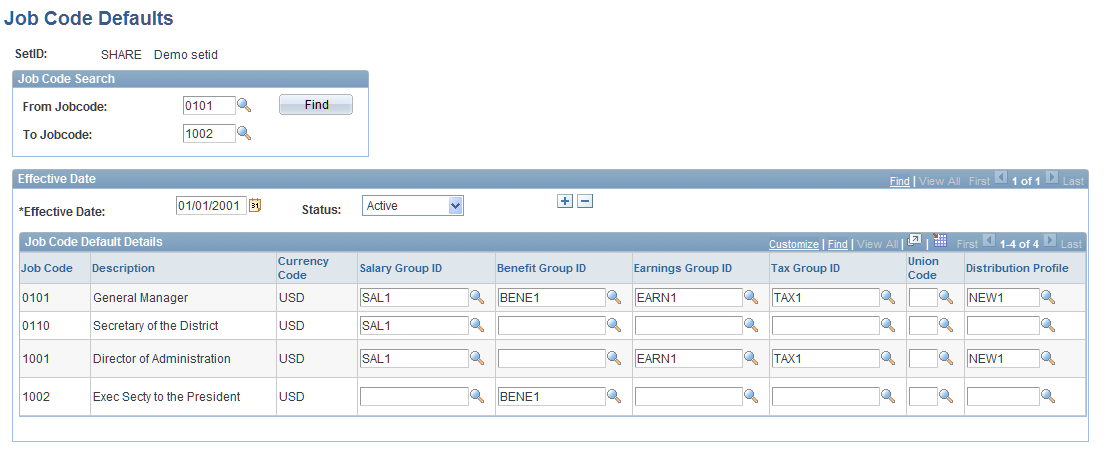

Job Code Defaults Page

Use the Job Code Defaults page (BP_ASSIGN_JOBCD) to assign the salary, benefits, earnings, and tax default groups to job codes, and associate distribution profile and union code defaults.

Image: Job Code Defaults page

This example illustrates the fields and controls on the Job Code Defaults page. You can find definitions for the fields and controls later on this page.

Note: Even if you do not want to assign any defaults at the job codes level, you must select at least one effective date to display available job codes, and then save the page to populate the record that is used for position budgeting activity. All defaults will then be extracted from the Position Data Defaults page by business unit.

If you have more than one set of accounts (more than one setID for account dimensions) for multiple models that use a single set of job code data (one setID), define any account-related defaults at the business unit level using the Position Data Defaults page.

Note: Access the Job Code - Maintain Dimension page in EPM Warehouse to inquire, update, or add job codes.