Working with Methods

Every line within a budget has a method assigned to it. A method defines how the system calculates the budget amount for the line or derives the amount if a calculation is not necessary.

This section provides an overview of method calculations, method attributes, and how methods work, lists common elements, and discusses how to use the:

AMTFTE (amount per full-time equivalent) method.

AMTHC (amount per headcount) method.

AMTPER (amount per budget period) method.

AMTUNT (amount times defined units) method.

ANN% (annual growth percentage) method.

ASSET (from asset budgeting) method.

BASBUD (base budget) method.

DISTR (distribution) method.

ECODRV (economic driver) method.

FLEX (flexible formula) method.

LINEITEM (from line item) method.

ITM (itemization) method.

JOIN method.

METH=0 (zero method amount) method.

PER% (period growth percentage) method.

POSBUD (from position budgeting) method.

RELATE (related account or statistical code) method.

UNTAMT (units times defined amount) method.

Pages Used to Work with Methods

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Line Item Details |

BP_LI_GRID |

Click the Edit link on the My Planning Workspace page. |

View, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments. |

|

Amount Per FTE (amount per full-time equivalent) |

BP_LI_AMTFTE |

|

View and modify the driver and cost per FTE used to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Amount Per Headcount |

BP_LI_AMTHC |

|

View and modify the driver and cost per headcount used to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Amount Per Period |

BP_LI_AMTPER |

|

View and manually enter a line item budget amount by budget period. Enter an adjustment amount by budget period. |

|

Amount x Defined Units |

BP_LI_AMTUNT |

|

Add and modify the cost per unit used to calculate the method amount for a line item. Also override the driver and the defined number of units. Enter an adjustment amount by budget period. |

|

Annual Growth Percentage |

BP_LI_ANNP |

|

Add and modify the base value and add the annual growth percentage rate to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Distribution Details |

BP_LI_DISTRB |

|

View and modify the driver and driver amount used to calculate the method amount for a line item. Enter an adjustment amount by budget period |

|

Economic Driver |

BP_LI_ECODRV |

|

View and modify the annual growth rate applied to a defined base. Override the base and driver. The system uses these values to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Flexible Formula |

BP_LI_FLEXFORM |

|

View and modify the Flexible Formula used to calculate the values for this line item. Enter an adjustment amount by budget period. |

|

Method Detail (page name varies with the method selected) |

BP_LI_PRD_DTL |

|

View and optionally adjust any of the following methods that share the characteristic of deriving their definition from another activity: LINEITEM, ASSET, and POSBUD. View and optionally adjust METH=0 and BASBUD methods. |

|

Itemization |

BP_LI_ITM |

|

Add and modify the items used to calculate the method amount for a line item. Enter a value or calculate a value by entering the number of units and cost per unit. Enter the spread type and budget period range for each item to be included in the method amount for a line item. Enter an adjustment amount by budget period. |

|

AMTUNT x UNTAMT |

BP_LI_JOIN |

|

View and modify the driver or driver parameters for cost and units used to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Percent Per Period |

BP_LI_PERP |

|

View and modify the base value and add any budget period growth rate used to calculate the method amount for a line item. Enter an adjustment amount by budget period. |

|

Related Account/Statistic Code |

BP_LI_RELATE |

|

View and modify a percentage or amount with which an account or statistic code is associated and calculated. The system uses these values to calculate the method amount for a line item. You can also modify the account or statistic code if override is not prevented. Enter an adjustment amount by budget period. |

|

Units x Defined Amount |

BP_LI_UNTAMT |

|

Add and modify the number of units used to calculate the method amount for a line item. Also override the driver and the defined cost per unit. Enter an adjustment amount by budget period. |

Understanding Method Calculations

The method group ID associated with a line item activity from the Activity Group page defines the methods that are available during the planning and budgeting development process.

The following methods require a calculation:

AMTFTE: The system uses a defined amount for each full-time equivalent (FTE).

AMTHC: The system uses a defined amount for each headcount.

ANN%: The system applies an annual growth rate to an historical or current base value.

ECODRV: The system applies a growth rate to an historical or current base value.

PER%: The system uses a defined growth rate for a budget period.

RELATE: The system multiplies a percentage or amount by a line item entry.

FLEX: The system calculates the budget amount using the user-defined formula specified for this line item

The following methods do not require a calculation because the system derives the budget amounts through other means:

AMTPER: Enter a budget amount by budget period.

ASSET: The system derives budget amounts from the details in the asset budgeting activity.

BASBUD: The system uses the base budget as the budget amount.

POSBUD: The system derives budget amounts from the details in the position budgeting activity.

LINEITEM: The system derives the budget amounts from the associated line item child activity.

A method can have an associated driver, driver parameter, and base. Coordinators create drivers for the methods that require them.

Methods that use delivered drivers include AMTFTE and AMTHC.

For example, you can use the BC FTE (planning center full-time equivalent) driver or the BU FTE (business unit full-time equivalent) driver for the AMTFTE method. You cannot change or add a driver for this method.

The value that you use as the driver—the driver parameter—determines the line item budget calculation. For example, suppose that the AMTFTE method uses the BC FTE driver. The coordinator defines the driver parameter as 100.00 USD. The system calculates the number of FTEs based on the position budgeting activity, and then multiplies it by 100.00 USD. You can change the driver amounts for the BC FTE driver only if the coordinator enables overrides. You cannot change the FTE count for this AMTFTE method. The system calculates it based on information in the position budgeting activity.

The following seven methods allow the use a lookup table for their driver parameters:

AMTFTE

AMTHC

AMTUNT

DISTR

FLEX

RELATE

UNTAMT

Coordinators use lookup tables to assign specific driver values to each planning center in the organization. Coordinators can choose to use these lookup tables to assign driver parameters or to define a default value for the method driver.

A method can also have a base against which the method is applied. Define the following types of method bases:

Prior year actuals

Year-to-date actuals

Current year budget

Current year forecast

History (up to five optional values that the coordinator defines)

Note: The following methods cannot be used with top-down scenario types: ASSETS, AMTFTE, AMTHC, and POSBUD.

The following methods cannot be used with forecast scenario types: ASSETS, AMTFTE, AMTHC, POSBUD, ANN%, PER%, and ECODRV.

Inflation Factors

If you want the system to calculate the line item budget for travel expenses by applying an inflation factor to the prior year actual expenditure for travel, the method base is the prior year actual expenditure figure.

The ECODRV method, which applies a growth rate to an historical value on an annual basis, uses both a driver parameter and a method base. For this method, define a growth rate (driver parameter) and an historical value (method base) on which to apply the growth rate. For example, you could specify a 5 percent growth rate (driver parameter) and apply it to the prior year budget value of 88,000.00 USD (method base) for the vehicle maintenance budget. The system calculates 92,400.00 USD as the proposed vehicle maintenance budget. For budgets that contain more than one period, such as quarterly periods, you may choose to spread the amount evenly or weight it.

Overrides

Coordinators define the default methods and the method details (driver, driver parameter, and base) for line items in the planning model. A preparer can override the defaults if the coordinator enables overrides for the method. Each method criterion has its own override check box. Overriding a method is not the same as overriding the driver, driver parameter, or method base associated with the method. For the ANN% and PER% methods, the driver parameter is not defined by the coordinator; instead, the preparer enters the parameter when preparing the budget.

Understanding Method Attributes

The following table shows the method attributes of the delivered methods. Change the method name to suit your organization's needs.

For budget preparers, detailed method definitions appear on a separate page. The method pages display similar information with variations in the use of drivers, driver parameters, and base fields depending on the method type. For the ASSET, POSBUD, METH=0, and BASBUD methods, the method detail pages are used only to make adjustments (when applicable) and to view total and period details.

|

Method ID |

Delivered Drivers |

Coordinator-Defined Drivers |

Coordinator-Defined Driver Parameter |

Required Method Base |

User Action |

|---|---|---|---|---|---|

|

AMTFTE |

BC FTE BU FTE |

No |

Yes The coordinator can define the amount per FTE. The system calculates the FTE count using position-budget data. |

NA |

Update the amount if override is allowed. |

|

AMTHC |

BC HC BU HC |

No |

Yes The coordinator can define the amount per headcount. The system calculates the headcount using position-budget data. |

NA |

Update the amount if override is allowed. |

|

AMTPER |

NA |

NA |

NA |

NA |

Enter the amount per period. |

|

AMTUNT |

No |

Yes |

Yes |

NA |

Enter the cost for predefined units. |

|

ANN% |

NA |

NA |

NA |

Yes |

Enter the growth rate. |

|

ASSET |

NA |

NA |

NA |

NA |

NA |

|

BASBUD |

NA |

NA |

NA |

NA |

NA |

|

DISTR |

No |

Yes |

Yes |

NA |

Update the amount if override is allowed. |

|

ECODRV |

No |

Yes |

Yes |

Yes |

No user action is required unless override is allowed. |

|

ITM |

QTY*COST PERSUM |

No |

NA |

NA |

Enter the number of units and cost per unit, or enter the calculated amount. |

|

JOIN |

No |

Yes |

Yes |

NA |

No user action is required unless override is allowed. |

|

LINEITEM |

NA |

NA |

NA |

NA |

NA |

|

METH=0 |

NA |

NA |

NA |

NA |

NA |

|

PER% |

NA |

NA |

NA |

Yes |

Enter the growth rate by budget period. |

|

POSBUD |

NA |

NA |

NA |

NA |

NA |

|

RELATE |

No |

Yes |

Yes |

NA |

No user action is required unless override is allowed. |

|

UNTAMT |

No |

Yes |

Yes |

NA |

Enter the number of units for predefined cost. |

|

FLEX |

No |

Yes |

NA |

NA |

Specify the Flexible Formula |

Understanding How Methods Work

This section reviews how methods work and provides examples. The methods available and their attributes, such as drivers, parameters, and analysis base, are defined by the coordinator. They can be assigned to specific accounts as a default, or available for the end users' use during line item preparation.

Note: We do not discuss the AMTPER, ASSET, BASBUD, METH=0, and POSBUD methods here because these methods do not use a driver, driver parameter, or method base.

AMTFTE

Position budgeting data defines the number of FTEs for a planning center or business unit, and is only used in conjunction with a position activity. The coordinator defines the cost per FTE to be calculated against the number of FTEs by budget period. The AMTFTE method does not use a method base. The formula for the AMTFTE method is:

(Cost per FTE for a budget period) * (Number of FTEs) = (Calculated amount for a budget period)

After the system calculates the amounts for each budget period and the totals for all budget periods, it adds them together to calculate the total method amount for the line item:

(Sum of all calculated budget period amounts) = (Method amount for line item)

For example, suppose that you are responsible for developing the office supplies budget for a new department that is starting up at the beginning of 2008. You want to accomplish this by budgeting 33.00 USD for each FTE in the department. You figure that, with the discount that your organization receives from the supplier, 33.00 USD for each FTE should be enough to cover the one-time costs of new office supplies and the ongoing costs of supplies for a year.

|

Field |

Value |

|---|---|

|

Budget Period |

Annual |

|

Amount |

33 USD |

|

Driver |

BC FTE |

Suppose that the planning center FTE value is 10. This is the number of FTEs that comes from the position budgeting data. The planning center (the new department) has 10 FTEs because that is the number of FTEs authorized to staff the new department.

|

Line Item |

2008 Total Budget Amount |

|---|---|

|

Office Supplies |

330 USD |

Note: When using the system delivered BU FTE driver with this method, the FTE count comes from the sum of all FTEs for the scenario and depends on the FTE count in the master version to capture this information. Therefore, an FTE value and calculated amount could vary until all related information is in the master version from planning center details.

AMTHC

The position budgeting data defines the headcount for a planning center or business unit, and is only used in conjunction with a position activity. The coordinator defines the cost per headcount to be calculated against the headcount by budget period. The AMTHC method does not use a method base. The formula for the AMTHC method is:

(Cost per headcount for a budget period) × (Headcount) = (Calculated amount for a budget period)

After the system calculates method amounts for all budget periods, it adds them together to calculate the total method amount for the line item:

(Sum of all calculated budget period amounts) = (Method amount for line item)

For example, suppose that you are budgeting for a business unit's annual employee recognition reception. You want to budget 7.00 USD per person for the beverages line item; so you enter 7.00 as the amount. You know that every employee within the business unit center plans to attend the event. The position budgeting data calculates a headcount of 2,670 employees in the planning center. The calculated line item budget amount is 18,690.00 USD, which is 2,670 multiplied by 7.00 USD.

Note: When using the system delivered BU HC driver with this method, the headcount (HC) comes from the sum of all headcounts for the business unit model and depends on the total headcount located in the master version to capture this information. Therefore, your headcount value and calculated amount could vary until all related information is located in the master version from planning center details.

AMTUNT

Using the AMTUNT method, the coordinator controls the number of units, and the preparer enters the cost per unit. The AMTUNT method uses a driver and driver parameters. Coordinators define drivers and driver parameters. For example, a coordinator can define drivers and driver values for such quantities as the number of trade shows planned, training classes, or items produced. Use any of these drivers and driver parameters to estimate a budget for a particular method. The method does not use a method base.

The formula for the AMTUNT method is:

(Cost per unit for a budget period) * (Number of units for a budget period) = (Calculated amount for a budget period)

After the system calculates the method amounts for all budget periods, it adds them together to calculate the total method amount for the line item:

(Sum of all calculated budget period amounts) = (Method amount for line item)

For example, suppose that you want to budget for supplies in the Customer Training Center. You want to estimate a certain amount for every student enrolled per quarter (assuming that the budget period is quarterly). The coordinator defines the number of students enrolled per quarter.

|

Budget Period |

Amount per Unit (USD) |

Number of Units (Defined at the Coordinator Level) |

Calculated Amount (USD) |

|---|---|---|---|

|

2008 Q1 |

2.00 |

2,000 |

4,000 |

|

2008 Q2 |

1.50 |

2,000 |

3,000 |

|

2008 Q3 |

2.00 |

2,500 |

5,000 |

|

2008 Q4 |

2.50 |

2,400 |

6,000 |

|

2008 Total |

18,000 |

ANN%

The ANN% method uses a method base. It does not use a driver or driver parameter. Enter an annual growth rate that the system applies to the method base to calculate the method amount. The formula for the ANN% method is:

(Method base) * [1 + (Growth rate)] = (Method amount)

For example, suppose that you use the ANN% method to estimate office supply expenses for 2008 (assuming that there are no adjustments or allocations). To apply a 5 percent growth rate to the 2001 actual expenditure for office supplies, enter Prior Year Actuals as the base and 5 for the percentage. If the annual 2001 actual expenditure for office supplies was 5,000.00 USD, the 2008 budget amount calculation is 5,250.00 USD for the year.

DISTR

Use the DISTR method to distribute or assign constant budget amounts by planning center when the activity scenario is staged for end users to work with their budgets. The DISTR method does not use a method base.

In line item budgeting, view the default values assigned to the planning center in the Amount column. If no overrides are allowed, you cannot change the driver. If overrides are allowed, select another driver. When overrides are allowed for the driver parameter, you can also change the amounts in the Amount column.

For example, suppose that the central budget office is responsible for the distribution of rent expenses across the organization. This expense is typically assigned and pushed down to the planning centers. In this case, constant dollar amounts are already assigned to an account by planning center when you copy from the base version.

ECODRV

The Economic Driver method uses a driver, driver parameter, and method base. Coordinators define the drivers, driver parameters, and method base when assigned to a specific account. For example, a coordinator can define drivers and driver values for economic indicators such as inflation rate, gross domestic product, unemployment rate, employment cost index, business licenses, and housing construction starts. Use any of these drivers and driver parameters to estimate a budget for a particular line item. The method is based on annual budget periods. It also uses a method base. Select a method base, and then enter the percentage rate that you want to apply against the base to calculate the method amount for the line item. The formula for the ECODRV method is:

(Method base) * [1 + (Percentage)] = (Method amount)

For example, suppose that you want to use the ECODRV method to estimate revenue growth based on the projected increase in sales in a region. Define a driver as regional growth and assign a driver parameter of 5 percent to it. The base is 1.5 million USD—the actual revenue figure for the prior year. The system calculates a budget amount for revenue of 1.575 million USD.

ITM

The ITM method does not use driver parameters or a method base. Define an item, select one of the delivered drivers, and then enter values for each item that the system uses to calculate the method amount. The formula for the ITM method using QTY*COST is:

(Number of units) * (Cost per unit) = (Calculated amount)

The formula for the ITM method using PERSUM is:

(Sum of calculated amounts for all items) = (Method amount)

|

Line Item |

2008 Quarter 1 |

2008 Quarter 2 |

2008 Quarter 3 |

2008 Quarter 4 |

2008 Total Budget Amount |

|---|---|---|---|---|---|

|

Travel Expenses (USD) |

2,000 |

8,000 |

2,000 |

5,000 |

17,000 |

|

Line Item |

Description |

Number of Units |

Cost Per Unit (USD) |

Spread Type |

From Budget Period |

To Budget Period |

|---|---|---|---|---|---|---|

|

1 |

Annual conference trips |

5 |

1,200 |

Spread |

2008-Q2 |

2008-Q2 |

|

2 |

Bus transportation for the employee appreciation event |

6 |

500 |

Spread |

2008-Q4 |

2008-Q4 |

|

3 |

Trips to national city and county managers' conferences |

2 |

4,000 |

Spread |

2008-Q1 |

2008-Q4 |

JOIN

The JOIN method combines the existing methods UNTAMT and AMTUNT into one method. It multiplies the defined amount by the defined unit. The JOIN method provides the driver parameter values for the amount per unit and number of units. Coordinators define the drivers and driver parameters. A coordinator can define drivers and set standard costs or number of units. This method requires a known number of units (such as number of computers) and the cost per unit must be defined. These components have already been linked and assigned a driver ID such as COMPUTERS. For example, when you select COMPUTERS as the driver ID, the system provides information by period for units and cost.

If the coordinator allows overrides of the driver parameter, change the parameters by entering new amounts in place of existing ones. If the coordinator allows driver overrides, change the driver, but only if there are other JOIN drivers defined. If overrides are not allowed, both the Number of Units column and the Cost Per Unit column are display-only.

This method can be associated with a driver lookup table by default.

For example, suppose that the coordinator defines the number of units per budget period as 2 and the cost per unit of travel as 2,500.00 USD. For any type of employee travel, the standard cost estimate per trip is 2,500.00 USD. The new travel policy for the department allows only two trips per month.

The coordinator defines a driver called TRAVEL to calculate two trips per month per department at a cost of 2,500.00 USD each. You know that in December there will be three authorized trips and that in August there will be only one. In this case, you could select the TRAVEL driver, and then override the entries for the 8th and 12th budget periods.

|

Budget Period |

Number of Units (Defined at the Coordinator Level) |

Amount Per Unit (USD) (Defined at the Coordinator Level) |

Calculated Amount (USD) |

|---|---|---|---|

|

2008 Month 1 |

2 |

2,500 |

5,000 |

|

2008 Month 2 |

2 |

2,500 |

5,000 |

|

2008 Month 3 |

2 |

2,500 |

5,000 |

|

2008 Month 4 |

2 |

2,500 |

5,000 |

|

2008 Month 5 |

2 |

2,500 |

5,000 |

|

2008 Month 6 |

2 |

2,500 |

5,000 |

|

2008 Month 7 |

2 |

2,500 |

5,000 |

|

2008 Month 8 |

1 |

2,500 |

2,500 |

|

2008 Month 9 |

2 |

2,500 |

5,000 |

|

2008 Month 10 |

2 |

2,500 |

5,000 |

|

2008 Month 11 |

2 |

2,500 |

5,000 |

|

2008 Month 12 |

3 |

2,500 |

7,500 |

|

2008 Total |

60,000 |

PER%

The PER% method uses a method base. The PER% method does not use a driver or driver parameter. Enter a growth rate value for each budget period. The system applies the growth rate to the method amount for the prior budget period. The formula for the PER% method is:

(Prior budget period calculated amount) * [1 + (Budget period growth rate)] = (Next budget period calculated amount)

There is one exception to this formula. No prior budget period calculated amount exists for the first budget period calculated amount. The calculated amount for the first budget period uses the defined method base. The system uses this formula to calculate the first budget period calculated amount:

(Last budget period of method base) * [1 + (Budget period growth rate)] = (Calculated amount for the first budget period)

After the system calculates the amounts for all budget periods, it adds them together to calculate the total method amount for the line item.

(Sum of all calculated budget period amounts) = (Method amount for line item)

For example, suppose that you want to generate a 2008 budget amount for telephone expenses using the PER% method and you have quarterly budget periods. Assume there are no adjustments or allocations. You define base as Current Year Budget, which has a Q4 budget amount of 100.00 USD.

|

Budget Period |

Percentage |

|---|---|

|

Q1 |

20 |

|

Q2 |

10 |

|

Q3 |

50 |

|

Q4 |

25 |

|

Line Item |

2008 Quarter 1 |

2008 Quarter 2 |

2008 Quarter 3 |

2008 Quarter 4 |

2008 Total Budget Amount |

|---|---|---|---|---|---|

|

Telephone Expenses (USD) |

120.00 |

132.00 |

198.00 |

247.50 |

697.50 |

RELATE

The RELATE method lets you define a line item budget by associating it with other account or statistical code amounts. Define these line item amounts or rates at a single, global level or value, or assign a lookup table driver to reference values specific to a planning center. The RELATE method accommodates the following scenarios in a line item activity:

To calculate anticipated overtime expenses, you could use the RELATE method to define a global percentage of 5 percent to be multiplied times account 610000 for employee salary. In this case, the driver is associated with the driver ID name, account, and percent value. The account reference is display-only if the coordinator prohibits driver parameter overrides.

An example using a statistical code follows:

To calculate the anticipated overtime expenses using the statistical code, the budget office could assign a lookup ID to the driver and use a statistical code instead of an account. In this case, the Basis and Value Type columns display the statistical source value used to calculate total overtime hours. The Value column represents an amount or rate applied against this statistical amount. In this case, the value is drawn from the driver lookup table (if a value exists for the planning center).

UNTAMT

In the UNTAMT method, the coordinator controls the costs per unit and the preparer enters the number of units. The UNTAMT method uses a driver and driver parameter. Coordinators define the drivers and driver parameters. A coordinator can define drivers and set standard costs for such items as airfare, hotel accommodations, computers, desk furniture, and vehicles. Use these drivers and driver parameters to estimate a budget for these items. The method does not use a method base. The preparer enters the number of units to be calculated against the cost per unit by budget period.

The formula for the UNTAMT method is:

(Number of units for a budget period) * (Cost per unit for a budget period) = (Calculated amount for a budget period)

After the system calculates the method amounts for all budget periods, it adds them together to calculate the total method amount for the line item:

(Sum of all calculated budget period amounts) = (Method amount for line item)

Suppose that the coordinator defines the cost per unit of travel as 2,500.00 USD for all budget periods. For any type of employee travel, the standard cost estimate per trip is 2,500.00 USD. You do not override this predefined cost per trip. You have monthly budget periods. You enter the number of trips estimated for the planning center for each month, and the budget amounts per budget period are calculated as shown in the following table:

|

Budget Period |

Number of Units |

Amount Per Unit (USD) (Defined at the Coordinator level) |

Calculated Amount (USD) |

|---|---|---|---|

|

2008 Month 1 |

0 |

2,500 |

0 |

|

2008 Month 2 |

2 |

2,500 |

5,000 |

|

2008 Month 3 |

1 |

2,500 |

2,500 |

|

2008 Month 4 |

0 |

2,500 |

0 |

|

2008 Month 5 |

4 |

2,500 |

10,000 |

|

2008 Month 6 |

0 |

2,500 |

0 |

|

2008 Month 7 |

2 |

2,500 |

5,000 |

|

2008 Month 8 |

3 |

2,500 |

7,500 |

|

2008 Month 9 |

7 |

2,500 |

17,500 |

|

2008 Month 10 |

1 |

2,500 |

2,500 |

|

2008 Month 11 |

0 |

2,500 |

0 |

|

2008 Month 12 |

5 |

2,500 |

12,500 |

|

2008 Total |

25 |

2,500 |

62,500 |

Common Elements Used in this Section

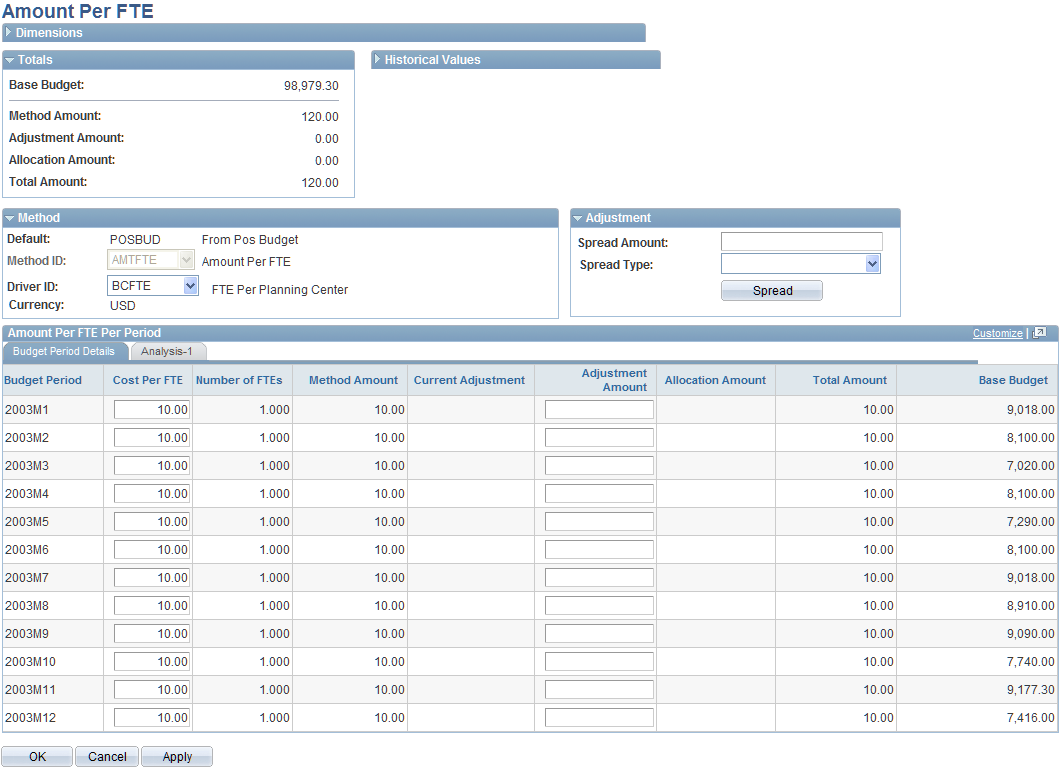

Amount Per FTE (amount per full-time equivalent) Page

Use the Amount Per FTE (amount per full-time equivalent) page (BP_LI_AMTFTE) to view and modify the driver and cost per FTE used to calculate the method amount for a line item.

Enter an adjustment amount by budget period.

Select AMTFTE from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Amount Per FTE page

This example illustrates the fields and controls on the Amount Per FTE page. You can find definitions for the fields and controls later on this page.

The AMTFTE method uses a driver and driver parameter. Select one of the delivered drivers as the driver of the method. The coordinator cannot add other drivers since they are system defined.

Note: If your organization does not use position budgeting, the coordinator can disable the AMTFTE method to make it unavailable.

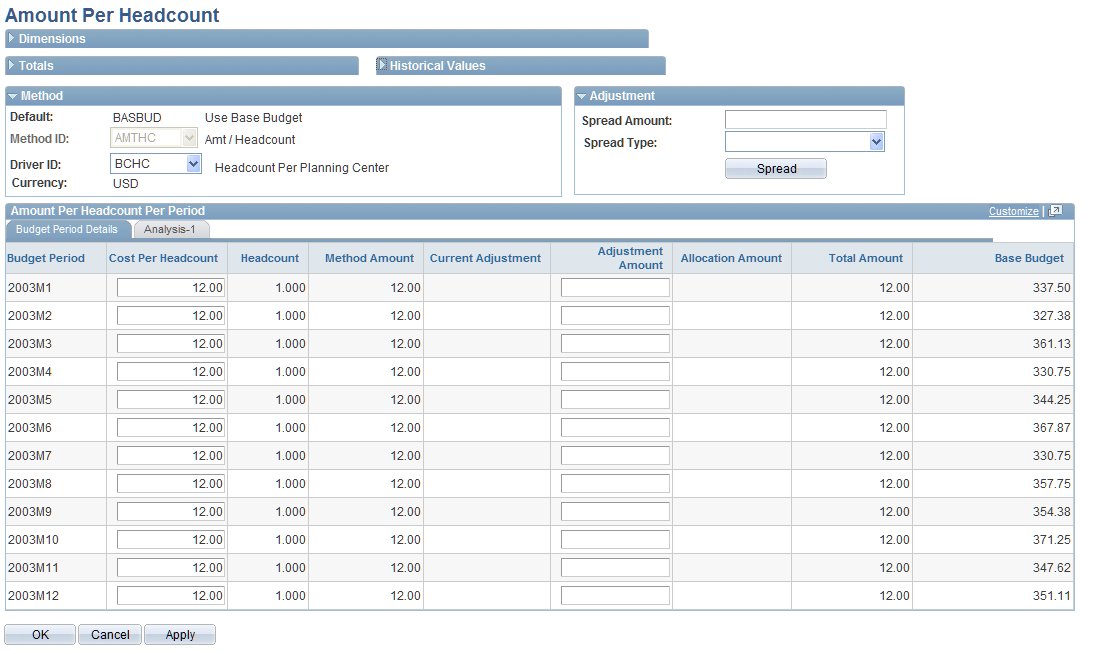

Amount Per Headcount Page

Use the Amount Per Headcount page (BP_LI_AMTHC) to view and modify the driver and cost per headcount used to calculate the method amount for a line item.

Enter an adjustment amount by budget period.

Select AMTHC from the Method ID dropdown list box

Click the Amount link on the Line Item Details page.

Image: Amount per Headcount page

This example illustrates the fields and controls on the Amount per Headcount page. You can find definitions for the fields and controls later on this page.

The AMTHC method uses a driver and driver parameter. Select one of the delivered drivers as the driver of the method. The coordinator cannot add other drivers since they are system defined.

Note: If your organization does not use position budgeting, the coordinator can disable the AMTHC method to make it unavailable.

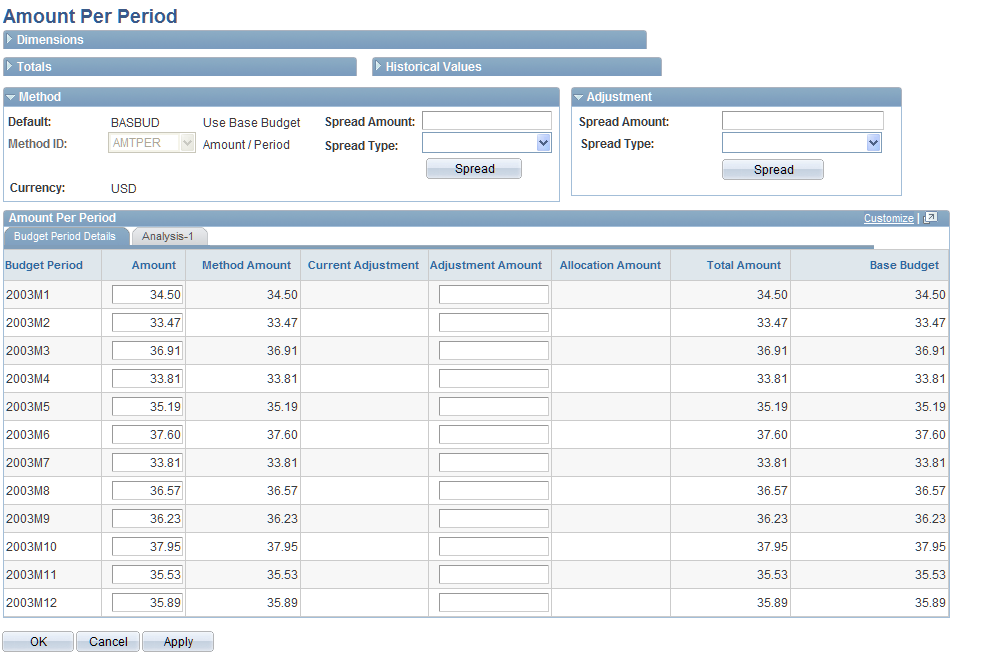

Amount Per Period Page

Use the Amount Per Period page (BP_LI_AMTPER) to view and manually enter a line item budget amount by budget period.

Enter an adjustment amount by budget period.

Select AMTPER from the Method ID dropdown list box

Click the Amount link on the Line Item Details page.

Image: Amount Per Period page

This example illustrates the fields and controls on the Amount Per Period page. You can find definitions for the fields and controls later on this page.

The AMTPER method does not use a driver, driver parameter, or method base. Use the AMTPER method to enter budget amounts by budget period to determine the amount for the line item. Applying the AMTPER method to a line item lets you manually control the amount to budget per budget period.

Note: The AMTPER method is the only one that allows update into a spreadsheet interface when using the spreadsheet add-in option for line item activities.

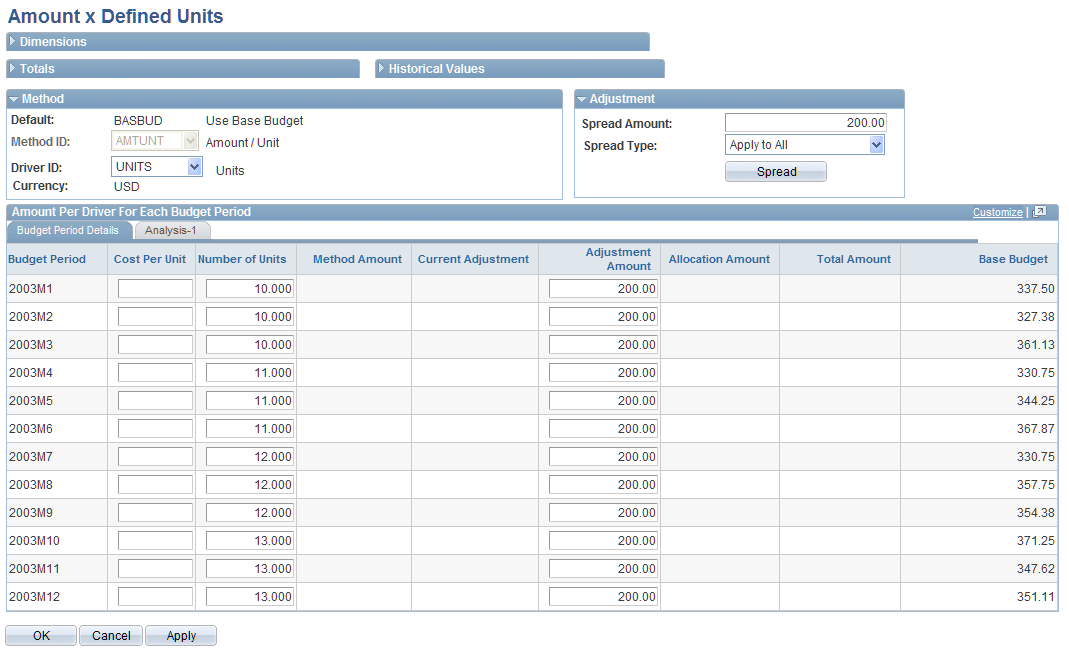

Amount x Defined Units Page

Use the Amount x Defined Units page (BP_LI_AMTUNT) to add and modify the cost per unit used to calculate the method amount for a line item.

Also override the driver and the defined number of units. Enter an adjustment amount by budget period.

Select AMTUNT from the Method ID dropdown list box

Click the Amount link on the Line Item Details page.

Image: Amount x Defined Units page

This example illustrates the fields and controls on the Amount x Defined Units page. You can find definitions for the fields and controls later on this page.

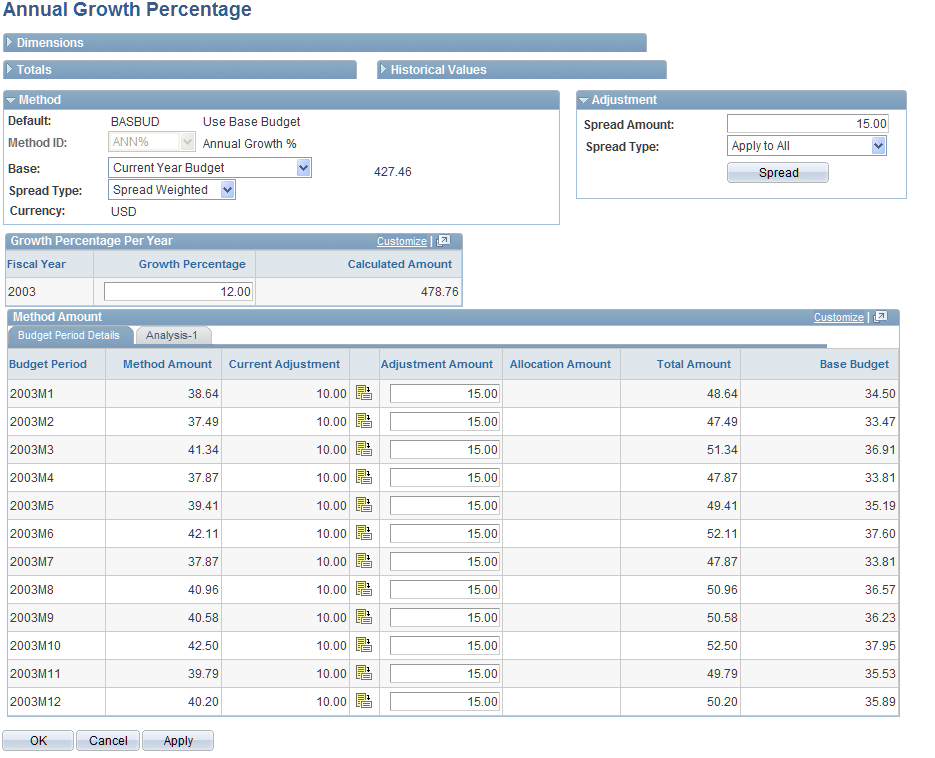

Annual Growth Percentage Page

Use the Annual Growth Percentage page (BP_LI_ANNP) to add and modify the base value and add the annual growth percentage rate to calculate the method amount for a line item.

Enter an adjustment amount by budget period.

Select ANN% from the Method ID dropdown list box

Click the Amount link on the Line Item Details page.

Image: Annual Growth Percentage page

This example illustrates the fields and controls on the Annual Growth Percentage page. You can find definitions for the fields and controls later on this page.

Line Item Details Page

Use the Line Item Details page (BP_LI_GRID) to view, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments.

The ASSET method does not use a driver, driver parameter, or method base. Assign the ASSET method to line items on the Line Item Details page in the budget to indicate that the budget amounts are calculated from asset data. When working with a balance sheet planning activity, the starting balance for balance sheet accounts can be populated from the Asset activity when including in-service assets from your source system. This starting balance represents the asset's original cost. Dimension combinations within line item activity pick up asset values defined in detail within the Asset Budgeting activity. The coordinator typically assigns the ASSET method as a default to all asset and depreciation accounts, and optionally the cash account when used.

The preparer cannot modify a method amount for a line item with the ASSET method. However, authorized users can apply adjustments, apply allocations, and select to hold the line item from mass adjustments. Preparers can also override the ASSET method assigned to a line item if the coordinator enables method overrides.

Note: If your organization does not use asset budgeting, the coordinator can disable the ASSET method to make it unavailable.

Line Item Details Page

Use the Line Item Details page (BP_LI_GRID) to view, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments.

For all line item activities, the source or seed data populating the proposed plan or budget is referred to as the base budget (BASBUD method).

The BASBUD method does not use a driver, driver parameter, or method base. The coordinator assigns the BASBUD method to line items to indicate that the budget amounts are derived from some historical base or historical amount. This base budget can serve as a starting point to prepare line item activities. The starting balance for balance sheet accounts defaults from the analysis base amount when available. Apply adjustments and allocations, and then select to hold the line item from mass adjustments. If the budget includes line items assigned the BASBUD method, preparers can override the method if the coordinator enables method overrides.

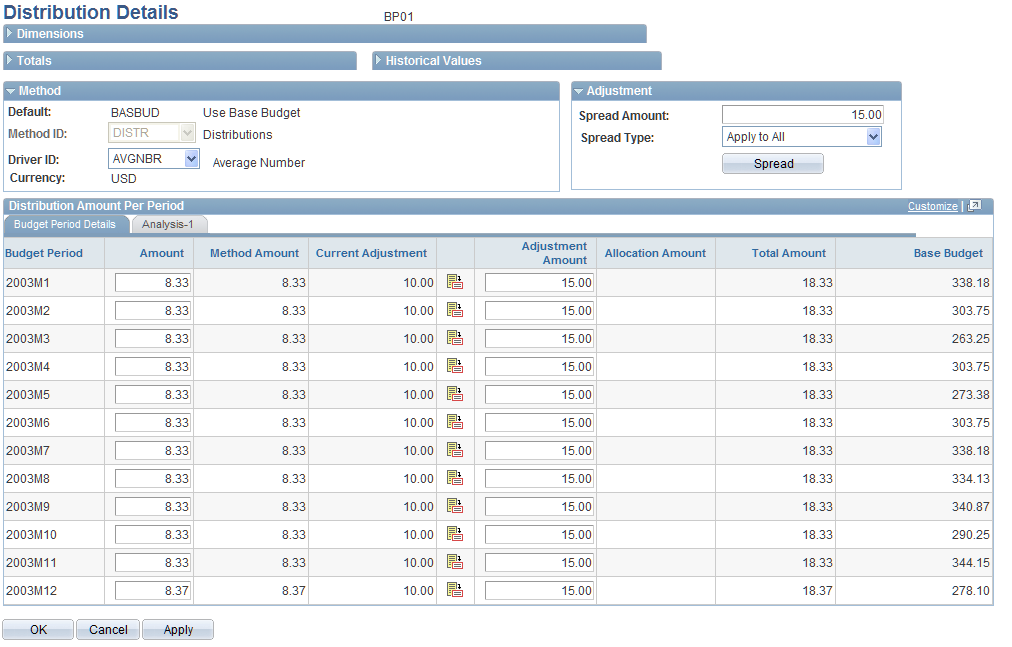

Distribution Details Page

Use the Distribution Details page (BP_LI_DISTRB) to view and modify the driver and driver amount used to calculate the method amount for a line item.

Enter an adjustment amount by budget period

Select DISTR from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Distribution Details page

This example illustrates the fields and controls on the Distribution Details page. You can find definitions for the fields and controls later on this page.

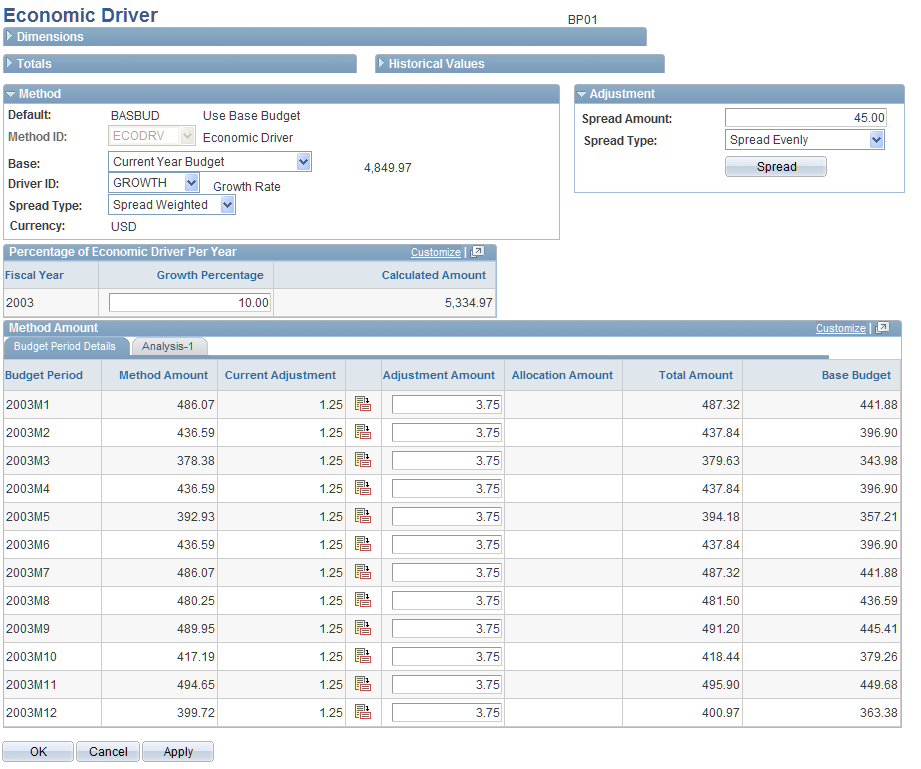

Economic Driver Page

Use the Economic Driver page (BP_LI_ECODRV) to view and modify the annual growth rate applied to a defined base.

Override the base and driver. The system uses these values to calculate the method amount for a line item. Enter an adjustment amount by budget period.

Select ECODRV from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Economic Driver page

This example illustrates the fields and controls on the Economic Driver page. You can find definitions for the fields and controls later on this page.

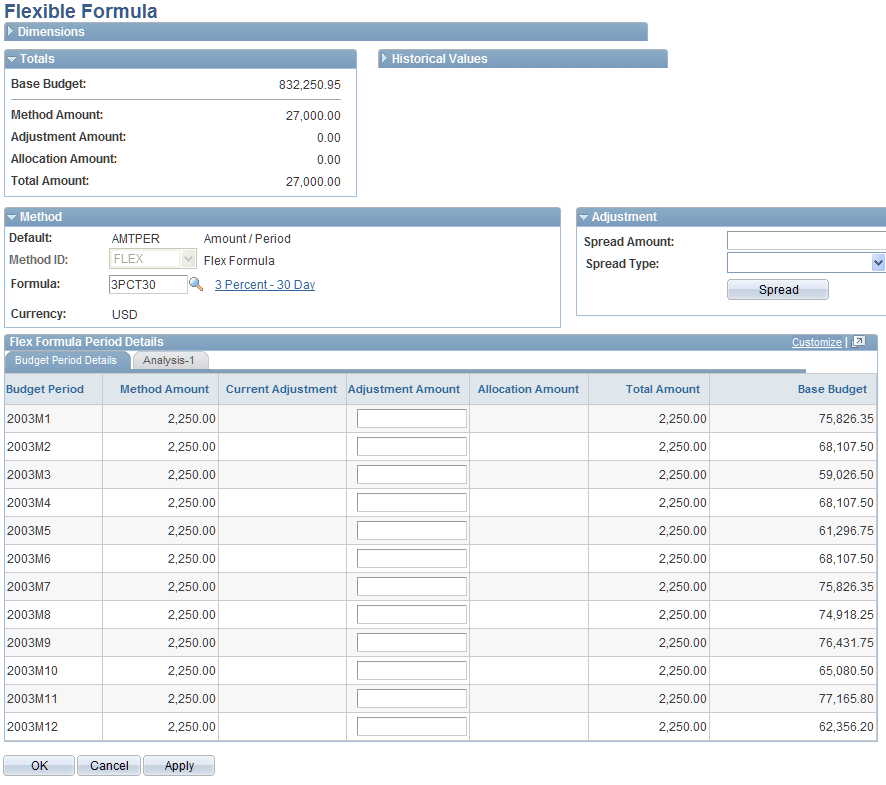

Flexible Formula Page

Use the Flexible Formula page (BP_LI_FLEXFORM) to view and modify the Flexible Formula used to calculate the values for this line item.

Enter an adjustment amount by budget period.

Select FLEX from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Flexible Formula page

This example illustrates the fields and controls on the Flexible Formula page. You can find definitions for the fields and controls later on this page.

Line Item Details Page

Use the Line Item Details page (BP_LI_GRID) to view, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments.

The LINEITEM method does not use a driver, driver parameter, or method base. Assign the LINEITEM method to line items in the budget to indicate that the budget amounts are calculated from another line item activity. Dimension combinations within the line item activity pick up values defined in detail within the other line item activity. The coordinator typically assigns the LINEITEM method to accounts when data is from another line item activity.

If the line item using this method is a balance sheet line item, then the system displays a starting balance row. If the source/child for this line item does not have a starting balance, then the starting balance defaults to 0. Use the Adjustment Amount field to manually override the starting balance amount.

The preparer cannot modify a method amount for a line item with the LINEITEM method. However, authorized users can apply adjustments, apply allocations, and select to hold the line item from mass adjustments. Preparers can also override the LINEITEM method assigned to a line item if the coordinator enables method overrides.

Note: When using the LINEITEM method, keep in mind this relationship requires that the source data from the child activity must come from the master version. Therefore, it may be necessary for a user to copy their budget to master in order to reflect the most current information in the parent line item activity.

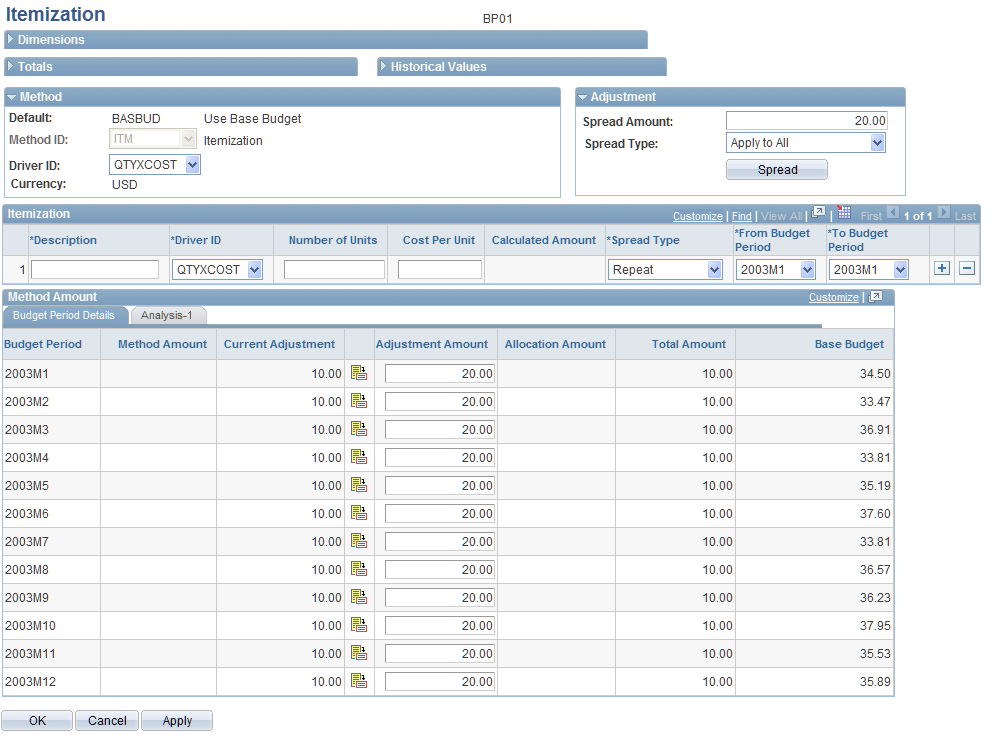

Itemization Page

Use the Itemization page (BP_LI_ITM) to add and modify the items used to calculate the method amount for a line item.

Enter a value or calculate a value by entering the number of units and cost per unit. Enter the spread type and budget period range for each item to be included in the method amount for a line item. Enter an adjustment amount by budget period.

Select ITM from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Itemization page

This example illustrates the fields and controls on the Itemization page. You can find definitions for the fields and controls later on this page.

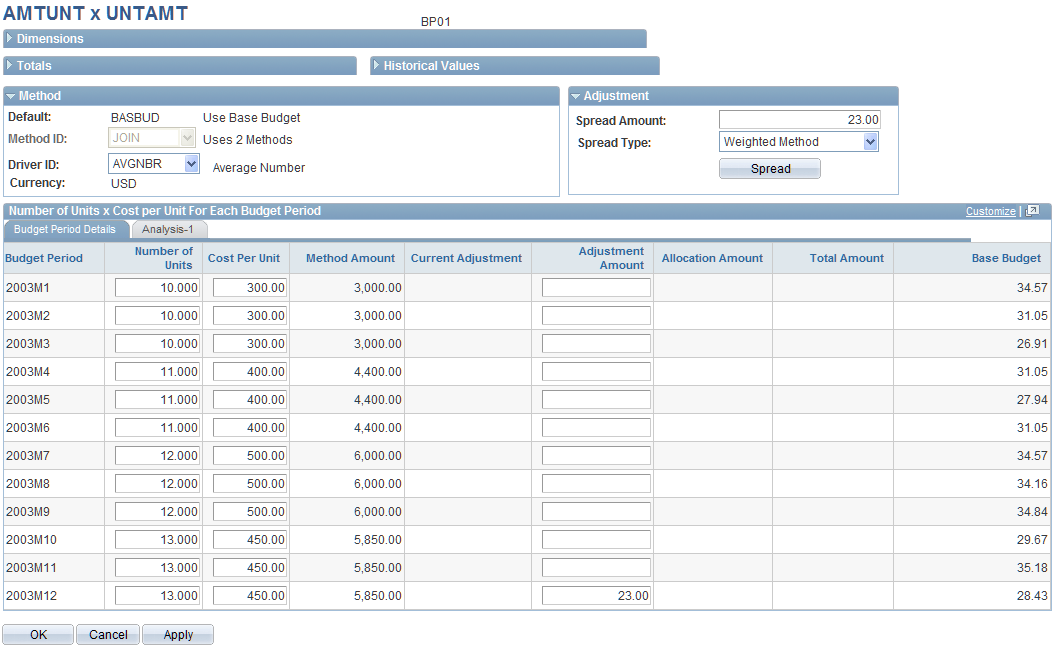

AMTUNT x UNTAMT Page

Use the AMTUNT x UNTAMT page (BP_LI_JOIN) to view and modify the driver or driver parameters for cost and units used to calculate the method amount for a line item.

Enter an adjustment amount by budget period.

Select JOIN from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Amtunt x Untamt page

This example illustrates the fields and controls on the Amtunt x Untamt page. You can find definitions for the fields and controls later on this page.

Line Item Details Page

Use the Line Item Details page (BP_LI_GRID) to view, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments.

The METH=0 method does not use a driver, driver parameter, or method base. Because you cannot delete existing, detailed line item rows, assign the METH=0 method to a line item to indicate that the budget amount is 0. The method amount for a line item using METH=0 has a 0 value. Apply adjustments, allocations, and then select to hold the line item from mass adjustments. If the budget includes line items assigned the METH=0 method, preparers can override the method if the coordinator enables method overrides.

For balance sheet accounts, the system displays a row for the starting balance, which defaults to 0. Use the Adjustment Amount field to manually override the starting balance default, unless the account default, as defined in the Assign Planning Method Defaults page, does not permit adjustments.

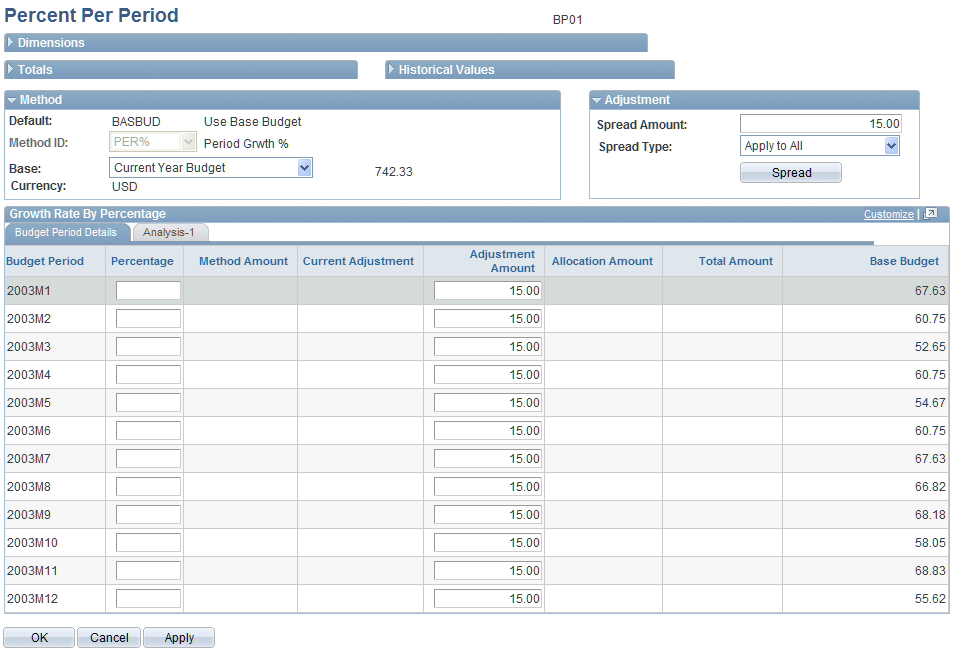

Percent Per Period Page

Use the Percent Per Period page (BP_LI_PERP) to view and modify the base value and add any budget period growth rate used to calculate the method amount for a line item.

Enter an adjustment amount by budget period.

Select PER% from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Percent Per Period page

This example illustrates the fields and controls on the Percent Per Period page. You can find definitions for the fields and controls later on this page.

Line Item Details Page

Use the Line Item Details page (BP_LI_GRID) to view, add, and modify budget amounts using methods; manually enter budget amounts for a line item; protect a line item budget from mass adjustments.

The POSBUD method does not use a driver, driver parameter, or method base. Assign the POSBUD method to line items in the budget to indicate that the budget amounts are calculated from position budgeting data. The coordinator typically assigns the POSBUD method to all personnel accounts (salary, earnings, and benefits accounts). The preparer cannot modify a method amount for a line item with the POSBUD method. However, authorized users can apply adjustments, apply allocations, and select to hold the line item from mass adjustments. Preparers can override the POSBUD method assigned to a line item on the Line Item Details page if the coordinator enables method overrides.

There is no starting balance available for this type of method, since POSBUD only supports expense planning.

Note: If your organization does not use position budgeting, the coordinator can disable the POSBUD method to make it unavailable.

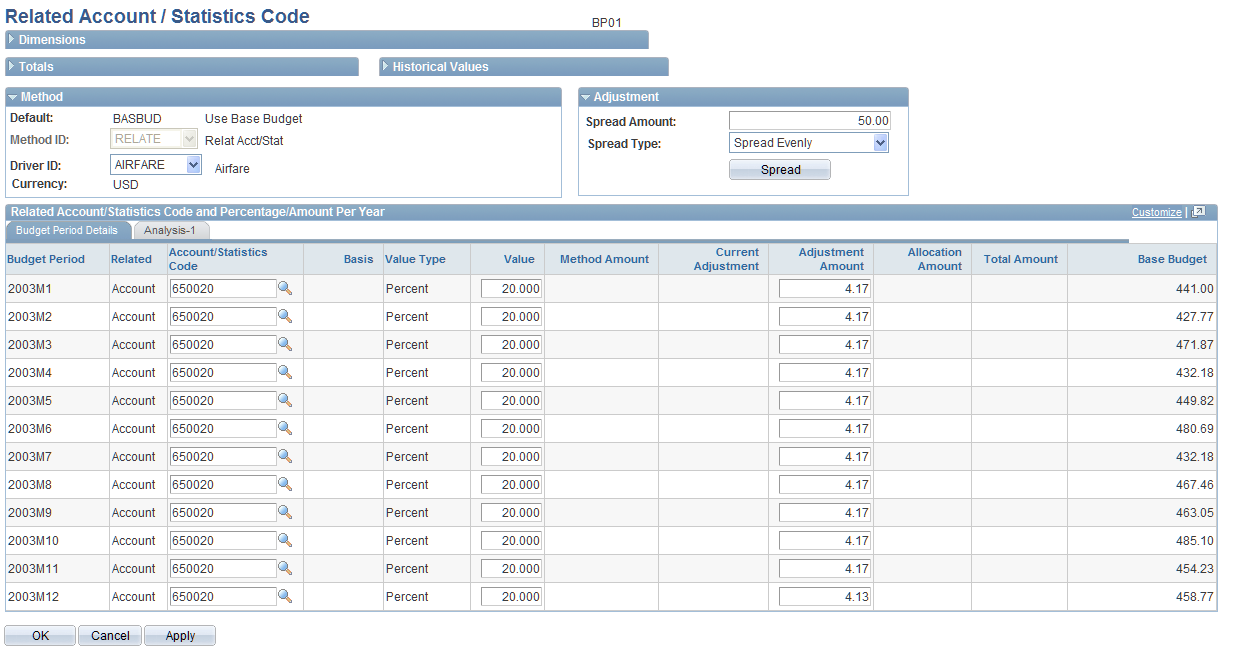

Related Account/Statistic Code Page

Use the Related Account/Statistic Code page (BP_LI_RELATE) to view and modify a percentage or amount with which an account or statistic code is associated and calculated.

The system uses these values to calculate the method amount for a line item. You can also modify the account or statistic code if override is not prevented. Enter an adjustment amount by budget period.

Select RELATE from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Related Account / Statistics Code page

This example illustrates the fields and controls on the Related Account / Statistics Code page. You can find definitions for the fields and controls later on this page.

If overrides are allowed for the driver parameter, changes to the Account/Statistics Code column and the Value Type column can affect the calculated amount.

An override option set by coordinator lets you select a different driver ID to associate with another account predefined by the budget coordinator. When override is enabled for the driver, selecting a different driver can change the lookup ID and account or statistics code to the code that the coordinator defined for the driver.

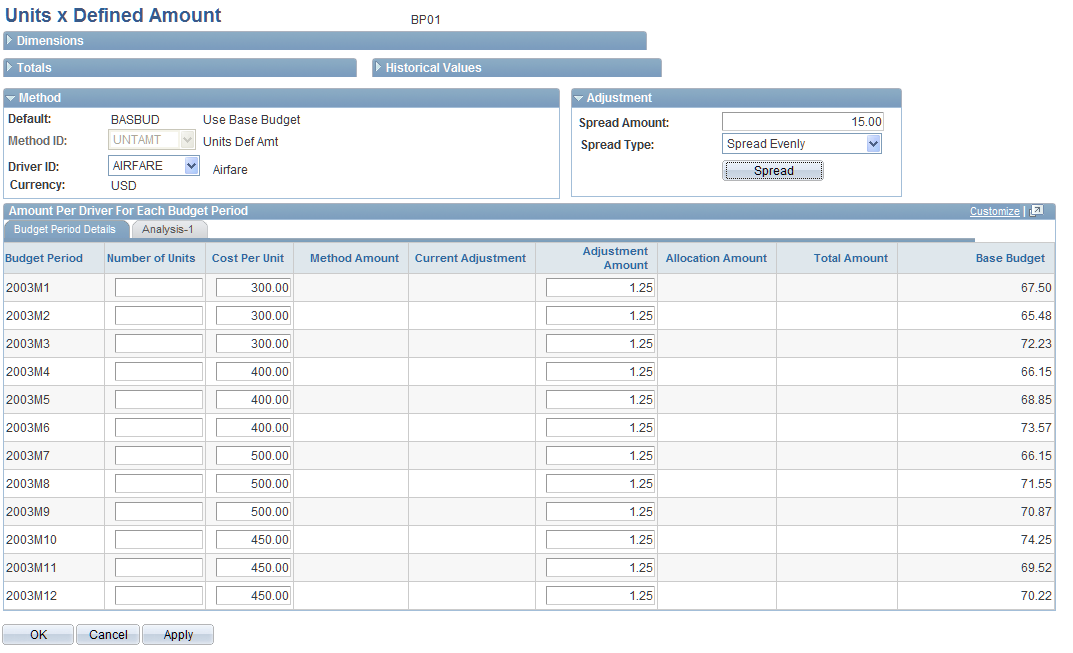

Units x Defined Amount Page

Use the Units x Defined Amount page (BP_LI_UNTAMT) to add and modify the number of units used to calculate the method amount for a line item.

Also override the driver and the defined cost per unit. Enter an adjustment amount by budget period.

Select UNTAMT from the Method ID dropdown list box.

Click the Amount link on the Line Item Details page.

Image: Units x Defined Amount page

This example illustrates the fields and controls on the Units x Defined Amount page. You can find definitions for the fields and controls later on this page.