Understanding Consolidation Rules

Prior to processing consolidations, you need to establish required rules that control how the processes consolidations and specify:

The accounts to use to determine if the ledger is balanced.

An acceptable limit for out of balance amounts and where the out of balance amounts should be posted.

Percent ownership of subsidiaries, equitization thresholds, and accounting methods.

Rules for closing accounts at period or year end and rolling forward balances to the next period.

These rules are then associated with the consolidation model and govern the processing of various consolidation engines. These topics cover how to establish each of these rules, associate them with the consolidation model, and validate them.

After these required rules are established, you define additional rules that determine how the system eliminates intercompany transactions, investments in subsidiaries, and non-controlling interest.

You can also establish flows, which track account movement (data flows) from the consolidated ledger.

When put together, all these rules define a consolidation model, and specify all of the parameters that are used as input into consolidation processing.

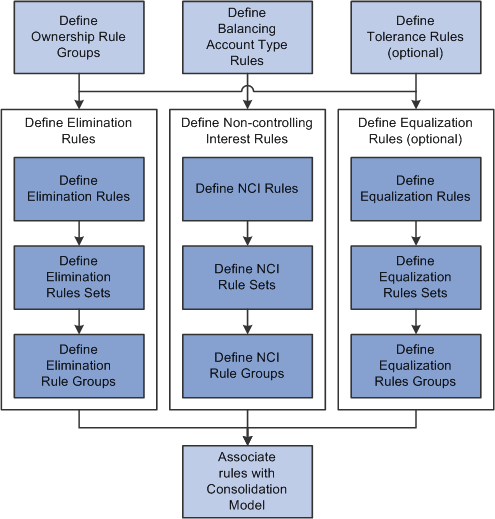

Image: Defining Consolidation Rules

This diagram shows the supporting data and rules that you define prior to processing consolidations:

Consolidation Rules

There are several types of consolidation rules that are associated with the consolidation model:

|

Consolidation Rule Name |

Rule Definition |

|---|---|

|

Tolerance rules |

These rules define an acceptable limit or threshold for out of balance amounts for journals generated by the consolidation processes. |

|

Account balance rules |

These rules specify which accounts within the consolidation ledger are used to determine if the ledger is balanced. |

|

Ownership rules |

These rules specify the accounting methods, equitization thresholds, and ownership levels of a parent for a subsidiary. They are based on the total and voting shares owned by the parent. Ownership rules should be established before you establish elimination, NCI, and equitization rules. |

|

Elimination rules |

These rules identify the accounts that store balances due to intercompany transactions, so that the system can eliminate those amounts from the consolidated results. |

|

Non-controlling interest rules (NCI rules) |

These rules identify the accounts that store balances for a parent's investment in a subsidiary and subsidiary equity, so that the system can eliminate each parent's investment against subsidiary equity and eliminate the remaining portion of subsidiary equity that is attributable to non-controlling interest from the consolidated results. For example, if a parent owns 80 percent of a subsidiary (the remaining 20 percent is externally owned), the NCI elimination engine eliminates 100 percent of the parent investment against 80 percent of the subsidiary equity, and then also eliminates the remaining 20 percent of the subsidiary equity against an entry to NCI Liability. |

|

Equitization rules |

These rules define how the system recognizes a parent's equity in the earnings of a qualifying subsidiary. |

|

Flow templates |

Flow templates define how the system recognizes tracking and reconciliation of gross variation (difference between the opening and closing balances) of an account. For example, the gross variation of fixed asset accounts can be distinguished by additions, disposals, , asset impairment, currency translation and reclasses. |

Rules, Rule Sets, and Rule Groups

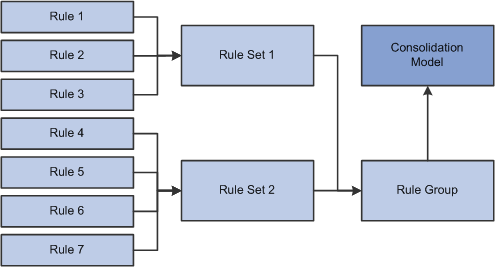

To enable you to share rules among multiple consolidation models, to facilitate using multiple scenarios, and to reduce ongoing maintenance, there is a hierarchy to many of the various rule definitions used for consolidations. At the lowest level, you define an individual rule, and then combine these rules into rule sets, and finally, one or more rule sets comprise a rule group. The rule groups are then associated with the consolidation model. Ownership rules, non-controlling interest rules, equitization rules, and elimination rules follow this hierarchy. The following diagram shows these relationships.

Image: Hierarchy of rules, rule sets, and rule groups

This diagram shows the relationship between ownership rules, non-controlling interest rules, equitization rules, and elimination rules

When you associate a rule set with a rule group, you assign it a use order. During processing, the rule sets are processed in sequence in ascending order based on their use order. Unless otherwise specified, within each rule set, the rules are processed by ownership set and rule ID.

When you are defining a new consolidation scenario, you can share or reuse rules, rule sets, and rule groups that you've already created for a previous consolidation model, provided that their consolidation ledgers share the same ledger template and consolidation dimension. When reusing rule sets in new rule groups, you specify a different use order, or insert new rule sets to override the current use order.