Understanding Data Flows

PeopleSoft Global Consolidations flows feature provides the ability to capture the change in account balances for a specified period. By considering the different type of flows (or activities) affecting the net balance of an account, you can reconcile account variation using account activities that traditional ledger mapping of accounts is unable to capture.

Data flows for consolidations are used to track and reconcile gross variation. Gross variation is the difference between the opening and closing balances of an account, which can be caused by many activities. For example, the gross variation of fixed asset accounts could be distinguished by additions, disposals, asset impairment, currency translation, and reclassification. Reporting the data flow for specific accounts is often required as part of regulatory reporting.

To track flow amounts you establish flow codes. Flow codes can track each of the activities associated with account balances so that you can easily determine the impact of each activity on the change in account balance. There are two types of flow codes: pre-defined system flow codes and manual flow codes:

System flow codes capture the system-generated information you need for any type of account, such as the opening balance of an account, the closing balance, translation adjustments, and the total amount of change.

The amounts associated with these flow codes are captured by the system. You cannot change them. System flow codes are pre-defined. You can modify certain attributes of system flow codes, but you cannot create your own.

Manual flow codes capture additional activities that are specific for certain types of accounts, such as the acquisition and disposal of fixed assets. The amounts associated with these flow codes can be entered manually, or captured by the system if the manual flow codes are added to consolidation rules and journal entries. You can review, change, and add the amounts for manual flow codes.

PeopleSoft provides several pre-defined manual flow codes with the sample data that you can import to your database. You can also create your own.

Note: When building an nVision layout that uses GC Flow codes, use a detail value table for the manual flow code table and use a system flow code tree. This will ensure that you can use both system and manual flow codes within the layout.

Flows are further categorized as source flows and journal flows:

Source flows are amounts associated with the source data after it goes through the ledger preparation process and can be tracked by both manual and system flow codes. Source flows are entered in the local book currency and translated at both the closing and cash flow rates.

Journal flows are amounts associated with journal entries or batches posted for the consolidation fiscal year and period, and can be tracked with both manual and system flow codes. Journal flow amounts are entered in the consolidation currency.

Flow templates link the flow codes with specific accounts. They specify the ledger template and effective date, which flow codes to use, and which accounts to use the flow codes with. You can also preview a flow template. There are two types of flow templates:

Manual flow templates are used to capture flow information with a combination of system and manual flow codes. For example, you could set up manual flow templates to track fixed asset activity, investments, stock holder's equity, and short and long term debt. You enter and review the amounts for manual flow templates on the Source Flow Input and Journal Flow Input pages.

System flow templates capture account activity that is calculated automatically by the system and use only system flow codes. For example, system flow templates can track changes in balances for accounts receivable and accounts payable used for cash flow reporting.

All of the flow templates that you want to use for a specific consolidation ledger are specified in a flow group. The flow group is associated with the consolidation model.

See Flow Group Page.

Two processes are run to update flow information:

The Source Flow Update process updates both system-generated and manually input flow data associated with the source data.

The Journal Flow Update process updates both system-generated and manually input flow data associated with journal entries for the consolidation fiscal year and period.

Phases of Flow Processing

There are three phases of flow processing:

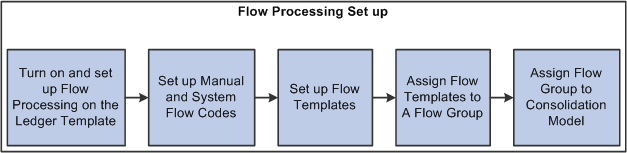

During the set up phase you turn on flow processing, set up manual and system flow codes, set up manual and system flow templates, assign flow templates to a flow group, and assign the flow group to the consolidation model.

You can also add manual flow codes to consolidation rules as targets so the system automatically captures flow amounts for those consolidation entries.

During the ledger preparation phase, you input, review, and correct amounts for manual flow codes on the Source Flow Input page as needed, and then run the source flow update engine.

During the consolidation and reporting phase you run the consolidation engines, post manual journals (assigning flow codes to journal lines), run Journal Flow Update, and then review, correct, and add manual flow amounts as needed on the Journal Flow Input page.

Steps for Setting Up Flow Processing

Image: Steps for setting up flow processing

This diagram illustrates the step you complete to establish flow processing.

You complete these basic steps when setting up flow processing:

Turn on and setup flow processing on the consolidation Ledger Template.

Modify descriptions for system delivered flow codes and select those system flow codes that you want to appear on your flow templates to suit your reporting purposes.

Set up manual flow codes that you want to use for your flow templates.

Assign flow codes and accounts to manual and system activity flow templates. You generally set up flow templates for related groups of accounts, whose changes are captured by the same activities.

Manual flow templates specify which flow codes (columns) and which accounts (rows) appear on the Source Flow Input and Journal Flow Input pages. Manual flow templates are designed for users to review, correct, and add flow amounts. They combine both system flow codes and manual flow codes.

System activity flow templates are used to automatically capture change in account balances used for cash flow reporting. You can review the amounts for system activity flow templates on the Flow Inquiry page.

Optionally, assign manual flow codes as targets to consolidation rules.

If manual flow codes are assigned to consolidation rules, the system automatically captures the flow amounts when the consolidation engines are run.

Example: Tracking Fixed Asset Flow Information

The manual flow templates are designed so that users can enter information for financial statement footnotes and cash flow analysis. The templates contain system flow codes to track changes in account balances as well as foreign currency translations, and manual flow codes to track specific types of activity related to the account, such as asset acquisitions and dispositions. If the user has multi-currency business units, then all source flow information must be translated at a closing rate and at a cash flow rate. To illustrate this concept, the following example is presented.

Suppose that fixed asset opening, closing, change, and flow activity amounts (Acquisitions & Disposals) are the following in a foreign currency:

|

System Flow Codes |

Manual Flow Codes |

||||||

|---|---|---|---|---|---|---|---|

|

Account |

Open |

Close |

Change |

FXAJ1 |

FXAJ2 |

ACQ |

DISP |

|

Fixed Assets |

100 |

200 |

100 |

0 |

0 |

200 |

-100 |

FXAJ1 and FXAJ2 are system flow codes that represent foreign currency translation and are calculated by the system. ACQ and DISP represent manual flow codes that are used to track acquisitions and disposals, respectively. Note that the flow codes of FXAJ1, FXAJ2, ACQ, and DISP add up to the Change amount.

Assume the following exchange rates.

|

Rate Type |

Rate |

|---|---|

|

Opening Rate: |

2 |

|

Closing Rate: |

4 |

|

Average Rate: |

3 |

When the amounts and balances are translated at the Closing Rate you would see the following.

|

Sum = Change Amount |

|||||||

|---|---|---|---|---|---|---|---|

|

Account |

Open |

Close |

Change |

FXAJ1 |

FXAJ2 |

ACQ |

DISP |

|

Fixed Assets |

200 |

800 |

600 |

200 |

0 |

800 |

-400 |

Open balance of 100 is translated at opening rate of 2, which equals 200.

Close balance of 200 is translated at closing rate of 4, which equals 800.

Change amount is 600.

ACQ amount is translated at closing rate of 4 multiplied by 200, which equals 800.

DISP amount is translated at closing rate of 4 multiplied by -100, which equals -400.

FXAJ1 represents the difference between the closing rate of 4 multiplied by the opening balance (4 X 100=400) and the opening rate of 2 multiplied by the opening balance (2 X 100=200), which equals 200.

|

A |

B |

A x B |

|

|---|---|---|---|

|

FXAJ1 |

Open Bal |

Rate |

Total |

|

Close |

100 |

4 |

400 |

|

Less: Open |

100 |

2 |

200 |

|

Total: |

200 |

When the amounts/balances are translated at the Cash Flow Rate or average rate, you would see the following:

|

Sum = Change Amount |

|||||||

|---|---|---|---|---|---|---|---|

|

Account |

Open |

Close |

Change |

FXAJ1 |

FXAJ2 |

ACQ |

DISP |

|

Fixed Assets |

200 |

800 |

600 |

200 |

100 |

600 |

-300 |

Open and close balances as well as the change amount are still the same as above.

ACQ amount is translated at average rate of 3 multiplied by 200, which equals 600.

DISP amount is translated at closing rate of 3 multiplied by -100, which equals -300.

FXAJ1 is the same as above.

FXAJ2 represents the difference between the closing rate of 4 multiplied by the flow amounts (4 X (200-100)=400) and the average rate of 3 multiplied by the flow amounts (3 X (200-100)=300), which equals 100.

|

A |

B |

A + B |

C |

(A+B)xC |

||

|---|---|---|---|---|---|---|

|

FXAJ2 |

ACQ |

DISP |

Flow Amt |

Rate |

Total |

|

|

Close |

200 |

-100 |

100 |

4 |

400 |

|

|

Less: Average |

200 |

-100 |

100 |

3 |

300 |

|

|

Total: |

100 |

Note: Combining FXAJ1 and FXAJ2 flow codes with the cash accounts will produce the net affect of currency translation line item on the cash flow statement.