Mapping Compensation Codes and Plan Values

To map compensation codes and plan values, use the WA_COMP_ERN_MAP.GBL, WA_COMP_PIN_MAP.GBL, WA_COMP_DED_MAP.GBL, and WA_BEN_VALU_TBL.GBL components.

This section discusses how to:

Review source table earnings, deductions, and benefits.

Enter compensation codes and create a COMPCODE tree.

Load source table dependencies.

Map deductions and benefit plans to compensation codes.

Map earnings to compensation codes.

Map pay item names to compensation codes.

Enter benefit plan values.

Review benefits valuation maps.

Load compensation data.

Pages Used to Map Compensation Codes and Plan Values

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Compensation Deduction Map |

WA_COMP_DED_MAP |

|

Map deduction codes and benefits plans from the HRMS system to compensation codes in EPM. Mappings are stored in the WA_COMP_DED_MAP table. |

|

Compensation Earnings Map |

WA_COMP_ERN_MAP |

|

Map earnings codes from the HRMS system to compensation codes in EPM. Mappings are stored in the WA_COMP_EARN_MAP table. |

|

Compensation GP Pin Map |

WA_COMP_PIN_MAP |

|

Map PIN (pay item name) codes from PeopleSoft Global Payroll to compensation codes in the EPM. Mappings are stored in the WA_COMP_PIN_MAP table. |

|

Benefits Valuation Map |

WA_BEN_VALU_TBL |

|

Assign a monetary amount to a benefit to distinguish whether the amount is an employee cost, employee value, or employer's cost. The benefits amounts and values that you enter using this page are stored on the WA_BEN_VALUE_TBL table. Use this page for compensation codes that you have already set up in the COMPCODE tree and mapped in the Comp Deduction Code Map (HR) page. |

Reviewing Source Table Earnings, Deductions, and Benefits

To load compensation data, the system uses the following HRMS source tables:

|

Compensation Type |

HRMS Source Tables |

|---|---|

|

Deductions |

PS_PAY_DEDUCTION, PS_PAY_CHECK, and PS_TOTAL_DED. |

|

Benefits |

PS_DEPENDENT_BENEF, PS_COVRG_CD, PS_HEALTH_BENEFIT, PS_LIFE_ADD_BEN, PS_DISABILITY_BEN, PS_FSA_BENEFIT, PS_SAVINGS_PLAN, PS_VACATION_BEN, PS_LEAVE_PLAN, PS_CAR_PLAN, PS_RTRMNT_PLAN, and PS_PENSION_PLAN. |

|

Earnings |

PS_PAY_EARNINGS, PS_PAY_CHECK, and PS_PAY_OTH_EARNS |

|

Pay Item Names |

PS_GP_RSLT_ERN_DED and PS_GP_PIN |

Generate a list of the HRMS deduction and earnings codes, benefits plans and plan types, and pay item names (PINs). Use this list to determine which ones to import into EPM. Each earnings code, deduction code, benefit plan, and PIN code that you want to import into EPM must map to one compensation code in the target system. Multiple codes and plan types can map to the same compensation code, or each one can have a separate compensation code.

Also determine whether any of these deductions, earnings, or benefit plan types normally don't have cost or value data stored in the HRMS system. Most commonly, this occurs for benefit plan-related information. For those items in need of a cost or value, first determine the cost or value, and then also determine whether it applies to the employee, the employer, or both. For example, assume that your company allows employees to enroll in a dental plan, and neither the employee nor the employer costs or values of the dental plan are tracked through payroll. In this situation, you may want to set up data in EPM to track the dental plan costs and to whom these costs apply.

Entering Compensation Codes and Creating a COMPCODE Tree

When you have a plan for mapping your compensation codes from the HRMS source tables to EPM, you create your compensation codes on the Compensation Code page and create the COMPCODE tree.

Loading Source Table Dependencies

On the compensation and benefits mapping pages, certain fields are supplied from OWS tables. You populate the OWS tables by ETL prior to beginning work on setting up Workforce Analytics. The following table summarizes the prompts for fields on the compensation and benefits mapping pages:

|

Compensation or Benefit Mapping Page |

OWS Prompt Tables |

|---|---|

|

Compensation Deduction Map |

Prompt values for deductions come from WA_PLAN_DED_VW and WA_PLAN_TYP_VW. These views in turn look at DEDUCTION_TBL and BENEF_PLAN_TBL. |

|

Compensation Earnings Map |

Prompt values for earnings come from EARNINGS_TBL. |

|

Compensation GP Pin Map |

Prompt values for pay item names come from the GP_PIN_TYPE table and WA_PLAN_PIN_VW table. These views in turn look to the GP_PIN table. |

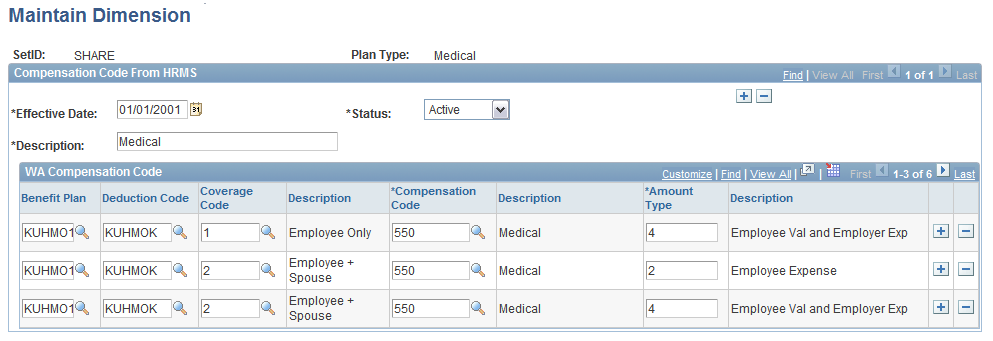

Compensation Deduction Map Page

Use the Compensation Deduction Map page (WA_COMP_DED_MAP) to map deduction codes and benefits plans from the HRMS system to compensation codes in EPM.

Mappings are stored in the WA_COMP_DED_MAP table.

Image: Compensation Deduction Map setup page

This example illustrates the fields and controls on the Compensation Deduction Map setup page. You can find definitions for the fields and controls later on this page.

| Plan Type |

When you access the page, you are prompted to specify a plan type. Valid values are from the translate table. If this mapping is for a general deduction, select General Deduction. |

Mapping Benefit Plan Types

To map a benefit, select from available plan types, other than General Deduction, that are summarized in the following table:

|

Plan Type |

Description |

Plan Type |

Description |

|---|---|---|---|

|

401(k) |

401(k) Retirement Account |

PERS |

Public Employees Retirement System |

|

AD/D |

Accidental Death or Dismemberment Insurance |

Personal |

Personal Leave |

|

Benefits Program |

Benefits Program |

Profit Sharing |

Profit Sharing |

|

Capital Accumulation |

Capital Accumulation |

Retirement Counseling Canada |

Canadian Retirement Counseling |

|

Company Car |

Company Car |

Short-term Disability |

Short-term Disability Insurance |

|

Dental |

Dental Insurance |

Sick |

Sick Leave |

|

Dependent AD/D |

Dependent Accidental Death or Dismemberment Insurance |

Standard Pension |

Standard Pension (Canada) |

|

Dependent Care |

Dependent Care Flexible Spending Account |

Supplemental AD/D |

Supplemental Accidental Death and Dismemberment Insurance |

|

Dependent Life |

Dependent Life Insurance |

Supplemental Life |

Supplemental Life Insurance |

|

Employee Stock Purchase Plan |

Employee Stock Purchase Program |

Supplemental Pension |

Supplemental Pension (Canada) |

|

Family and Medical Leave Act |

Family Medical Leave Act |

Survivors Income |

Survivors Income |

|

General Deduction |

General Deductions |

Thrift |

U.S. federal government employee Thrift Savings Plan |

|

Health Care Can |

Canadian Health Care |

USDB Pension Plan 1 |

U.S. Defined Benefit Pension Plan 1 |

|

Health Care |

Health Care Flexible Spending Account |

USDB Pension Plan 2 |

U.S. Defined Benefit Pension Plan 2 |

|

IRA |

Individual Retirement Account |

USDB Pension Plan 3 |

U.S. Defined Benefit Pension Plan 3 |

|

Life and AD/D |

Life Insurance - Accidental Death or Dismemberment Insurance |

USDB Pension Plan 4 |

U.S. Defined Benefit Pension Plan 4 |

|

Life |

Life Insurance |

USDB Pension Plan 5 |

U.S. Defined Benefit Pension Plan 5 |

|

Long-term Disability |

Long-term Disability Insurance |

USDB Pension Plan 6 |

U.S. Defined Benefit Pension Plan 6 |

|

Major Medical |

Major Medical |

U.S. Savings Bonds |

U.S. Savings Bonds |

|

Medical |

Medical |

Vacation |

Vacation Leave |

|

NQ Dental |

Non-Qualified Dental Insurance |

Vacation Buy |

Vacation Leave Buy |

|

NQ Vision |

Non-Qualified Vision Insurance |

Vacation Sell |

Vacation Leave Sell |

|

Nonelective Contrib |

Non-elective contributions to a retirement savings or pension plan. |

Visn/Hear |

Vision and Hearing Insurance |

|

FEGLI Living Ben |

Federal Employees Group Life Insurance Living Benefit |

Option A Standard |

Option A - Standard Option in the FEGLI program |

|

403(b) |

Type of U.S. retirement savings program. |

Retirement TSP 1 % |

U.S. government retirement plan called Thrifts Savings Plan, for which agency contribution is one percent. |

|

Employer Only |

Retirement savings program contributions, which are employers only. |

None |

|

WA Compensation Code

Compensation Earnings Map Page

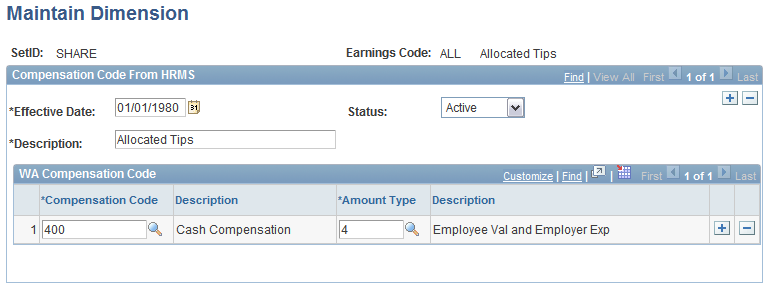

Use the Compensation Earnings Map page (WA_COMP_ERN_MAP) to map earnings codes from the HRMS system to compensation codes in EPM.

Mappings are stored in the WA_COMP_EARN_MAP table.

Image: Compensation Earnings Map setup page

This example illustrates the fields and controls on the Compensation Earnings Map setup page. You can find definitions for the fields and controls later on this page.

Earnings Code

When you access the page, you are prompted to specify an earnings code. Earnings are those values from the ERNCD field on the PS_EARNINGS and PS_PAY_OTHER_EARNS tables from HRMS.

WA Compensation Code

Compensation GP Pin Map Page

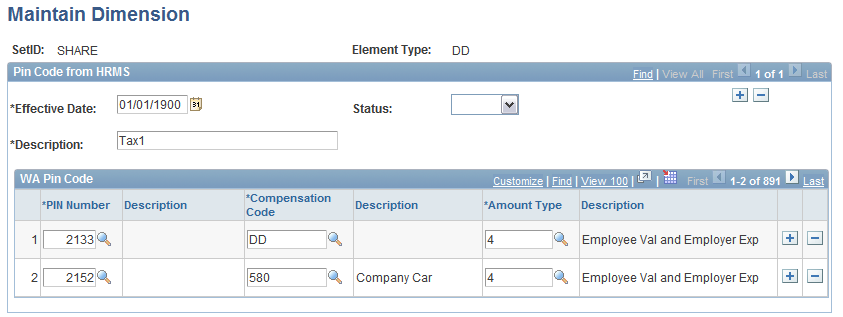

Use the Compensation GP Pin Map page (WA_COMP_PIN_MAP) to map PIN (pay item name) codes from PeopleSoft Global Payroll to compensation codes in the EPM.

Mappings are stored in the WA_COMP_PIN_MAP table.

Image: Compensation GP Pin Map setup page

This example illustrates the fields and controls on the Compensation GP Pin Map setup page. You can find definitions for the fields and controls later on this page.

Pay Element Types

WA PIN Code

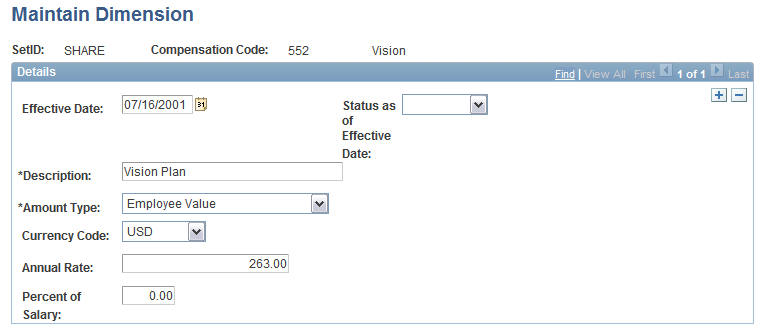

Benefits Valuation Map Page

Use the Benefits Valuation Map page (WA_BEN_VALU_TBL) to assign a monetary amount to a benefit to distinguish whether the amount is an employee cost, employee value, or employer's cost.

The benefits amounts and values that you enter using this page are stored on the WA_BEN_VALUE_TBL table. Use this page for compensation codes that you have already set up in the COMPCODE tree and mapped in the Comp Deduction Code Map (HR) page.

Image: Benefits Valuation Map setup page

This example illustrates the fields and controls on the Benefits Valuation Map setup page. You can find definitions for the fields and controls later on this page.

Warning! Whenever you enter data in this page, ensure that you aren't creating redundant data. Use this page only to provide a valuation of benefits plans that don't otherwise have an amount and value associated with them in HRMS. That is, use it for a given compensation code when that information is not available through payroll data, or when your source data does not provide the amounts and values that your company wants to track. Do not use this table for expenses, or for duplicating information that is available from payroll data.

Loading Compensation Data

Use the ETL process to load compensation data from the OWS staging tables to the data warehouse tables. Here is a summary of what happens when you load compensation data:

|

Compensation Type |

Mapping Tables Referenced |

Target Data Warehouse Tables |

|---|---|---|

|

Deductions |

WA_COMP_DED_MAP. Any deductions not mapped are not loaded. |

WA_COMP_HST_F00 with rows of employee-level compensation cost and value data. |

|

Benefits |

WA_COMP_DED_MAP and WA_BEN_VALU_TBL tables. Any benefit plans not mapped are not loaded. |

WA_COMP_HST_F00 with rows of employee-level compensation cost and value data, as annualized costs. WA_BEN_HST_F00 with benefits enrollment data. Note. If, while loading WA_COMP_HST_F00, the system finds an enrollment row for an employee on one of the enrollment tables (Health Benefit, Life Add Benefit, Disability Benefit, FSA, Savings, and so on), then the system looks to the WA_BEN_VALU_TBL table for a corresponding compensation code. If a row exists for mapping that benefit to a compensation code on the WA_BEN_VALU_TBL table, then the mapped values associated with that benefit are inserted for that employee on WA_COMP_HST_F00, with a compensation source ofB. |

|

Earnings |

WA_COMP_ERN_MAP. Any earnings not mapped are not loaded. |

WA_COMP_HST_F00 with rows of employee-level compensation cost and value data. |

|

Pay Item Names |

WA_COMP_PIN_MAP. Any pay items not mapped are not loaded. |

WA_COMP_HST_F00 with rows of employee-level compensation cost and value data. |