Batch Owner Statements

When the OPV_<version number> OPERA Vacation Ownership System license code is active, select Ownership>Accounts>Batch Statements to access the Batch Owner Statements screen and prepare owner and fractional owner statements for print, fax, or email. Account balances for owners typically have a negative amount that displays a credit to the owner for rental revenue, showing amounts owed by account holders.

Note: If the PROFILE_LANGUAGE function is active, statements can be translated to and prepared in the appropriate language, both for owners and co-owners.

Statements are typically prepared at the end of the month, or specified period, to consolidate the owners’ rental revenue and fees. Owners with negative balances will be sent a check, owners with a positive balance, will be sent a bill. OPERA makes it possible to produce statements on an as-needed basis (this is sometimes called "on-demand"), for either one account at a time or in batch for two or more selected accounts. Statements can be generated in detail, summary, or cashbook format.

Account Name. Type part or the full name of the account. This includes owner and fractional owner accounts. (See Fractional Ownership for details)

From Account No. Type the beginning account number to begin the search with.

To Account No. Type the end account number to finish the search with.

Account Type. Select the down arrow to select an account type, or types, from a list of values to search for.

Contract No. Type part or the full contract number.

Unit. Select the down arrow to select a unit, or units, from a list of values to search for.

Unit Type. Select the down arrow to select a unit type, or unit types, from a list of values to search for.

Co-Owner. Select the check box to include co-owners names and units in the search results. Leave blank to show only the primary owners and units.

Show Inactive. Select the check box to show all contracts where the end date is less than the current business date.

Accounts Per Profile. Select to print a statement for all owner accounts associated with this profile.

Customized Only. Select to display only owners that have a customized statement.

X. An X in this column indicates that the record is selected.

Account Name. The name listed on the account.

Account No. The number that has been assigned to the account.

Balance. The difference between the debits and credits of the account.

Unit. The unit number(s) that are attached to the account.

Type. The account type.

Note: Default filter settings for the Batch Owner Statement form, except for the Use Customized option, can be defined from Configuration>Setup>Report Setup>Reports>Owner Statements Report Group>Edit sample_owner_statement report>Parameters button. Based on the filter options that are selected/de-selected when the Save button is selected, these will automatically be populated when opening the Owner Statement form.

Begin/End Date. Select the dates to indicate a date range of transactions you wish to cover in this statement. Use the calendar tool to select a date or enter the date manually. For example, if you set Last Activity to 10-01-03 and To to 10-31-03, the statement would include all invoices whose final transaction is dated between 10-01-03 and 10-31-03. Any payments dated within this period would also be included on the statement.

Detail. Select this radio button to generate a detailed owner account statement.

When the Ownership>Revenue Pooling application function is set to Y and the account is for an Owner Only Contract, then the Detail radio button is automatically selected and is disabled. This will generate a detailed owner statement, but without the reservation details. But if the Owner Account has a rental contract(s) attached to it and is not associated to a Revenue Pool, then the Detail button is active.

Summary. Select this button to generate an owner account statement in summary format.

When the Ownership>Revenue Pooling application function is set to Y and the account is for an Owner Only Contract, then the Summary radio button is automatically not selected and is disabled. But if the Owner Account has a rental contract(s) attached to it and is not associated to a Revenue Pool, then the Summary button is active.

Cashbook. Available when the Owner Cashbook Ownership Group Application Parameter is set to "Y" and the Revenue Pooling Application Function is set to "N", select this radio button to generate owner account information in a format that facilitates an internal audit by State Auditors. For additional information on Owner Cashbooks, see Owner Cashbooks.

Use Customized. Select to use the Customized Statement.

Email List/Attach. Available when the General>File Attachments application function is set to Y and a value has been defined for the General>Email Attachment Directory Name application setting, select this check box to email the selected Batch Owner Statements as an attached file to one or multiple email addresses. When this check box is selected and the Email button is chosen, then the Email/Fax Destination screen is displayed to select the email addresses. See Email/Fax Destinations for details.

Reverse Signs (+/-). On the Owner Statement, any postings that are adding to the owner account are displayed as a negative number and any posting that are subtracting from the owner account are displayed as a positive number. To keep the numbers displaying this way, leave this check box as not selected, but to reverse the way these number are displayed, select this check box.

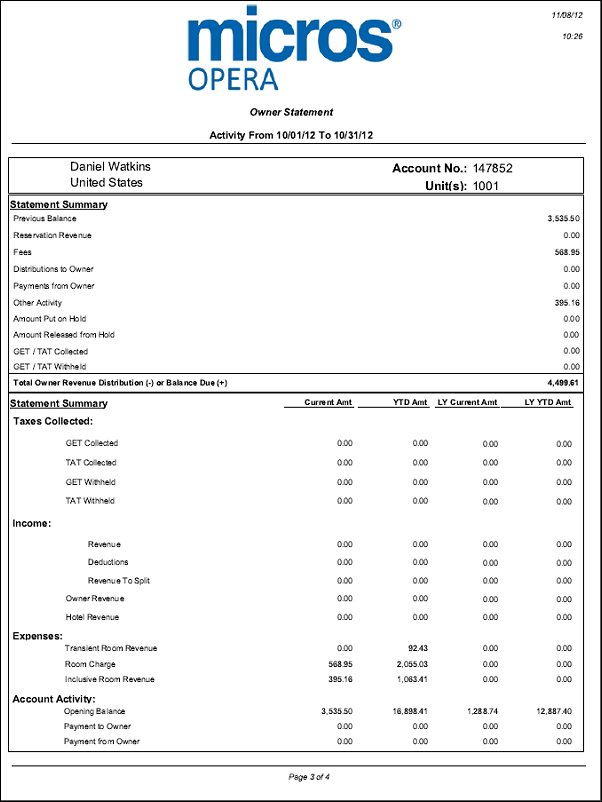

Style 1 Statement Summary. Select to provide the old style summary of statement activity, including the following information: The previous account balance, reservation revenue, fees, distributions to the owner, payments from the owner, other activity, any amount put on hold, any amount released from hold, and the total revenue distribution or balance due.

Note: For a reservation that gets checked into a unit, incurs charges that are not eligible as owner revenue transactions, and then this reservation is room moved on the same date into another room/unit, the reservation will not be visible on the owner statements. If however the charges incurred before the room move do account for eligible owner revenue transaction codes, these will remain visible on the owner statements with an equal Arrival and Departure date even though the reservation was not a Day Use reservation.

Style 2 Statement Summary. Select to provide the new style summary of statement activity, including the totals and breakdowns of the Taxes Collected, Income, Expenses, and Account Activity categories.

Additional columns for the new style statement summary details can be included by selecting the Year to Date check box and/or the Last Year check box.

Statement Occupancy Summary. Select to display the occupancy details for the period, including the room number, the number of owner nights used, any authorized user nights, rental nights, the total number of nights used (representative of the total Statement Nights), the percent occupancy, and the average room rate. The Average Room Rate calculation is the average based on the nightly rate amounts on reservations and excludes any nightly rates for any authorized user or owner reservation.

Additional columns for the occupancy details can be included by selecting the Year to Date check box and/or the Last Year check box.

Reserve Account Summary. Available when the Ownership>Reserve Accounting application function is set to Y, select to provide the reserve account summary, and details, for the period including

Additional columns for the reserve account details can be included by selecting the Year to Date check box and/or the Last Year check box.

Rental Activity Details. Select the check box to display the total revenue and all the revenue details in separate line items. If this check box is not selected, then the total revenue will be displayed on 1 line item.

Note: When the Ownership>Zero Revenue Rental Activity On Owner Statement application parameter is set to Y, all rental activity will show on the Owner Account Statement, even if the revenue was zero. If the Ownership>Zero Revenue Rental Activity On Owner Statement application parameter is set to N, no rental activity with zero revenue will display on the Owner Account Statement. However, the Rental Nights in the Occupancy Summary section of the statement will still be included for such zero revenue reservations.

Revenue Adjustment Details. Select the check box to display the total revenue adjustment amount and the details pertaining to the revenue adjustments made on the owner account. When revenue adjustments are made and the Show as Revenue on Current Statement check box is not selected, any rental revenue adjustments will display on the statement in the Rental Activity section in which the original revenue was reported in and will be reflected a single record for that rental activity. When this check box is not selected, then the Revenue Adjustment section will not be displayed.

Owner Activity Details. Select the check box to display the total numbers and details of any owner/authorized user activity for the period, including the following details: The confirmation number, the unit number, the arrival and departure dates, reservation nights, statement nights, and the name of the guest. Reservation nights signify the total number of nights for the reservation stay and Statement Nights signify the total number of nights stayed within the statement date range.

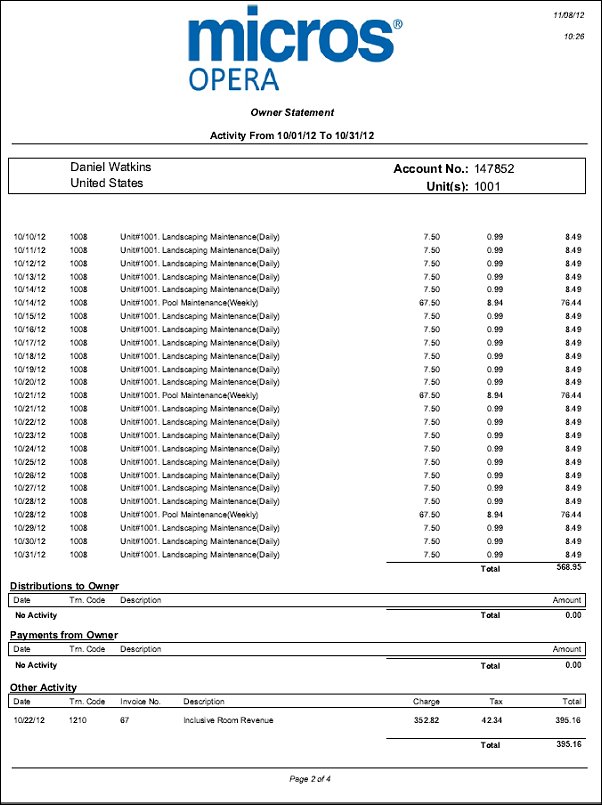

Fee Details. Select to displays the total amount and details for any fees for the period, including the following details: The date, the transaction code, a description of the transaction, the amount of the charge, any tax, and the total charge.

Payment to Owner Details. Select to display the total amount and details for any distributions to the owner, including the following details: The transaction date, the transaction code, a description of the transaction, and the amount.

Payment to Hotel Details. Select to display the total amount and details for any owner payments, including the following details: The date of the payment, the transaction code, a description of the transaction, and the amount of the payment.

Other Activity Details. Select to display the total amount and details for any other activity for the period, including the following details: The date, the transaction code, the invoice number, a description of the transaction, the amount, any tax, and the total amount of the transaction.

Note: When the Ownership>Effective Date application parameter is set to Y, any transactions that are posted using the Effective Date column on the Posting Transactions screen will be displayed in this section.

Restriction Info. Select to display the total amount and details for the restriction information for the period, including the room number, the type of restriction, the start date and end date, a grid displaying the days of the week that the restriction applies, the number of nights used, and the number of nights left.

Search. Select to search for the accounts that meet the search criteria. Search results can be displayed in different orders by clicking on the column headings.

All. Select to choose all of the statements in the Search Results Grid.

None. Select to un-select all of the statements that have been selected in the Search Results Grid.

Customize. Select to customize the highlighted owner statement in the search results grid. Once the customization is completed, you will then be asked if you want to save any changes that you have made to the statement. Select No to disregard any changes and select Yes to save your changes.

Preview. Select this button to review the selected statement before generating. If more than one owner account is selected in the grid, then this button is disabled.

Print. Select this button to print the statement(s). The statements are processed from the top to the bottom of the list grid display based on how they are ordered to display in the grid when selected to be processed.

File. Select to save the statements(s) to file in a location that is specified.

Fax. Select to send the statement(s) to the owner's fax number. If no fax number has been specified, then the user will need to enter a fax number in the prompt that is displayed.

Email. Select to send the statement(s) to the owner's email address. If no email address has been specified, then one will need to be entered in the prompt that is displayed. When this button is selected and the Email List/Attach check box is selected, then the Email/Fax Destination screen is displayed to select the email addresses. See Email/Fax Destinations for details.

Close. Select to close out of the Batch Statement functionality.

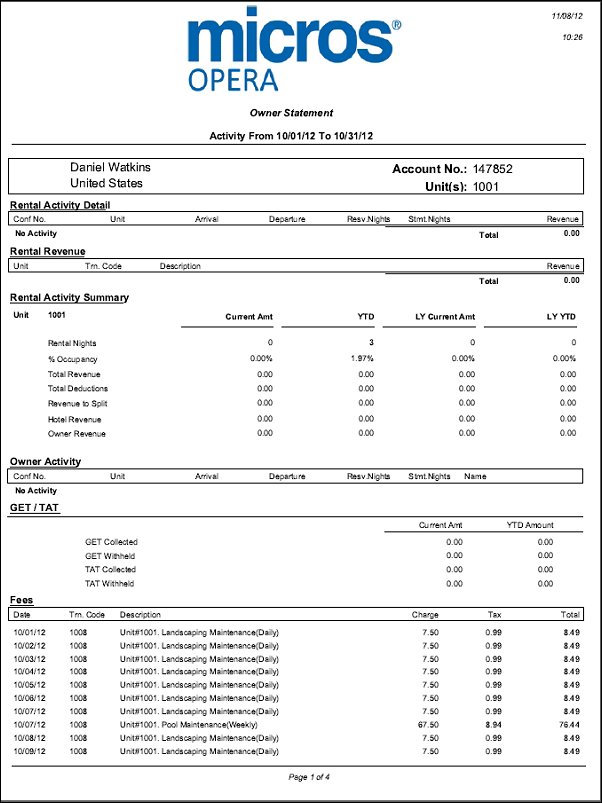

A sample statement is displayed below. If you want to print this topic, it is recommended you print in Portrait format.

In this sample report output, the format type is Details and all filter criteria has been selected, except for the Email List/Attach, Reverse Signs (+/-), and the Fee Details.

When the GET/TAT Handling application function is set to Y, the amounts of GET (General Excise Tax) and TAT (Transient Accommodation Tax) are displayed for the amounts of revenue made on the unit in the Rental Activity section. Also, a GET/TAT section is displayed that will show the total amounts of the GET/TAT that have been collected for the Month-to-Date and Year-to-Date. If the property is taking the responsibility of submitting the taxes, then the GET/TAT Withheld total amounts will also be populated for Month-to-Date and Year-to-Date. Also the GET/TAT Collected and Withheld amounts for the summary period are also displayed in the Statement Summary section.

See Also