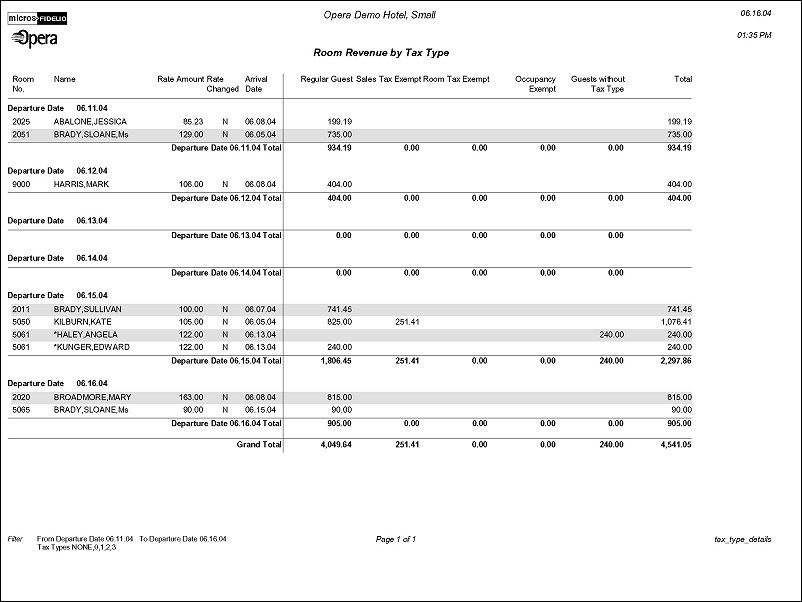

Room Revenue by Tax (tax_type_details with GEN1.FMX)

The Room Revenue by Tax Type report displays the amount of Room Revenue generated within each Tax Type for a Reservation.

Based on the application setting of TAX TYPE CALCULATION, the report will either consider the Tax Type field on the Reservation or on the Profile. Tax Types are configured in System Configuration>Cashiering>Tax Types.

A Reservation may have generated Room Revenues under more than one Tax Type during their stay. In some states, if a guest stays in a Property more than 30 days, they are considered a full time resident and do not have to pay Bed Tax. In this case, the Reservation would be changed from one Tax Type (Full Tax) to another Tax Type (No Bed Tax). In this example, the Room Revenues generated for the first 30 days would be under the ‘Full Tax’ Tax Type column and the reminder of the stay would be displayed under the ‘No Bed Tax’ Tax Type column on the report.

Tax Type. A Multi Select LOV of the configured Tax Types. Tax Types are configured in System Configuration>Cashiering>Tax Types.