Revenue Type Cross Reference

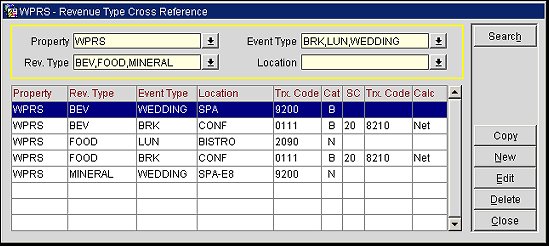

Select Configuration>Cashiering>Revenue Type Cross Reference to display the Revenue Type Cross reference screen. (This menu item is visible only when the Catering>Catering Events application function is set to Y or when the WCC_XXX or WCS_XXX license code is active.) Use this feature to associate revenue types (per event type/location) with a transaction code. These cross references are applied when posting event charges (see Posting Event Charges for details) and when generating the Pro Forma Invoice Generates Report (rep_proforma_invoice.rep with rep_proforma_generates.fmx).

Enter your search options and select the Search button.

Property. This field is visible when the OPP_MHT2 Multi-Property add-on license code is marked as Active. In the Property list of values, OPERA displays the properties with activated multi property licenses codes allowing you to switch between properties that have been configured in this property cluster (via the Property Details>Alternates Tab).

Rev. Type. Enter one or more appropriate revenue type codes; separate entries with a comma, no spaces (such as BEV,FOOD). Or, select the down arrow to choose one or more from the available list of values.

Event Type. Enter one or more event type codes; separate entries with a comma, no spaces (such as BRK,LUN). Or, select the down arrow to choose one or more from the available list of values.

Location. Enter one or more function space room or function space type codes; separate entries with a comma, no spaces (such as CONF,SPA-E8). Or, select the down arrow to choose one or more from the available list of values.

The Revenue Type Cross Reference screen provides the following information for each cross reference.

Property. Property where this cross reference is applicable. Available when the OPP_MHT2 Multi-property add-on license is active.

Rev. Type. Revenue type associated with the revenue type cross reference.

Event Type. Event type associated with the revenue type cross reference.

Location. Function space associated with the revenue type cross reference.

Trx. Code (Transaction Code). Transaction code associated with the revenue type cross reference.

Cat (Catering Only). An N in this field indicates a revenue type cross reference that is not catering only (cross reference applies when Catering Only is not selected on the business block). A Y indicates a catering only revenue type cross reference (cross reference applies when Catering Only is selected on the business block). B indicates the revenue cross reference is applicable to both types of business blocks.

SC (Service Charge %). The Service Charge associated with the revenue type cross reference, displayed in percentage.

Trx. Code (Service Charge Transaction Code). The transaction code to which the service charge is to be posted.

Calc (Service Charge Calculation Method). The calculation method, either Net or Gross, on which the service charge computation was based.

Select New to create a code and all its relevant information, or highlight an entry and select Edit to change any of the attributes for this cross reference. The Revenue Type Cross Reference - New or Revenue Type Cross Reference - Edit screen appears.

Each revenue type cross reference record must be unique based on the Property, Revenue Type, Catering Only, Event Type, and Location.

Provide the following information and select OK to save your changes.

Property. View only. The property for which you are setting up the revenue type cross reference.

Revenue Type. This field is used to assign a revenue type to the transaction code. Enter the appropriate code or select one from the available list of values.

Catering Only. Select Yes if the revenue type cross reference applies to Catering Only business blocks; select No if the revenue type cross reference applies to non-Catering Only business blocks only; select Both if the revenue type cross reference applies to both types of business blocks.

Event Type. Select the down arrow to choose an event type(s) associated with the revenue type cross reference. For example, ‘MTG’ for meeting, ‘LUN’ for lunch, etc.

Location. Select the down arrow to choose a function space(s) that are associated with the revenue type cross reference. The LOV lists all function spaces and all function space locations. If a function space location is selected, then all function spaces configured for that location will be considered when selecting the appropriate transaction code for posting.

Transaction Code. Select the transaction code to which the charges for the selected revenue type, event type, and location should be posted. Only transaction codes configured for Manual Posting will be displayed.

The service charge section allows you to add a service charge generate to the revenue covered by the revenue type cross reference. This will not configure a generate for the selected transaction code, but will act as a generate when posting from events or generating the Pro Forma Invoice Generates Report.

Note: If the main transaction code has a service charge generate already attached to it, it may not be necessary to specify a service charge in the Service Charge section. If the main transaction code has a service charge generate, and a service charge is configured in this section, two service charges will be calculated when posting the event from S&C for this revenue type cross reference and when generating the Pro Forma Invoice Generates Report.

%. Enter the percentage of the service charge. Negative percentages and percentages greater than 100 are not allowed.

Transaction Code. This field is enabled when a percentage is entered into the % field. Select the down arrow to choose the transaction code to which the service charge indicated in the % field is to be posted.

Calculation Method. Select Net if you wish to calculate the service charge based on the revenue not including tax for the service charge transaction code. Select Gross if you wish to calculate the service charge based on the revenue including tax for the service charge transaction code.

Note: The Net/Gross option applies only to the service charge configured in the Service Charge section for the service charge transaction code. It does not apply to any generates that may be configured for the main transaction code.

The TRX Setup button is active when a value has been entered in the Transaction Code or Service Charge Transaction Code field and the cursor is in one of those fields. Select this button to display the Transaction Codes - Edit screen for the service charge.

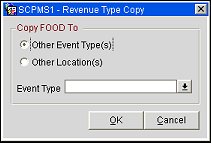

Highlight an entry on the Revenue Type Cross Reference screen and select the Copy button to create a new revenue type cross reference by copying (and modifying) an existing revenue type cross reference. When you select Copy button the following screen appears.

Provide the following information and select the OK button.

Other Event Types(s). Select this radio button to copy the cross reference to one or more other event type(s). The Event Type field appears below. Select the down arrow to choose the event type(s) to which you wish to copy the cross reference.

Other Location(s). Select this radio button to copy the cross reference to one or more other function space(s). The Location field appears below. Select the down arrow to choose the location(s) to which you wish to copy the cross reference.

Please note: If any of the selected Event Type or Locations would create a duplicate record, a new record for that Event Type or Location will not be created.