Defining Tender Types

To set up tender types, use the Tender Types component (AV_GFT_TNDR_TBL).

This section discusses how to set up tender types at your institution.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Tender Types |

AV_GFT_TNDR_TBL |

|

Set up the monetary forms in which gifts are received. Examples are cash, credit card, check, and so on. |

Access the Tender Types page ().

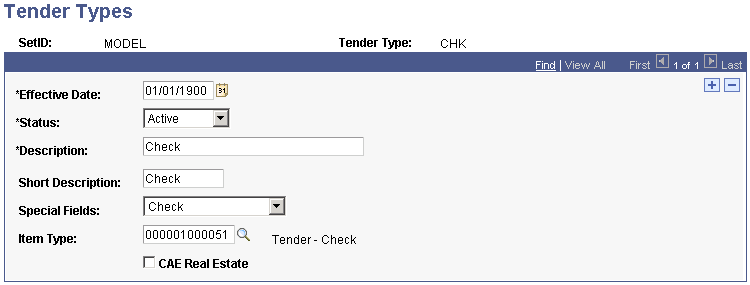

Image: Tender Types page

This example illustrates the fields and controls on the Tender Types page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Special Fields |

Select Credit Card or Check if additional fields should appear when the tender type you are entering is selected during transaction entry. If you select Credit Card, fields for the card type, number, holder, and expiration date appear. If you select Check, a check number field appears. Select Allow Zero Amount in this field to enable gifts to be entered on the Gift Entry page with no monetary value to the institution. Note: When you enter a gift with a tender type that has the Allow Zero Amount field value selected, the Tender Detail button on the Gift Entry page does not appear for that gift. If any other gift is entered in the same session with a tender type that has a special field value of Check or Credit Card, then the Tender Detail button appears. |

| Item Type |

Enter the item type to be used when processing a transaction with this tender to the financial system. |

| CAE Real Estate (Council for Aid to Education real estate) |

Select if the tender type represents a property gift that you want included in the CAE report. When selected, this check box separates gifts-in-kind, such as equipment and applications, from other property, such as real estate. Gifts of property are reported in Part IV of the CAE report (II, C2b, Number and dollar value of other property). |