Using the Return of Funds Worksheet

This section discusses how to:

Generate a valid calculation.

Recalculate TIV aid information.

Recalculate percentage of TIV aid earned using credit hours.

View institutional and budget charges.

Calculate return amounts.

Review loan debts for withdrawn students.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Return of Funds Worksheet |

STDNT_RTRN_TIV_WK1N |

|

Enter values in the editable fields to generate a valid calculation or to recalculate the totals due by the student and school. |

|

Calculate TIV Aid Information |

STDNT_RTRN_TIVSEC1 |

Click the Detail link to the right of the E. Total TIV Aid Disb field on the Return of Funds Worksheet page. |

Recalculate or view the E. Total TIV Aid Disb field. The information displayed under Student's TIV Aid Information is from the Student Award Disbursement table and is used to populate the fields under Student's TIV Aid Amounts. |

|

Calculate Pct. TIV Aid Earned |

STDNT_RTRN_TIVSEC2 |

Click the Detail link to the right of the H. Pct. TIV Aid Earned field on the Return of Funds Worksheet page. |

Recalculate the Percentage of Title IV Aid Earned field and view the Holiday Adjustment field. |

|

Calculate Charge Information |

STDNT_RTRN_TIVSEC6 |

Click the Detail link to the right of the L. Total Institutional Chrgs (charges) field on the Return of Funds Worksheet page. |

View institutional and budget charges. |

|

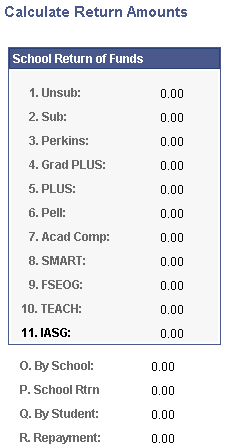

Calculate Return Amounts |

STDNT_RTRN_TIVSEC4 |

Click the Detail link to the right of P. Total School Must Return field on the Return of Funds Worksheet page. |

View amounts to returned by the institution. |

|

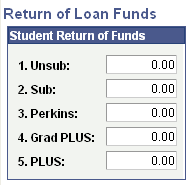

Return of Loan Funds |

STDNT_RTN_TIVSEC7N |

Click the Detail link for the R. Student Loan Repayment Amount field on the Return of Funds Worksheet. |

Enter debt totals for various loan types for withdrawn students to reviewing loan debts. |

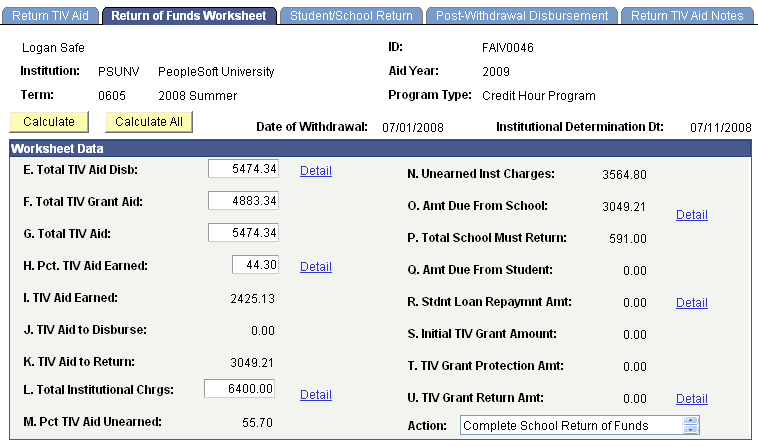

Access the Return of Funds Worksheet page ().

Image: Return of Funds Worksheet page

This example illustrates the fields and controls on the Return of Funds Worksheet page. You can find definitions for the fields and controls later on this page.

Use the Detail links to view or recalculate specific amounts.

Click Calculate to recalculate the values based on the adjustments you made to the percentages.

Click Calculate All to update and populate the fields with the student's calculated withdrawal information. The system displays the withdrawal status of the student for the specified term and calculates the actual values for the amount of earned aid, unearned aid, and aid to be returned. The system uses the setup and award data specific to the student.

If you change the start and end dates from the Return of TIV Aid page, click Calculate All to update the values on the Return of Funds Worksheet page.

|

Field or Control |

Definition |

|---|---|

| E. Total TIV Aid Disb (E. total Title IV aid disbursed) |

Displays Title IV Grant and Loan Programs amounts to be disbursed for grants, amounts that could have been disbursed for grants, net amounts disbursed for loans and net amounts that could have been disbursed for loans. Totals based on the actual federal worksheet are also displayed. |

| F. Total TIV Grant Aid (F. total Title IV grant aid) |

Displays grant aid disbursed and amount that could have been disbursed. |

| G. Total TIV Aid (G. total Title IV aid) |

Displays grant and loan aid disbursed and amount that could have been disbursed. |

| H. Pct. TIV Aid Earned (H. percent Title IV aid earned) |

Displays percentage of period of enrollment completed. |

| I. TIV Aid Earned (I. Title IV aid earned) |

Displays aid earned by the student based on percentage of enrollment period completed. |

| J. TIV Aid to Disburse (J. Title IV aid to disburse) |

Displays amount of aid that could have been disbursed. |

| K. TIV Aid to Return (K. Title IV aid to return) |

Displays amount aid to be returned. |

| L. Total Institutional Chrgs (L. total institutional charges) |

Displays the value of the charges your institution set up in the Institutional Charges setup page. Institutional costs are defined as charges—the cost of attendance—a student must pay to the institution directly. Whether you use the actual or budgeted charges, the system displays the value for the institutional charges you defined in your setup. |

| M. Pct TIV Aid Unearned (M. percent title IV aid unearned) |

Displays the amount to be returned based on the percentage of the unearned aid. |

| N. Unearned Inst Charges (N. unearned institutional charges) |

Displays the amount of aid that must be returned for unearned institutional charges. For example, tuition is an institutional charge. If a student withdraws at 10% of the term, the student earns 10% of the charges for tuition. The remaining 90% is unearned. |

| O. Amt Due From School (O. amount due from school) |

Displays the amount of aid the institution must return to the Title IV program. The institution determines its share of unearned funds first. |

| P. Total School Must Return: |

Displays the total loans the school must return. |

| Q. Amt Due From Student (Q. amount due from student) |

Displays the amount of aid the student must return to the Title IV program. The student returns the difference between the Title IV aid to be returned and the amount of Title IV aid due by the institution. For example, if the returned aid is 1000.00 USD and your institution returns 600.00 USD, the initial unearned calculation for the student to return is 400.00 USD. |

| R. Stdnt Loan Repaymnt Amt: (R. Student loan repayment amount) |

Displays the total amount the student must repay, which consists of loan funds the student has earned, or unearned loan funds that the school is not responsible for repaying, or both. |

| S. Initial TIV Grant Amount: (S. initial Title IV grant amount) |

Displays the Initial amount of Title IV grants the student must return. |

| T. TIV Grant Protection Amt: (T. Title IV grant protection amount) |

Displays the amount of Title IV grant protected using the value in F. Total TIV Grant Aid and applying the 50 percent grant protection. |

| U. TIV Grant Return Amt: (U. Title IV grant return amount) |

Displays the net Title IV grant funds that the student must return. |

| Action |

After you calculate the Return of Title IV Funds, the system displays a note as a reminder to update the tracking fields on the Student/School Return page or the Post-Withdrawal Disbursement page based on what has occurred with the student. |

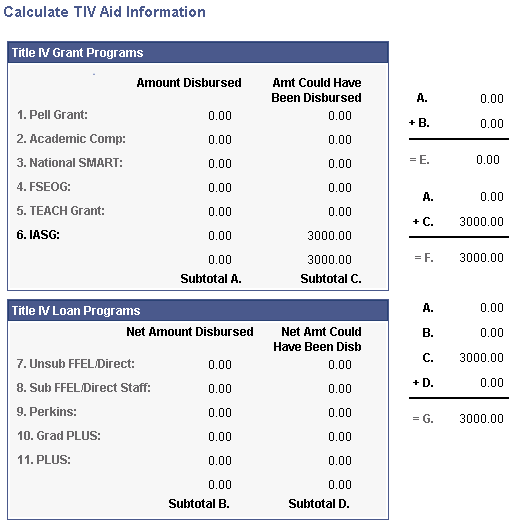

Access the Calculate TIV Aid Information page (click the Detail link to the right of the E. Total TIV Aid Disb field on the Return of Funds Worksheet page).

Image: Calculate TIV Aid Information page

This example illustrates the fields and controls on the Calculate TIV Aid Information page. You can find definitions for the fields and controls later on this page.

The system displays grant and net loan amounts that are disbursed and that could have been disbursed. Totals based on the actual federal worksheet are also displayed

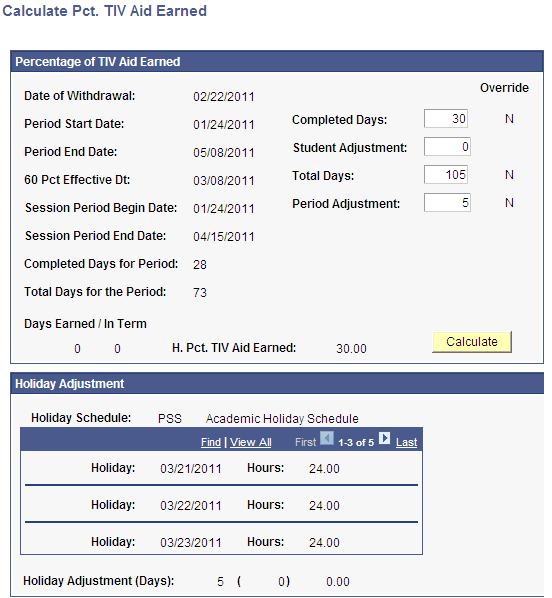

Access the Calculate Pct. TIV Aid Earned page (click the Detail link to the right of the H. Pct. TIV Aid Earned field on the Return of Funds Worksheet page).

Image: Calculate Pct. TIV Aid Earned page

This example illustrates the fields and controls on the Calculate Pct. TIV Aid Earned page. You can find definitions for the fields and controls later on this page.

Percentage of Title IV Aid Earned

|

Field or Control |

Definition |

|---|---|

| Date of Withdrawal |

Displays the student's day of withdrawal as entered on the Return of TIV Aid page. |

| Period Start Date |

Displays the first day of the term or payment period. |

| Period End Date |

Displays the last day of the term or payment period. |

| 60 Pct Effective Date(60 percent effective date) |

Displays the 60 percent date for the session in which the withdraw is taking place as recorded in the Term/Session Table or as entered in the Return TIV Session table. Note: This date is not necessarily a 60 percent point in time for the span of multiple sessions. |

| Session Period Begin Date |

Displays the lowest beginning date of the Session Period as entered in the as entered in the Return TIV Session table. |

| Session Period End Date |

Displays the highest end date of the Session Period as entered in the Return TIV Session table. |

| Completed Days for Period |

Displays calculated earned days for a session. |

| Total Days for Period |

Displays calculated total days for a session period. |

| Completed Days |

Displays the number of days between the Period Start Date and student's Date of Withdrawal. Enter a value in this field to manually override and set the Override flag to "Y". |

| Student Adjustment |

Enter a value in this field to exercise professional judgment by adjusting the student's completed days. |

| Total Days |

Displays the number of days between the Period Start Date and Period End Date, inclusive. Enter a value in this field to manually override and set the Override flag to "Y". |

| Period Adjustment |

Displays the adjustment that is required for scheduled holidays of five consecutive days or more. The system displays 0 if no holidays are scheduled consecutively for 5 or more days. Enter a value in this field to manually override and set the Override flag to "Y". |

| Days Earned / In Term |

Displays the number of completed days divided by the total days after performing a calculation. Note: This field is reset to zero every time you access the component. Click Calculate to update. |

| H. Pct TIV Aid Earned (H. percent Title IV aid earned) |

Displays the percentage of the period of enrollment or payment period that the student completed. |

| Calculate |

Click to recalculate the percentage of the period of enrollment or payment period that the student completed if updating Completed Days, Student Adjustment, Total Days, or Period Adjustment. |

Holiday Adjustment

|

Field or Control |

Definition |

|---|---|

| Holiday Schedule |

Displays the name of the holiday schedule defined and set up in human resources for that term. Student Records associates this schedule to terms and sessions used in Campus Solutions. |

| Holiday |

Displays the date of the holiday. The system lists all holidays, not just those that are consecutive. |

| Hours |

Displays the number of clock hours for the holiday. |

| Holiday Adjustment (Days) |

Displays the number of consecutive holidays defined in the holiday schedule. |

| Calculate |

Click to recalculate the adjustment for holidays if you made a change to the start and end dates of the payment or enrollment period. The system determines whether there are any changes to the holiday schedule based on the new start and end dates. |

Note: The system does not support clock hours even though you can select clock hours as a program type when you enter the access requirements to enter the Return of TIV Aid page.

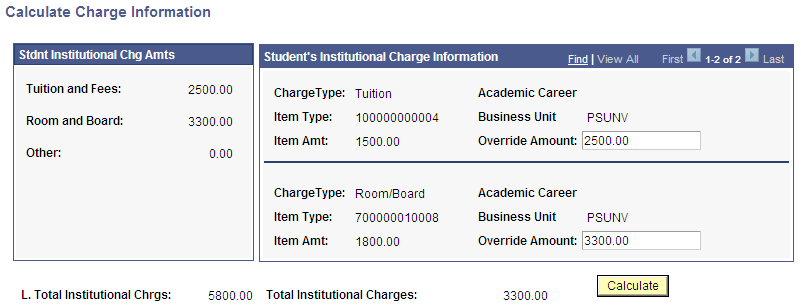

Access the Calculate Charge Information page (click the Detail link to the right of the L. Total Institutional Chrgs (charges) field on the Return of Funds Worksheet page).

Image: Calculate Charge Information page

This example illustrates the fields and controls on the Calculate Charge Information page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Charge Type |

Displays institutional charges for the student associated with an item type group for the term. |

| Category |

Displays the budget category for which the charge type is associated. |

| Academic Career |

Displays the grouping of all academic work undertaken by a student at an institution. |

| Item Code |

Displays a budget item within a budget category. |

| Amount |

Displays the charge amount for the charge type. |

| Override Amount |

Enter an amount to override institutional charges when 'Use Actual Charges' is selected in Define Rules for Return . |

| L. Total Institutional Chrgs (L. total institutional charges) |

|

| Total Institutional Charges |

|

| Calculate |

Click to recalculate total institutional charges and to update the Return of Funds Worksheet page. |

Access the Calculate Return Amounts page (click the Detail link to the right of O. Amt. Due From School or P. Amount Due From Student fields on the Return of Funds Worksheet page).

Image: Calculate Return Amounts page

This example illustrates the fields and controls on the Calculate Return Amounts page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| School Return of Funds |

Displays the amount to be returned by the school by aid fund and amount. |

| O. By School |

Displays total amount from the School Return of Funds group box. |

| P. School Rtrn (school return) |

Displays total loans to be returned by school from the School Return of Funds group box. |

| Q. By Student |

Displays initial grant amount student must return. |

| R. Repayment |

Displays loan amount student must repay. |

| Calculate |

Click to recalculate the totals if you updated or modified the values. |

Access the Return of Loan Funds page (click the Detail link for the R. Stdt Loan Repaymnt Amount field on the Return of Funds Worksheet).

Image: Return of Loan Funds page

This example illustrates the fields and controls on the Return of Loan Funds page. You can find definitions for the fields and controls later on this page.

Enter the totals for any Unsubsidized FFEL or Direct Loan, Subsidized FFEL or Direct Loan, Perkins, Graduate PLUS, or PLUS loans for which the student is responsible.

This worksheet is useful when counseling a withdrawn student on loan indebtedness.

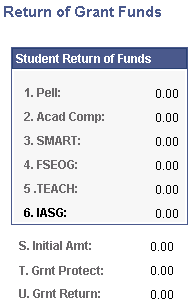

Access the Return of Grant Funds page (click the Detail link for the U. TIV Grant Return Amt field on the Return of Funds Worksheet).

Image: Return of Grant Funds page

This example illustrates the fields and controls on the Return of Grant Funds page.

Displays the amount of grant funds being returned.