Setting Up Adjustment Calendars

To set up adjustment calendars, use the Adjustment Calendars component (ADJ_TERM_PANEL).

This section provides an overview of adjustment calendars and discusses:

Adjustment calendars determine the refund schedules that you apply to the members of a tuition group. These calendars govern how the system adjusts term and class level fees when a student withdraws or drops a class. The system uses the number of days that a term or class has been in session or the class attendance percentage to determine the percentage of refund due. The system calculates these figures using date and time stamps located in the STDNT_ENRL table. State government, an agency, the federal government, or your institution can mandate refund schedules. The pro rata refund is applied to first-time students who withdraw. Federal regulations require you to use the refund table that is best for the student.

The logic for term fee calculations and adjustments for each student is:

The student enrollment record contains all the add and drop transactions. When a student adds or drops a class, the Tuition Calculation process records various fields from the enrolment records in a temporary table. The temporary table references the add and drop dates as the transaction date.

When a student drops a class, the Tuition Calculation process calculates the drop costs by comparing the amount before the drop to the amount after the drop. Tuition Calculation then applies the appropriate adjustment calendar percentage.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Adjustment Calendars |

ADJ_TERM_TABLE |

|

Define adjustment calendars. |

|

Administrative Fee Setup |

ADMIN_FEE_SP |

Click the Administrative Fee Setup link on the Adjustment Calendars page. |

Define administrative fee for adjustment periods. |

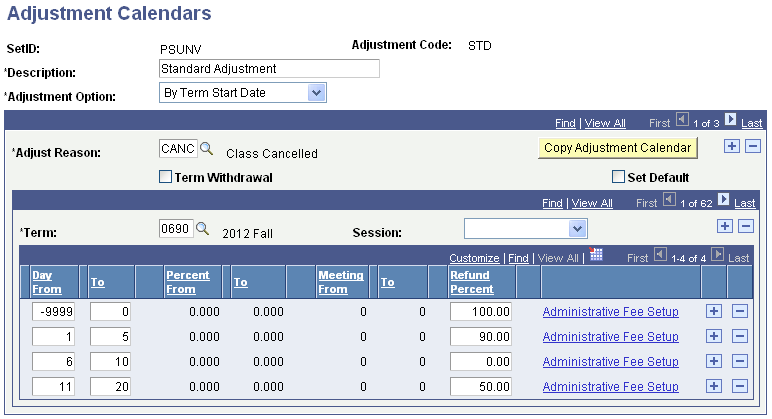

Access the Adjustment Calendars page ().

Image: Adjustment Calendars page

This example illustrates the fields and controls on the Adjustment Calendars page. You can find definitions for the fields and controls later on this page.

Note: Most types of financial aid have specific fee adjustment requirements. Consult your financial aid staff to determine adjustment calendar requirements.

|

Field or Control |

Definition |

|---|---|

| Description |

Enter a description to identify this adjustment calendar. |

| Adjustment Option |

Select the adjustment option for this adjustment calendar. Values are: By Census Date:Select to adjust fees based on the census date. Use only for Higher Education Contribution Scheme (HECS) calculation. This adjustment option is not available for term fees. By Class Length % (by class length percentage): Select to adjust fees based on the number of days that have passed out of the total number of class days scheduled. For example, if a class is scheduled to run for 13 weeks, and a student drops the class at the end of the second week, the student would have attended slightly over 15 percent of the class length. By Class Meeting % (by class meeting percentage): Select to adjust fees based on the number of class meetings attended out of the total number of scheduled class meetings. By Class Meetings Select to adjust fees based on the number of class meetings attended regardless of the total number of meetings scheduled. By Class Start Date: Select to adjust fees based on the number of days that have passed from the class start date. By Session Start Date: Select to adjust fees based on the number of days that have passed from the first day of the session. By Term Start Date: Select to adjust fees based on the number of days that have passed from the first day of the term. |

| Adjust Reason (adjustment reason) |

Select the adjustment reason code. You might adjust fees differently depending on the reason that the student drops or withdraws. For example, you might give a full refund to a student who has to drop for reasons beyond his control. The adjust reason is a short explanation of the difference. Note: If you want to select an adjustment reason for a term withdrawal, you must first select the Term Withdrawal check box. |

| Term Withdrawal |

Select if this adjustment code is to be used for term withdrawal. Do not select this check box if the adjust reason is for dropped classes. |

| Copy Adjustment Calendar |

Click to copy an adjustment calendar from one term to another. |

| Set Default |

Select to designate an adjust reason as the default reason for both term withdrawal and dropping a class. Both term withdrawal and class drop must have one adjustment calendar defined as the default. |

| Term and Session |

Enter the appropriate term and session information for each adjust reason. |

| Day From and To |

If you select the adjustment options By Class Start Date, By Term Start Date, or By Session Start Date, enter the beginning (Day From) and ending point (Day To) of the time period. For both of these fields, express the number of days before the start date defined in the Adjustment Option field as a negative number. For example, if you want a student to receive a full refund from any time before the start of a term to the day before the start of a term, enter –9999 in the From Day field and –1 in the To Day field. |

| Percent From and To |

If you select the adjustment options By Class Length % or By Class Meeting %, enter a beginning (Percent From) and ending point (Percent To) of the range. Percent values cannot be expressed as negative numbers. For example, if you want students to receive a full refund if they drop any time before attending at least 10 percent of the class, enter 0% in the Percent From field and 9.999% in the Percent To field. |

| Meeting From and Meeting To |

If you select the adjustment option By Class Meetings, enter a beginning (Meeting From) and ending (Meeting To) class session. For example, if you want students to receive a full refund if they drop any time before attending the third class session, enter 0 in the Meeting From field and 2 in the Meeting To field. |

| Refund Percent |

Enter the percent of fees charged that you want the student to receive as a refund. |

| Administrative Fee Setup |

Click to define any administrative fees that are associated with the adjustment period. Note: Administrative fees for withdrawal can be defined for each refund range row. You can set up an administrative fee for cancellation only on the first row and only if the refund percent is 100 percent. |

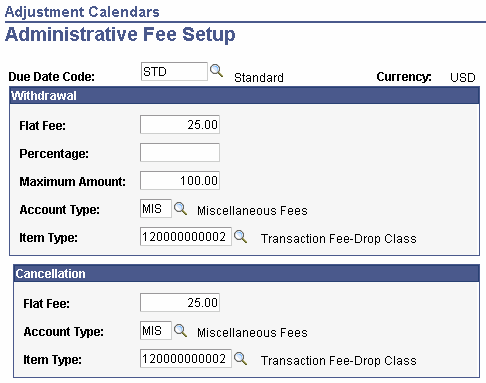

Access the Administrative Fee Setup page (click the Administrative Fee Setup link on the Adjustment Calendars page).

Image: Administrative Fee Setup page

This example illustrates the fields and controls on the Administrative Fee Setup page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Due Date Code |

Select the due date code (billing and due calendar) that you want to use for the administrative fee. |

Withdrawal Group Box

|

Field or Control |

Definition |

|---|---|

| Flat Fee |

If you want to charge a student a specific amount for withdrawing from school or for canceling enrollment in classes, enter the amount in the Flat Fee fields. This option can be used alone or in conjunction with a percentage fee. |

| Percentage |

If you want to charge students a percentage of their tuition and fees when they withdraw from school, enter that percentage in this field. This option can be used alone or in conjunction with a flat fee. This option applies to withdrawal only. |

| Maximum Amount |

If you want to put a limit on the total administrative fees that can be charged to students who withdraw from school, enter a maximum amount in this field. This option applies to withdrawal only. |

| Account Type |

Select an account type for the administrative fee. |

| Item Type |

Select the item type that you have set up for administrative fee charges. |

Cancellation

|

Field or Control |

Definition |

|---|---|

| Flat Fee |

If you want to charge a student a specific amount for withdrawing from school or for canceling enrollment in classes, enter the amount in the Flat Fee fields. This option can be used alone or in conjunction with a percentage fee. |

| Account Type |

Select an account type for the administrative fee. |

| Item Type |

Select the item type that you have set up for administrative fee charges. |

The following scenarios describe how the system calculates the term fees after a student initially enrolls in four classes and then:

Drops one class.

Adds an additional class.

Drops two classes on the same day, with the same reason.

Drops two classes on the same day, with two different reasons.

The term fee is assessed through an equation and is charged by term and adjusted by term. Refer to the section Using Equation Engine to Define Tuition Calculation Equations to see the sample equation, SFTDTFTRMTRM (Charge by Term, Adjust by Term).

Scenario 1: On January 1, 2007 the student enrolled in four classes at 100 per unit. Each class is three billing units; therefore, the total billing units equals 12 and the total amount equals 1200.00 USD, as shown in the following examples:

|

Class_nbr |

Stdnt_enrl_status |

Enrl_add_dt |

Trans_date |

Enrol_actn_rsn_last |

|---|---|---|---|---|

|

1001 |

E |

01/01/2007 |

N/A |

N/A |

|

1022 |

E |

01/01/2007 |

N/A |

N/A |

|

1003 |

E |

01/01/2007 |

N/A |

N/A |

|

1004 |

E |

0/01/2007 |

N/A |

N/A |

The following table lists the transaction in the Tuition Calculation temporary table after initial enrollment:

|

Transaction Date |

Amount |

Difference |

Drop Date |

Reason |

Refund % |

Drop Cost |

|---|---|---|---|---|---|---|

|

01/01/2007 |

1200.00 |

N/A |

N/A |

N/A |

/AN |

N/A |

Student Balance is 1200.00

Scenario 2: On January 1, 2007 the student initially enrolled in four classes. Then on January 2, 2007 the student drops one class:

|

Class_nbr |

Stdnt_enrl_status |

Enrl_add_dt |

Trans_date |

Enrol_actn_reason_last |

|---|---|---|---|---|

|

1001 |

D |

01/01/2007 |

01/02/2007 |

SDRP |

|

1002 |

E |

01/01/2007 |

N/A |

N/A |

|

1003 |

E |

01/01/2007 |

N/A |

N/A |

|

1004 |

E |

01/01/2007 |

N/A |

N/A |

The following table lists the transactions in the Tuition Calculation temporary table after initial enrollment and dropping one class:

|

Transaction Date |

Amount |

Difference |

Drop Date |

Reason |

Refund % |

Drop Cost |

|---|---|---|---|---|---|---|

|

01/0/2007 |

1200.00 |

N/A |

N/A |

N/A |

N/A |

N/A |

|

01/02/2007 |

900.00 |

300.00 |

01/02/2007 |

SDRP |

80% |

300* (100% — 80%) = 60 |

Student balance: 900.00 + 60.00 = 960.00

Scenario 3: On January 3, 2007 the student initially enrolled in four classes. On January 2, 2007 the student dropped a class and then on January 3, 2007 the student adds an additional class:

|

Class_nbr |

Stdnt_enrl_status |

Enrl_add_dt |

Trans_date |

Enrol_actn_ran_last |

|---|---|---|---|---|

|

1011 |

D |

01/01/2007 |

01/02/2007 |

SDRP |

|

1002 |

E |

01/01/2007 |

N/A |

N/A |

|

1003 |

E |

01/01/2007 |

N/A |

N/A |

|

1004 |

E |

01/01/2007 |

N/A |

N/A |

|

1005 |

E |

01/03/2007 |

N/A |

N/A |

The following table lists the transactions in the Tuition Calculation temporary table after initial enrollment and dropping one class and adding one class:

|

Transaction Date |

Amount |

Difference |

Drop Date |

Reason |

Refund % |

Drop Cost |

|---|---|---|---|---|---|---|

|

01/0/2007 |

1200.00 |

N/A |

N/A |

N/A |

N/A |

N/A |

|

01/02/2007 |

900.00 |

300.00 |

01/02/2007 |

SDRP |

80% |

300* (100% — 80%) = 60 |

|

01/03/2007 |

1200.00 |

N/A |

N/A |

N/A |

N/A |

N/A |

Note: In this example, the drop cost of 1200.00 on January 3, 2007 is not calculated on an added class.

Student balance: 1200.00 + 60.00 = 1260

Scenario 4; On January 1, 2007 the student initially enrolled in four classes. Then on January 2, 2007 the student drops two classes with the same reason, on the same day.

|

Class_nbr |

Stdnt_enrl_status |

Enrl_add_dt |

Trans_date |

Enrol_actn_ran_last |

|---|---|---|---|---|

|

1011 |

D |

01/01/2007 |

01/02/2007 |

SDRP |

|

1002 |

D |

01/01/2007 |

01/02/2007 |

SDRP |

|

1003 |

E |

01/01/2007 |

N/A |

N/A |

|

1004 |

E |

01/01/2007 |

N/A |

N/A |

The following table lists the transactions in the Tuition Calculation temporary table after the initial enrollment and dropping of two classes with the same reason, on the same day.

|

Transaction Date |

Amount |

Difference |

Drop Date |

Reason |

Refund % |

Drop Cost |

|---|---|---|---|---|---|---|

|

01/0/2007 |

1200.00 |

N/A |

N/A |

N/A |

N/A |

N/A |

|

01/02/2007 |

900.00 |

600.00 |

01/02/2007 |

SDRP |

80% |

600 (100% — 80%) = 120.00 |

Student balance: 600.00 + 120.00 = 720.00

Scenario 5: On January 1, 2007 the student initially enrolled in four classes. Then on January 2, 2007 the student drops two classes with two different reasons:

|

Class_nbr |

Stdnt_enrl_status |

Enrl_add_dt |

Trans_date |

Enrol_actn_ran_last |

|---|---|---|---|---|

|

1011 |

D |

01/01/2007 |

01/02/2007 |

SDRP |

|

1002 |

D |

01/01/2007 |

01/02/2007 |

CANC |

|

1003 |

E |

01/01/2007 |

N/A |

N/A |

|

1004 |

E |

01/01/2007 |

N/A |

N/A |

The following table lists the transactions in the Tuition Calculation temporary table after the initial enrollment and dropping of two classes with two different reasons, on the same day.

|

Transaction Date |

Amount |

Difference |

Drop Date |

Reason |

Refund % |

Drop Cost |

|---|---|---|---|---|---|---|

|

01/0/2007 |

1200.00 |

N/A |

N/A |

N/A |

N/A |

N/A |

|

01/02/2007 |

900.00* |

300.00 |

01/02/2007 |

CANC |

90% |

300* (100% — 90%) = 30.00 |

|

01/02/2007 |

600.00 |

300.00 |

01/02/2007 |

SDRP |

80% |

$600 (100% — 80%) = 60.00 |

Student Balance: 600.00 + 30.00 + 60.00 = 690.00

When a student drops two classes with two different reasons on the same day, the temporary table is inserted alphabetically by reason and each class is calculated separately. The first amount is calculated by only noting that one class has been canceled. The second amount is calculated by using the second class that has been dropped by the student.

If the adjustment calendar is by session start date, the session code is taken into account similarly to the reason.

During withdrawal processing, the student's enrollment record, for enrolled classes, will have the drop date equal the last attendance date. Therefore, the transaction date will be the last attendance date.