Setting Up Your Business Unit to Refund Customers

This section discusses how to:

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Refund Setup |

BUS_UNIT_TBL_SF3 |

|

Define the rules governing how your business unit handles refunds. |

|

Refund Approval |

BUS_UNIT_TBL_SF20 |

|

Define refund approval levels. |

|

Payroll Defaults |

BUS_UNIT_TBL_SF4 |

|

Create default parameters for refunds that use the payroll interface. |

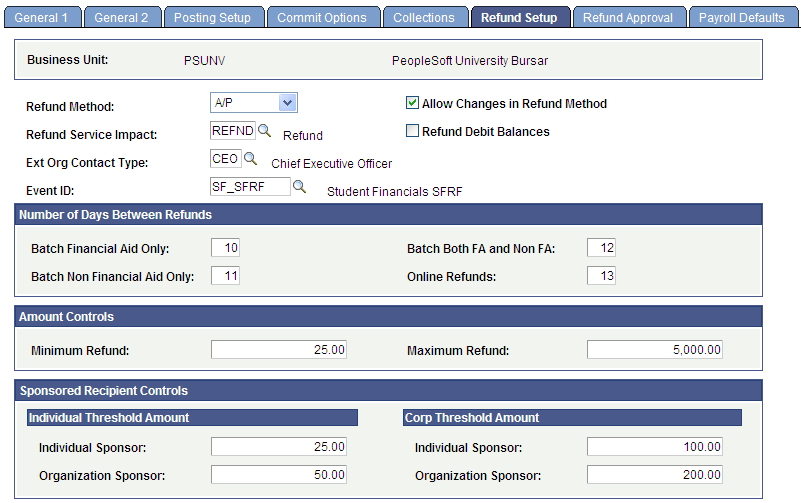

Access the Refund Setup page ().

Image: Refund Setup page

This example illustrates the fields and controls on the Refund Setup page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Refund Method |

Values are: A/P: Create the refund in Student Financials and have your accounts payable department produce and distribute the refund by direct deposit or check. Other: Create the refund in Student Financials and produce a check using a third-party application. Payroll: Use PeopleSoft Payroll for North America to create refunds and produce checks. You can use this option for individual refunds only, not for refunds to an organization. |

| Allow Changes in Refund Method |

Select to enable a user to switch between the AP, Other, and Payroll methods when processing online and batch refunds. If you clear this check box, the user can use only the refund method specified for the SF Business Unit. |

| Refund Service Impact |

Select the value to use to prevent or deny a refund. |

| Refund Debit Balances |

Select to create refunds that exceed the available credit balance. For example, if a student has charges of 9,000 USD and an unapplied credit of 10,000 USD from a fellowship award, the system allows a refund of the excess unapplied credit even though the student's account technically has a debit balance. |

| Ext Org Contact Type (external organization contact type) |

Select the external organization contact type for processing batch refunds for external organizations. The system uses the external organization contact type to determine an address for a corporate refund, both on-line and batch. Both a contact type and a preferred contact must be set up on the Organization Table component. |

| Event ID |

This field is available only if A/P is selected in the Refund Method field on this page. Select an event ID to be used in the generation of communication records when refunds are processed using the Create Refund Voucher process. You must first complete the relevant 3C setup in Campus Community. See Understanding Communications Setup. The value that you select here appears by default in the Event ID field on the Batch Refund run control page and on the online refund pages—for example, the Student Refund page. You can change the value for specific populations—for example, PLUS refunds. Values appear in the Event ID field based on the Administrative Function of SFRF and the academic institution that is associated with the SF Business Unit. |

See:

Number of Days Between Refunds

Define the minimum number of days between the times refunds can be processed for a particular customer.

Note: These restrictions prevent refunds processed in batch mode, but produce only warning messages for online refunds.

|

Field or Control |

Definition |

|---|---|

| Batch Financial Aid Only |

Enter the minimum number of days between batch-produced refunds of excess financial-aid credits. This setting restricts refunds of financial aid item type credits only and does not affect batch-produced refunds of nonfinancial-aid credits. Note: Use this setting to specify a different interval between refunds for financial aid and nonfinancial-aid credits only. |

| Batch both FA and Non FA (batch both financial aid and nonfinancial aid) |

Enter the minimum number of days between batch-produced refunds of all excess credits. Use this setting to process financial-aid and nonfinancial-aid credits the same way. |

| Batch Non Financial Aid Only |

Enter the minimum number of days between batch-produced refunds of excess nonfinancial-aid credits. This setting restricts nonfinancial-aid credits only and does not affect batch-produced refunds of financial aid item type credits. Note: Use this setting to specify a different interval between refunds for nonfinancial-aid and financial aid credits only. |

| Online Refunds |

Enter the minimum number of days between online-produced refunds of all excess credits. Note: Because online refunds are usually produced for extraordinary reasons, this setting results in a warning message when you attempt to process refunds more frequently than the specified number of days. It does not prevent you from processing the refund. |

Amount Controls Group Box

|

Field or Control |

Definition |

|---|---|

| Minimum Refund |

Enter an amount below which you do not want to produce refunds in batch mode. Refunds below this amount can be processed online. You receive a warning message, but you can override it. |

| Maximum Refund |

Enter an amount above which you do not want to produce refunds. You cannot override this amount. |

Sponsored Recipient Controls

Sponsored recipient controls refer to the threshold below which student refunds are paid directly to the sponsored student or organization rather than to the sponsor. For example, if the individual sponsor threshold amount is established at 25.00 USD and a sponsored student has a refundable credit balance of 20.00 USD, the refund is paid to the student rather than to a sponsor. Sponsors can be either individuals or organizations.

Individual Threshold Amount

|

Field or Control |

Definition |

|---|---|

| Individual Sponsor and Organization Sponsor |

Enter a monetary amount (threshold) below which student refunds are not paid to an individual or an organization sponsor. |

Corp Threshold Amount

|

Field or Control |

Definition |

|---|---|

| Individual Sponsor and Organization Sponsor |

Enter a monetary amount (threshold) below which refunds to an organization are not paid to an individual or an organization sponsor. |

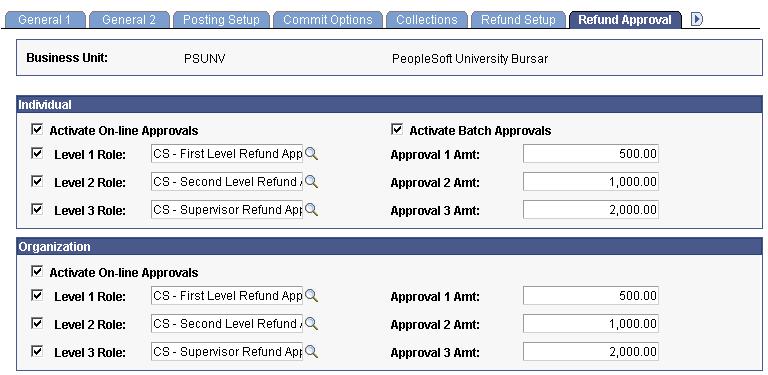

Access the Refund Approval page ().

Image: Refund Approval page

This example illustrates the fields and controls on the Refund Approval page. You can find definitions for the fields and controls later on this page.

Refund approval controls determine whether approval is required before a refund can be issued. If approval is required, refund requests are routed to the appropriate approver's worklist.

Approval amounts define a range. For example, if the approval 1 amount is set at 500 USD, the approval 2 amount is set at 1,000 USD, and the approval 3 amount is set at 2,000 USD, all refunds under 500 USD do not require approval. All refunds between 500 USD and 999 USD require only level 1 approval, and so on.

Individual

|

Field or Control |

Definition |

|---|---|

| Activate Online Approvals and Activate Batch Approvals |

Select to require approval of online or batch refunds. If you activate approvals, you must establish roles and approval amounts. |

| Level 1 Role, Level 2 Role, and Level 3 Role |

Select the appropriate role for each level of approval. |

| Approval 1 Amt (approval 1 amount), Approval 2 Amt (approval 2 amount), and Approval 3 Amt (approval 3 amount) |

Enter the refund amount for which the system requires each level of approval. |

Organization

Establish approval parameters for corporate refunds. The fields in this group box are identical to those in the Individual group box, except that batch approvals do not apply for organization refunds.

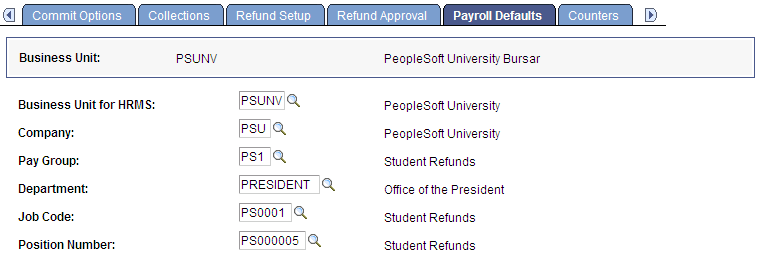

Access the Payroll Defaults page ().

Image: Payroll Defaults page

This example illustrates the fields and controls on the Payroll Defaults page. You can find definitions for the fields and controls later on this page.

Note: Before entering data on this page, consult your institution's payroll staff to determine the correct settings. Use PeopleSoft Payroll for North America to set up and process payroll refunds.

|

Field or Control |

Definition |

|---|---|

| Business Unit for HRMS (business unit for human resources management system) |

Select the business unit that PeopleSoft Payroll for North America uses to identify the refund company. |

| Company |

Select the company code that has been designated for individual refunds. |

Default withholding amounts, as well as Federal, State, and company tax tables, are set up in PeopleSoft Payroll for North America.