13 Enter Additional Address Book Information

This chapter contains these topics:

-

Section 13.1, "Entering Additional Address Book Information for Brazil"

-

Section 13.2, "Entering Address Book - Customer Master Information"

-

Section 13.3, "Entering Address Book - Supplier Master Information"

13.1 Entering Additional Address Book Information for Brazil

From Address Book (G01), choose Address Book Revisions

You enter address book records to create a database of information about your employees, customers, suppliers, and tax authorities.

You can use address book records to maintain a wide variety of miscellaneous information about various entities. The information you include in address book records can indicate, among other things, the e-mail preference for a supplier, a particular business's primary language, or the tax code that a company uses.

To process business transactions accurately in Brazil, the government requires companies to maintain detailed tax information and specifications for all customers, suppliers, and tax authorities. To do this, you can access an additional tax information screen when you add a new address book record to the system, or change the information for an existing record.

Alternatively, you can access customer and supplier address book records from the following forms:

-

Customer Master Information (P01053)

-

Supplier Master Information (P01054)

13.1.1 Before You Begin

-

Verify that Brazil is the country that you have selected for your user display preferences.

-

Verify that you have a Generic Function Key Exit set up for V01051, country = BR, to call program and screen ID P76011B, version ZJDE0001. For more information, see Section 5.2, "Setting Up Generic Function Key Exits." The version ZJDE0001 matches the version of P01051 on menu G01. The version names for P76011B and P01051 must be the same.

-

Processing options for Address Book Additional Information - Brazil (P76011B) specify whether the system validates, allows duplicates for, and displays error or warning messages for CGC and CPF numbers.

To enter additional address book information

The additional address book information program, P76011B, is called automatically when you enter a new address book entry. Note that the Dream Writer version of P76011B must be the same name as the version of P01051 that is called from your menu. For example, if your menu calls version ZJDE0001 of Address Book Revisions (P01051), then the version of P76011B will also be ZJDE0001.

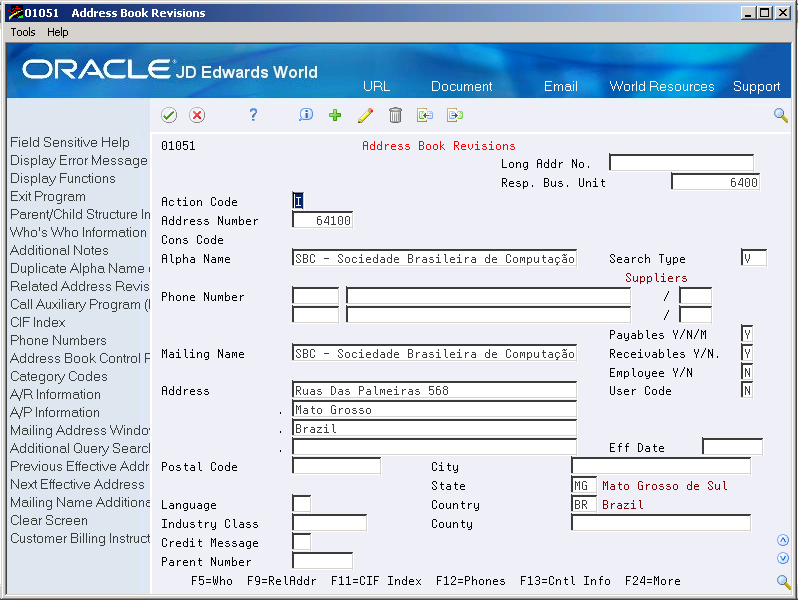

On Address Book Revisions

Figure 13-1 Address Book Revisions screen

Description of ''Figure 13-1 Address Book Revisions screen''

-

To locate an address book record, complete the following field:

-

Address Number

-

-

Select the Brazil Address Book generic function key.

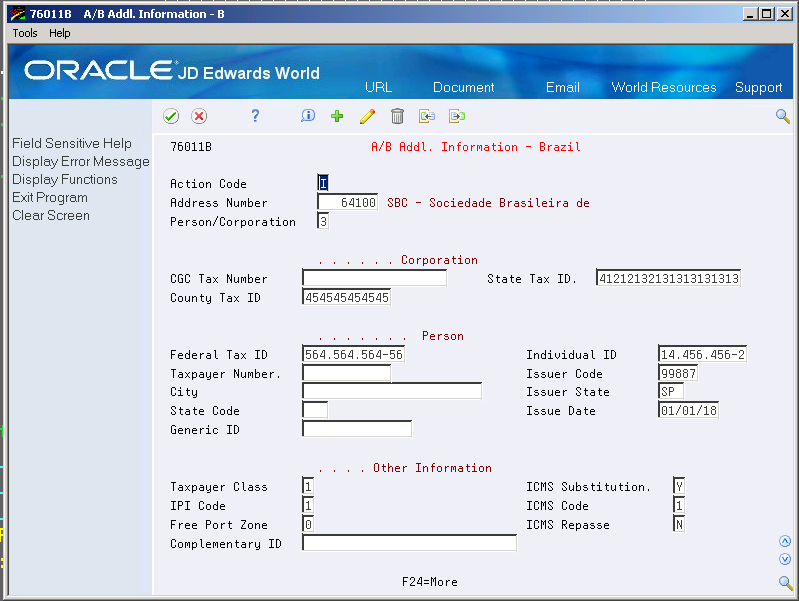

Figure 13-2 A/B Additional Information-Brazil screen

Description of ''Figure 13-2 A/B Additional Information-Brazil screen''

-

On Additional Information Brazil, complete the following field:

-

Person/Corporation

-

-

To specify the tax information for a Brazilian corporation, complete the following fields:

-

CGC Tax Number

-

ICMS Tax ID

-

ISS Tax ID

-

-

To specify the tax information for a Brazilian individual, complete the following fields:

-

Federal Tax ID

-

Individual ID

-

Taxpayer Number

-

Issuer Code

-

City

-

State Code

-

Issuer State

-

Issue Date

-

Generic ID

-

-

To specify general tax information, complete the following fields:

-

Taxpayer Class

-

ICMS Substitution

-

ICMS Code

-

ICMS Repasse

-

IPI Code

-

Free Port Zone

-

Complementary ID

-

| Field | Explanation |

|---|---|

| Person/Corporation Code | A code that designates the type of taxpayer. U.S. users use one of the following codes with the 20-digit Tax field:

C Corporate entity (printed as 12-3456789) P Individual (printed as 123-45-6789) N Non-corporate entity (printed as 12-3456789) Blank Non-corporate entity (not formatted) The system selects suppliers with P and N codes for 1099 reporting. Non-U.S. users use the following codes with the 20-digit Company field and Individual field: 1 Individual 2 Corporate entity 3 Both an individual and a corporate entity 4 Non-corporate entity 5 Customs authority |

| CGC Tax Number | Complete this alphanumeric, 19-character field to identify the ship-from company. The local tax authority requires that this ship-from tax identification number is included on Notas fiscais and legal reports.

Enter the ship-from tax identification number using the following convention: XXX.XXX.XXX/YYYY-WW The definitions of the variables for this convention are as follows: XXX.XXX.XXX = Corporation code YYYY = Headquarters or branch code WW = Check digits Note: This field is required only if the country entered on V01051 is equal to 'BR' (Brazil). Foreign companies do not have CGC numbers. |

| ICMS Tax ID | An additional identification number that a tax authority assigns to an individual. |

| ISS Tax ID | Complete this alphanumeric, 12-character field to identify a corporation for tax purposes. The identification number used by the county to identify a taxpayer. In Brazil, this information is mandatory on Notas Fiscais and all legal reports.

Enter the identification number using the following convention: X.XXX.XXX-X |

| Federal Tax ID | Enter the unique tax identification number that the federal tax authorities use to identify individuals. Use the following convention: XXX.XXX.XXX-YY.

In this convention, XXX.XXX.XXX is the tax identification number and YY is the check digit. Note: This field is required only if the country entered on V01051 is equal to 'BR' (Brazil). Foreign individuals do not have CPF numbers. |

| Individual ID | Enter the unique number that the state police department uses to identify the person.

The system stores the identification number in the Address Book ABTX2 tables. For the system to edit the number, you must enter identification numbers using the following convention: XX.XXX.XXX-Y In this convention, XX.XXX.XXX is the identification number and Y is the check digit. |

| Taxpayer Number | County Contractor Taxpayer Number (ID). |

| Issuer Code | The short name for the issuer of the ID card. |

| City | The city associated with the address. |

| State Code | A 2-character abbreviation of a state name. |

| Issuer State | The code defined for the state in F0075. It is a postal service abbreviation. |

| Issue Date | The date on which an address becomes active. |

| Taxpayer Class | Use this code to indicate the tax status of the party with which you are dealing.

Valid values are hard-coded and include: 1 = Taxpayer 2 = Consumer 3 = Taxpayer/Consumer |

| ICMS Substitution | Use this code to indicate whether a client or product is subject to tax substitution.

Valid values are: Y = Yes N = No |

| ICMS Repasse | Use this code to indicate whether a customer is subject to ICMS repasse.

Valid values are: Y - Yes N - No |

| ICMS Code | Use this code to indicate how ICMS tax is assessed.

For example, you might set up your codes as follows: 1 - Taxable 2 - Exempt or Not Taxable 3 - Other This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the ICMS tax amount. |

| IPI Code | Use this code to indicate how IPI is assessed.

Valid values are: 1 - Taxed 2 - Exempt 3 - Other or not taxed This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. |

| Free Port Zone | Enter a value in the Free Port Zone field to indicate whether a company is located in a free port zone. |

| Complementary ID Code | Use this field to enter another type of identification number, different than the numbers usually used (CGC, State Tax ID). This alternate identification number must be printed on the Nota Fiscal for fiscal purposes. |

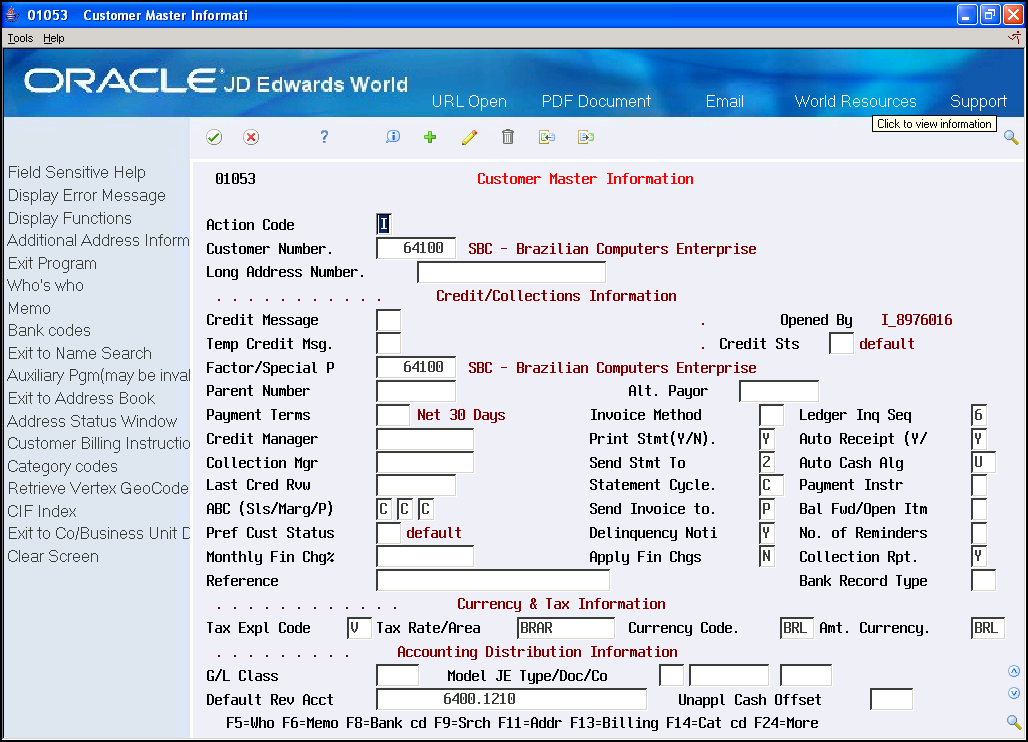

13.2 Entering Address Book - Customer Master Information

The Tax Area is required for tax calculation of PIS/COFINS/ISS for Sales Orders. It can be assigned when updating the Customer Master Information.

Figure 13-3 Customer Master Information screen

Description of ''Figure 13-3 Customer Master Information screen''

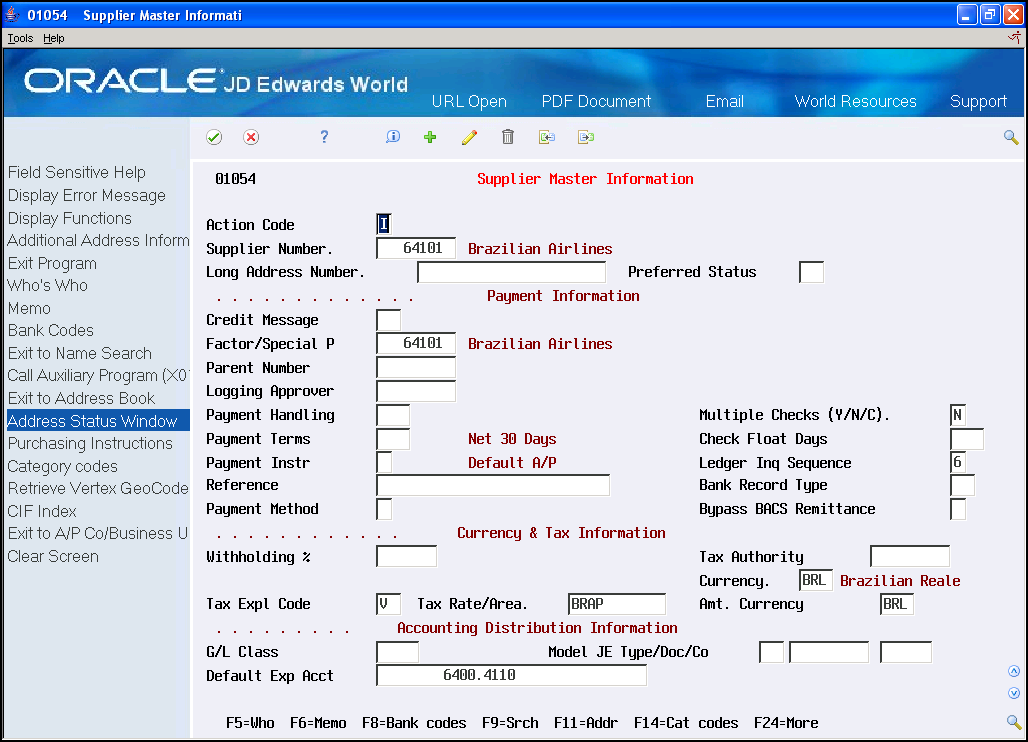

13.3 Entering Address Book - Supplier Master Information

The Tax Area is required for tax calculation of PIS/COFINS for Purchase Orders. It can be assigned when updating the Supplier Master Information.

Figure 13-4 Supplier Master Information screen

Description of ''Figure 13-4 Supplier Master Information screen''