12 Set Up ICMS and IPI Tax Rates

This chapter contains these topics:

12.1 Setting Up ICMS Tax Rates

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose ICMS Tax Revision

ICMS is a state tax that the government levies on purchasing and sales transactions in Brazil. The tax rate varies from state to state and some products may be taxed at different rates. The price of the product always includes ICMS tax, but the amount of this tax also appears on the Nota Fiscal.

You must set up and maintain current ICMS tax rates for all of the states in which you do business. The system calculates the ICMS tax amount for purchasing and sales transactions based on the rates you set up on the ICMS tax table.

You can define specific ICMS tax rates for individual inventory items, or generically by state. For example, if you specify an ICMS tax rate for an item with a "ship to state" or "ship from state," the system uses the rate for the item. If you do not specify an ICMS tax rate for an item, the system uses the rate for the "ship to state" or "ship from state." You can also define ICMS tax by mark up level.

Federal Senate Resolution No. 13, dated April 25, 2012, changed to 4% the rate of the ICMS (Tax on circulation of Goods and Services) applicable to interstate transactions involving imported goods not submitted to industrial processing, as well as to imported goods submitted to industrialization resulting in imported content higher than 40%. It represents the goods that have been subjected to any transformation, processing, assembling, packaging, repackaging, renovation or refurbishment process, but its Import Content still accounts for more than 40% of its composition.

|

Note: The 4% tax rate and the 40% threshold on imported goods are the amounts determined by the resolution when the resolution was published. You should verify the current tax rates and thresholds before you process transactions subject to ICMS tax. |

To enable you to correctly process and report transactions subject to ICMS, the JD Edwards World software enables you to:

-

Enter the appropriate item origin code and complete fields required for reporting on transactions for imported goods in the Brazil-specific screens for the Item Master file and the Item Location Master file.

See Section 17.2, "Entering Additional Item Master Information for Brazil" and Section 17.3, "Entering Additional Branch/Plant Information for Brazil".

-

Enter imported content information when you enter a purchase order.

-

Include required import information in purchase order receipts.

-

Include required information in sales orders.

See Chapter 25, "Enter Additional Information for Sales Orders"

Additionally, the system performs actions to process ICMS import information when you run the following programs:

-

Includes FCI number and the percentage of imported content information in the NFe file when you run the XML Generator SEFAZ program (P76B601).

See Chapter 39, "Processing Electronic Nota Fiscal (NFe) in Normal Mode"

-

Deletes item import information from the Nota Fiscal Tag File Res. 13 file (F76B13) when you use the Reverse/Void Nota Fiscal program (P76B559) to reverse or void nota fiscal lines.

The system applies tax rates by exception. Set up all of the general tax rates first. Then, if a transaction has special or unique settings, use the ICMS Tax Revisions program to set up the ICMS tax on a case-by-case basis. Enter the data of the transaction as a record, and then enter the exceptions.

The system retrieves the ICMS tax rate using this hierarchy:

-

Item Origin, From State, To State, Item, MarkUp Level

-

Item Origin, From State, To State, MarkUp Level

-

Item Origin, From State, Item, MarkUp Level

-

Item Origin, From State, MarkUp

If the system does not locate the ICMS tax rate using the above hierarchy, then the system uses this hierarchy to locate the ICMS tax rate:

-

Item Origin = *, then From State, To State, Item, MarkUp Level

-

Item Origin = *, then From State, To State, MarkUp Level

-

Item Origin = *, then From State, Item, MarkUp Level

-

Item Origin = *, then From State, MarkUp

|

Note: A pre-installation table conversion program populates the Item Origin field with *. If you do not assign an item origin code in the item master or item branch set up, then the value for the item origin remains *. |

On ICMS Tax Revision

To set up ICMS tax information for a specific item, complete the following field:

-

Item Number

-

Item Origin

-

Mark-Up Level

The Item Number field is optional. Complete this field only to set up ICMS tax rates that apply to specific items.

-

Complete the following fields:

-

From State

-

To State

-

ICMS State Tax Percent

-

ICMS Interstate Percent

-

Taxbase Reduction

-

Subst. Mark-up

-

Subst. Tax Base Reduc.

-

ICMS Deferred Percentage

| Field | Explanation |

|---|---|

| Item Number - Unknown Format Entered | A number that the system assigns to an item. It can be in short, long, or 3rd item number format. |

| Item Origin | Use the Item Origin code to specify the origin of a product. Values are hard coded.

If you enter a code from UDC 76/IO that includes 1 in the Special Handling Code field, you must provide import content information in the item or item/branch master file. Item Origin codes 3, 5, and 8 include 1 in the Special Handling Code field of the UDC. Valid values are: 0: National, and does not meet requirements for codes 3, 4, 5, or 8. 1: Imported; foreign supplier 2: Imported; Brazilian supplier 3: National, where over 40% of the cost are from foreign components. 4: National, where the production is compliant with local production rules. 5: National, where under or 40% of the cost are from foreign components 6: Foreign, acquired abroad, does not have similar in the domestic market, and belongs to CAMEX list and natural gas. 7: Foreign, acquired on domestic market, does not have similar goods in the domestic market and belongs to CAMEX list and natural gas. 8: National, with imported content over 70%. |

| Mark-up Level | A code that is used in conjunction with an Address Book Category code to create different ICMS Substitution mark-up tables depending on the customer mark-up level.

This field cannot be left blank. To make this field a blank space, type an asterisk (*). |

| State From | A standard postal code for a state that indicates the location of the manufacturer (branch/plant). It is a code that identifies the point of origin for goods or services in a transaction (user defined code system 00, type S).

This field cannot be left blank. To make a blank space, type an asterisk (*). |

| To | A standard postal code for a state that indicates the location of a customer. It is a code that identifies the destination of the goods or services in a transaction (user defined codes, system 00/type S).

This field cannot be left blank. To make this field a blank space, type an asterisk (*). |

| Tax Rate 1 | A number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7 percent as 7. The value appears as 7.000.

Screen-specific information This number is the ICMS tax rate that regulations apply to transactions within the same state. |

| Tax Rate 2 | A number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7 percent as 7. The value appears as 7.000. |

| Reduction | Complete the ICMS/IPI Taxbase Reduction Factor field to specify the factor that the system uses to reduce the amount of the taxable base of a product. |

| Substitution Mark-up | A theoretical mark-up factor, defined by the state, that is used to calculate the maximum price a retail seller can charge customers for a given product. |

| Reduction | A factor that reduces the ICMS substitution tax amount. |

| ICMS Deferred Percentage | A number that identifies the percentage of ICMS tax that the system defers. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7 percent as 7. The value appears as 7.000.

Despite the value you enter in this field, the system only calculates deferred ICMS on Outbound Notas Fiscais where the From State and To State are the same; and only when the ICMS Tributary Situation Code is either 51 (Deferred) o 90 (Others). If the conditions for the deferred ICMS calculation are met and you leave this field blank, the system defers 100 percent of the ICMS due for the transaction. |

12.2 Setting Up IPI Tax Rates for Brazil

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose IPI Tax Revision

IPI (Imposto Sobre Produtos Industrializados) is a federal excise tax and the government levies it at various rates on manufactured products. The tax is payable at the point of production or importation.

To calculate the IPI tax that you pay to your customers and suppliers, you must set up:

-

Tax rates

-

Tax reductions

You can set up IPI tax rates by fiscal classification. You can also set up a default IPI tax rate that applies to all customers and suppliers.

12.2.1 Before You Begin

-

Set up all tax authorities as address book records

-

Set up fiscal classification codes

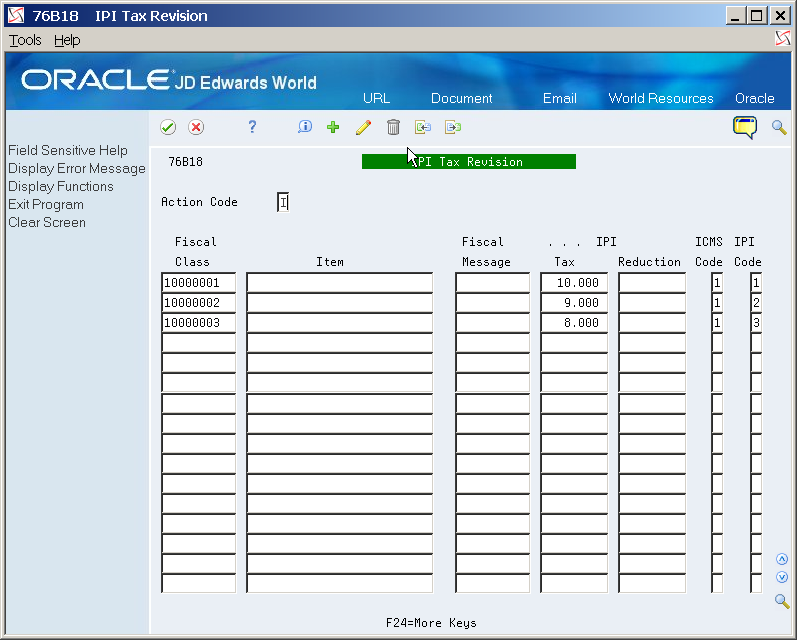

On IPI Tax Revision

-

Complete the following fields:

-

Fiscal Class

-

Fiscal Message

-

-

To identify a tax rate for a tax authority that has jurisdiction in a geographic area, complete the following fields:

-

I.P.I. Tax

-

I.P.I. Reduction

-

-

To associate tax information with the classification, complete the following fields:

-

I.C.M.S. Code

-

I.P.I. Code

-

| Field | Explanation |

|---|---|

| Fiscal Class | Use the Fiscal Classification code to identify groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product. |

| Fiscal Message | A user defined code (system 40, type PM) that you assign to each Fiscal print message that appears on the Nota Fiscal. |

| IPI Tax | A number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7 percent as 7. The value appears as 7.000. |

| Reduction | A number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7 percent as 7. The value appears as 7.000.

Screen-specific information A factor that reduces the IPI substitution tax amount. |

| ICMS Code | Use this code to indicate how ICMS tax is assessed.

For example, you might set up your codes as follows: 1 - Taxable 2 - Exempt or Not Taxable 3 - Other This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the ICMS tax amount. |

| IPI Code | Use this code to indicate how IPI is assessed.

Valid values are: 1 - Taxed 2 - Exempt 3 - Other or not taxed This information indicates in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. |