21 Work with Receipts for Procurement

This chapter contains these topics:

21.1 Working with Receipts for Procurement

You must enter receipt information to verify the receipt of goods or services on a purchase order. You must verify the quantity, cost, and so on, for each order you receive. If you make an error or need to cancel a receipt for any other reason, you can enter reversing receipts.

When you enter receipts for purchase orders, you create the related Brazilian Nota Fiscal document.

You use the Enter Receipts by PO (P4312) program to enter receipts. When you work with Brazilian records, the P4312 program calls the Receive Nota Fiscal Records program (P43125BR) so that you can enter information for notas fiscais. The P43125BR program saves data to these files:

-

F76B4311 (Purchase Order Detail Tag File)

-

F76B0401 (FCI by Item Supplier)

-

F76B432 (Item Location tag File Res 13)

-

F76432 (Purchase Order Detail Tag File)

21.1.1 Import Information in Purchase Order Receipts

When you enter a receipt for items that have imported content, the value in the item origin field for the item determines if item import information is required. If the item origin assigned to the item includes 1 in the first position of the Special Handling Code field, you must provide item import information. This list describes the import information that you enter on the Item/Branch Additional Info screen if import information is required:

-

Import Content Form (FCI)

-

Import Content

-

Value of the Portion from Abroad

-

Total Value of the Interstate Outbound

When you create a purchase order receipt for an item that requires import information, the system retrieves the import information from the F76B4311 file. If the import information does not exist in the F76B4311 table, then you must enter it manually. When you save the purchase order receipt, the system saves the information to the following files:

-

F76B4311

-

F76B432

-

F76B0401

21.1.2 What You Should Know About

| Topic | Description |

|---|---|

| Alternate entry formats | When you enter receipts for purchase orders, you can use three different entry screen formats, depending on the type of purchase order information that is most readily available to you. Depending on the entry format you choose, you can enter receipts for purchase orders by purchase order number, item number, or General Ledger Account number. You use a function key to switch between entry formats. |

| Canceled purchase order detail lines | When you cancel an order detail line (inventory and non-inventory), the program enters the current date in the Actual Cancel Date (CNDD) in the Purchase Order Detail file (F4311). You can use the Prevent Cancellation in a Different Fiscal Year processing option to prevent users from cancelling an order detail line that was committed or encumbered in a different fiscal year than the year in which you cancel the line.

For committed or encumbered lines, you can enter a cancel date in the G/L Date field in the fold at the same time you enter 9 in the Option field to cancel the line. The system enters this date in the G/L Cancel Date field in the F4311. Otherwise, the system enters the current date in the G/L Cancel Date field in the F4311. |

21.2 Entering Receipts for Brazilian Procurement

From Localizations - Brazil (G76B), choose Purchase Order Management

From Purchase Order Management - Brazil (G76B43), choose Purchase Order Processing

From Purchase Order Processing - Brazil (G76B4311), choose Enter Receipts by PO or

From Purchase Order Processing (G43A11), choose Enter Receipts by Item

To enter a receipt, you must first locate the open purchase order detail lines that correspond to the receipt. An open detail line contains items that have not yet been received. The system retrieves all open detail lines for the item number, purchase order number, or account number you specify.

If the detail lines on a purchase order differ from the details of the actual receipt, you must adjust the purchase order detail lines to reflect the receipt. For example, if the order quantity on a detail line is 20, but you receive a quantity of 10, you must change the quantity on the detail line to 10. You specify whether to close the remaining balance on the line or to keep it open.

To enter receipts for Brazilian procurement

On Enter Receipts

-

To locate purchase order detail lines that correspond to a receipt, complete one of the following fields, depending on the format that you are using:

-

Order Number

-

Item Number

-

Account Number

The system displays only those detail lines with a next status code equal to that which you specified in processing options.

-

-

Select the Receive option (option 1) for each of the details lines that you want to receive for the purchase order and press Enter.

Alternately, you can select options to close the balance (option7), or cancel the line entirely (option 9).

-

Enter Y to record the receipt.

The system displays the PO Additional Info. - Brazil screen.

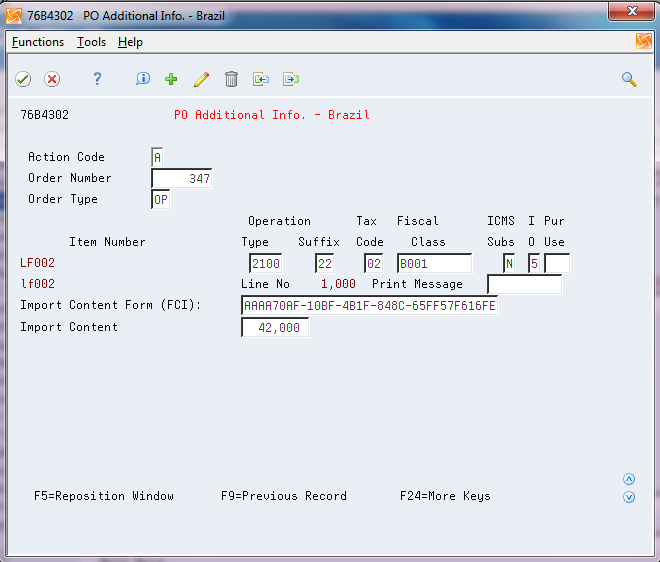

Figure 21-1 P.O. Additional Info. - Brazil screen

Description of ''Figure 21-1 P.O. Additional Info. - Brazil screen''

-

Review the fields and complete those for which you need to add information.

If the Special Handling Code field of the value in the Item Origin field indicates that the item is foreign and requires import information, the fields for imported content become available. The system retrieves the values for the fields from the FCI by Item/Supplier file (F76B0401) if the information exists in the file. If the information does not exist in the F76B0401 file, then you must manually enter it.

-

Fiscal Class

-

Tax Code

-

Item Origin

-

ICMS Substitution

-

Print Message

-

Purchase Use

-

Import Content Form - FCI

-

Import Content

-

Value of the Portion From Abroad

-

Total Value of the Interstate Outbound

See Also: Section 17.3, "Entering Additional Branch/Plant Information for Brazil"

-

-

Click OK.

The system displays the Nota Fiscal Selection screen.

-

Complete the following fields:

-

Document Type

-

Nota Fiscal Number

-

Series

-

Issue Date

-

Legal Access Key (optional)

If the selected document type is for Electronic Nota Fiscal (00/DT SPHD = 355), Legal Access Key information is required.

The Legal Access Key fields 1 to 7 are calculated based on the supplier's setup and supplier's nota fiscal information entered in this screen.

Field 8 needs to be entered by the user based on the information in the Nota Fiscal provided by the Supplier.

Field 9 is a check digit field and is automatically calculated based on the information in all 8 fields.

-

See Section 35.2, "Overview of the Electronic Nota Fiscal (NFe) XML File".

Depending on your processing option selections, the system returns to the Enter Receipts screen.

| Field | Explanation |

|---|---|

| NF Number | In Brazil, Notas fiscais are identified based the combination of a Nota Fiscal number and a Nota Fiscal series number.

Use this numeric, 15-digit field to identify the Nota Fiscal number. The Nota Fiscal Number field is the first key that the system uses to access a specific Nota Fiscal. |

| FCI number | This number is sent by Fiscal SEFAZ together with protocol to Authorization of use. The FCI number needs to be included in the exit fiscal document (NF-e) so that the taxpayers acquiring the product after importation and individual processing may also know about it. When the imported products are not subject to industrial processing, it is not necessary to generate the FCI.

This field should be completed with the 36-character value that your supplier included in the nota fiscal sent to you with the goods. |

| Import Content | Import Content is the percentage corresponding to the ratio between the value of the imported portion coming from abroad (data item BVPA) and the total value of the exit interstate transaction (data item BVIO) of goods or property subject to the industrialization process. The formula is: (BVPA / BVIO) x 100 = Import Content. |

21.2.1 What You Should Know About

| Topic | Description |

|---|---|

| Receipts for multiple Nota Fiscal documents | You can enter receipts for multiple Nota Fiscal documents without leaving the Enter Receipts screen. To do this, select the Nota Fiscal Search function key. The system displays the Display Nota Fiscal screen. Enter the Nota Fiscal number and series and press enter. Accept the remaining lines associated to the second Nota Fiscal document.

NOTE: The Nota Fiscal number associated with the item that you are receiving is the same number that you used for the last item received. |

| Receipts for multiple Nota Fiscal documents | Processing options configure the Nota Fiscal document. The version you use must be the same one as the version you use for the receipt program. If no version exists, the system will use ZJDE0001. |

| Multiple Purchase orders received for same Nota Fiscal | The system allows the same Nota Fiscal number to be associated with more than one purchase order receipt. |

| Nota Fiscal Statuses | During the PO Receipt, Receive Nota Fiscal Records program (P4312ABR) is called to retrieve the nota fiscal statuses. Make sure that this program's document type and statuses processing options are properly set up, otherwise, error message:

137J - Status FlowNot Set Up for Nota Fiscal is displayed. |

| Brazil - Nota Fiscal Number Format Valid (X76B4002) | This program is called at PO Receipt time to validate the nota fiscal number format. |

21.3 Entering Reversing Receipts for Brazilian Procurement

From Localizations - Brazil (G76B), choose Purchase Order Management

From Purchase Order Management - Brazil (G76B43), choose Purchase Order Processing

From Purchase Order Processing - Brazil (G76B4311), choose Enter Receipts by PO or

From Purchase Order Processing (G43A11), choose Enter Receipts by Item

You can reverse a receipt as long as you have not yet created a voucher for the receipt. You might do this if you recorded a receipt by mistake or you recorded the wrong receipt.

When you reverse a receipt, the system accounts for the order as if it were never received. The system reverses all accounting and inventory transactions.

To enter reversing receipts for Brazilian procurement

On Enter Receipts

-

Complete the following field:

-

Received

-

-

Locate the received detail lines that you want to reverse.

Specify 8 in the following field for the receipts you want to reverse:

-

O (Option Exit)

-

21.3.1 What You Should Know About

| Topic | Description |

|---|---|

| Reversing a receipt in a receipt routing process | If an item goes through a receipt routing process, you must move it back to the first operation in the route before you can reverse the receipt. You must also reverse all dispositions.

For more information, see Working with Items in Receipt Routing in the JD Edwards World Procurement Guide. |