22 Enter Landed Costs Title

This chapter contains these topics:

-

Section 22.2, "Entering Landed Costs During the Receipt Process for Brazil"

-

Section 22.3, "Entering Stand-Alone Landed Costs for Brazil"

22.1 About Landed Costs for Brazil

When you purchase items, it is not uncommon to pay extra costs for delivery fees, broker fees, import taxes, and so on. These costs are called "landed costs." You can enter landed costs for items during the receipt process, the voucher match process, or as a stand-alone process.

In Brazil, companies enter stand-alone landed costs for expenses that are associated with Nota Fiscal documents. Typically, these expenses include freight, insurance, and so on.

The two types of landed costs are:

-

Landed costs that are entered immediately after the receipt process and are included in the nota fiscal

-

Standalone landed costs that are entered at some point after the receipt process (called freight notes) and are included in a separate Nota Fiscal. You can enter landed costs for a purchase order immediately after the receipt process. If you enter landed costs immediately after the receipt process, you can enter only the costs for a specific Nota Fiscal document.

22.2 Entering Landed Costs During the Receipt Process for Brazil

From Localizations - Brazil (G76B), choose Purchase Order Management

From Purchase Order Management - Brazil (G76B43), choose Purchase Order Processing

From Purchase Order Processing - Brazil (G76B4311), choose Enter Receipts by PO Enter Receipts by Item

From Purchase Order Processing (G43A11), choose Enter Receipts by Item

You can enter landed costs for a purchase order during the receipt process. If you enter landed costs during the receipt process, you can enter only the costs for the specific purchase order and related Nota Fiscal document for which you are creating receipt records.

You can enter landed costs when you enter receipt information. You might choose this process if you receive landed cost information when you receive items. You can use one of the following methods to enter landed costs during the receipt process:

Have the system automatically display the landed costs that are applicable to items so you can review, change, and enter the costs. You might use this method if landed costs and the suppliers to whom you pay landed costs differ each time you receive a certain item.

Have the system automatically enter landed costs. You can use this method if landed costs and the suppliers to whom you pay landed costs are the same each time you receive a certain item.

Perform no landed cost processing

After you enter the landed costs for the Nota Fiscal document, the system prevents you from entering additional costs to the same document. JD Edwards World recommends that you enter landed costs only after you receive all Nota Fiscal lines.

To reverse landed costs, you must reverse every line of the associated Nota Fiscal document, enter receipts for each line again, reapply landed costs, and re-post the batch.

22.2.1 Before You Begin

-

Set the processing options for the Receipts by PO/Item/Account program (P4312) to specify the landed cost method you want to use.

-

Set up UDCs 40/CA and 76B/TT. See Section 3.2, "Setting Up User Defined Codes for Brazil"

-

Enter a Stand-Alone Nota Fiscal. See Chapter 43, "Sales Stand-Alone Electronic Nota Fiscal Process for Brazil"

To enter landed costs during the receipt process

On Enter Receipts

-

Enter receipts for a specific purchase order and related Nota Fiscal document.

See Work with Receipts for Brazilian Procurement.

Depending on your processing option selections, the system displays the Landed Costs screen.

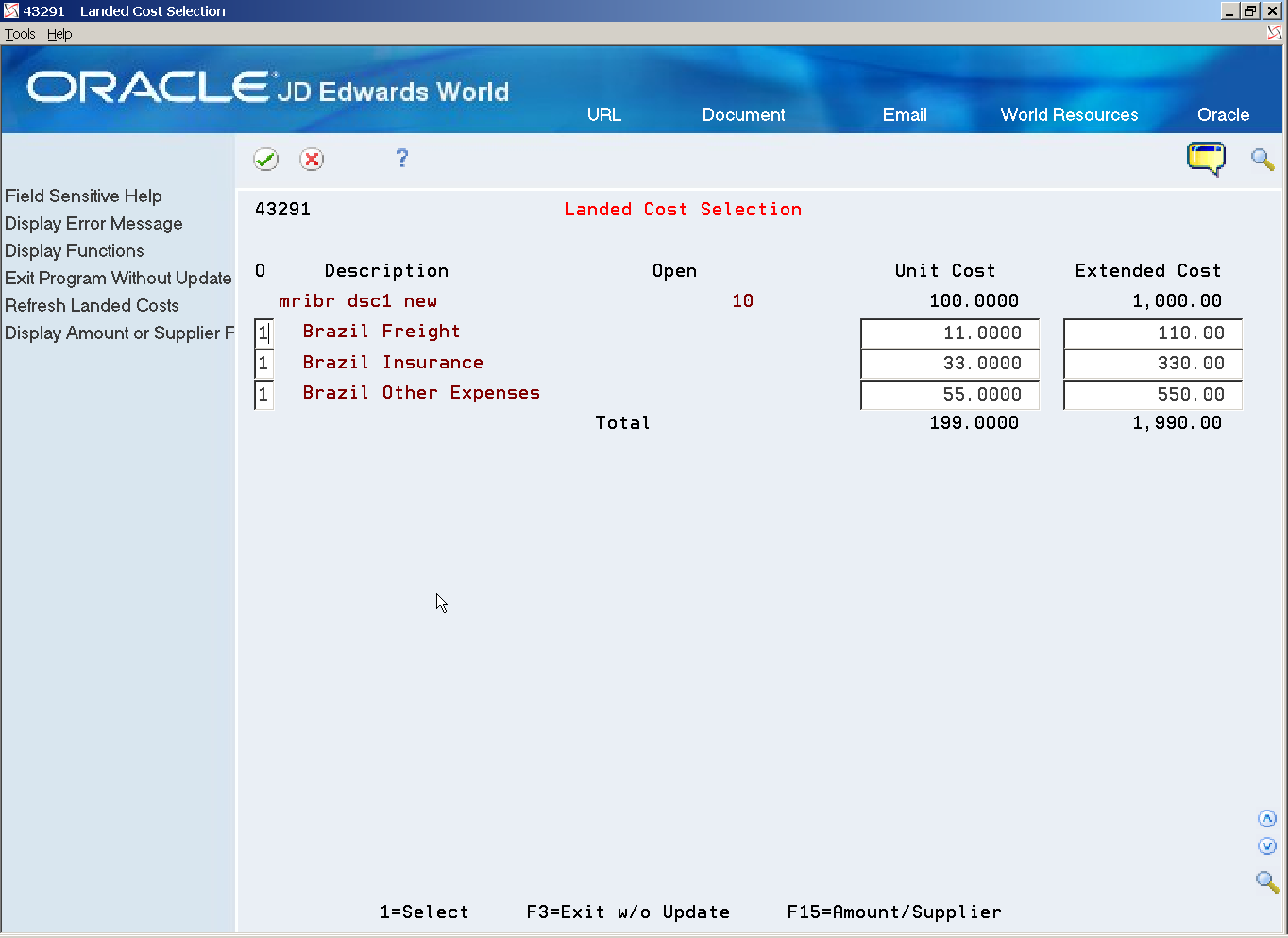

Figure 22-1 Landed Cost Selection screen

Description of ''Figure 22-1 Landed Cost Selection screen''

-

On Landed Costs, complete the following fields:

-

Description

-

Open

-

Unit Cost

-

Extended Cost

-

22.3 Entering Stand-Alone Landed Costs for Brazil

From Localizations - Brazil (G76B), choose Purchase Order Management

From Purchase Order Management - Brazil (G76B43), choose Purchase Order Processing

From Purchase Order Processing - Brazil (G76B4311), choose Stand-Alone Landed Cost

If you use invoices to create vouchers, you can enter landed costs when you create vouchers. You might choose this process if you obtain landed cost information from invoices. You can also enter landed costs as a stand-alone process. You might choose this process if landed cost information is not available to you upon receipt of an item, and you create vouchers in batch mode. In either case, you must access the Stand-Alone Landed Cost program for Brazil.

When you enter stand-alone landed costs, you can enter all of the landed costs for multiple Nota Fiscal documents at once. The system prorates the total amount of the landed costs to the Nota Fiscal documents and creates a batch of transactions to record the landed costs in the Accounts Payable system. You must review and post this batch. The system prorates the PIS/COFINS taxes for Freight for every item of all the Nota Fiscal documents to which the Landed Costs are applied.

After you enter the landed costs for the Nota Fiscal document, the system prevents you from entering additional costs. JD Edwards World recommends that you enter landed costs only after you receive all Nota Fiscal lines.

To reverse landed costs, you must reverse every line of the associated Nota Fiscal document, enter receipts for each line again, reapply landed costs, and repost the batch.

To enter stand-alone landed costs

On Stand-Alone Landed Cost

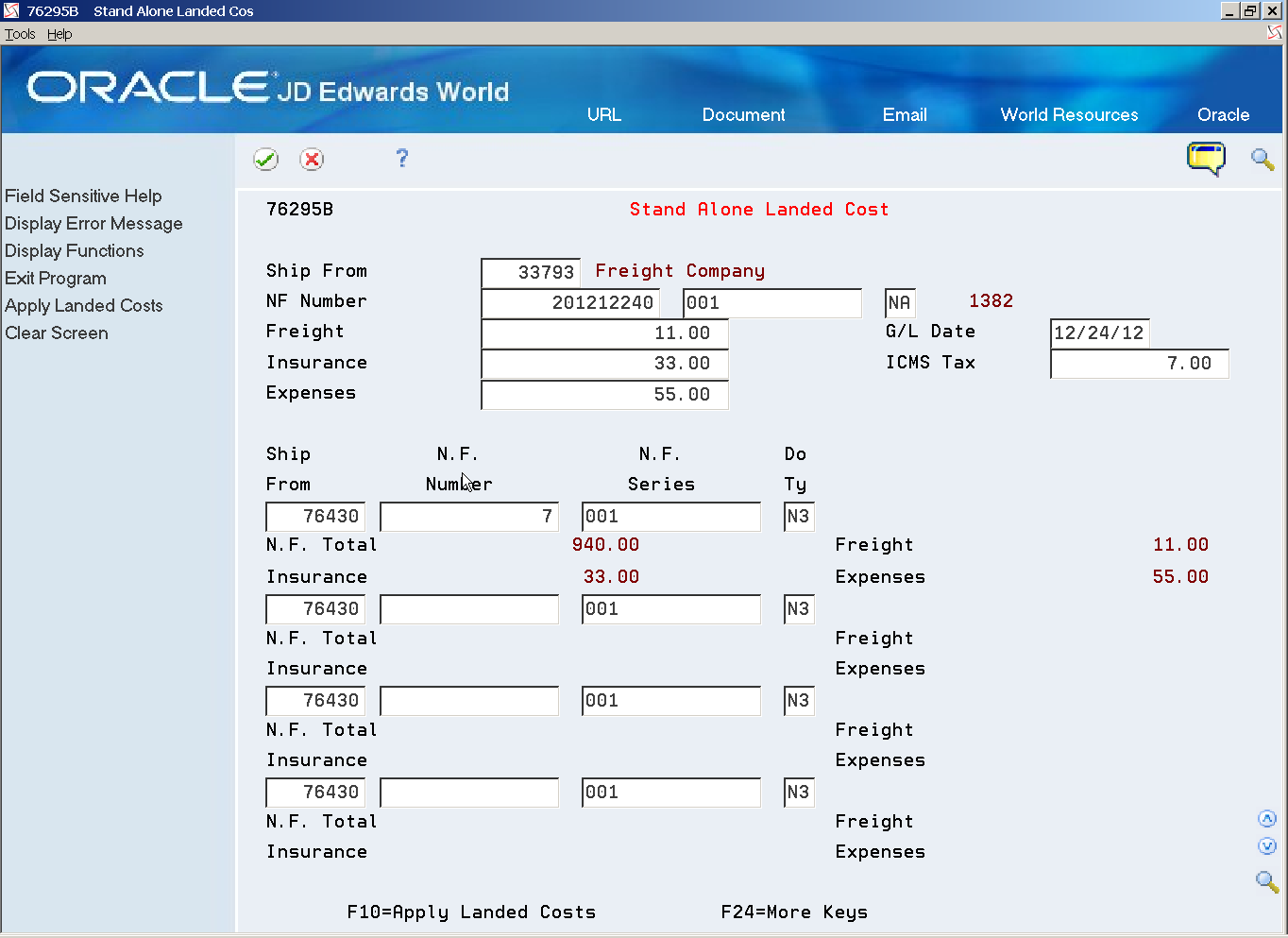

Figure 22-2 Stand-Alone Landed Cost screen

Description of ''Figure 22-2 Stand-Alone Landed Cost screen''

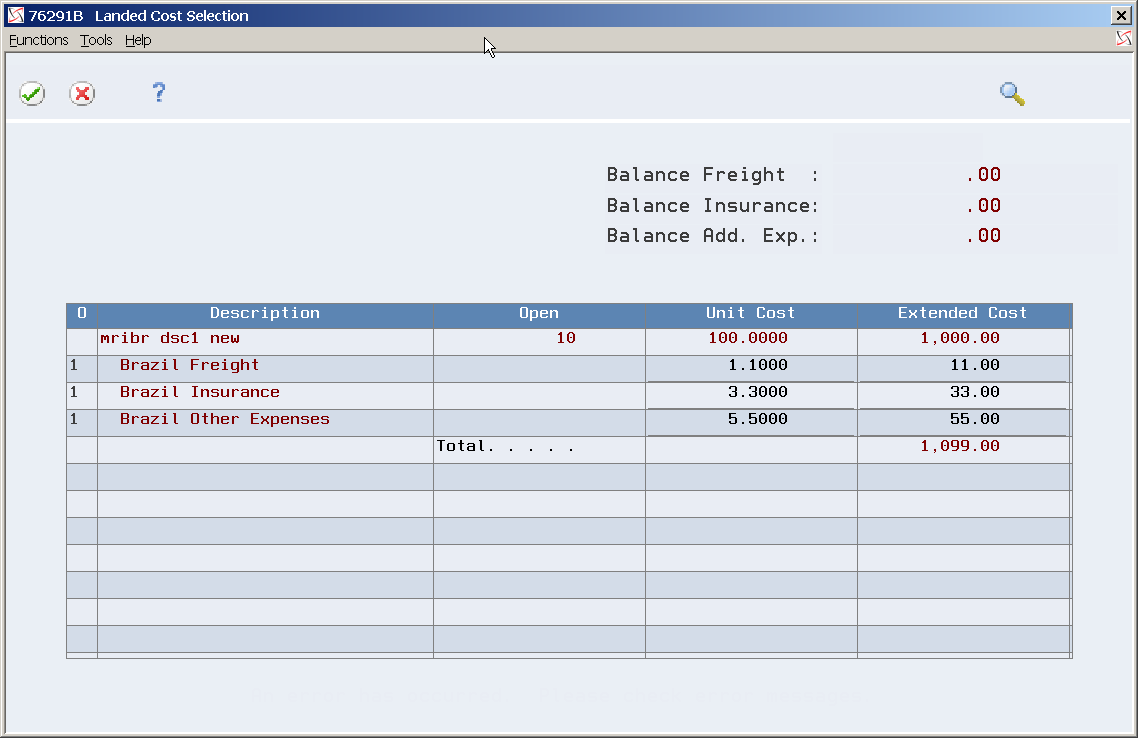

Figure 22-3 Landed Cost Selection window

Description of ''Figure 22-3 Landed Cost Selection window''

-

To specify the supplier to whom landed costs are to be paid, complete the following field:

-

Supplier Number

-

-

To specify the total landed cost amounts due the supplier, complete the following fields:

-

G/L Date

-

ICMS Tax

-