43 Sales Stand-Alone Electronic Nota Fiscal Process for Brazil

This chapter contains these topics:

43.1 Understanding the Electronic Sales Stand-Alone Nota Fiscal Process

The Sales Stand-Alone Electronic Nota Fiscal process is similar to the NFe process. JD Edwards World provides the Stand-Alone Nota Fiscal Entry program to manually enter the data, which produces records in the Nota Fiscal Files, which then follows the process for NFe, without requiring a sales order. The Stand-Alone Nota Fiscal does not create records in general ledger, purchase order, sales order, accounts payable, or accounts receivable. However, the system does write the import information that you enter in the Import Content and FCI Number fields to the Item Master Tag File Res. 13 file (F76B431) if you complete the fields for the import information.

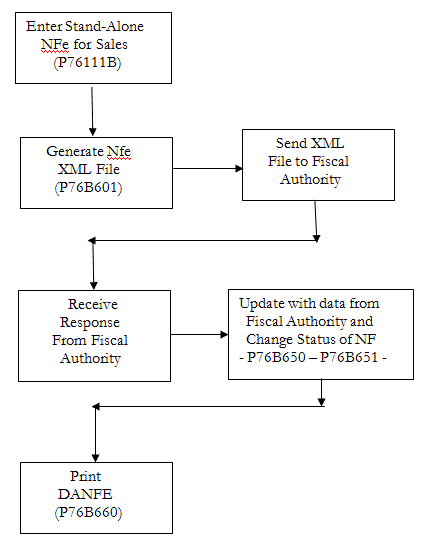

This graphic shows the normal process.

Figure 43-1 Sales Stand-Alone Electronic Nota Fiscal Process

Description of ''Figure 43-1 Sales Stand-Alone Electronic Nota Fiscal Process''

43.2 Entering the Stand-Alone Sales Order NFe

From Localizations - Brazil (G76B), choose Purchase Order Management

From Purchase Order Management - Brazil (G76B42), choose Stand Alone Nota Fiscal

From Stand Alone Nota Fiscal - Brazil (G76B4321), choose an option

Stand-Alone NF Entry - SO

The Sales Stand-Alone Electronic Nota Fiscal is completely manually entered, as usual.

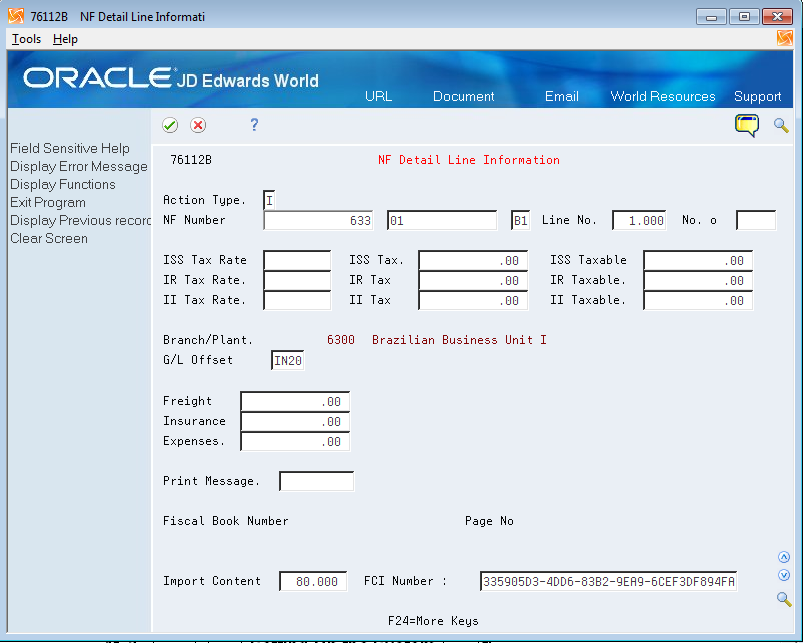

After you save information on the Stand-Alone NF Entry - SO screen, you can inquire on the record, and then choose option 1 (Add. Detail) to access the NF Detail Line Information screen. You enter tax information, including import information for ICMS taxes, on the NF Detail Line Information screen. The system saves the import information to the Nota Fiscal Tag File Res. 13 file (F76B13).

43.3 Setting Up the System

The set up is similar to the set up for Sales NFe, special considerations are:

-

UDC 00 / DT represents document types. Each document type you use for Import NF should have this value added to the Special Handling Code in the fold area of the UDC:

355 - National Electronic Nota Fiscal, or 365 - Final Consumer NFe: The 3 represents the type of Nota Fiscal. The 55 or 65 represents the government's code, Modelo 55 or Modelo 65. The model code is part of the legal access key and is printed in the XML element, infNFe ID.

-

Nota Fiscal Next Number: The nota fiscal number for NFe is assigned in the same way as for a traditional paper nota fiscal. On G76B41B, choose Next Number - Nota Fiscal (P7600B). You must set up the next number for each document type that will be used for Import NFe, and the series must be a 3 digit number, as in '001.' For additional information, see the chapter, Chapter 4, "Work with Next Numbers for Brazil"

-

Next Number for the XML file name: Each XML file will have a unique name, such as NF76SP_00000034.xml. For the part of the name that is a number, define next numbers for each Nota Fiscal document type, i.e., XM and XC. On menu G76B41B, choose Next Numbers, then select Next Numbers by Company / Fiscal Year (P0002). Enter a '1' or '2' in the Next Number Constant field, the company number, document type, and next number. Other fields are optional.

Choose Order Activity Rules from menu G76B41B. At a minimum, create a status code for these steps in the process:

-

Generate Stand-Alone NFe

-

Generate XML

-

Contingency

-

NFe Status Update (after XML is sent)

-

Print DANFE/Print Contingency DANFE

After the Electronic Stand-Alone NF for Sales is entered, the current process for NFe can be followed.