4 Work with Next Numbers for Brazil

This chapter contains these topics:

4.1 Working with Next Numbers for Brazil

The basic element of the taxing system in Brazil is the Nota Fiscal. The Nota Fiscal is a document that is similar to an invoice or bill of lading. It must accompany merchandise during the delivery process. The government requires companies to group Nota Fiscal documents in Fiscal Books using preapproved numbers.

When you set up next numbers, you enable the system to automatically assign numbers to various items in your system that must have unique numbers.

4.1.1 Setting up Standard Next Numbers for Brazil

From Localizations - Brazil (G76B), enter

From Localization Setup - Brazil (G76B41B), choose Next Numbers

You must set up Standard Next Numbers to retrieve the nota fiscal temporary number. A temporary nota fiscal number is assigned to the nota fiscal during its generation.

You must also set up a next number for the documents that you generate for remittance to the bank (remessa).

You may use Next Numbers program (P0002) and/or Next Number by Company/Fiscal(P00021).

See General Accounting manual for additional information.

4.1.1.1 Setting up standard next numbers

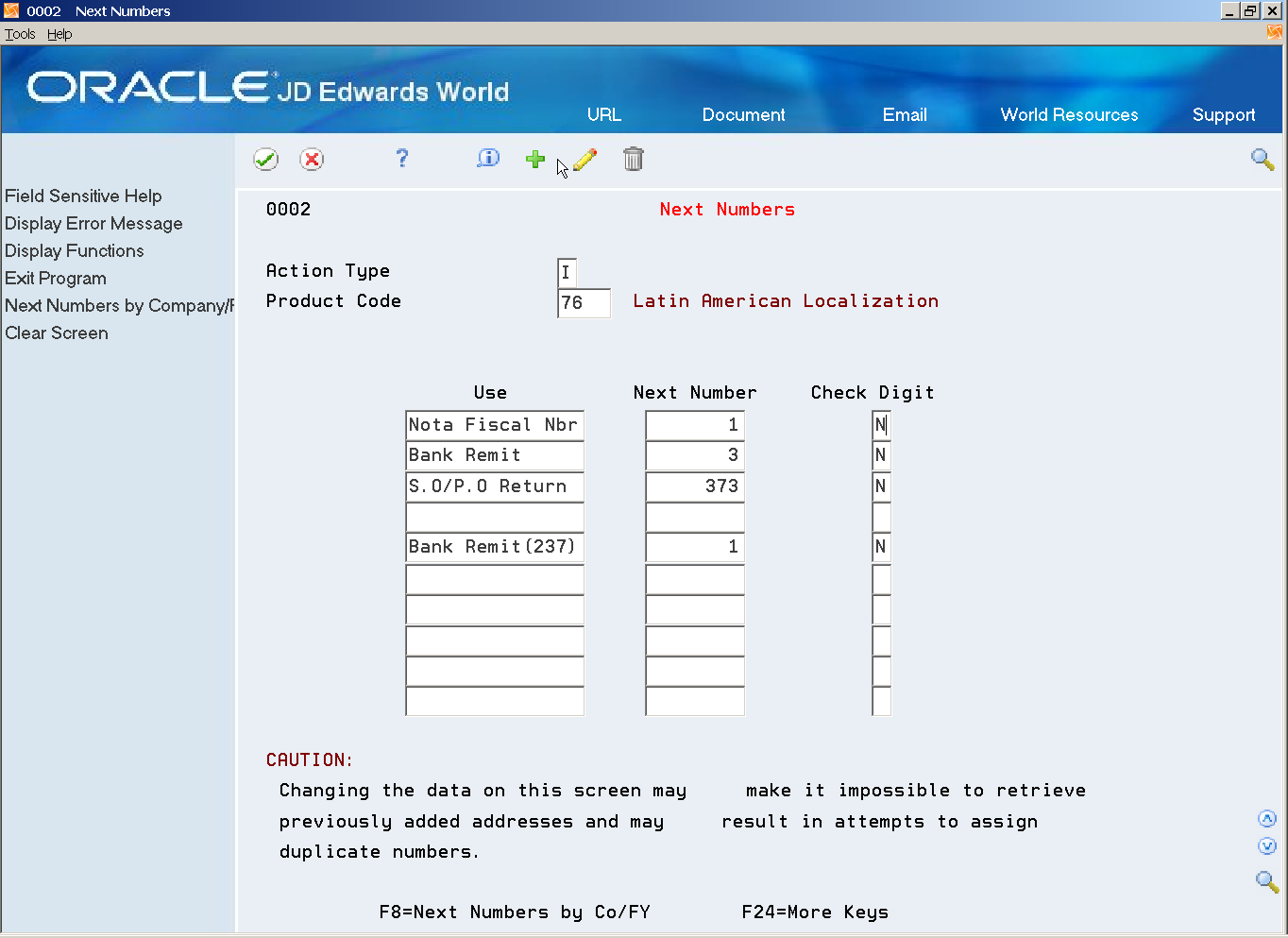

On Next Numbers

-

To specify the Latin American Localization system, complete the following field with 76 and 76B:

-

System Code

-

-

Complete the following fields for each next number assignment:

-

Next Number

-

Check Digit

-

| Field | Explanation |

|---|---|

| Next Number | The next number which will automatically be assigned by the system. Next numbers can be used for many types of documents including voucher numbers, invoice numbers, journal entry numbers, employee numbers, address numbers and so on. Next numbers can be reviewed from the Operations Control Menu. You must adhere to the next numbers that have been preestablished unless custom programming has been provided. |

| Check Digit | A number that prevents the Next Numbers program (P0002) from assigning transposed numbers. If you use check digits, the system automatically adds a number to the end of each number that it assigns through Next Numbers. |

4.1.1.2 Setting up Next Numbers for Nota Fiscal

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose Next Number - Nota Fiscal

The basic element of the taxing system in Brazil is the Nota Fiscal (Fiscal Note). The Nota Fiscal is a document that is similar to an invoice or bill of lading. It must accompany merchandise during the delivery process. Companies are required to group Nota Fiscal documents in Fiscal Books using numbers that are preapproved by the Brazilian government.

For traditional printed Notas fiscais, the Brazilian government assigns each fiscal company a unique series of Nota Fiscal numbers. To ensure that the system assigns the correct numbers to the Nota Fiscal documents that your company creates, you must set up and maintain a specific next numbering system.

The system assigns the official numbers to the documents when you print Notas fiscais in final mode (Nota Fiscal Paper) or when you generate the Nota Fiscal xml (Electronic Nota Fiscal).

4.1.1.3 Setting up next numbers for Nota Fiscal

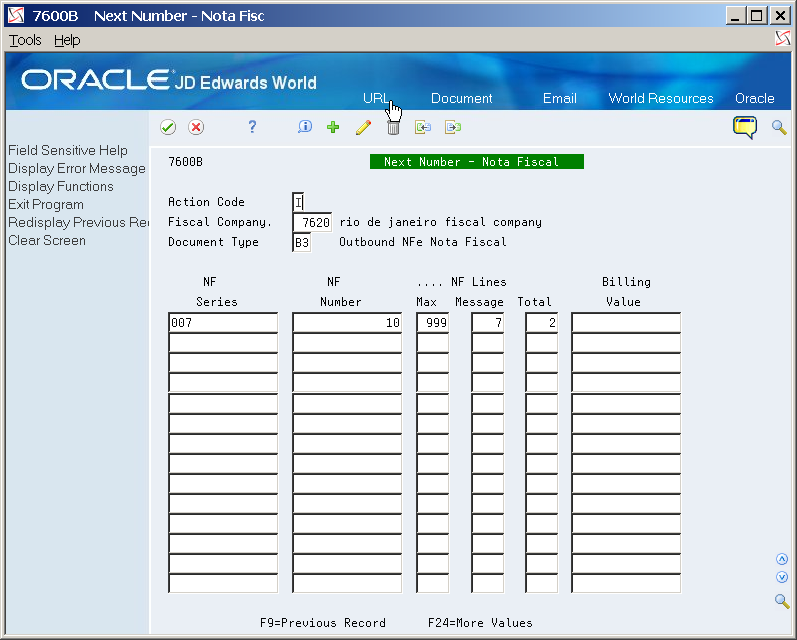

On Next Number - Nota Fiscal

Figure 4-2 Next Numbers - Nota Fiscal screen

Description of ''Figure 4-2 Next Numbers - Nota Fiscal screen''

To define Nota Fiscal Next Numbers, complete the following fields:

-

Fiscal Company

-

Document Type

-

NF Sr

-

NF Number

-

NF Lines Max

-

Message

-

Total Lines

-

Billing Value

| Field | Explanation |

|---|---|

| Company | A code that identifies a specific organization, fund, entity, and so on. This code must already exist in the Company Constants table (F0010). It must identify a reporting entity that has a complete balance sheet. At this level, you can have intercompany transactions.

Note: You can use company 00000 for default values, such as dates and automatic accounting instructions (AAIs). You cannot use it for transaction entries. |

| Document Type | A user defined code (system 00/type DT) that identifies the origin and purpose of the transaction.

JD Edwards World reserves several prefixes for document types, such as vouchers, invoices, receipts, and timesheets. The reserved document type prefixes for codes are: P Accounts payable documents R Accounts receivable documents T Payroll documents I Inventory documents O Order processing documents J General ledger/joint interest billing documents The system creates offsetting entries as appropriate for these document types when you post batches. |

| NF Sr | In Brazil, Notas fiscais are identified based on the combination of a Nota Fiscal number and a Nota Fiscal series number. The numbering scheme includes a fifteen digit number and an alphanumeric series.

Use this alphanumeric field to identify the Nota Fiscal series. The Nota Fiscal Series field is the second key that the system uses to access a specific Nota Fiscal. |

| NF Number | Use this numeric, 15-digit field to identify the Nota Fiscal number. The Nota Fiscal Number field is the first key that the system uses to access a specific Nota Fiscal. |

| NF Lines Max | A number that identifies multiple occurrences, such as line numbers on a purchase order or other document. Generally, the system assigns this number, but in some cases, you can override it. |

| Number of Lines in message | The number of lines to be printed in the message section of the Nota Fiscal. |

| Billing Value | Value above which an order is placed on hold. If you try to enter an order whose total is more than the maximum order value, the system displays an error message.

This field is maintained as an integer without decimals. |

| Maximum Order Value | Value above which an order is placed on hold. If you try to enter an order whose total is more than the maximum order value, the system displays an error message.

This field is maintained as an integer without decimals. |

4.1.2 Setting up Next Numbers for Fiscal Books

From Localizations - Brazil (G76B), enter 29

From Localization Setup - Brazil (G76B41B), choose Next Number - Journal Entry

The basic element of the taxing system in Brazil is the Nota Fiscal (Fiscal Note). The Nota Fiscal is a document that is similar to an invoice or bill of lading. It must accompany merchandise during the delivery process. Companies are required to group Nota Fiscal documents in Fiscal Books using numbers that are preapproved by the Brazilian government.

For traditional printed Notas fiscais, the Brazilian government assigns each fiscal company a unique series of Nota fiscal numbers. To ensure that the system assigns the correct numbers to the Nota Fiscal documents that your company creates, you must set up and maintain a specific next numbering system.

The system assigns the official numbers to the documents when you print Notas fiscais in final mode.

4.1.2.1 Setting up next numbers for fiscal books

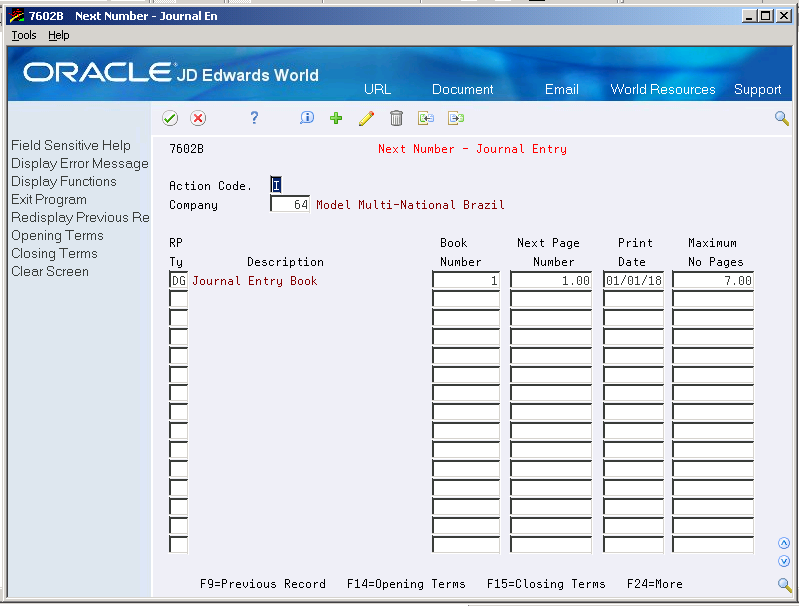

On Next Number - Journal Entry

Figure 4-3 Next Numbers - Journal Entry screen

Description of ''Figure 4-3 Next Numbers - Journal Entry screen''

-

To specify a company, complete the following fields:

-

Company

-

For each of the company's fiscal books, complete the following fields:

-

RP Ty

-

Description

-

Book Number

-

Next Page Number

-

Print Date

-

Maximum No Pages

| Field | Explanation |

|---|---|

| Company | A code that identifies a specific organization, fund, entity, and so on. This code must already exist in the Company Constants table (F0010). It must identify a reporting entity that has a complete balance sheet. At this level, you can have intercompany transactions.

Note: You can use company 00000 for default values, such as dates and automatic accounting instructions (AAIs). You cannot use it for transaction entries. |

| RP Ty | A Fiscal Book identification code. |

| Fisc Book Number | The number which the system will use next for automatically assigning numbers. Next numbers can be used for many types of documents including voucher numbers, invoice numbers, journal entry numbers, employee numbers, address numbers and so on. You must adhere to the next numbers that have been preestablished unless custom programming has been provided. |

| Next Page Number | Next sequence number. |

4.1.3 Processing Options

See Section 64.1, "Processing Options for Next Number Journal Entry (P7602B)"