44 Tax Netting Process

This chapter contains these topics:

44.1 Processing Tax Netting

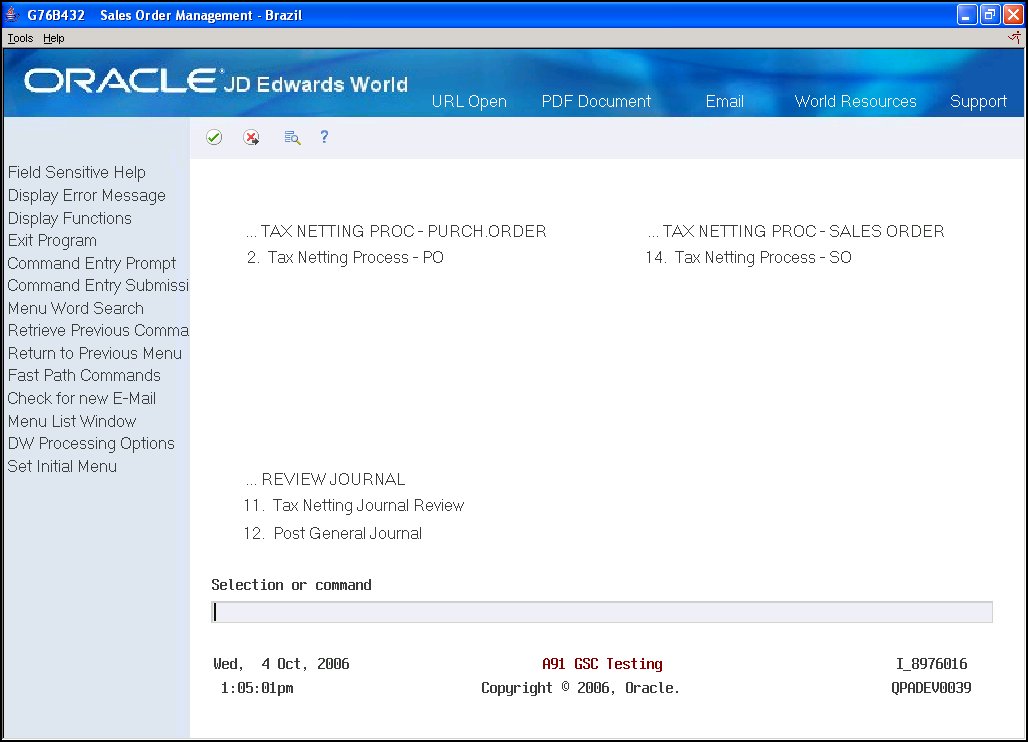

From Localizations - Brazil (G76B), choose Purchase Order Management or Sales Order Management

From Purchase Order Management - Brazil (G76B43), choose Tax Netting Process or

From Sales Order Management - Brazil (G76B42), choose Tax Netting Process

From Tax Netting Process - Brazil (G76B4322), choose Tax Netting Process - PO or Tax Netting Process - SO

Figure 44-1 Sales Order Management - Brazil screen

Description of ''Figure 44-1 Sales Order Management - Brazil screen''

The Tax Netting Process is run to generate journal entries in the Account Ledger File with PIS and COFINS tax amounts after processing vouchers or updating sales. PIS/PASEP (Programa de Integração Social/Programa de Formação do Patrimônio do Servidor Público) and COFINS (Contribuição para Financiamento daSeguridade Social) are mandatory contributions that are levied as a percentage of monthly billings.

This process retrieves information from the Nota Fiscal Taxes Detail - Brazil File.

(F76B4001) and the Nota Fiscal Detail File - Brazil (F7611B). It selects only unprocessed records for which the Tax Type Definition is set to be included. See Part IV, "Setup Requirements" of this chapter.

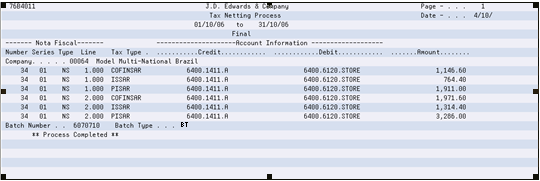

You can run the Tax Netting Process program in either proof or final mode. When you run the program in proof mode, you can review the report that the system produces to determine if any errors exist. The report includes:

-

Date range for the processed records.

-

Whether the report is for the proof or final run of the program.

If you set the processing option to print in detail, information is printed about the nota fiscal for each record, including the number, series, line, and tax type.

Additionally, the report shows whether each transaction generated a debit or credit journal entry, and the amount of the entry. The Debit Account Number and Credit Account Number is also printed.

Errors that occurred during processing. If any validation error is detected when assigning the account, an error message is printed below the detail line. After you correct any errors, you can run the report in final mode to create the journal entries and the batch.

The batch number and batch type (if you set the processing option to run the program in final mode and no errors occurred during processing) are also printed.

Figure 44-2 Example of the Tax Netting Report

Description of ''Figure 44-2 Example of the Tax Netting Report''

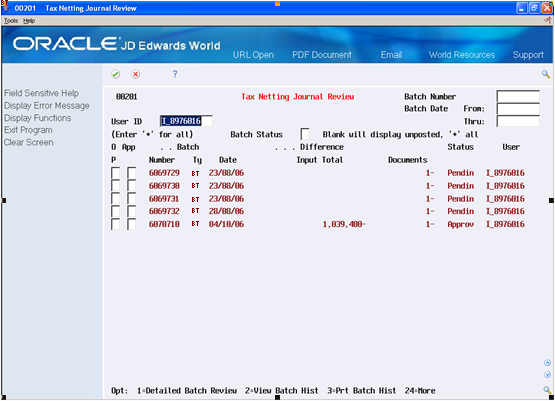

44.2 Process Flow for Final Mode

When you run the Tax Netting Process program in final mode, and there are no errors, the system writes records to the F0911 table for each selected, unprocessed record in the Nota Fiscal Taxes Detail - Brazil File (F76B4001). The processed flag in F76B4001 is set to '1,' the batch type is set to 'BT' and the batch number is populated. The batch can be reviewed and posted.

A stand-alone nota fiscal is not directly attached to a purchase or sales order. You enter the taxes when you enter a stand-alone nota fiscal, so stand-alone notas fiscais are not processed in Tax Netting.

Figure 44-3 Tax Netting Journal Review screen

Description of ''Figure 44-3 Tax Netting Journal Review screen''

44.2.1 Required Setup

| Code | Action |

|---|---|

| UDC 98/IT | Enter a Batch type code BT with the description "Tax Netting" |

| UDC 76B/TT | Enter at least one code for every Tax Type, such as PIS, COFINS, ISS for Sales and PIS, COFINS for Purchasing. The UDC code should identify the Tax Type. Any text can be entered in the Description. In Description-2 you must enter three alphanumeric characters to represent the tax. For example, you might enter COP in Description-2 to represent COFINS for Purchasing. |

| UDC 41/9 | Enter category codes for each Tax, according to standard setup. For example, you might enter a code C010 with a Description of COFINS. |

| AAI's | DMAAIs must be set up. See Section 15.1, "Setting Up AAIs for Brazil Localization Programs" |

| UDC 76/GL | GL/Class Code Cross Reference (system 76/code GL) must be set up. See Section 3.2, "Setting Up User Defined Codes for Brazil" |

44.2.2 Processing Options

See Section 67.11, "Processing Options for Tax Netting Process (P76B4011)."