15 Setup AAIs for Brazil Localization Programs

This chapter contains these topics:

Many JD Edwards World programs need information about your account structure and specific account values in order to process business transactions properly. You define your account structure and specific account values using automatic accounting instructions (AAIs). The system stores the AAI values you define for your company in the Automatic Accounting Instructions Master file (F0012). Whenever a program performs an accounting function, it accesses this table.

Automatic accounting instructions (AAIs) are the links between your day-to-day functions, chart of accounts, and financial reports. The system uses AAIs to determine how to distribute G/L entries that the system generates. For example, in the Sales Order Management system, AAIs indicate how to record the transaction when you sell a stock item to a customer, or when you transfer stock within a company.

For distribution systems, you must create AAIs for each unique combination of company, transaction, document type, and G/L class that you anticipate using. Each AAI is associated to a specific G/L account that consists of a business unit, an object, and optionally, a subsidiary.

The system stores these AAIs in the Distribution / Manufacturing AAI Values table (F4095).

You set up AAIs by company, based on ranges of account numbers. The system includes predefined ranges. You must specify the business unit, object, and subsidiary accounts for the ranges as necessary.

|

Caution: Many programs throughout JD Edwards World software use specific AAIs and AAI ranges. You should be thoroughly familiar with the use of an AAI or range before you make any changes to the AAI values. |

15.1 Setting Up AAIs for Brazil Localization Programs

Automatic accounting instructions are called by the following Brazil Localization programs to record journal entries for landed cost and taxes:

-

Stand-Alone Landed Costs (P76295B/P76291B)

-

Close Nota Fiscal/Receipt Taxes Generator (P76B804)

-

Call the following DMAAIs to retrieve tax account numbers:

-

DMAAI 4385

-

DMAAI 4390

-

-

Sales Update (P42800) calls the following DMAAIs to retrieve account numbers:

-

DMAAI 4220

-

DMAAI 4240

-

DMAAI 4230

-

Tax Netting Process (P76B4011) calls the following DMAAIs to retrieve account numbers:

-

In Sales Mode

-

DMAAI 4220

-

DMAAI 4240

-

-

In Procurement Mode

-

DMAAI 4385

-

DMAAI 4390

-

The account number is retrieved based on the sales order/purchase order Company (CO).

The Document Type (DCT) is retrieved based on the sales order/purchase order Document Type (DCT).

G/L Class (GLC) value is retrieved from different places depending on the type of transaction:

-

For Brazil Taxes, it comes from G/L Class Code Cross Reference (system 76, code GL), Description field (DSC-1)

-

For Purchasing Landed Costs, it comes from Landed Costs (system 40/ code CA), Special Handling Code field (SPHD)

-

For Sales Landed Costs, it comes from Order Line Types (P40205) , G/L Class field (GLC).

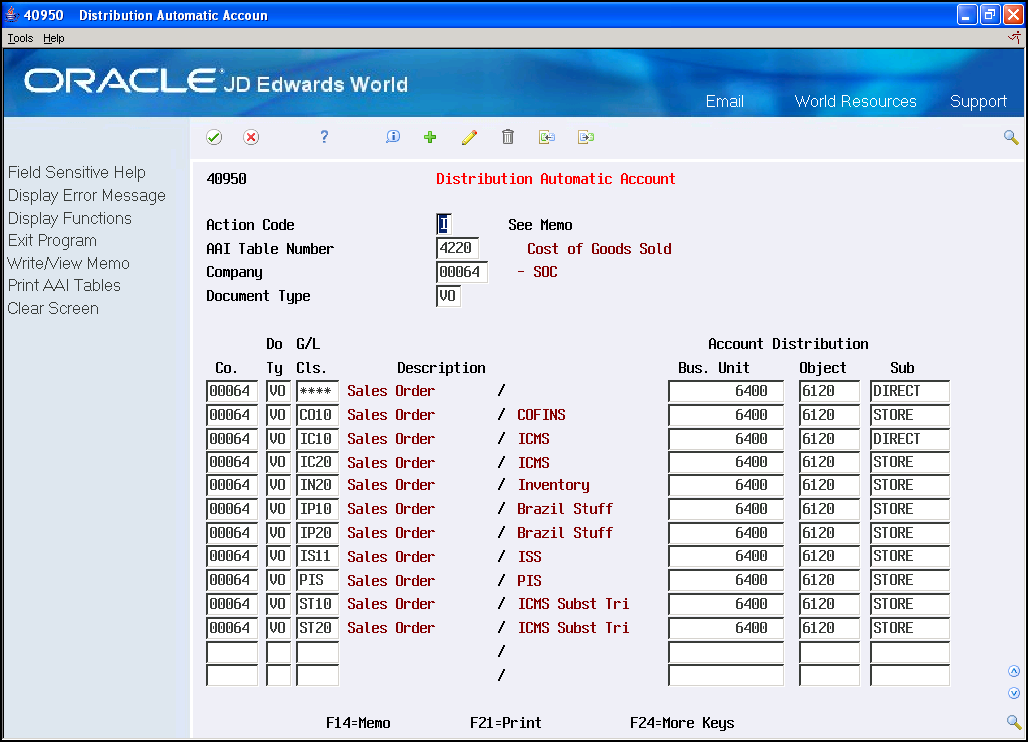

Figure 15-1 Distribution Automatic Account (AAI table number=Cost of Goods Sold) screen

Description of ''Figure 15-1 Distribution Automatic Account (AAI table number=Cost of Goods Sold) screen''

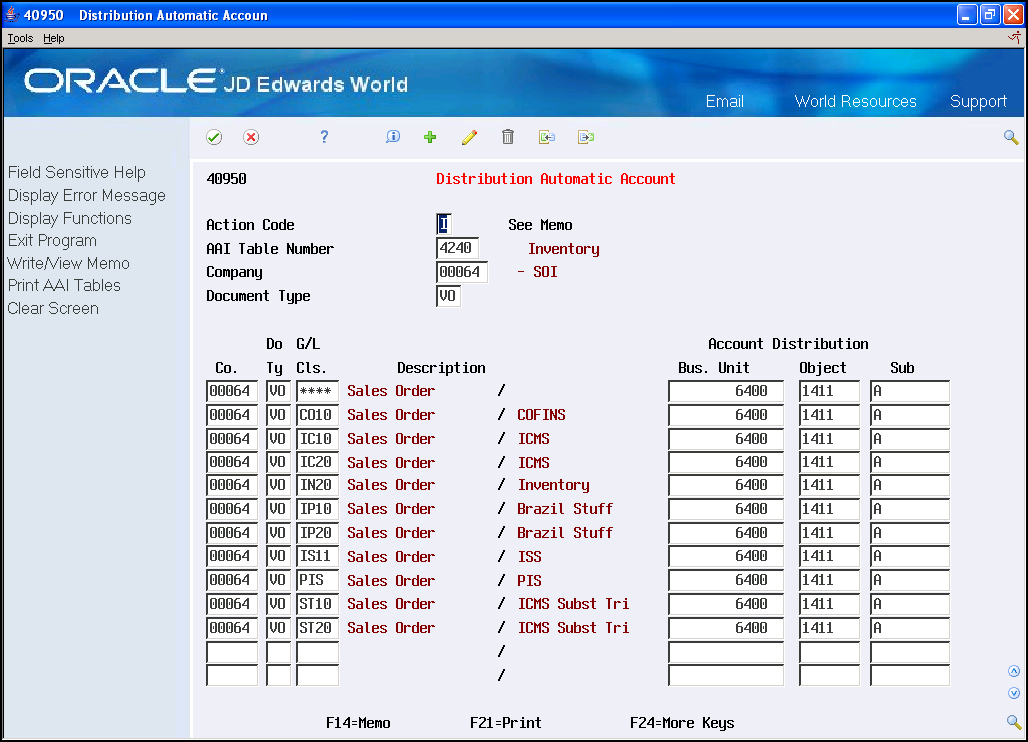

Figure 15-2 Distribution Automatic Account (AAI table number=Inventory) screen

Description of ''Figure 15-2 Distribution Automatic Account (AAI table number=Inventory) screen''

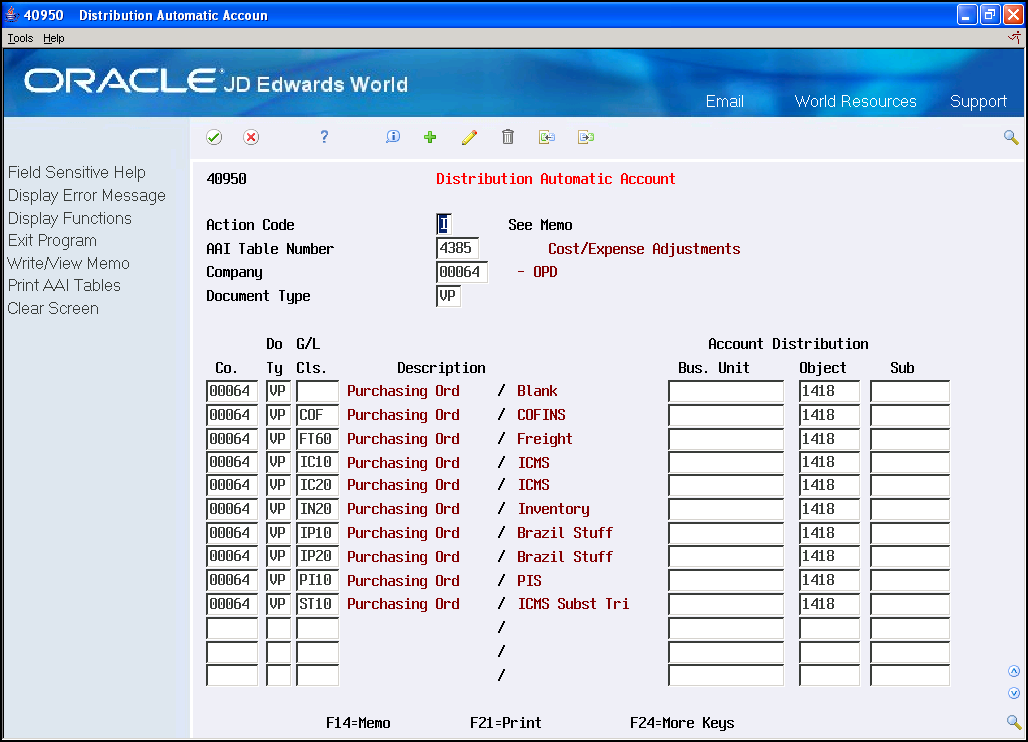

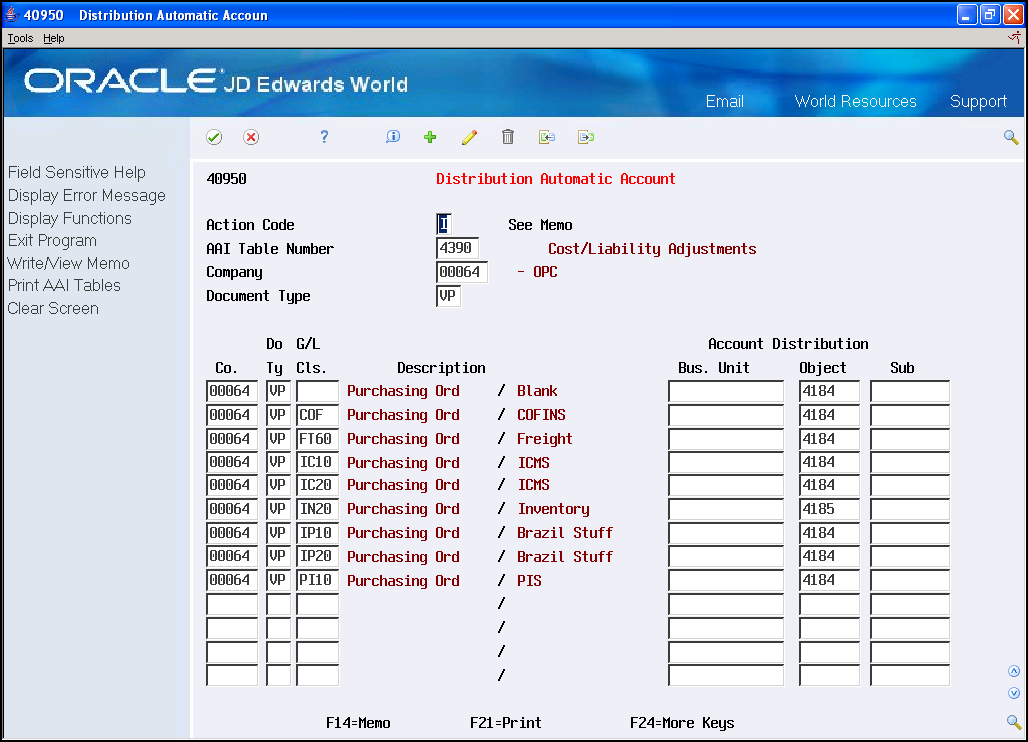

For Procurement, the AAI associated with the debit is '4385' and the AAI associated with the credit is '4390'. For example:

Figure 15-3 Distribution Automatic Account (AAI table number=Cost/Expense Adjustments) screen

Description of ''Figure 15-3 Distribution Automatic Account (AAI table number=Cost/Expense Adjustments) screen''

Figure 15-4 Distribution Automatic Account (AAI table number=Cost/Liability Adjustments) screen

Description of ''Figure 15-4 Distribution Automatic Account (AAI table number=Cost/Liability Adjustments) screen''

| Field | Explanation |

|---|---|

| Co. (Company) | The Company of the Order |

| Do Ty (Document Type) | The Document Type of the Order |

| G/L Cls (G/L Class) | This code is retrieved from the first four characters of the field Description-1, in the UDC 76/GL. The UDC 76/GL is a cross-reference of two fields -- the first field is a code of three characters retrieved from the first three characters of the field Description-2 in the UDC 76B/TT, the second field is the G/L Offset assigned to the Tax in the tax calculation process from UDC 41/9. For more information, see Chapter 44, "Tax Netting Process". |

15.1.1 Before You Begin

-

Verify that the User Defined Code for the G/L Posting Category (41/9) is set up.

|

Caution: Many programs throughout JD Edwards World software use specific AAIs and AAI ranges. You should be thoroughly familiar with the use of an AAI or range before you make any changes to the AAI values. |