42 Understand the Import Electronic Nota Fiscal Process

This chapter contains these topics:

42.1 Overview

The Brazilian Government requires that Brazilian Companies emit the electronic nota fiscal (NFe) on behalf of Foreign Suppliers. A Nota Fiscal must accompany the imported merchandise from Customs to the Customer's Branch/Plant. JD Edwards World provides the Stand-Alone Nota Fiscal Entry program to manually enter the data, including the Import information, that produce records in the Nota Fiscal Files, which then follows the process for NFe, without requiring a sales order. The Stand-Alone Nota Fiscal does not create records in general ledger, purchase order, sales order, accounts payable, or accounts receivable.

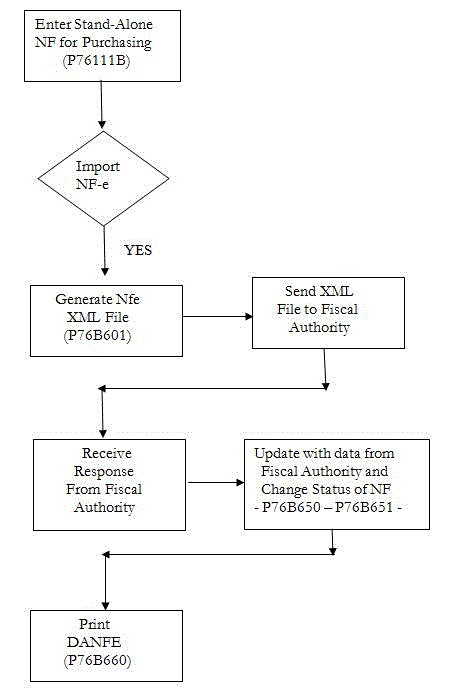

This graphic shows the normal process:

Figure 42-1 Import Electronic Nota Fiscal Process

Description of ''Figure 42-1 Import Electronic Nota Fiscal Process''

42.2 Setting Up the System

The set up is similar to the set up for Sales NFe. Special considerations are:

-

UDC 00 / DT represents document types. Each document type you use for Import NF should have this value added to the Special Handling Code in the fold area of the UDC:

355: National Electronic Nota Fiscal, or 365: Final Consumer NFe The 3 represents the type of Nota Fiscal. The 55 or 65 represents the government's code, Modelo 55 or Modelo 65. The model code is part of the legal access key and is printed in the XML element, infNFe ID.

-

UDC 00/LC contains the code of the Local Country. This code is used to verify if the Supplier belongs to a Foreign Country. The system compares the value entered in this table with the Country Code entered in the Supplier's Address Book record to determine if the Supplier is a Foreign Supplier.

-

UDC 76/NF includes the value 8 (Import Stand-Alone N.F.) which you must use for this process.

-

Additional UDCs that hold values for notas fiscais.

See Section 36.4, "Set Up User Defined Codes for Electronic Notas Fiscais"

-

Nota Fiscal Next Number: The nota fiscal number for NFe is assigned in the same way as for a traditional paper nota fiscal. On G76B41B, choose Next Number - Nota Fiscal (P7600B). You must set up the next number for each document type that will be used for Import NFe, and the series must be a 3 digit number, as in '001.' For additional information, see the chapter, Chapter 4, "Work with Next Numbers for Brazil"

-

Next Number for the XML file name: Each XML file will have a unique name, such as NF76SP_00000034.xml. For the part of the name that is a number, define next numbers for each Nota Fiscal document type, i.e., XM and XC. On menu G76B41B (Localization Setup - Brazil), choose Next Numbers (P0002), then press F8 (Exit to Next Numbers by Company / Fiscal Year). At Next Numbers by Company / Fiscal Year (P00021), inquire on the Fiscal Company number, and make sure that Document Types XM and XC are defined and their Next Number field (N0001) is populated with a value.

From menu G76B41B, choose Order Activity Rules (P40204)

Create a status code for these steps in the process:

-

Generate Stand-Alone NFe

-

Generate XML

-

Contingency

-

NFe Status Update (after XML is sent)

-

Print DANFE/Print Contingency DANFE

42.3 Entering the Stand-Alone Imported NFe

-

Create a version of Stand-Alone NF Entry - PO and name it Stand-Alone NF Importation.

-

Review the following processing options:

| Processing Option | Processing Option Requiring Further Description |

|---|---|

| MODE OF OPERATION:

3. Select the mode of operation: '1' P.O. Stand Alone Nota Fiscal Entry '4' P.O. Nota Fiscal Revision '5' S.O. Stand Alone Nota Fiscal Entry '7' S.O. Nota Fiscal Revision '8' Import Electronic Nota Fiscal If left blank selection '1' will be used. |

The type '8', indicates that the Nota Fiscal is a Stand-Alone Import Electronic Nota Fiscal. It means that the two new screens will be displayed to enter the Import data. |

| VERSION:

4.Enter the version of the NF-e Default blanks assume version number 1.10 |

|

| IMPORT ELECTRONIC NOTA FISCAL:

21. Enter the quantity of declarations allowed when inform the DI data. Default 100. |

|

| 22. Enter the quantity of Additions allowed. Default value 100. |

As in regular Stand-Alone NF Entry - PO, Import Electronic Nota Fiscal information is entered manually.

In Nota Fiscal Entry - Detail (P76111B), Legal Access Key Protocol Number is calculated using the Branch/Plant CNPJ, not the Supplier CNPJ.

In Import Electronic Nota Fiscal IPI Tax and II Tax are required. You must enter IPI Tax and II Tax Information.

See Section 44.2, "Process Flow for Final Mode" for additional stand-alone purchase order information.

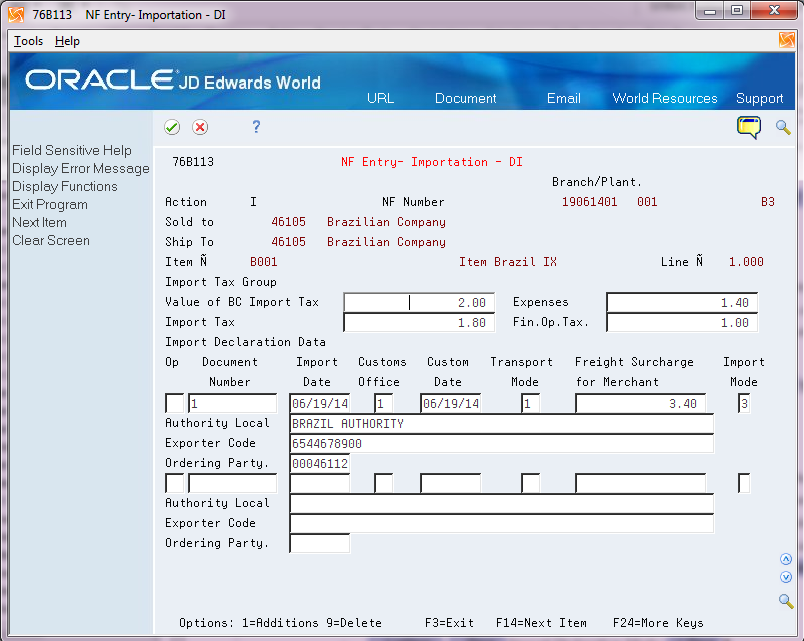

The process displays the NF Entry-Importation - DI and the NF Entry - Importation - Additional screens so that you can enter additional information about the Importation transaction. You use these forms to enter data about the imported goods including:

-

Transportation Mode

Enter a value from UDC 76B/TW.

-

Freight Surcharge Amount

Enter a value that identifies the additional freight amount for the renewal of merchant navy services. The value for the Freight Surcharge Amount field must be other than zero if the value in the Special Handling Code field of UDC 76B/TW is 1. If the value in the Special Handling Code field of UDC 76B/TW is not 1, then the value in the Freight Surcharge Amount field must be zero.

-

Import Declaration Mode

Enter a value from UDC table 76B/IB that indicates the import type according to who buys the items and for whom.

-

Ordering Party

Enter an address book number of the person ordering. You must complete this field if the value in the Special Handling Code field of UDC 76B/IB is 1.

When the Import Declaration Mode value is Importação por conta e ordem (Importing for another person) or Importação por encomenda (Importing through the postal service), the CNPJ field must be completed with a valid value. The system accesses the address book record to validate the CNPJ number. If the CNPJ is missing from the address book record, the system issues an error message.

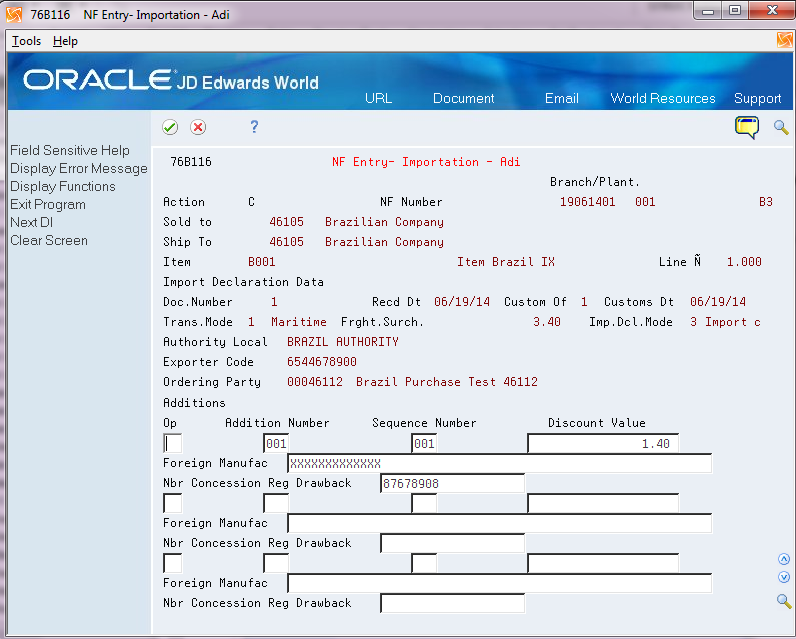

-

Nbr Concession Reg Drawback

The system saves import data that you enter on the NF Entry-Importation - DI and the NF Entry - Importation - Additional screens to the Nota Fiscal Import Data - DI - Brazil (F76B114) and Nota Fiscal Import Data - Addition (F76B116) files.

The following images illustrate the screens.

Figure 42-2 NF Entry - Importation - DI screen

Description of ''Figure 42-2 NF Entry - Importation - DI screen''

Figure 42-3 NF Entry - Importation - Additional screen

Description of ''Figure 42-3 NF Entry - Importation - Additional screen''

42.4 Reviewing Import Electronic Nota Fiscal

After the Import Electronic Nota Fiscal is entered, you can review Importation information by going to Nota Fiscal Entry - Detail (P76111B) and selecting option 3 (Importation Data).

From NF Entry - Importation - DI (P76B113), choose option 1 (NF Entry - Importation - Additions) to go to NF Entry - Importation - Additions (P76B116)

42.5 Processing Import Electronic Nota Fiscal

You must process the Import Electronic Nota Fiscal the same way you process the regular Electronic Nota Fiscal (NFe).

See Chapter 39, "Processing Electronic Nota Fiscal (NFe) in Normal Mode" for additional information.

42.6 Generate the XML

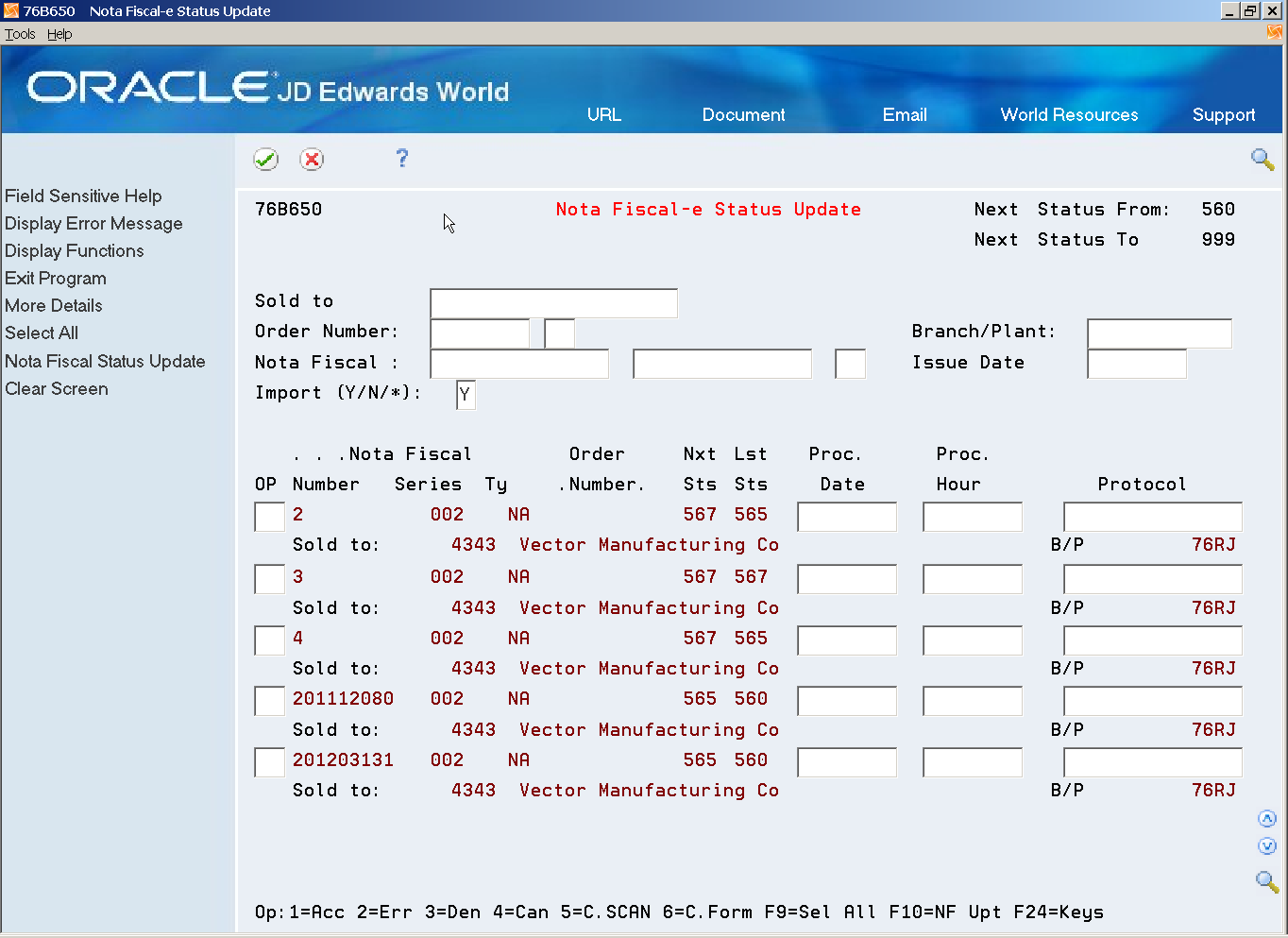

42.7 Nota Fiscal-e Status Update

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Sales Order Processing

From Sales Order Processing - Brazil (G76B4211), choose Nota Fiscal Processing

From Nota Fiscal Processing (G76B42111), choose National NFe

From Electronic Nota Fiscal - National (G76B42114), choose Nota Fiscal -e Status Update

A new filter was added in the heading of the screen to select Import Electronic Nota Fiscal (Y) to be displayed, Outbound If Nota Fiscal (N) to be displayed, or both types (*) to be displayed. In the Selection option, the Sales Order Detail Inquiry option will not be available for Import Electronic Nota Fiscal. An example of the screen is show here.

Figure 42-4 Nota Fiscal-e Status Update screen

Description of ''Figure 42-4 Nota Fiscal-e Status Update screen''

42.8 Printing the DANFE -- Documento Auxiliar da Nota Fiscal Eletronica

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Sales Order Processing

From Sales Order Processing - Brazil (G76B4211), choose Nota Fiscal Processing

From Nota Fiscal Processing (G76B42111), choose National NFe

From Electronic Nota Fiscal - National (G76B42114), choose DANFE Generation

The DANFE process was not changed, except that the status in the Sales Order is not updated as a Sales Order does not exist for Stand-Alone Import Nfe.

42.8.1 Before you Begin

-

Make sure that DANFE-Generation (P76B660) Data Selection includes Nota Fiscal Number (BNNF), Nota Fiscal Series (BSER), and Document Type (DCT).

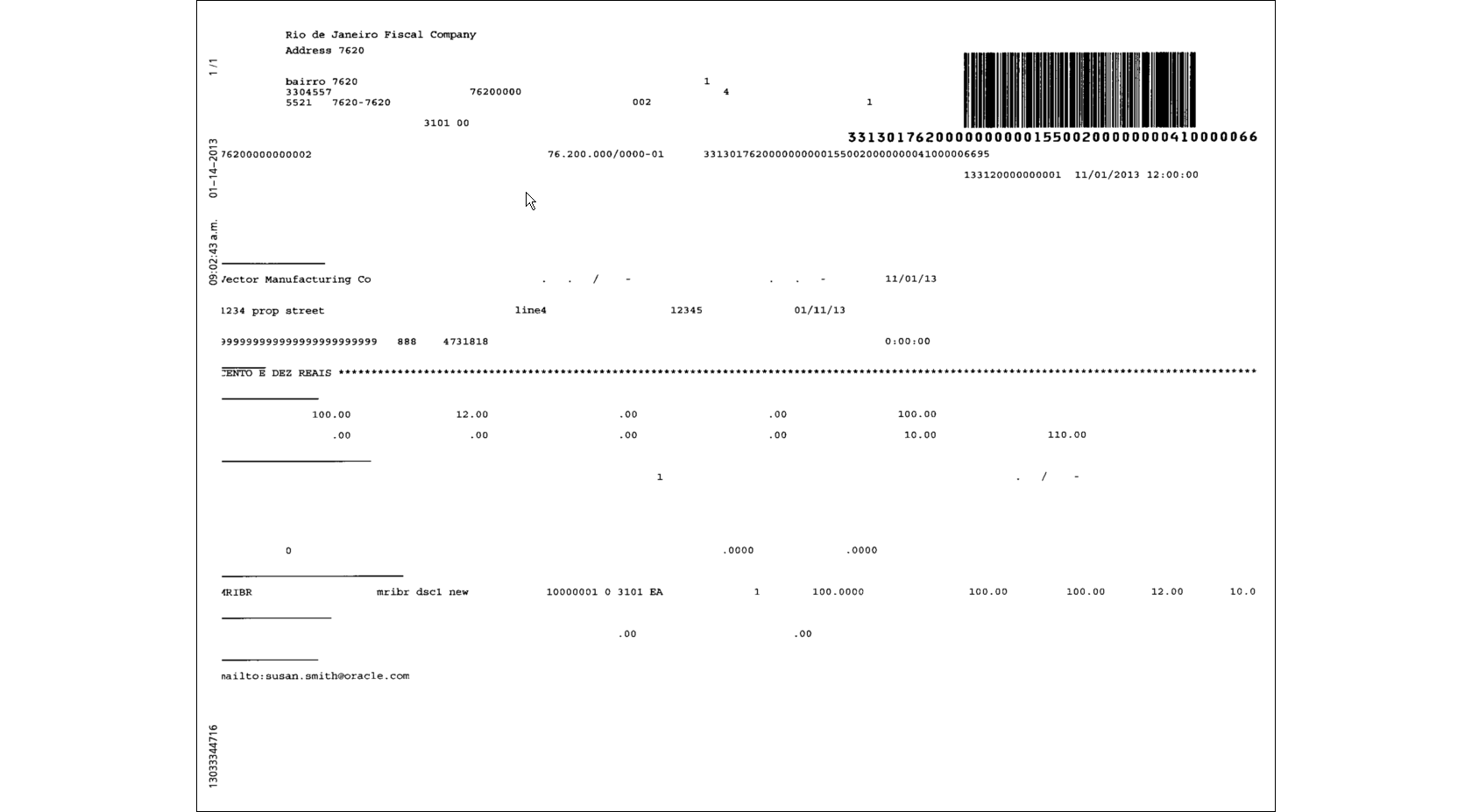

Figure 42-5 Example of Import Electronic Nota Fiscal DANFE

Description of ''Figure 42-5 Example of Import Electronic Nota Fiscal DANFE''