41 Generating Stand-Alone Nota Fiscal

This chapter contains these topics:

41.1 Overview

In Brazil, the government requires that businesses maintain detailed information regarding all merchandise and associated taxes. The information accompanies shipments in the form of a document that is referred to as Nota Fiscal.

At times it may be necessary to generate the Nota Fiscal when it is not directly attached to a purchase or sales order. For example, if someone enters the wrong IPI percentage, you can make a correction without affecting inventory in any way. Also, you may want to move stock from one warehouse to another warehouse. Or, a product may arrive from a different country. If a manufacturer ships merchandise into Brazil, that merchandise will not arrive with a Nota Fiscal. The receiving company in Brazil would need to generate a Nota Fiscal to begin the tracking process. In cases such as these, JD Edwards World provides you with the ability to generate the Nota Fiscal.

Because a stand-alone nota fiscal is not associated with a sales order in the JD Edwards World system, you must enter all information manually, including information that would generally be populated from the sales order. In addition to standard customer and item information, you might need to enter information about the item origin, the taxpayer classification (intermediate/business or final consumer), transportation information, and the method in which the transaction was generated (via phone, in person, and so on.) Refer to the chapters in this guide that discuss sales order entry for more information about specific fields that you must complete.

|

Caution: The stand-alone Nota Fiscal is not linked to any other accounting processes. For example, when you generate a stand-alone Nota Fiscal, it does not interface with general ledger, inventory, purchase order, sales order, accounts payable, or accounts receivable processes. Generate a stand-alone Nota Fiscal only when you want to print a document that does not affect any other accounting process. |

41.2 Entering Header and Detail Information on the Nota Fiscal

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Stand Alone Nota Fiscal

From Stand Alone Nota Fiscal - Brazil (G76B4321), choose Stand Alone NF Entry - PO or From Stand Alone Nota Fiscal - Brazil (G76B4321), choose Stand Alone NF Entry - SO

Entering stand-alone Nota Fiscal header and detail information consists of the following tasks:

-

Entering Nota Fiscal header information

-

Entering Nota Fiscal detail information

-

Entering Nota Fiscal detail additional information

-

Entering Nota Fiscal header additional information

|

Note: Note that the same program used to review Sales/Procurement Nota Fiscal (P76111B) is also used to enter Stand-Alone Nota Fiscal. This program's processing options determine how these videos are displayed. That is, many fields that are enabled when a Stand-Alone Nota Fiscal for Purchasing is entered are disabled when a Stand-Alone Nota Fiscal for Sales is entered. |

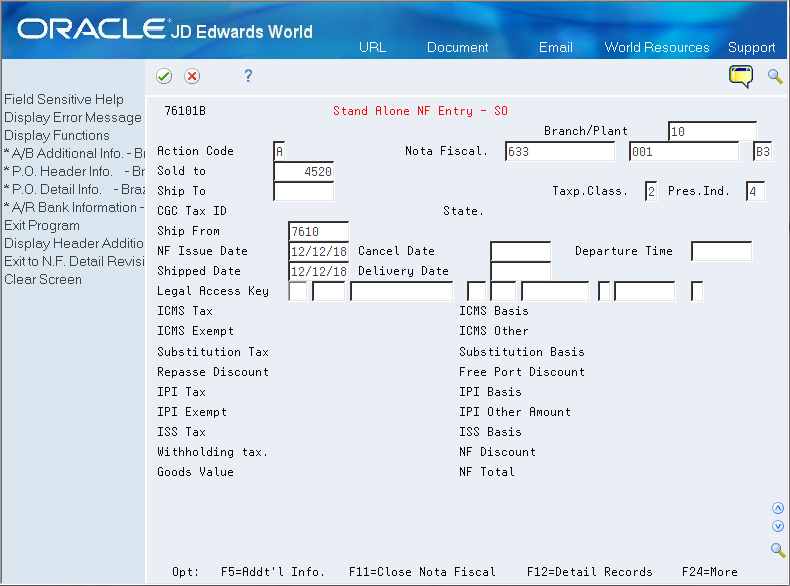

To enter Nota Fiscal header information

From Stand Alone Nota Fiscal - Brazil (G76B4321), choose Stand Alone Nota Fiscal Entry-PO (for Purchase Orders) or choose Stand Alone Nota Fiscal Entry - SO (for Sales Orders)

Figure 41-1 Stand Alone NF Entry - PO screen

Description of ''Figure 41-1 Stand Alone NF Entry - PO screen''

-

On Stand-Alone NF Entry - PO (P76101B), complete the following identification information:

-

Nota Fiscal

-

Branch Plant

-

Supplier

-

Ship From

-

Ship To

-

Taxp. Class. (Taxpayer Classification)

-

Pres. Ind. (Presence Indicator)

-

-

Complete the following date information:

-

Issue

-

Cancel

-

Shipped

-

Delivery Date

-

Departure Time

-

| Field | Explanation |

|---|---|

| Nota Fiscal | In Brazil, Notas fiscais are identified based on the combination of a Nota Fiscal number and a Nota Fiscal series number.

Use this numeric, 15-digit field to identify the Nota Fiscal number. The Nota Fiscal Number field is the first key that the system uses to access a specific Nota Fiscal. |

| Supplier | Address number of the supplier or subcontractor. This will be verified against Address Book. |

| Ship From | Enter the address number of the supplier from which you want to ship this order. The system determines the address of the supplier, including street, city, state, zip code, and country, based on the record that you enter for the supplier in the Address Book. |

| Ship To | The address number of the location to which you want to ship this order. The address book provides default values for customer address, including street, city, state, zip code, and country. |

| Issue | The date the log entry was issued. For example, consider a submittal requirement for an insurance certificate. For such an entry the effective date for the insurance policy would be entered in the Issue Date field. |

| Cancel | The date that the order should be canceled if the goods have not been sent to the customer or the goods have not been received from the supplier. This is a memo-only field and does not cause the system to perform any type of automatic processing. |

| Taxp. Class. (Taxpayer Classification) | A value from UDC 76/CC to specify the taxpayer class. When you generate the electronic nota fiscal, the system populates fields in the XML file differently for business consumers and final consumers. |

| Pres. Ind. (Presence Indicator) | A value from UDC 76B/PR that indicates the presence of the consumer when the transaction occurred. |

| Shipped | The date you confirmed a specific order line as shipped. |

| Delivery Date | The date that the shipment to the customer is confirmed as shipped. This date will be updated to the Sales Order Detail file at shipment confirmation. |

| Departure Time | The time the vehicle left the depot/gantry. |

| ICMS Tax | The ICMS tax amount that is printed on the Nota Fiscal. |

| ICMS Basis | The amount on which ICMS taxes are assessed. |

| ICMS Def % | The ICMS percentage that the system defers.

The system only displays the field for Sales Order fiscal notes. |

| ICMS Def Amount | The deferred ICMS amount.

The system only displays the field for Sales Order fiscal notes. |

| ICMS Exempt | The amount that is not eligible for ICMS tax. |

| ICMS Other | Any merchandise value amount that is classified as Other for ICMS taxing purposes. |

| Substitution Tax | The ICMS Substitute amount that your customer must remit in advance if they are subject to Tax Substitution Mark-up. |

| Substitute Basis | The amount on which ICMS Substitute tax is assessed. Products that are eligible for ICMS Substitute tax are listed in ICMS government directive 14. |

| Repasse Discount | ICMS Repass Amount (Valor do Repasse) is an additional discount granted to the client on interstate sales regarding the tax rate difference among states. |

| Free Port Discount | The amount of the discount available to a Free Port zone customer. |

| ISS Tax | The ISS tax amount that is printed on the Nota Fiscal. |

| ISS Basis | The amount on which ISS taxes are assessed. |

| Withholding Tax | Amount of the withholding tax calculated based on the amount subject to withholding tax entered and the withholding tax code (percentage). |

| IPI Tax | The IPI tax amount that is printed on the Nota Fiscal. |

| IPI Basis | The amount on which IPI taxes are assessed. |

| IPI Exempt | The amount that is not eligible for IPI tax. |

| IPI Other | Any merchandise value amount that is classified as Other for IPI taxing purposes. |

| Goods Value | An amount for VAT applications that is determined by subtracting the tax from the gross. |

| Net Amount | The net price of the merchandise included in the Nota Fiscal. The system calculates the net price of merchandise as follows:

Merchandise value - Discounts + IPI tax amount |

| N. F. Discount | The amount of the discount amount available for the Nota Fiscal. |

| Amount - Nota Fiscal Total | The total amount of the Nota Fiscal. The system calculates the total as follows:

Merchandise + IPI tax amount + ICMS Substitute tax amount + Complementary Expenses - Discounts |

To enter Nota Fiscal detail information

After you complete the steps to Stand-Alone NF Entry - PO (P76101B), you must enter nota fiscal detail information.

-

Stand-Alone NF Entry - PO (P76101B), press F12 (Detail Records) to go to Nota Fiscal Entry - Detail (P76111B).

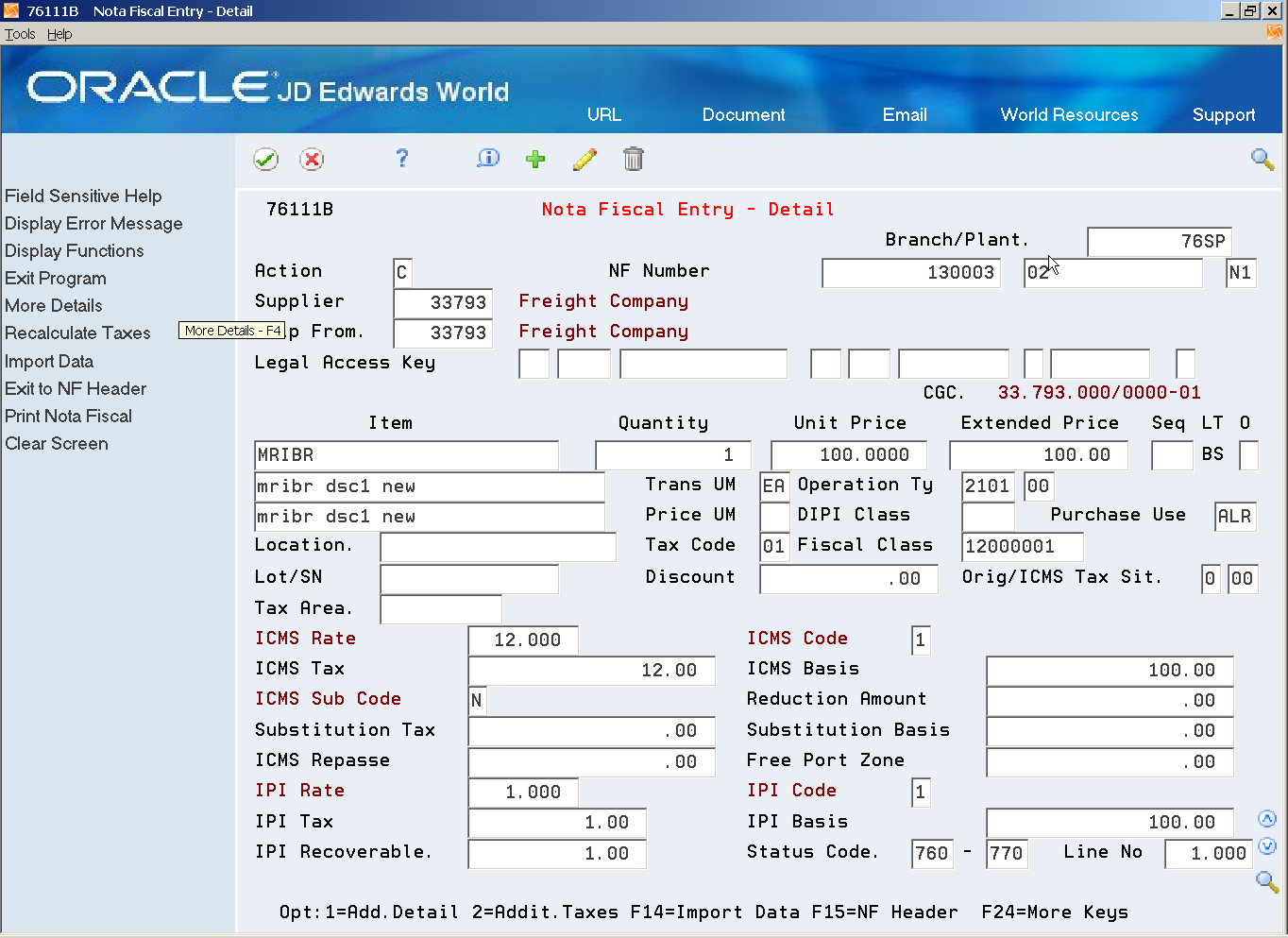

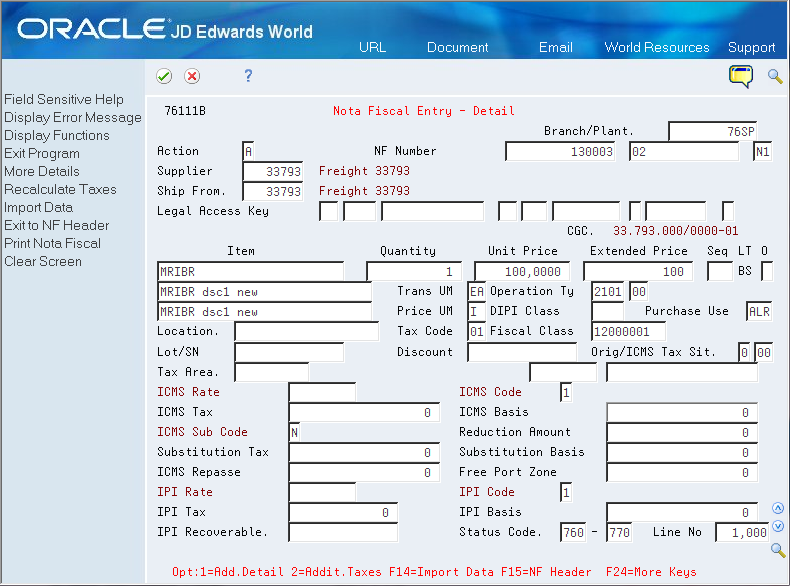

Figure 41-2 Nota Fiscal Entry - Detail screen

Description of ''Figure 41-2 Nota Fiscal Entry - Detail screen''

-

Complete the Item Information:

-

Item

-

Quantity

-

Unit Price

-

Extended Price

-

-

Press F4 (More Detail) and Complete the Tax Information:

-

Operation Type

-

Tax Code

-

Original/ICMS Tax Situation

-

-

Then enter either Additional Tax Information:

-

ICMS tax information:

-

ICMS Tax

-

ICMS Basis

-

ICMS Deferred Percentage

-

ICMS Deferred Amount

-

ICMS Exempt

-

ICMS Other

-

Substitution Tax

-

Substitute Basis

-

Repasse Discount

-

Free Port Discount

-

-

IPI tax information:

-

IPI Tax

-

IPI Basis

-

IPI Exempt

-

-

-

Press Enter to Confirm the Order.

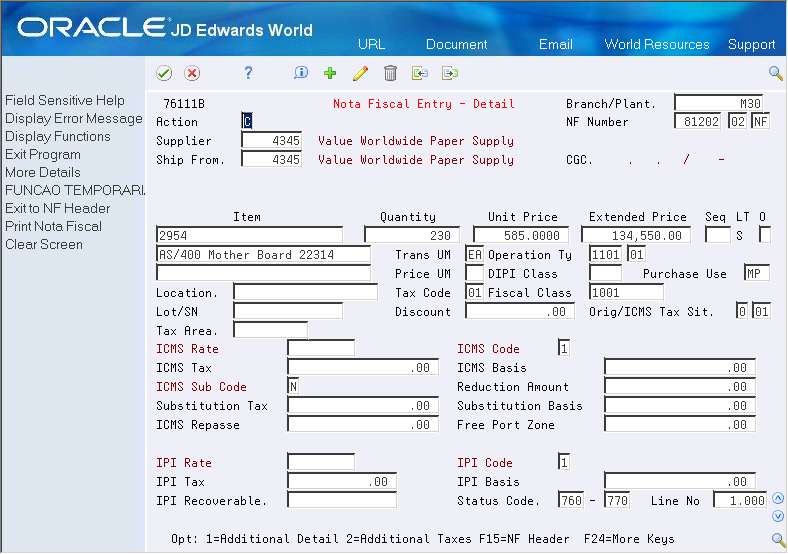

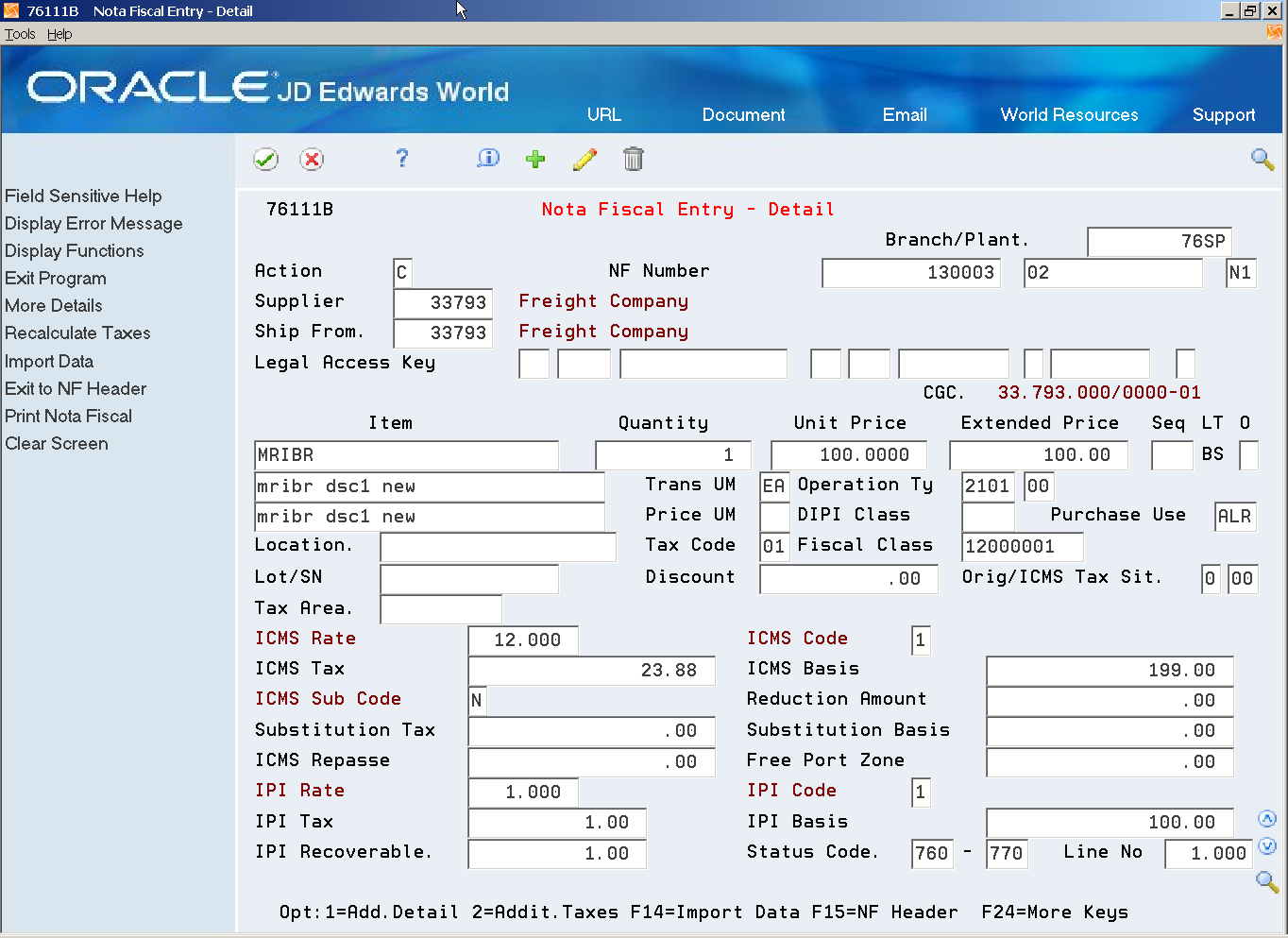

Figure 41-3 Nota Fiscal Entry - Detail screen

Description of ''Figure 41-3 Nota Fiscal Entry - Detail screen''

-

You can Inquire on the order and press F10 (Recalculate Taxes) to calculate the taxes automatically based on your item/tax setup:

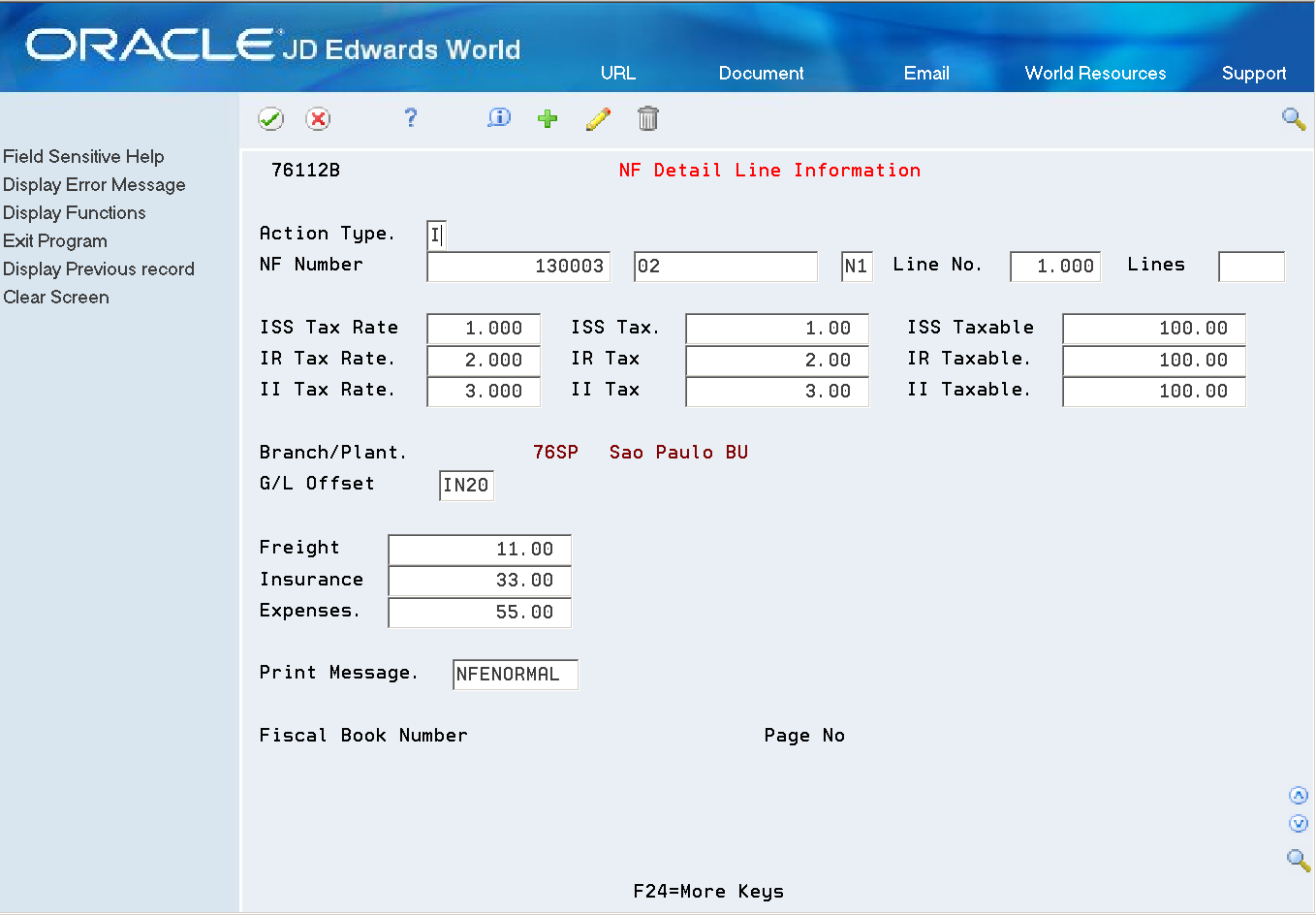

To enter Nota Fiscal additional detail information

-

Select option 1 (Additional Detail) to add ISS Tax, IR Tax, II Tax, Freight, Insurance and Other Expenses and Print Message information to your nota fiscal record.

-

On NF Detail Line Information (P76112B), complete the following:

-

ISS tax fields:

-

ISS Tax Rate

-

ISS Tax

-

ISS Taxable

-

-

Review the following IR tax rate fields:

-

IR Tax Rate

-

IR Tax

-

IR Taxable

-

-

Review the following II tax rate fields:

-

II Tax Rate

-

II Tax

-

II Taxable

-

-

Review the following Nota Fiscal fields:

-

Nota Fiscal Freight

-

Nota Fiscal Insurance

-

Nota Fiscal Expenses

-

-

Review/Add the following additional fields:

-

G/L Offset

-

Print Message

Figure 41-6 NF Detail Line Information screen

Description of ''Figure 41-6 NF Detail Line Information screen''

Taxes based on landed costs are not automatically updated. You may need to execute Recalculate Taxes again to recalculate these taxes.

-

-

-

Go to Nota Fiscal Entry - Detail (P76111B).

-

Press F24 (More Keys).

-

Select Recalculate Taxes.

Note that ICMS Tax fields were recalculated.

Figure 41-7 Nota Fiscal Entry - Detail screen

Description of ''Figure 41-7 Nota Fiscal Entry - Detail screen''

Field Explanation ISS Tax Rate Number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7% as 7; the system will display 7.000. ISS Tax The ISS tax amount that is printed on the Nota Fiscal. ISS Taxable The amount on which ISS taxes are assessed. IR Tax Rate Number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7% as 7; the system will display 7.000. IR Tax The IR tax amount that is printed on the Nota Fiscal. IR Taxable The amount on which IR taxes are assessed. II Tax Rate Number that identifies the tax rate for a tax authority that has jurisdiction in the tax area. Tax rates must be expressed as a percentage and not as the decimal equivalent. For example, type 7% as 7; the system will display 7.000. II Tax The II tax amount that is printed on the Nota Fiscal. II Taxable The amount on which II taxes are assessed. Nota Fiscal Freight Complete the Nota Fiscal Freight field whenever you classify freight as a complementary expense to your customer. The system prorates this expense amount among each of the Nota Fiscal listed and adds the prorated amount to the ICMS taxable amounts for each document. Nota Fiscal Insurance The insurance amount that you charge the client as complementary expense. This amount must be included on the Nota Fiscal. Nota Fiscal Expenses The amount of the total financial expenses that are printed on the Nota Fiscal. Print Message A user defined code (system 40, type PM) that you assign to each Fiscal print message that appears on the Nota Fiscal. The table of Automatic Accounting Instruction accounts that allows you to predefine classes of automatic offset accounts for Accounts Payable, Accounts Receivable, and other systems. G/L offsets might be assigned as follows:

blank or 1210- Trade Accounts Receivable

RETN or 1220 - Retainages Receivable

EMP or 1230 - Employee Accounts Receivable

JIB or 1240 - JIB Receivable (See A/R Class Code - ARC)

blank or 4110 - Trade Accounts Payable

RETN or 4120 - Retainage Payable

OTHR or 4230 - Other Accounts Payable (See A/P Class code - APC)

If you leave this field blank during data entry, the system uses the default value from the Customer Master Information table (F0301) or the Supplier Master Information table (F0401). The post program uses the G/L Offset class to create automatic offset entries.

Note: Do not use code 9999. It is reserved for the post program and indicates that offsets should not be created.

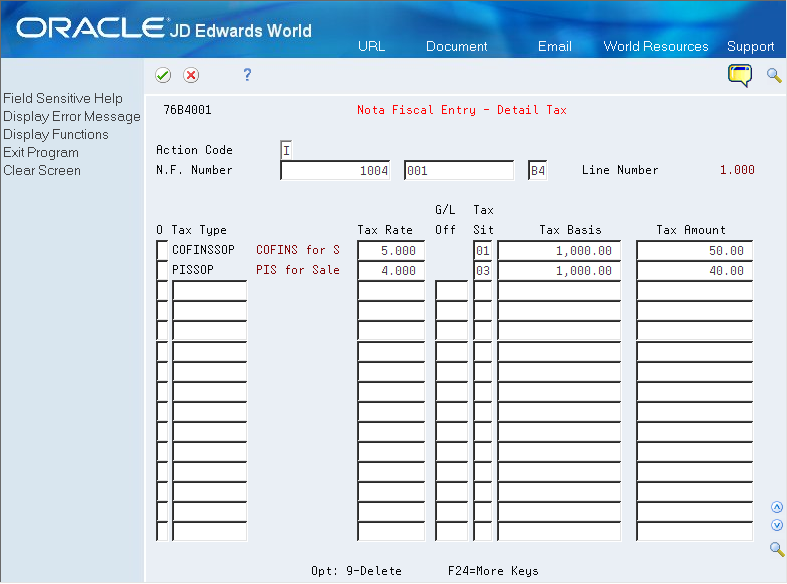

-

Select option 2 (Additional Taxes), to enter General Taxes (PIS, COFINS, etc.).

-

Complete:

-

Tax Type

-

Tax Rate

-

G/L Offset

-

Tax Basis

-

Tax Amount

-

Figure 41-8 NF Entry - Detailed Tax screen

Description of ''Figure 41-8 NF Entry - Detailed Tax screen''

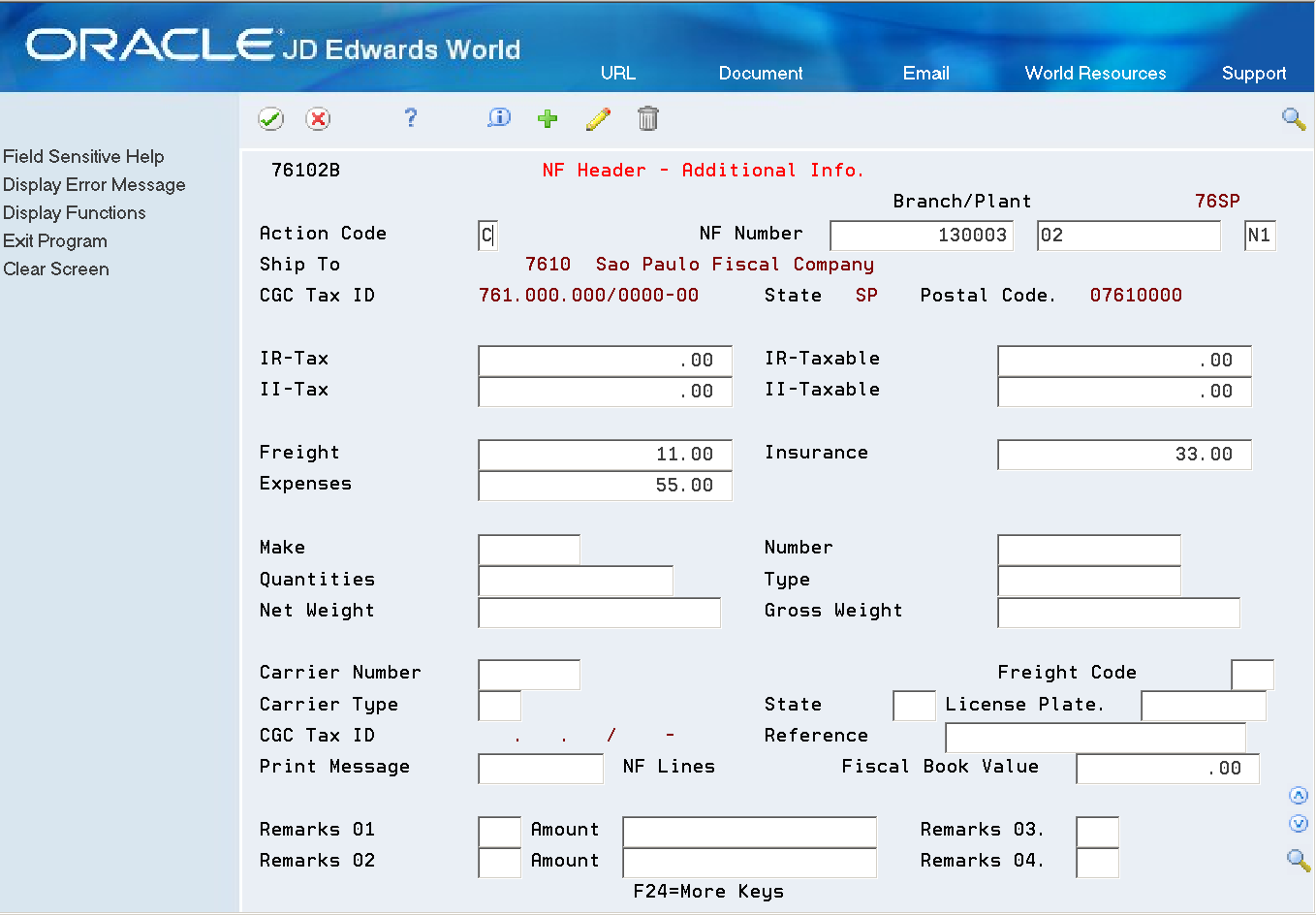

To enter Nota Fiscal header additional information

After you complete the steps to enter Nota Fiscal Entry - Detail (F76111B), you must review/ enter Nota Fiscal Header Additional Information (F76102B).

-

Go to Stand-Alone NF Entry (P76101B).

-

Press F5 (Add'l Info).

-

On NF Header - Additional Info (P76102B), complete the following tax information fields:

-

Nota Fiscal Number

-

IR Tax

-

IR Taxable

-

II Tax

-

II Taxable

-

-

Complete the following freight information fields:

-

NF Freight

-

NF Insurance

-

Expenses

-

Make

-

Number

-

Quantities

-

Type

-

Net Weight

-

Gross Weight

-

Carrier Number

-

Freight Code

-

Carrier Type

-

State

-

License Plate No

-

CGC Tax ID

-

Reference

-

-

Complete the following additional fields:

-

Print Message

-

Fiscal Book Value

-

Remarks 01

-

Amount 1

-

Remarks 02

-

Amount 2

-

Remarks 03

-

Remarks 04

-

Figure 41-9 NF Header - Additional Info. screen

Description of ''Figure 41-9 NF Header - Additional Info. screen''

| Field | Explanation |

|---|---|

| Nota Fiscal Number | In Brazil, Notas fiscais are identified based on the combination of a Nota Fiscal number and a Nota Fiscal series number.

Use this numeric, 15-digit field to identify the Nota Fiscal number. The Nota Fiscal Number field is the first key that the system uses to access a specific Nota Fiscal. |

| IR Tax | The IR tax amount that is printed on the Nota Fiscal. |

| IR Taxable | The amount on which IR taxes are assessed. |

| II Tax | The II tax amount that is printed on the Nota Fiscal. |

| II Taxable | The amount on which II taxes are assessed. |

| NF Freight | Complete the Nota Fiscal Freight field whenever you classify freight as a complementary expense to your customer. The system prorates this expense amount among each of the Nota Fiscal listed and adds the prorated amount to the ICMS taxable amounts for each document. |

| NF Insurance | The insurance amount that you charge the client as complementary expense. This amount must be included on the Nota Fiscal. |

| Make | A number that provides an audit trail for specific transactions, such as an asset, supplier number, or document number. |

| Number | An alphanumeric value used as a cross-reference or secondary reference number. Typically, this is the contract number or special catalog number. |

| Quantities | This field accumulates the quantity of goods sold which contribute to a sales rebate. |

| Type | The description of the equipment used to move materials. |

| Gross Weight | This field accumulates the weight of goods sold which contribute to a sales rebate. |

| Net Weight | The weight of one unit in the primary unit of measure. |

| Freight Handling Code | A user defined code (system 42/type FR) designating the method by which supplier shipments are delivered. For example, the supplier could deliver to your dock, or you could pick up the shipment at the supplier's dock.

You can also use these codes to indicate who has responsibility for freight charges. For example, you can have a code indicating that the customer legally takes possession of goods as soon as they leave the supplier warehouse and is responsible for transportation charges to the destination. |

| Reference | An alphanumeric value used as a cross-reference or secondary reference number. Typically, this is the customer number, supplier number, or job number. |

| Carrier Number | The address number of the carrier, which is specified by the customer or by your organization. Possible reasons for using this carrier might be due to route or special handling requirements. |

| Carrier Type | This 3 character field is to be used to assist you in characterizing the nature of the carrier you specify. You might, for instance, choose to treat this field essentially as another reporting code, so that you could define types of carriers, such as CTY (city delivery), REF (refrigerated hauling), or CON (contract services). Then you could run a query and sort by type of carrier. |

| CGC Tax ID - Ship To | Complete this alphanumeric, 19-character field to identify the ship-to company. The local tax authority requires that this ship-to tax identification number is included on Notas fiscais and legal reports.

Enter the ship-to tax identification number using the following convention: XXX.XXX.XXX/YYYY-WW The definitions of the variables for this convention are as follows: XXX.XXX.XXX = Corporation code YYYY = Headquarters or branch code WW = Check digits |

| License Plate | The license plate number of a given truck in the truck assignment system. |

| State | A 2-character abbreviation of a state name. |