46 Maintain Additional Invoice Information for Brazil

This chapter contains this topic:

46.1 Maintaining Additional Invoice Information for Brazil

In Brazil, businesses remit customer invoice information, including interest rates for amounts that are past due, to banks for collection. Banks attempt to collect on the invoices and return collection information so that the business can update Accounts Receivable information. Invoice information that is exchanged between businesses and banks for collection purposes is referred to as Duplicata.

You can use JD Edwards World base software to process invoices for your customers. The system automatically associates the additional information required by the Brazilian bank to collect on the invoice when you enter the invoices. This additional information is based on the A/R Brazilian Tag Maintenance country server and user defined codes.

This section contains the following:

-

Revising Additional Bank Information

-

Reviewing the Bank Duplicata

Verify that Brazil is the country that you have selected for your user display preferences.

46.1.1 Revising Additional Bank Information

From Localizations - Brazil (G76B), choose Accounts Receivable

From Accounts Receivable - Brazil (G76B03), choose A/R Bank Information Revision

After you enter invoices, you can review the collection information and status codes for each pay item that is associated with the invoice. You can review invoice and collection information before you send the information to the bank and after the bank returns the updated information to you. You can also revise this information as needed. For example, you might want to revise collection information if you have agreed with your customer to charge a different interest rate on a specific invoice or if a customer disputes an invoice amount.

46.1.1.1 Before You Begin

-

Set up the interest rate that you charge your customers by choosing A/R Tag Maintenance from the Dream Writer Setup - Brazil menu (G76B412).

-

Verify that you have set up the user defined codes tables for sent and received transaction status codes (76/RS and 76/SS). See Work with User Defined Codes in the JD Edwards World Technical Foundation Guide.

-

Verify that you have set up the user defined codes tables for Bank Send Code (76/SC), Bank Receive Code (76/RC), and Bank Record Status (76/BS). See Work with User Defined Codes in the JD Edwards World Technical Foundation Guide.

To revise additional bank information for Brazil

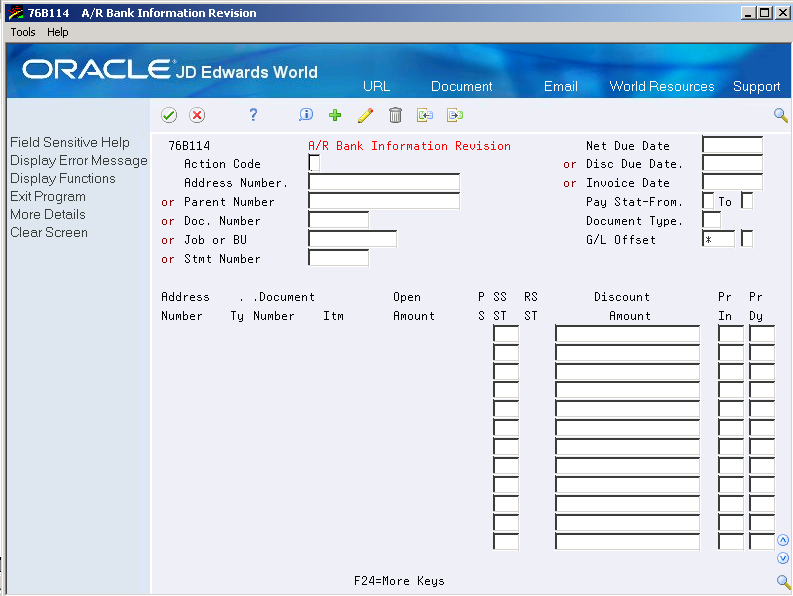

On A/R Bank Information Revision

Figure 46-1 A/R Bank Information Revision screen

Description of ''Figure 46-1 A/R Bank Information Revision screen''

-

To locate a specific invoice, complete one of the following identification number fields:

-

Address Number

-

Parent Number

-

Doc Number

-

Job or BU

-

Stmt Number

-

-

Complete one of the following date fields:

-

Net Due Date

-

Disc. Due Date

-

Invoice Date

-

-

Complete the following document fields:

-

Document Ty

-

Document Number

-

Document Itm

-

-

The system lists each pay item for the invoice. The type of collection information that the system displays on the screen depends on whether the invoice is ready to remit to the bank or has been returned by the bank.

-

To override default collection information before you remit the invoices to the bank for collection, complete the following fields:

-

Send Transaction Status

-

Discount Amount

-

Protest Instructions

-

Protest Instruction Days

-

-

For bank identification and collection information regarding the invoice, review the following field:

-

Receive Transaction Status

The system prevents you from changing this information.

| Field | Explanation |

|---|---|

| Address Number | The address number you want to retrieve. You can use the short format, the long format, or the tax ID (preceded by the indicators listed in the Address Book constants). |

| Parent Number | The Address Book number of the parent company. The system uses this number to associate a particular address with a parent company or location. For example:

Subsidiaries to parent companies Branches to a home office Job sites to a general contractor If you leave this field blank on an entry screen, the system supplies the primary address from the Address Number field. This address must exist in the Address Book Master file (F0101) for validation purposes. |

| Doc. Number | A number that identifies the original document, such as a voucher, invoice, unapplied cash, journal entry, and so on. On entry forms, you can assign the original document number or let the system assign it through Next Numbers.

Matching document (DOCM) numbers identify related documents in the Accounts Receivable and Accounts Payable systems. Examples: Automated/Manual Payment Original document - Voucher Matching document - Payment A/R Original Invoice Original document - Invoice Receipt Application Original document - Invoice Matching document - Receipt Credit Memo/Adjustment Original document - Invoice Matching document - Credit Memo Unapplied Receipt Original document - Receipt |

| Job or BU | An alphanumeric field that identifies a separate entity within a business for which you want to track costs. For example, a business unit might be a warehouse location, job, project, work center, or branch/plant.

You can assign a business unit to a voucher, invoice, fixed asset, employee, and so on, for purposes of responsibility reporting. For example, the system provides reports of open accounts payable and accounts receivable by business units to track equipment by responsible department. Security for this field can prevent you from locating business units for which you have no authority. Note: The system uses this value for Journal Entries if you do not enter a value in the AAI table. |

| Statement No | A/P Control field usage: Defines the order in which A/P checks should be printed. For example, if checks are to be printed by job, this field would contain job number. If checks were to be printed by contract number, this field would contain contract number. The A/P check build will sort on this field.

A/R Statement field usage: This is the statement number which the invoice printed on. For example, when statements are run, if statement number 1234 contains invoices 151 and 152, then this field will contain the value 1234 for all invoice records for invoices 151 and 152. |

| Net Due Date | In accounts receivable, the date that the net payment is due.

In accounts payable, the discount due date. If you leave this field blank in invoice entry or voucher entry, the system computes the due date using the invoice date and the payment terms code. If you leave the payment terms field blank, the system computes payment terms using the payment terms code from the Customer Master Information file (F0301) or Supplier Master Information table (F0401) for that customer or supplier. |

| Discount Due Date | The last date that the discount on an invoice is available. For example, if payment is due within 30 days of invoice date, customer entitled to a 2% discount for early payment within ten days of the invoice date (2/10 net 30).

If you leave the Discount Due Date field blank, the system automatically calculates the date using the payment terms code assigned to the invoice. |

| Invoice Date | The date of the invoice. This can be either the date of the supplier's invoice to you or the date of your invoice to a customer. |

| Pay Stat-From | A user defined code (00/PS) that indicates the current payment status for a voucher or an invoice. Codes are:

P Paid. The voucher or invoice is paid in full. A Approved for payment, but not yet paid. This applies to vouchers and automatic cash applications. H Hold pending approval. R Retainage. % Withholding applies. ? Other codes. All other codes indicate reasons that payment is being withheld. # Payment-in-process. |

| Document Type | A user defined code (system 00/type DT) that identifies the origin and purpose of the transaction.

JD Edwards World reserves several prefixes for document types, such as vouchers, invoices, receipts, and timesheets. The reserved document type prefixes for codes are: P Accounts payable documents R Accounts receivable documents T Payroll documents I Inventory documents O Order processing documents J General ledger/joint interest billing documents The system creates offsetting entries as appropriate for these document types when you post batches. |

| G/L Offset | The table of Automatic Accounting Instruction accounts that allows you to predefine classes of automatic offset accounts for Accounts Payable, Accounts Receivable, and other systems.

G/L offsets might be assigned as follows: blank or 1210- Trade Accounts Receivable RETN or 1220 - Retainages Receivable EMP or 1230 - Employee Accounts Receivable JIB or 1240 - JIB Receivable (See A/R Class Code - ARC) blank or 4110 - Trade Accounts Payable RETN or 4120 - Retainage Payable OTHR or 4230 - Other Accounts Payable (See A/P Class code - APC) If you leave this field blank during data entry, the system uses the default value from the Customer Master Information table (F0301) or the Supplier Master Information table (F0401). The post program uses the G/L Offset class to create automatic offset entries. Note: Do not use code 9999. It is reserved for the post program and indicates that offsets should not be created. |

| Currency Code | A code that indicates the currency of a customer's or a supplier's transactions. |

| Itm | A number that identifies the pay item for a voucher or an invoice. The system assigns the pay item number. If the voucher or invoice has multiple pay items, the numbers are sequential. |

| Open Amount | The amount of an invoice, voucher, or pay item that is unpaid.

The open amount reflects the gross amount of the voucher after this manual payment was applied. |

| Send Transaction Status Code | A user defined code (system 76, type SS) that indicates the status of the Duplicata that you send to the bank that is responsible for the collection of your Accounts Receivable invoices. You complete this field before you remit the Duplicata to the bank.

You should establish these codes in conjunction with your bank to ensure effective communication. |

| Protest Instructions | Use this field to indicate any special instructions for the Duplicata that you remit to your bank for collection from your customers.

Establish the valid values you enter in this field in conjunction with your bank to ensure effective communication. For example, 1 might indicate to the bank that the Duplicata must be sent to a collection agency. |

| Protest Instructions Days | The number of days a client has to protest the amount due on an invoice. |

| Receive Transaction Status | A user defined code (system 76, type RS) that indicates the status of the Duplicata that you receive from the bank that is responsible for the collection of your Accounts Receivable invoices. The bank completes this status field after processing the Duplicata. You cannot revise or change the value in this field.

You should establish these codes in conjunction with your bank to ensure effective communication. |

46.1.1.2 Alternate Inquiry Forms

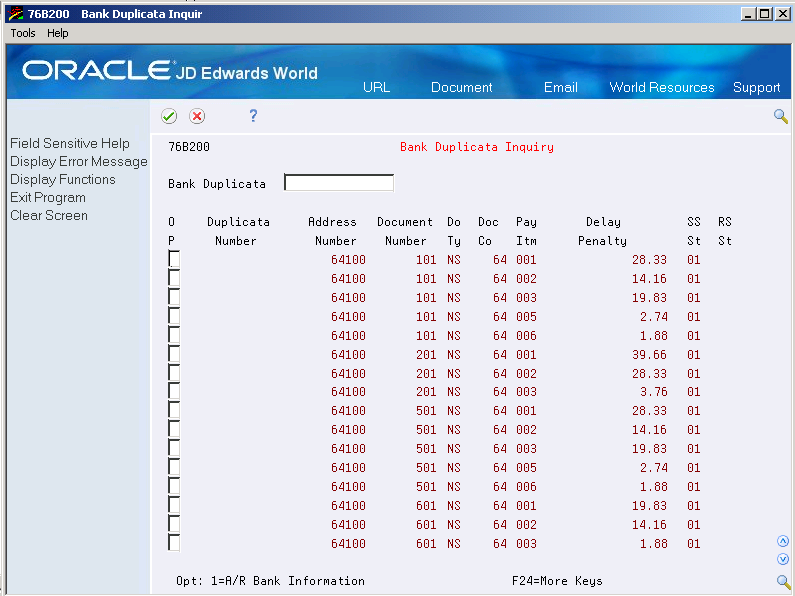

The bank identifies each invoice that you remit for collection by a bank-assigned Duplicata number. To communicate with the bank, you must use this bank-assigned number.

To review the collection information for an invoice by the bank-assigned number, access the Bank Duplicata Number Inquiry screen.

46.1.1.3 Processing Options

See Section 68.1, "Processing Options for A/R Brazilian Tag Maintenance (XT0311Z1BR)".

46.1.1.4 Reviewing the Bank Duplicata

From Localizations - Brazil (G76B), choose Accounts Receivable

From Accounts Receivable - Brazil (G76B03), choose Bank Duplicata Inquiry

In Brazil, businesses remit customer invoice information, including interest rates for amounts that are past due, to banks for collection. Banks attempt to collect on the invoices and return collection information so that the business can update Accounts Receivable information. Invoice information that is exchanged between businesses and banks for collection purposes is referred to as Duplicata.

On Bank Duplicata Inquiry

Figure 46-2 Bank Duplicate Inquiry screen

Description of ''Figure 46-2 Bank Duplicate Inquiry screen''

To locate a specific invoice, complete the following fields:

-

Duplicata number

Review the following fields:

-

Address number

-

Document number

-

Do ty

-

Doc co

-

Pay itm

-

Amount

-

SS St

-

RS St

| Field | Explanation |

|---|---|

| Bank Duplicata | The number assigned to the Duplicata by the bank. |

| Address Number | A number that identifies an entry in the Address Book system. Use this number to identify employees, applicants, participants, customers, suppliers, tenants, and any other Address Book members. |

| Document Number | A number that identifies the original document, such as a voucher, invoice, unapplied cash, journal entry, and so on. On entry forms, you can assign the original document number or let the system assign it through Next Numbers.

Matching document (DOCM) numbers identify related documents in the Accounts Receivable and Accounts Payable systems. Examples: Automated/Manual Payment Original document - Voucher Matching document - Payment A/R Original Invoice Original document - Invoice Receipt Application Original document - Invoice Matching document - Receipt Credit Memo/Adjustment Original document - Invoice Matching document - Credit Memo Unapplied Receipt Original document - Receipt |

| Do Ty | A user defined code (system 00/type DT) that identifies the origin and purpose of the transaction.

JD Edwards World reserves several prefixes for document types, such as vouchers, invoices, receipts, and timesheets. The reserved document type prefixes for codes are: P Accounts payable documents R Accounts receivable documents T Payroll documents I Inventory documents O Order processing documents J General ledger/joint interest billing documents The system creates offsetting entries as appropriate for these document types when you post batches. |

| Doc Co | A number that, along with document number, document type and G/L date, uniquely identifies an original document, such as invoice, voucher, or journal entry.

If you are using the Next Numbers by Company/Fiscal Year feature, the Automatic Next Numbers program (X0010) uses the document company to retrieve the correct next number for that company. If two or more original documents have the same document number and document type, you can use the document company to locate the desired document. |

| Pay Itm | A number that identifies the pay item for a voucher or an invoice. The system assigns the pay item number. If the voucher or invoice has multiple pay items, the numbers are sequential. |

| Delay Penalty | A number that identifies the actual amount. Type debits with no sign or a plus sign (+). Type credits with a minus sign (-) either before or after the amount. You can use decimals, dollar signs, and commas. The system ignores non-significant symbols. |

| SS St | A user defined code (system 76, type SS) that indicates the status of the Duplicata that you send to the bank that is responsible for the collection of your Accounts Receivable invoices. You complete this field before you remit the Duplicata to the bank.

You should establish these codes in conjunction with your bank to ensure effective communication. |

| RS St | A user defined code (system 76, type RS) that indicates the status of the Duplicata that you receive from the bank that is responsible for the collection of your Accounts Receivable invoices. The bank completes this status field after processing the Duplicata. You cannot revise or change the value in this field.

You should establish these codes in conjunction with your bank to ensure effective communication. |