47 Process Automatic Receipts

This chapter contains these topics:

47.1 Processing Automatic Receipts

In Brazil, banks collect funds from customers to pay for goods or services. You can process automatic receipts if you receive payments directly from a customer's bank on custom bank tapes (lock box). You can create a bank tape with information about your customer and send it to the bank. The bank processes this information and contacts your customers with the amount they owe you. The customers send this money to the bank and the bank sends you information about the transaction.

This section contains the following:

-

Remitting Bank Data

-

Loading Bank Tape Information

-

Maintaining Bank Tape Information

-

Receiving Bank Data

47.2 Remitting Bank Data

From Localizations - Brazil (G76B), choose Accounts Receivable

From Accounts Receivable - Brazil (G76B03), choose Bank Data Remit - Standard

You can create a bank tape with information about your customer and send it to the bank. All of this data is sent to the bank electronically. In Brazil, this process is called Remessa. After you send this data to the bank, the bank contacts the customer with the amount they owe you.

To send information to the bank, you must enter the code assigned to you by the bank that identifies your company. You must also enter the Carteira, branch ID, account number, and account number check digit. If these codes are not entered manually, the program does not run properly.

The Boleto is a document like an invoice that you or your bank can send to the customer. You enter a code that indicates whether the customer accepts the terms of the transaction.

You must set up the base file, Accounts Receivable Ledger (F0311), by selecting the payment instrument and document type to process the correct bank.

47.2.1 Before You Begin

-

Set up your user display preference for Brazil. See Setting Up User Display Preferences. in the JD Edwards World Technical Tools Guide.

-

Set up your system to process next numbers. See Setting up Standard Next Numbers in the JD Edwards World Accounts Payable Guide, and SSection 36.2, "Set Up Next Numbers".

-

Set up your system to use Advanced Sales Pricing. In the JD Edwards World Advanced Pricing Guide, see Set Up System Constants and Set Up Pricing Constants.

47.3 Loading Bank Tape Information

From Accounts Receivable (G03), choose Automatic Receipts Processing

From Automatic Receipts Processing (G0313), choose Load Bank Tape - Custom

To automatically process and apply receipts to the customer accounts, you must load the receipt information from the bank tape to the Accounts Receivable system.

When you load the bank tape for receipts, the system:

-

Reads the magnetic tape from the bank

-

Creates a Bank Tape Worktable (F03551) to store the information from the tape

-

Converts the information in the worktable to the Batch A/R Cash Application table (F0312)

The following graphic illustrates how the system processes bank tape information.

Figure 47-1 How the System Processes Bank Tape Information

Description of ''Figure 47-1 How the System Processes Bank Tape Information''

After the system converts the information in the worktable to the Batch A/R Cash Application table, it applies the receipts to the appropriate customer accounts in the A/R Ledger table (F0311). The system stores those items that it cannot process in the Batch A/R Cash Application Worktable until you rework and process them. The system then applies the reworked items to the A/R Ledger table.

47.3.1 Before You Begin

-

Set the appropriate processing options for the version you want to run. You must access the processing options from the menu before you choose the Load Bank Tape - Custom program. After you choose this program from the menu, you cannot change the processing options.

-

Ensure that the bank tape program is customized based on the information that is provided by your bank.

-

Activate Auto Receipt on accounts receivable constants.

-

Ensure that the following information is set up in the customer master record for each customer eligible for bank tape processing:

-

A bank transit account number, as well as an account number

-

An auto receipt value

-

An auto cash algorithm

-

47.3.2 Releasing the Lock on the System

If you press exit at the Load the tape prompt, you lock the system to prevent further processing. To release the lock, choose 4 in the Option field and press Enter.

The versions for the Load Your Custom Bank Tape program include the correct data selections. Do not change this information.

47.4 Maintaining Bank Tape Information

You can review or modify information you send to the bank. For example, you can indicate protest instructions, or assign abatement, on a case-by-case basis. You can review this information before or after sending it to the bank.

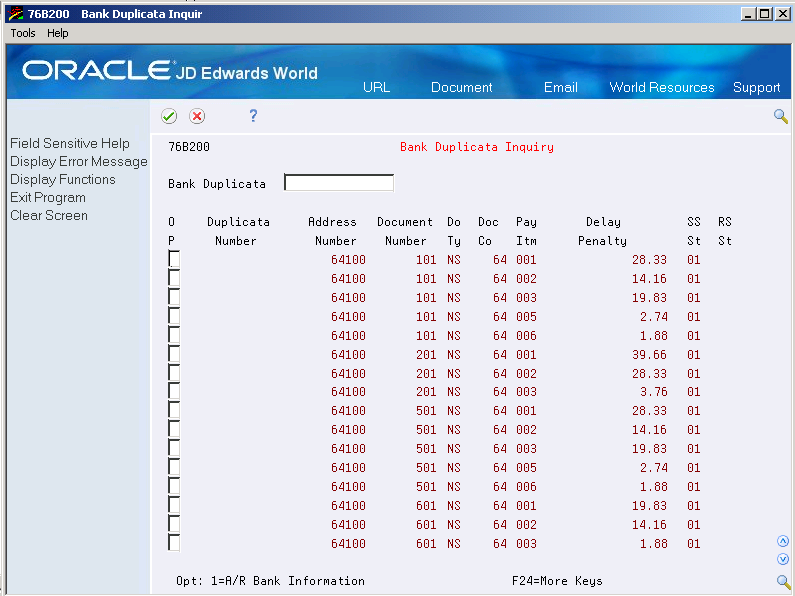

To revise additional bank information for Brazil

-

From the Accounts Receivable - Brazil menu (G76B03), choose Bank Duplicata Inquiry.

Figure 47-2 Bank Duplicate Inquiry screen

Description of ''Figure 47-2 Bank Duplicate Inquiry screen''

-

Press Enter. Or, to locate a specific invoice, enter the Bank Duplicata Number.

-

Enter a 1 in OP to choose a record.

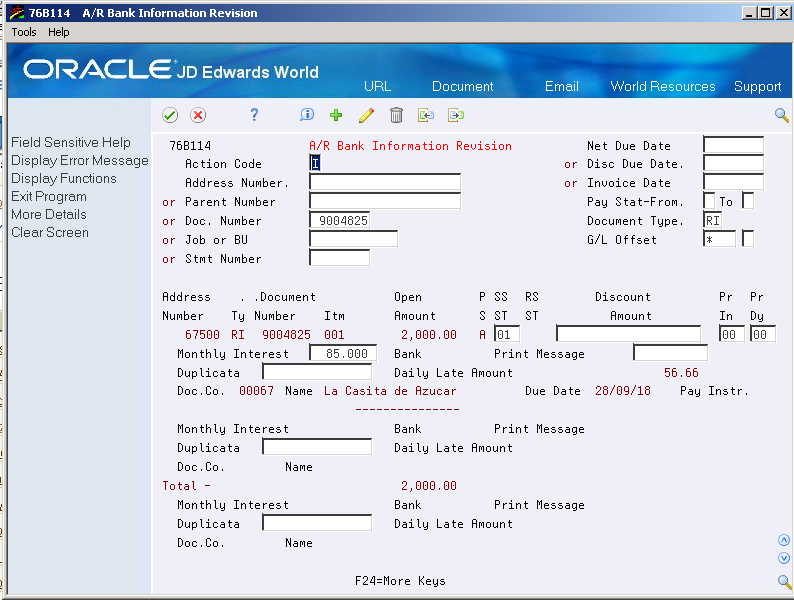

Figure 47-3 A/R Bank Information Revision screen

Description of ''Figure 47-3 A/R Bank Information Revision screen''

-

-

On A/R Additional Info. Brazil - Revisions, complete the following Send Information fields:

-

Monthly Interest

-

Discount (Abatement)

-

Print Message

-

Send/Bank Code

-

-

Complete the following Protest Instructions fields:

-

Code

-

Days

-

47.5 Receiving Bank Data

From Localizations - Brazil (G76B), choose Accounts Receivable

From Accounts Receivable - Brazil (G76B03), choose Bank Data Receipt - Standard

Once your customers send their payments to the bank, the bank sends all the information about the transactions back to you. This process is called Retorno.

To load information from the bank, you must enter the code assigned to you by the bank that identifies your company. You must also enter the system and UDC table name for the Bank/Interest account. If these codes are not entered manually, the program does not run properly.

You can choose to have the journal entries written in detail or summarized.

If you receive a bank tape of your customer's payments (lock box), you must load the information from the bank tape to the Accounts Receivable system to apply them to the customer's account.

After you load bank tape information into the Accounts Receivable system, you process the receipts to update the Receipts Register (F03B13) and A/R Ledger (F03B11) tables.

47.5.1 Before You Begin

-

Verify that the following AAIs are set up for Company 00000:

-

RCUC (unapplied receipts account)

-

RC__ (chargebacks and A/R trade accounts)

-

RAxx (write off reason codes)

-

RKD (discounts taken account)

-

-

See About AAIs for A/R in the JD Edwards World Accounts Receivable Guidefor more information about the A/R system and specific AAIs.