9 Set Up PIS, COFINS, and ISS Taxes

This chapter contains the following topics:

9.1 Overview of PIS, COFINS, and ISS Taxes

You must set up tax information in the JD Edwards World software before the system can calculate taxes on Brazilian transactions. This table describes the tax types to set up:

You can set up the system to perform calculations for these taxes:

-

ISS (Imposto sobre Serviços).

-

PIS/PASEP (Programa de Integração Social/Programa de Formação do Patrimônio do Servidor Público).

-

COFINS (Contribuiço do Financiamento para Seguridade Social).

The system uses the setup described in this chapter when you run the General Tax Calculator - Brazil (X76B4001) program. The General Tax Calculator reads values from these tables:

-

Tax Groups - Brazil (F76B4003)

-

Tax Type Definition - Brazil (F76B4005)

-

Preferences - Brazil (F76B4004)

-

Tax Rates - Brazil (F76B4002)

The General Tax Calculator program writes records to the Nota Fiscal Taxes Detail - Brazil file (F76B4001) and the Nota Fiscal Taxes Detail (tag file) (F76B4006).

To set up taxes, complete these tasks:

-

Set up values in the 76B/TT UDC table.

You also use values in UDC 76B/BC and 76B/CP when you set up taxes, but the values in those UDC tables are hard-coded.

-

Set up tax rate areas that you will use when grouping tax types.

See "Tax Rate and Areas" in the JD Edwards World Tax Reference Guide.

-

Set up tax type groups to associate tax types with tax rate areas.

-

Set up tax type definitions to set parameters for how the system uses the tax types.

-

Set up tax type preferences to define the sequence in which the system uses tax concepts to search for tax rates.

This task is optional.

See Section 9.5, "Setting Up Tax Type Preferences (Optional)"

-

Set up tax values.

9.2 Setting Up UDCs

Set up the following UDC tables to work with Brazilian Taxes:

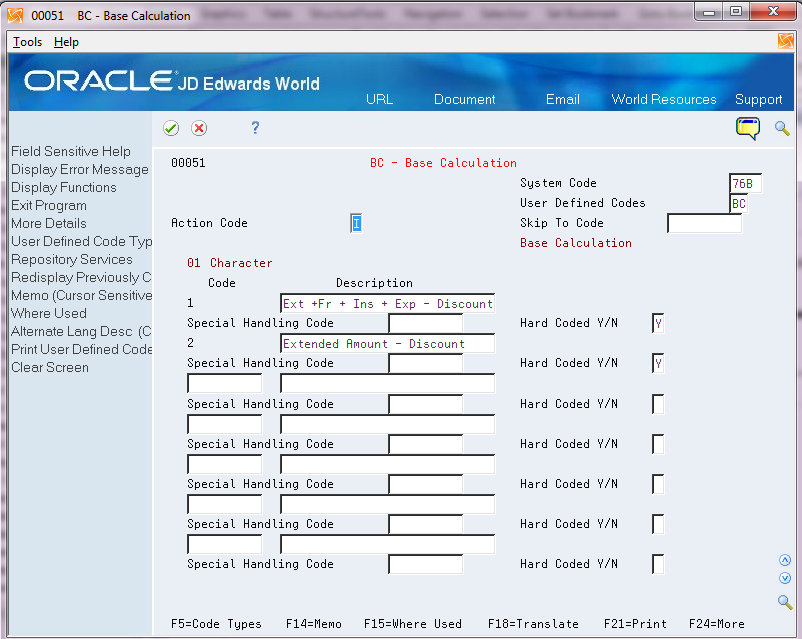

9.2.1 76B/BC (Base Calculation)

From Taxes set up - Brazil (G76B40) choose BC - Base Calculation

The system provides hard-coded values for this UDC. The system uses the values when it calculates taxes. You assign values from this UDC when you set up tax type definitions.

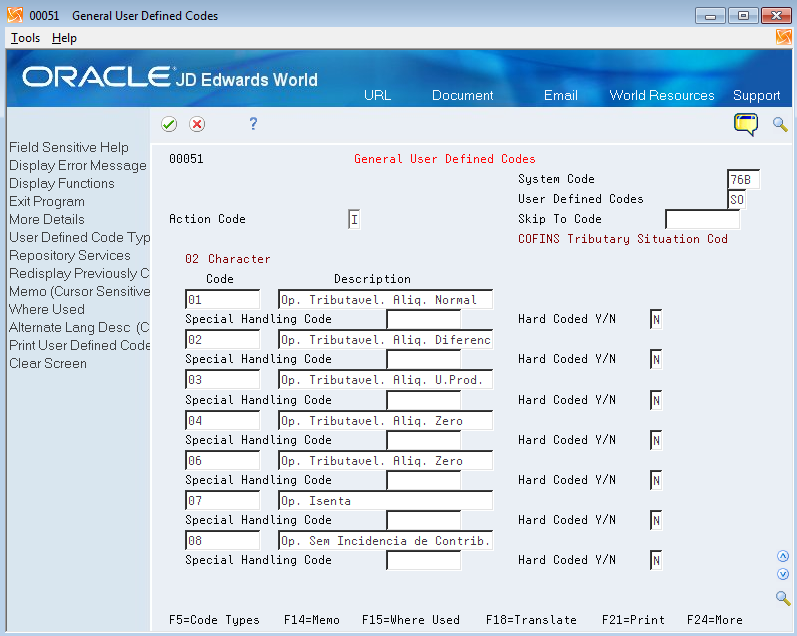

Figure 9-1 BC - Base Calculation UDC screen

Description of ''Figure 9-1 BC - Base Calculation UDC screen''

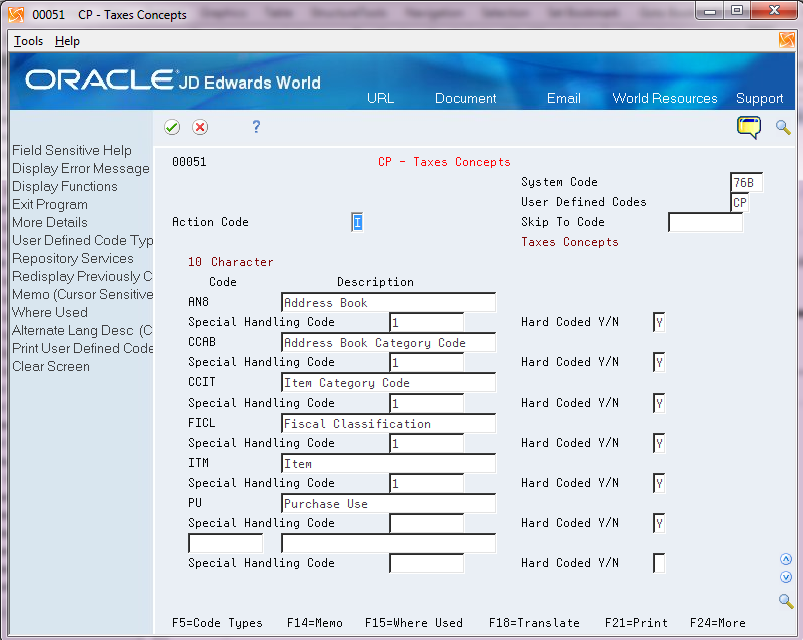

9.2.2 76B/CP (Taxes Concepts)

From Taxes set up - Brazil (G76B40) choose CP - Taxes Concepts

The system provides hard-coded values for this UDC table.

Figure 9-2 CP - Taxes Concepts UDC screen

Description of ''Figure 9-2 CP - Taxes Concepts UDC screen''

9.2.3 76B/SO (COFINS Situation Tributary Code)

Set up Tax Classification Codes (Código de Situação Tributária) for COFINS. The Brazilian government provides the codes that you must use.

This graphic illustrates examples of values for the 76B/SO UDC table:

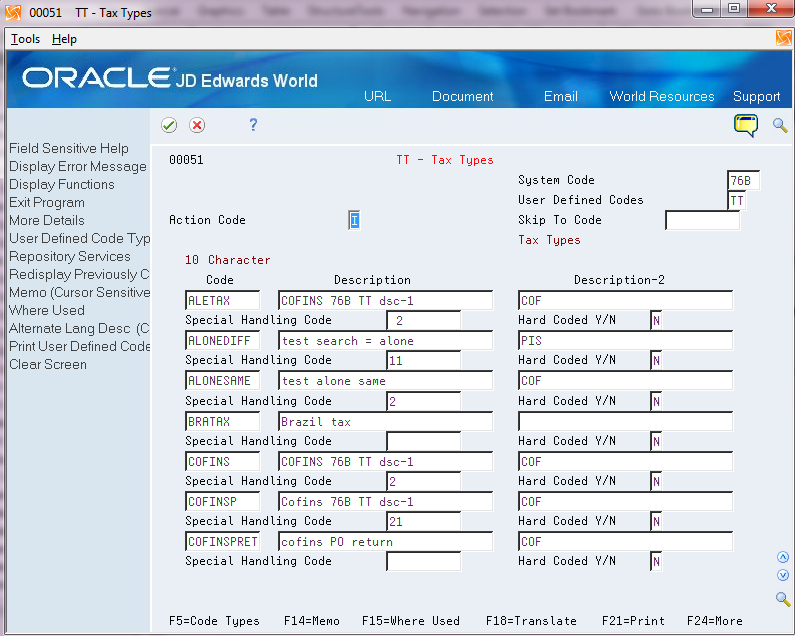

9.2.4 76B/TT (Tax Types)

From Taxes set up - Brazil (G76B40) choose TT - Tax Types

Enter at least one code for every tax type, such as PIS, COFINS, ISS for Sales and PIS, COFINS for Purchasing. You can enter any descriptive text in the Description field that you want to print on sales order and purchase order tax records. In Description-2 field, you must enter the three alphanumeric characters to represent the tax. Only the following values are valid for the Description 2 field:

-

COF

-

ISS

-

PIS

The system uses the values in the Special Handling Code (SHC) field to identify when PIS and COFINS taxes are applicable for landed costs and to identify when PIS and COFINS taxes should be included in the electronic nota fiscal XML file. Populate the first position in the SHC field to indicate that the system should calculate the tax on landed costs when you run the Landed Cost Selection program (P76291B). Populate the second position of the SHC field to indicate that the system should include the calculated tax in the NFe XML file. For PIS tax types, enter 1 in the SHC field. For COFINS tax types, enter 2 in the SHC field.

|

Note: Blank is a valid value for the first position in the SHC field. For example, you might leave the first position blank and enter 1 in the second position of the SHC field if you want to have the system include the calculated PIS tax in the NFe XML file and you do not want the system to calculate PIS for landed costs. |

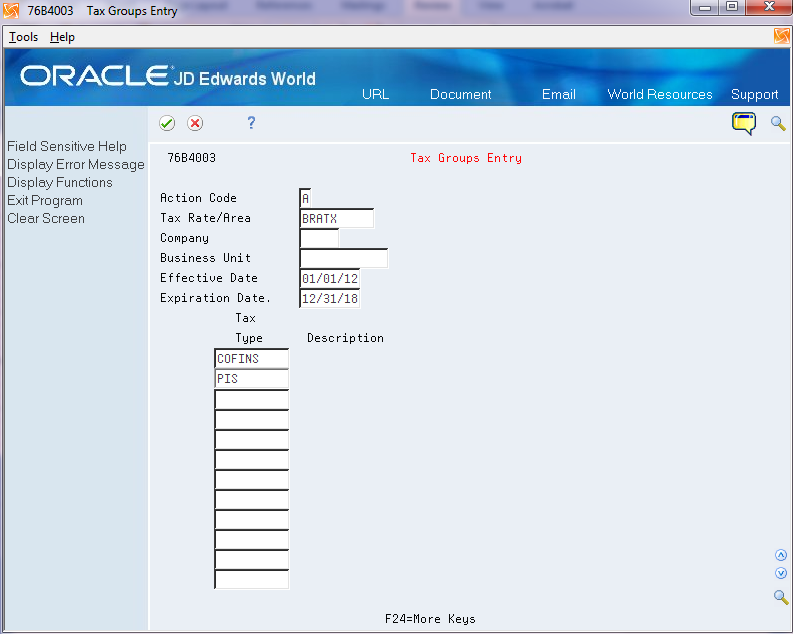

9.3 Setting Up Tax Groups

From Taxes set up - Brazil (G76B40) choose Tax Group Entry

You use the Tax Group Entry program (P76B4003) to associate a tax rate area with one or more tax types. For example, you might set up a tax rate area named BRTAX and then associate COFINS and PIS tax types from UDC 76B/TT to the tax rate area. You set up values in this program to use for sales orders and purchase orders.

When you set up the tax groups, you can specify that you want to use the tax group for a specific company and business unit, or you can leave the Company and Business Unit fields blank to have the tax group apply to all companies and business units.

When you set up the tax groups, you can use the same name for more than one tax group, but the effective dates cannot overlap. The system saves the records that you create to the Tax Groups file (F76B4003).

After you set up tax groups, you can associate the tax group to customers and suppliers using the following programs:

-

Customer Master (P01053)

-

Supplier Master (P01054)

-

Customer Co/Bus. Unit Defaults (P01153)

-

Supplier Co/Bus. Unit Defaults (P01054)

|

Note: When you set up the tax code definition, you indicate whether the tax type is used during the tax netting process. You should not create tax groups with tax types that you will define with different values for the Netting Process flag. |

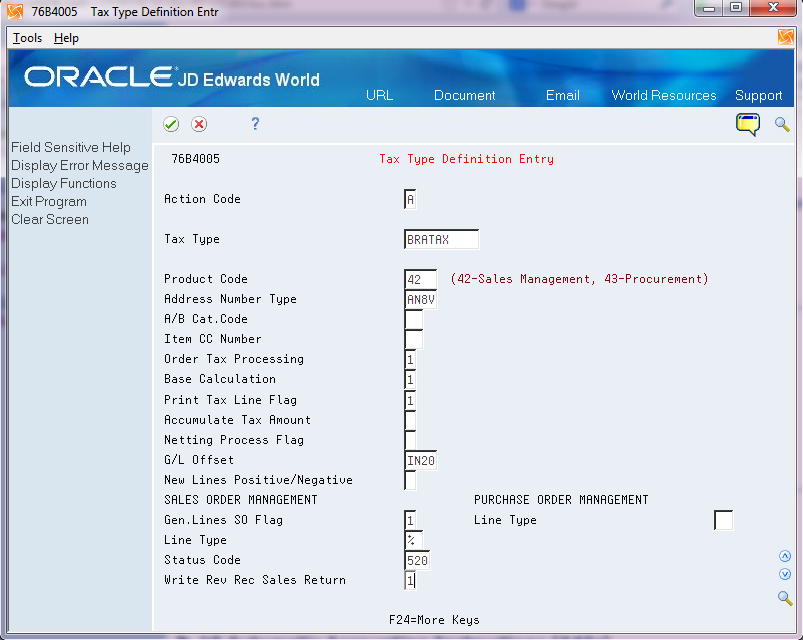

9.4 Setting Up Tax Type Definitions

From Taxes set up - Brazil (G76B40) choose Tax Type Definition Entry

You use the Tax Type Definition Entry program (P76B4005) to define how the tax is calculated and how the tax rate is retrieved.

To set up tax type definitions

Figure 9-6 Tax Type Definition Entry screen

Description of ''Figure 9-6 Tax Type Definition Entry screen''

On Tax Type Definition Entry

-

Complete the following fields:

-

Tax Type

-

Product Code

-

Address Number Type

-

A/B Cat Code (address book category code)

-

Item CC Number (item category code number)

-

Order Tax Processing

-

Base Calculation

-

Print Tax Line Flag

-

G/L Offset

-

New Lines Positive/Negative

-

-

To set up tax calculation information for sales orders, complete the following fields in the SALES ORDER MANAGEMENT section. If you selected system 42 in the Product Code field, you must complete these fields.

-

Gen. Lines SO Flag

-

Line Type

-

Status Code

-

Write Rev Rec Sales Return

-

-

To set up tax calculation information for purchase orders: complete the following field in the PURCHASE ORDER MANAFGEMENT SECTION:

Line Type

| Field | Description |

|---|---|

| Tax Type | A value from UDC 76B/TT. |

| Product Code | The code assigned to the JD Edwards World software system. Only values 42 (Sales Management) or 43 (Procurement Management) are valid for the ax Type Definition Entry program. |

| Address Number Type | The address number type that the system uses when searching for tax rates. Values are:

AN8V: Supplier's address number FCO: Fiscal company SHAN: Ship-to address number |

| A/B Cat Code (address book category code) | The address book category code to use when the tax concept is address book category code. |

| Item CC Number (item category code number) | The item category code to use when the tax concept is item category code. |

| Order Tax Processing | A code to specify how the system determines the order in which the tax retrieval rules are read when no tax preference is set up for a tax type. You set up tax preferences in the Tax Preference program (P76B4004). Valid values are:

C: Customer rules, then item rules I: Item rules, then customer rules If you leave this field blank, the system uses item rules then customer rules. |

| Base Calculation | A value from UDC 76B/ BC. |

| Print Tax Line Flag | A code that the system uses to determine whether to print a tax line on the nota fiscal. Values are:

0: Tax line is not printed. 1: Tax line is printed. 2: Tax is ISS tax and is printed. When you select this option, the system also populates the ISS fields in the Nota Fiscal Header (F7601B) and Nota Fiscal Detail (F7611B) files. Note: For all values, the system creates tax lines in the Sales Order Detail file (F4211) for sales orders and the PO Receipt file (F43121) for purchase orders. |

| Accumulate Tax Amount | A code to indicate whether the system accumulates the tax amounts and includes them in the Total Amount field of the nota fiscal. Values are:

Blank or 0: The system does not accumulate tax amounts. 1: The system accumulates the tax amounts. |

| Netting Process Flag | A code that indicates whether to calculate taxes using programs in the Sales Management and Purchase Management systems, or calculate taxes using the Tax Netting Process program (P76B4011). Values are:

0: Calculate taxes using programs in the Sales Management and Purchase Management systems. 1: C.alculate taxes using the Tax Netting Process program |

| G/L Offset | A value used to have the system write a default value to the Nota Fiscal Taxes Detail Brazil file (F76B4001). This file is used to retrieve general tax account values. |

| New Lines Positive/Negative | A code that indicates whether the tax lines are debits or credits. |

| Print Tax Line Flag | A code to indicate whether the system generates records in the Sales Order Detail File (F4211) and print the tax lines in the sales order. Values are:

0: Do not print tax lines 1: Print tax lines. |

| Line Type (sales order) | A value set up in the Order Line Types program (P40205). Enter the line type value to print in general tax lines in sales orders. |

| Status Code | The status code to print on the nota fiscal.

You must set up rules in the Order Activity Rules program (P40204) for the combination of Sales Order Document Type (DOCO) and Line Type (LNTY). |

| Write Rev Rec Sales Return | A code to indicate whether the system reverses general tax records for sales returns. Values are:

Blank or 0: Do not reverse records. 1: Reverse records. |

| Line Type (purchase order) | A value set up in the Order Line Types program (P40205). Enter the line type value to print in general tax lines in purchase orders. You must complete this field if you specified 43 (Procurement) in the Product Code field.

This value is used by the Receipt Taxes Generator program (P76B804) to retrieve the value of Account Ledger, Inventory Ledger/Cardex and Accounts Payable interfaces. |

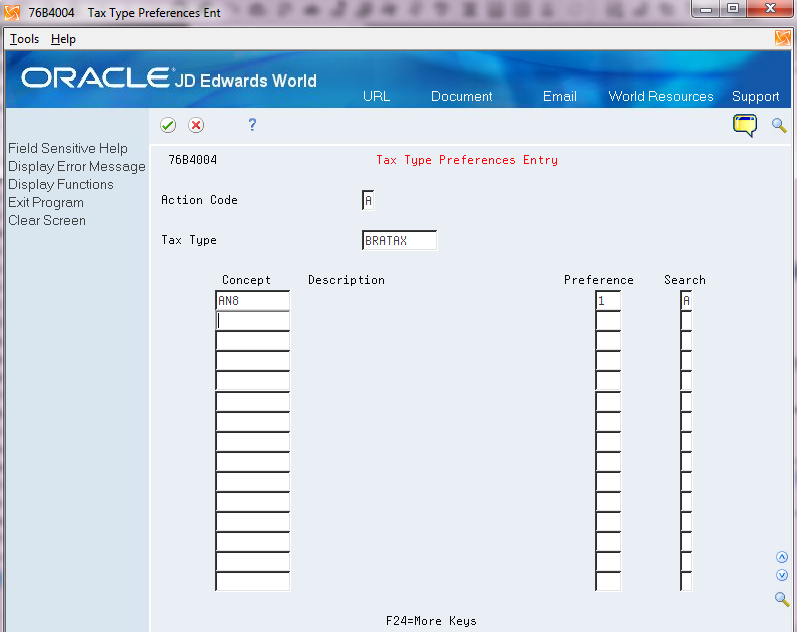

9.5 Setting Up Tax Type Preferences (Optional)

From Taxes set up - Brazil (G76B40) choose Tax Type Preference Entry

Use the Tax Type Preference Entry program (P76B4004) to set up the sequence in which the system uses the concepts to retrieve tax rates.

You can retrieve a tax rate based on the following factors:

-

Single concept

-

Multiple concepts in a user-defined order

-

Multiple concepts in a hard-coded order provided in the software

|

Note: When you specify a user-defined order, you cannot use the following concepts together:Item (ITM) and Item Category Code (CCIT) Address Book (AN8) and Address Book Category Code (CCAB) If you set up the tax type preference with the invalid combinations, you will receive an error message when you attempt to set up the records in the Tax Value Entry program (P76B4002). |

Tax concepts exist in UDC 76B/CP and are hard-coded.

This task is optional. If you do not set up tax type preferences, the system uses the value in the Order Tax Processing field in the Tax Type Definition Entry program (P76B4005) to determine the order in which tax rules are retrieved.

If the value in the Order Tax Processing field is C (customer), the system uses this hierarchy to search for tax rules:

| Hierarchy level | Data Item AN8 | Data Item ITM | Data Item AC20 | Data Item SPRO | Data Item FICL | Data Item PU |

|---|---|---|---|---|---|---|

| 0 | X | X | ||||

| 1 | X | X | X | X | ||

| 2 | X | X | X | |||

| 3 | X | X | X | |||

| 4 | X | X | X | |||

| 5 | X | X | ||||

| 6 | X | X | ||||

| 7 | X | X | ||||

| 10 | X | X | ||||

| 11 | X | X | X | X | ||

| 12 | X | X | X | |||

| 13 | X | X | X | |||

| 14 | X | X | X | |||

| 15 | X | X | ||||

| 16 | X | X | ||||

| 17 | X | X | ||||

| 18 | X |

If the value in the Order Tax Processing field is I (item), the system uses this hierarchy to search for tax rules:

| Hierarchy level | Data Item AN8 | Data Item ITM | Data Item AC20 | Data Item SPRO | Data Item FICL | Data Item PU |

|---|---|---|---|---|---|---|

| 20 | X | X | ||||

| 21 | X | X | ||||

| 22 | X | |||||

| 31 | X | X | X | X | ||

| 32 | X | X | X | |||

| 33 | X | X | X | |||

| 34 | X | X | X | |||

| 35 | X | X | ||||

| 36 | X | X | ||||

| 37 | X | X | ||||

| 41 | X | X | X | X | ||

| 42 | X | X | X | |||

| 43 | X | X | X | |||

| 44 | X | X | X | |||

| 45 | X | X | ||||

| 46 | X | X | ||||

| 47 | X | X | ||||

| 51 | X | X | X | |||

| 52 | X | X | ||||

| 53 | X | X | ||||

| 54 | X | X | ||||

| 55 | X | |||||

| 56 | X | |||||

| 57 | X |

To set up tax type preferences

Figure 9-7 Tax Type Preference Entry screen

Description of ''Figure 9-7 Tax Type Preference Entry screen''

On Tax Type Preference Entry

Complete the following fields:

-

Tax Type

-

Concept

-

Preference

-

Search

| Field | Description |

|---|---|

| Tax Type | A tax type code that you set up in UDC 76B/TT. |

| Concept | A code from UDC 76B/CP. The values in this UDC table are hard-coded. Values are:

AN8 (Address Book) CCAB (Address Book Category Code) CCIT (Item Category Code) FICL (Fiscal Classification) ITM (Item) PU (Purchase Use) If you select the AN8, CCAB, or CCIT concepts, you must also set up the corresponding fields in the Tax Type Definition Entry program (P76B4005): |

| Preference | A number from 1 through 999 that indicates the sequence in which the system uses the concept to search for tax rates. |

| Search | A code that determines whether the system searches using one concept at a time or uses the concepts concurrently. Values are:

A: Alone. The system searches using only the indicated concept. C: Combined. The system search using multiple concepts. |

9.6 Setting Up Tax Values

From Taxes set up - Brazil (G76B40) choose Tax Value Entry

Use the Tax Value Entry program (P76B0002) to associate tax rates to tax types.

On Tax Value Entry, complete the following fields. At minimum, you must complete the Tax Type, Tax Rate, Date from, and Date Until fields.

-

Tax Type

-

Address Number

-

A/B CC (address book category code)

-

Item No (item number)

-

Item CC (item category code)

-

Purch Use (purchase use)

-

Fiscal Class

-

Date from

-

Date until

-

Tax Rate

-

Reduction

-

GL Off (GL offset)

-

Tax Situation

| Field | Definition |

|---|---|

| Tax Type | A code from UDC 76B/TT. |

| Address Number | The address book number that you use to search for the tax rate. Complete this field only if you entered a value in the Address Book Type field in the Tax Type Definition Entry program (P76B4005). This field and the A/B CC (address book category code) field are mutually exclusive. You can enter a value in only one or the other. |

| A/B CC (address book category code) | The address book category code that you use to search for the tax rate. Complete this field only if you entered a value in the A/B Cat Code field in the Tax Type Definition Entry program (P76B4005). This field and the Address Number field are mutually exclusive. You can enter a value in only one or the other. |

| Item No (item number) | The short item number that you use to search for the tax rate. Complete this field only if you entered a value in the Item CC (item category code) field in the Tax Type Definition Entry program (P76B4005). This field and the Item CC (address book category code) field are mutually exclusive. You can enter a value in only one or the other. |

| Item CC | The item category code that you use to search for the tax rate. Complete this field only if you entered a value in the Item CC (item category code) field in the Tax Type Definition Entry program (P76B4005). This field and the Item No (item number) field are mutually exclusive. You can enter a value in only one or the other. |

| Purch Code (purchase code) | A value from UDC 76/PU. |

| Fiscal Class | A code that identifies groups of products as defined by the local tax authorities. |

| Date from | Enter the beginning of the date range for the effective date. |

| Date Until | Enter the end of the date range for the effective date. |

| Tax Rate | The tax rate as a percentage. For example, for a 7 percent rate, enter 7. |

| Reduction | The reduction as a percentage. For example, for a 7 percent rate, enter 7. |

| G/L Off (GL Offset) | The G/L offset account that the system uses for the tax. |

| Tax Situation | A code from UDC 76B/SO. |