32 Updating Sales

This chapter contains these topics:

32.1 Sales Update - Brazil

From Localizations - Brazil (G76B), choose Sales Order Management

From Sales Order Management - Brazil (G76B42), choose Sales Order Processing

From Sales Order Processing - Brazil (G76B4212), choose Sales Update - Brazil

This program adds tax lines to sales orders.

The Line Type (LNTY) value for the tax record is retrieved based on Additional Charge Line Types processing option.

The tax G/L Class (GLC) comes from GL/Class Code Cross Reference (76B/GL).

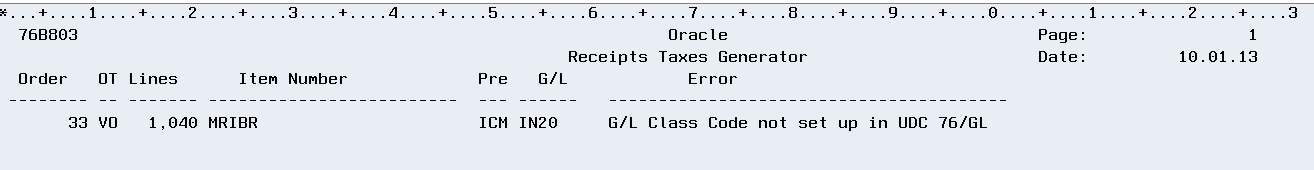

If tax lines are not generated, you must review Receipts Taxes Generator report (R76B803) and correct the errors.

Figure 32-1 Receipts Tax Generator Report

Description of ''Figure 32-1 Receipts Tax Generator Report''

Receipts Taxes Generator report (R76B803)

32.2 Updating Customer Sales

After you print your Nota Fiscal documents in final mode, you can update your customer sales information. When you update customer sales information, the system creates A/R records for your sales information. It is very important that you update customer sales information only after you print Nota Fiscal in final mode so that the A/R records include the official Nota Fiscal document numbers required by the Brazilian government.

From Sales Order Management (G42), choose End of Day Processing

From End of Day Processing (G4213), choose Update Customer Sales

When you run the Update Customer Sales program, the system generates reports that include summary or detail information about the following:

-

Update information about customer sales

-

Accounts receivable and G/L entries

-

Sales for different categories, such as stock sales and freight, cost of goods sold, and profit percentages

-

Errors that result from running the program

Depending on how you set the processing options, the system:

-

Updates all status codes according to the order activity rules, such as all order detail lines with a status of 600 are updated to 999

-

Updates the Sales Order Header table (F4201) and the Sales Order Header History table (F42019)

-

Updates the Sales Order Detail table (F4211) and the Sales Order Detail History table (F42119)

-

Updates on-hand inventory for bulk items in the Item Location table and writes a record to the Bulk Product Transaction table (F41511)

-

Updates on-hand inventory in the Item Location table if the quantity is not updated during shipment confirmation (F41021), the Item History table (F4115), and the Item Ledger table (F4111)

-

Updates invoice information, such as the dates of the first and last invoices, and year-to-date totals for invoices

-

Updates the General Ledger table (F0911), the Accounts Receivable table (F0311), and the Sales Ledger table (F42199)

-

Creates invoices and assigns invoice numbers to sales orders that you do not process through the Print Invoices program (P42565) or the Schedule Invoice Cycle program

-

Creates invoices and assigns invoice numbers to sales orders that you do not process through the Print Invoices program (P42565) or the Schedule Invoice Cycle program

-

Updates inventory balances in the Item Location table (F41021), the Item History table (F4115), and the Item Ledger table (F4111)

-

Updates commission information in the Commissions table (F42005), and summarizes cost of goods sold and sales by item in the Sales Summary table (F4229)

-

Updates costs with the current information in the Item Cost table (F4105) and prices in the Sales Price Adjustment table (F4074)

-

Updates interbranch sales information

-

Updates the Text table (F4314) with current messages

You can use the proof or final mode of this version when the sales order has been processed through Invoice Print and contains a document number and type in the Sales Order Detail file.

|

Note: Because of the number of transactions that occur when you run the Update Customer Sales program, JD Edwards World recommends that you run the program in proof mode first to detect and correct any errors before you run it in final mode. |

32.2.1 Before You Begin

-

It is recommended that you run the sales update when no one is on the system. When you run the program during non business hours, you can accurately update the history files.

-

Notify the system operator before you run the sales update or consider running the program during non business hours .

-

Verify that the appropriate line types are set up and that the processing options are set to correctly interface with the G/L and accounts receivable.

-

Verify that the status code for sales update and any status codes that follow are set up in the order activity rules.

32.2.2 What You Should Know About

| Topic | Description |

|---|---|

| Updating multi-currency sales orders | You can run the Update Customer Sales program for multi-currency sales orders. |

| Updating the on-hand quantity and the Cardex | You can relieve the on-hand quantity for an item during shipment confirmation or sales update. The method you choose affects the history files that are written to the Cardex.

If you subtract the on-hand quantity from inventory during shipment confirmation, the system creates a record in the Cardex with the sales order as the document number and the order type as the document type. During sales update, the system overwrites the record with the invoice number and type, G/L date and batch number. If you subtract the on-hand quantity from inventory during sales update, the system writes the invoice number, type, and G/L date to the Cardex. No record is written during shipment confirmation. For more information on the Cardex, see Locating On-Hand Quantity Information in the JD Edwards World Inventory Management Guide. |

| Running Sales Update in proof or final mode | When you run the sales update in proof mode, you can:

View the journal entries and correct any errors. Review proof copies of Invoice Journal, an Error Report and depending on the processing options, a Sales Journal. The system does not perform updates to status codes or any files. When you run the sales update in final mode, you can: Review the Invoice journal, a complete Error report, and depending on the processing options, a Sales Journal. The system updates status codes and files, performs edits, such as checking for duplicate records, against the G/L, A/R, and A/P functional servers. |

| Updating on-hand quantity during shipment confirmation | You can run the Update Customer Sales program for multi-currency sales orders. |

| Updating interbranch sales orders | The system can create entries for interbranch orders for both the supplying branch/plant and the selling branch/plant, and the subsequent sale to the customer. |

| Updating inventory for bulk items | During the load confirmation process, the system updates the quantity of on-hand inventory for bulk items in the Item Location table.

If you do not process a detail line through Load Confirmation, the Update Customer Sales program updates inventory for bulk items and writes a record to the Bulk Production Transaction table (F41511). If you process a sales order detail line through load confirmation, the system does not update inventory quantity during sales update. |

| Updating sales costs manually | In standard cost environments, it is important to run the Sales Cost Update program to update the sales order cost information with the item cost from the Item Cost table (F4105). Run this program daily to keep the Item Ledger table (F4111) synchronized with the General Ledger table (F0911). |

| Bypassing records during sales update | You can bypass updates to the following tables, depending on how you set a processing option:

Accounts Receivable (F0311) Item Location (F41021) Commissions (F42005) Sales History Summary (F4229) Sales Rebate History (F4079) Accounts Payable (F0411) |

32.2.3 Processing Options

See Section 66.9, "Processing Options for Update Customer Sales (P42800)".