49 Work with the Fixed Asset Write-Off Note

This chapter contains these topics:

-

Section 49.1, "Understanding the Fixed Asset Write-Off Note,"

-

Section 49.2, "Setting User Defined Codes for Fixed Asset Write-Off."

49.1 Understanding the Fixed Asset Write-Off Note

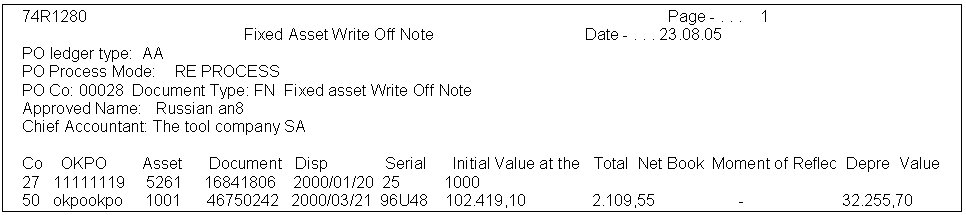

When a fixed asset disposal takes place, the Fixed Asset Write-Off Note must be printed. The Fixed Asset Write-Off Note contains references for the related approvals and shows the results of the disposal.

You have the option to print the Fixed Asset Write-Off Note in proof or final mode. Both modes produce the same document and a set of outfiles. You can print in proof mode as many times as needed, but when you print in final mode, the system updates F74R1201 by adding the Write-Off number and the Write-Off printing date. Once you print the Fixed Asset Write-Off Note in final mode, you should not print it again.

49.2 Setting User Defined Codes for Fixed Asset Write-Off

For the fixed asset program to run correctly, you must set up Used Defined Codes (UDC). The UDCs for Fixed Asset Write-Off are:

-

Document Type for Write-Off (00/DT)

-

Status or Disposal Code (12/ES)

To set up the UDCs for Document Type for Write-Off (00/DT) and Status or Disposal Code (12/ES), use menu G00.

49.2.1 Document Type for Write-Off (00/DT)

The Document Type UDC must have a value for fixed asset write-off note. For example you might set up this value:

| Field | Explanation |

|---|---|

| FN | Fixed Asset Write-off Note |

49.2.2 Status or Disposal Code (12/ES)

The Status or Disposal Code UDC must have a Disposal Code values for fixed asset write-off. For example you might set up this value:

| Field | Explanation |

|---|---|

| 1C | Disposed - Charity |

| 1D | Disposed - Destroyed |

| 1O | Disposed -Outright Sale |

| 1S | Disposed -Scrapped |

| 1T | Disposed -Sale w/ Trade In |

| 1X | Disposed -Theft |

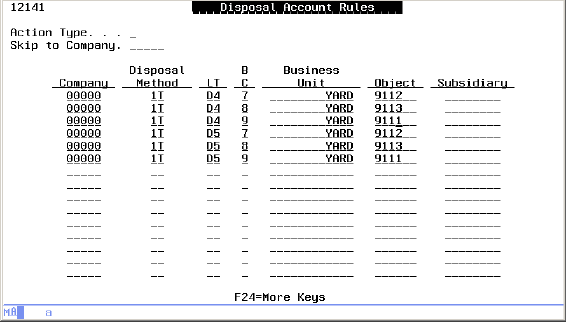

49.2.3 Setting Up Fixed Asset Disposal Account Rules

Users must set up the Fixed Asset Disposal Account Rules (P12141). Disposal Code UDCs must exist in 12/ES.

Figure 49-1 Disposal Account Rules screen

Description of "Figure 49-1 Disposal Account Rules screen"

To set up Disposal Account Rules

From Fixed Asset Setup (G1241), choose option 11 (Disposal Account Rules)

-

On Disposal Account Rules, type C (Change) in the Action Type field.

-

For each asset disposal rule needed for your company, complete the following:

-

Company - Enter the company number for the disposal rule.

-

Disposal Method - Enter the code for the disposal method. Codes must exist in UDC 12/ES.

-

LT (Ledger Type) - Enter the code for the disposal ledger type.

-

BC (Balance Character) - Enter the code for the balance character. Codes must exist in UDC 12/BC.

-

Business Unit - Enter the business unit number.

-

Object - Enter the object account portion of the G/L account.

-

Subsidiary - Enter the subsidiary account portion of the G/L account, if applicable.

-

-

Press Enter to accept the changes.

49.2.4 Printing the Fixed Asset Write-Off Note (P74R1280)

When a fixed asset disposal takes place, the Fixed Asset Write Off Note (also known as the Fixed Asset Disposal Note), OC-4, must be printed. It contains information about the fixed asset being disposed of, related approvals, and the results of the disposal.

Once the Fixed Asset Write Off Note is printed, it should not be printed again.

Run the Fixed Asset Write-Off Note program from the localized Fixed Asset menu (G74R12).

To generate the Write-Off Note

From Fixed Asset (G74R12), choose option 6 (Fixed Asset Write-Off Note)

-

Select the program version to run.

-

Complete the Processing Options and press Enter.

-

Enter the Data Selection criteria and press Enter.

The following table shows default Data Selection criteria.

| IN | Explanation | Relation | Value |

|---|---|---|---|

| Y | Date disposed or retired | NE | *ZEROS |

The program generates the output files F74R1280 (header/footer) and F74R1282 (detail). The user will need to transfer the output files to the PC and use another tool to print the form. The output file contains the detail of the fixed asset disposal generated in the database files.

|

Note: Each time the program is run, the outfiles are overwritten with the new report data. |

In addition, the system updates the tag file, F74R1201, with the write-off document number and the date the write-off note was printed to avoid printing it again unless a reprinting is required. Example: