Sectional Center Facility (SCF) codes represent the first 3 digits of the destination postal (zip) code. The Work with SCF function allows you to enter information specific to the SCF, including the valid states, the preferred method of shipping to this area, and a warehouse list which defines a hierarchy for reserving merchandise in warehouses.

Shipping address validation: The system uses the SCF table to validate that the customer’s postal code and state are consistent. For example, if you set up an SCF of 011 for the state of MA, but no other states, the system prevents you from entering a customer address with a postal code that starts with 011, but a state of CT. This validation occurs in order entry, customer maintenance, and other functions where you enter name and address information. However, there are a few functions where this validation does not occur, including Working with Customer Fraud Tables (WCFD), Working with Vendors (WVEN) (except for working with vendor FOB), and Setting Up Companies (WCMP).

Note: SCF validation occurs only if the customer’s address include a postal code and state. These fields are optional if the Require postal code? or Require state? flags for the country are unselected.

Tax information: An important function of the SCF Tax Rate table, accessible through the Work with SCF function, is to define the tax rate that applies to orders shipped to this SCF. For Canadian SCFs, you can define GST and/or PST rates, and a calculation method.

You can also define tax information at the postal code level. See Setting Up the Zip/City/State (Postal Code) Table (WZIP) for more information and flow charts depicting the tax hierarchy.

The steps in which the system determines a customer's tax rate vary, depending on the setting of the Tax Included in Price (E70) system control value:

• unselected = The system first checks the VAT % defined for the country where the order is being shipped. If there is no rate defined for the country, the system checks the rate for the postal code. If there is no postal code tax information, the system checks the SCF Tax Rate table.

• selected = If the state is exempt from VAT, the system checks the postal code rate first. If there is no tax information for the postal code, the system checks the SCF Tax Rate table. If the order is subject to VAT, tax-inclusive prices are used on the order and a hidden tax is included in the order line detail.

You can also define tax exemptions or exceptions for certain items in particular states in the United States, or in Canadian provinces. See Working with Item Tax Exemptions (WITX) and Working with GST Tax Exemption Status (MGTX). Additionally, a customer can be tax- or VAT-exempt; see Working with Customer Tax Status. Also, you can exempt special handling from tax by setting the S/H exclude tax? field for the additional charge code; see Establishing Additional Charge Codes (WADC).

Geographic zone information: The SCF table can be used to identify the geographic zone of a shipping address. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. See Shipping Zone Reservation Overview.

The SCF information you enter through this menu option is unique to a particular company, unlike the information in the Zip/City/State table. Information entered through Setting Up the Zip/City/State (Postal Code) Table (WZIP) applies to all companies on your system; information entered through Work with SCF Codes applies only to the company for which it is set up.

If the postal code is optional for a country: If the Require postal code? flag for a country is unselected, it is not necessary to specify a postal or zip code for a customer address; however, if the country has the Perform ship via edit? flag selected, the system still needs to validate the SCF/ship via combination for an order. See If the Postal Code is Optional for a Country for a discussion, and see Setting Up the Country Table (WCTY) for more information about the address validation settings available for countries.

In this chapter:

• Work with SCF Tax Rates Screen (Change Mode)

How to display this screen: Enter WSCF in the Fast path field at the top of any menu or select Work with SCF Codes from a menu.

Field |

Description |

Country |

A code for the country associated with this SCF. Country codes are defined in and validated against the Country table; see Setting Up the Country Table (WCTY). Alphanumeric, 3 positions; optional. |

SCF (Sectional Center Facility) |

A code that represents the first 3 digits of a postal code. Alphanumeric, 3 positions; optional. |

State # 1 |

The primary state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

State # 2 |

The second state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

State # 3 |

The third state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

State # 4 |

The fourth state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

State # 5 |

The fifth state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

Warehouse list |

The warehouse list to use for orders to this SCF. If the Ship Complete from 1 Warehouse (B16) system control value is selected, the system searches warehouses in the sequence specified in the list for inventory to fulfill an order. You can set up warehouse lists to make fulfillment more efficient and save on shipping costs. See Working with Warehouse Lists (WWHL) for an explanation of warehouse list logic. Numeric, 2 positions; optional. |

Ship via |

The preferred ship via for this SCF. The system changes the ship via on the order header to this ship via unless another override takes precedence; however, the Allow auto assignment flag for the ship via controls whether this automatic assignment takes place. See Ship Via Override Hierarchy for a list of ways the system can override the shipper specified on the order with another shipper and the hierarchy in which the ship via overrides take precedence. Numeric, 2 positions; optional. |

Geographic zone |

A code representing a region of the country. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. Geographic zones are used in conjunction with zone reservation codes, assigned to items or SKUs, to control item reservation in order entry. Zone reservation coded items/SKUs are not reserved during order entry; instead they are reserved during pick generation, at an optimal time for shipping. |

|

Zone reservation logic requires: • The item/SKU must be assigned a zone reservation code • The offer associated with the order must be assigned a season code • The shipping address for the order must be assigned to a geographic zone, using either the postal zip code of the ship to address, or the SCF code of the ship to address. • For each zone reservation code, you must define zone date windows for all geographic zones in the country See Shipping Zone Reservation Overview. Alphanumeric, 3 positions; optional. |

Store tax code |

The cross-reference to the corresponding tax code in a point-of-sale system. This field is available only if the Default Location for ORCE Download (K69) system control value is populated. Alphanumeric, 8 positions; optional. |

.

Screen Option |

Procedure |

Create a new SCF code |

Select Create to advance to the Create SCF Screen. |

Change an SCF code |

Select Change for an SCF code to advance to the Change SCF screen. At the Change screen you can change any information except the SCF code. See Create SCF Screen for field descriptions. |

Delete an SCF code |

Select Delete for an SCF code to delete it. |

Display an SCF code |

Select Display for an SCF code to advance to the Display SCF screen. You cannot change any information on this screen. See Create SCF Screen for field descriptions. |

Work with tax rates |

Select Work with tax rates for an SCF to advance to the Work with SCF Tax Rates Screen (Change Mode). |

Purpose: Use this screen to create an SCF code.

How to display this screen: At the Work with SCF Codes Screen, select Create.

Field |

Description |

Country code |

A code for the country associated with this SCF code. Country codes are defined in and validated against the Country table; see Setting Up the Country Table (WCTY). Alphanumeric, 3 positions; required. |

SCF |

The first 3 digits of the destination postal code. Alphanumeric, 3 positions. Create screen: required. Change screen: display-only. |

Valid state 1 |

The primary state or province associated with this SCF. If you are defining an SCF for a country that does not require state or province codes, you can enter ** in this field. Alphanumeric, 2 positions; required. |

Valid state 2 |

The second state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

Valid state 3 |

The third state or province associated with this SCF. Note: The system does not validate that your entries for the first and second states are different from the third, fourth and fifth states. Alphanumeric, 2 positions; optional. |

Valid state 4 |

The fourth state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

Valid state 5 |

The fifth state or province associated with this SCF. Alphanumeric, 2 positions; optional. |

A code that represents a carrier for an order, such as UPS or USPS. This Ship Via defaults in Order Entry if the ship-to address on the order is for this SCF and a default ship via has not been defined on the Default Values for Orders screen. This default may be overridden by another ship via override; however, the preferred ship via for the SCF does not override the current ship via on the order if the current ship via’s Allow auto assignment field is unselected. See Ship Via Override Hierarchy for a list of ways the system can override the shipper specified on the order with another shipper and the hierarchy in which the ship via overrides take precedence. Ship via codes are defined in and validated against the Ship Via table; see Working with Ship Via Codes (WVIA). Numeric, 2 positions; optional. |

|

Warehouse list |

A code that represents a warehouse list used to specify the sequence in which reservation warehouses should be searched for inventory, based on the SCF where the order will be shipped. The system refers to the warehouse list during Batch and Immediate Reservation and when evaluating backorders if the Ship Complete from 1 Warehouse (B16) system control value is selected. If this system control value is unselected, the system first reserves stock from the primary warehouse in the item table, and, if there is not enough available stock in the item’s primary warehouse, reserves stock from the warehouses on the list. See Working with Warehouse Lists (WWHL) for an explanation of the logic the system uses in assigning warehouses from warehouse lists, and for information on defining warehouse lists. Alphanumeric, 2 positions; optional. |

Geographic zone |

A code representing a region of the country. Geographic zones are used to divide the country into shipping regions for the purpose of restricting the shipment of weather-sensitive inventory such as plant stock. Geographic zones are used in conjunction with zone reservation codes, assigned to items or SKUs, to control item reservation in order entry. Zone reservation coded items/SKUs are not reserved during order entry; instead they are reserved during pick generation, at an optimal time for shipping. |

|

Zone reservation logic requires: • The item/SKU must be assigned a zone reservation code • The offer associated with the order must be assigned a season code • The shipping address for the order must be assigned to a geographic zone, using either the postal ZIP code of the ship to address, or the SCF code of the ship to address. • For each zone reservation code, you must define zone date windows for all geographic zones in the country See Shipping Zone Reservation Overview. Alphanumeric, 3 positions; optional. |

Store tax code |

The cross-reference to the corresponding tax code in a point-of-sale system. This field is available only if the Default Location for ORCE Download (K69) system control value is populated. Alphanumeric, 8 positions; optional. |

Work with SCF Tax Rates Screen (Change Mode)

Purpose: Use this screen to review or work with tax rate information for an SCF. This screen includes historical information regarding when tax rules became effective for the SCF; however, only the most current SCF tax rate record, which displays at the top of the list, is currently in effect.

Note: The system does not consider the settings at this screen if you use the Oracle Retail Order Management System/Vertex Interface unless the Use Standard Tax Calc if Tax Interface Communication Fails (J13) system control value is selected and the integration with Vertex fails.

How to display this screen: Select Work with tax rates for an SCF at the Work with SCF Codes Screen

Field |

Description |

Effect date (Effective date) |

The date that this tax rate became effective. Numeric, 6 positions (MMDDYY format); display-only. |

Tax rate % |

The default tax rate for this SCF. You can also define a tax rate for a postal code or for a country; for a description of the way that the system determines the tax rate that applies to an order see Working with SCF Codes (WSCF). If you are using Vertex to calculate tax, you would enter a tax rate of 100%. Numeric, 5 positions with a 2-place decimal; optional. |

GST rate % |

The default Canadian Goods and Services Tax (GST) rate for this SCF. You can also define a GST rate at the postal code level; the way that the system determines the tax rate that applies to an order is described earlier in this topic. If you are using Vertex to calculate tax, you would enter a tax rate of 100%. If this field is blank but the SCF tax rates would normally apply to the order, the system uses the default GST Rate (A90) in the System Control table. Numeric, 5 positions with a 2-place decimal; optional. |

PST rate % |

The default Canadian Provincial Services Tax (PST) rate for this SCF. You can also define a PST rate at the postal code level; the way that the system determines the tax rate that applies to an order is described earlier in this topic. If you are using Vertex to calculate tax, you would enter a tax rate of 100%. Numeric, 5 positions with a 2-place decimal; optional. |

GST/PST method |

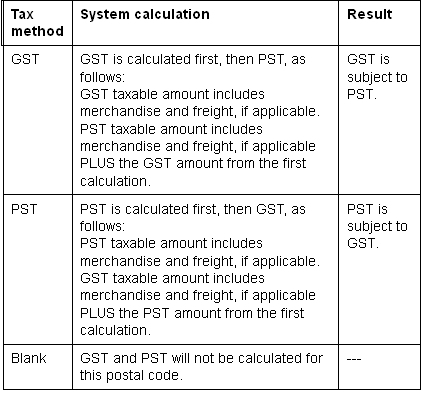

Determines the sequence in which the Canadian Goods and Services Tax (GST) and the Provincial Services Tax (PST) are calculated. If you do not define a calculation method, the system does not charge either GST or PST on orders to this SCF even if you have defined GST or PST rates. Valid GST/PST tax calculation methods: • blank = none • GST • PST Optional. |

|

|

Tax freight |

Indicates whether there is a tax on freight in this SCF. This is controlled by state or province regulations in each jurisdiction. Valid values: Yes = Any dollar amount in the Freight and Freight + fields on the order is taxed. No = Any dollar amount in the Freight and Freight + fields on the order is not taxed. Note: Acts as an override to the Tax on Freight (B14) field in the System Control table if the system control value is selected. If the order uses the tax rate for the postal code, but the Tax freight field is unselected, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. |

Tax handling |

The value indicates whether there is a tax on handling in this SCF. This is controlled by state or province regulations in each jurisdiction. Valid values: Yes = Any dollar amount in the Handling field on the order, with the exception of duty, is taxed. No = Any dollar amount in the Handling field on the order is not taxed. Note: • Acts as an override to the Tax on Handling (B15) field in the System Control table if the system control value is selected. If the order uses the tax rate for the SCF, but the Tax handling field is blank, the system uses the value from the System Control table. If the system control value is unselected, you cannot override this value by selecting it here. • If the S/H exclude tax? field for the special handling code is selected, the handling charge is not evaluated for tax. • You can override this setting by a setting at the zip code level; see Setting Up the Zip/City/State (Postal Code) Table (WZIP). |

Screen Option |

Procedure |

Change existing tax rate information |

Use the Tab key to advance to the tax information you want to change and type over it. Select Update when you are done. |

Add new tax rate detail |

Select Add to advance to the Work with SCF Tax Rates screen in Add mode. Use this screen to add a new SCF tax record. See above for field descriptions. |

Delete a tax rate record |

Select Delete for the tax rate record you want to delete. The system deletes the record immediately without displaying a confirmation message. |

| Working with Ship Via Codes (WVIA) | Contents | SCVs | Search | Glossary | Reports | Solutions | XML | Index | Working with SCF/Ship Via Values (WSHV) |

WSCF OROMS 15.1 June 2016 OTN