Transaction Codes

Prerequisites

Prerequisites

PARAMETERS

PARAMETERS

CASHIERING

Transaction Code by User Role

Ability to manage the available transaction codes for posting by Property Roles

ROLES / TASK PERMISSIONS

Financial Admin >

Financial Transactions

Financial Transactions

Transaction Codes

Transaction Codes

New/Edit Transaction Codes

New/Edit Transaction Codes

The Transaction Codes jump on the Transaction Configuration Workspace allows you to configure and edit Transaction Codes. Every charge that appears on a folio or an AR invoice must have a transaction code.

|

|

|

|

|

|

|

Currently there are no videos for this topic.

|

|

|

|

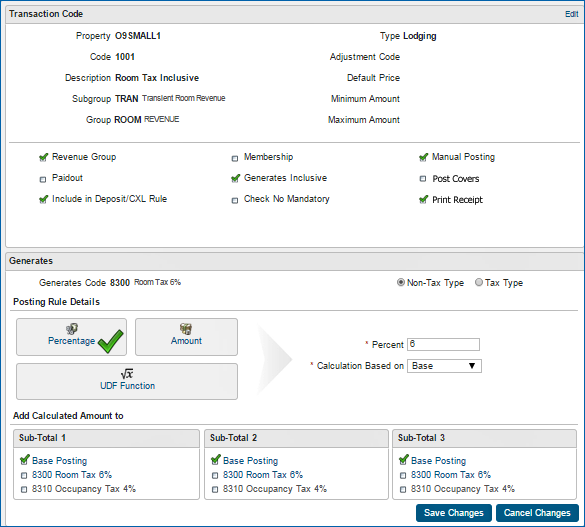

Creating a New Transaction Code

Each Transaction Code is identified by a number. Consider numbering your transaction codes in a logical order to keep the auditing task simple. For example, all room related charges could be in the 1000 group, food and beverage related charges in the 2000 group, etc.

Creating Transaction Codes

- On the Transaction Codes jump, select New to begin.

- Enter the property name, create a numeric code, and create a description to represent your new Transaction Code.

- Select a Subgroup.

- Complete the remaining fields and checkboxes as needed (view Transaction Code Field Explanations below).

Transaction Code Field Explanations

Transaction Code Field Explanations

Property

Where the Transaction Code may be used.

Code

A number to represent the new Transaction Code. You can use any number.

Description

A text description of the Transaction Code for identifying charges on folios.

Subgroup

A way of grouping transaction codes for reporting purposes. Selecting a subgroup automatically populates the Group field. Transaction Codes that belong to the same subgroup are grouped together for the same date on the Billing screen and Folio Styles.

Type

Transaction types are used to cluster similar transaction codes. Examples are: Lodging, Food and Beverage, Telephone, Minibar, Tax, Non-Revenue, Others, or blank.

Adjustment Code

The transaction code to use when posting an adjustment to the current transaction code. Adjustment transaction codes let you store and track updates to transactions (and linked transactions). For example, you can use them to track customer reimbursements, credit adjustments, corrections (including same day corrections), and rebates.

Service Recovery Code

The transaction code to use when posting a Service Recovery Adjustment to the current transaction code. Select a Service Recovery Code from the list of eligible Service Recovery Transaction Codes provided.

Default Price

The cost associated with the new Transaction Code and to be posted under the new Transaction Code.

Minimum Amount

Minimum amount allowed under the new Transaction Code

Maximum Amount

Maximum amount allowed over the new Transaction Code.

Checkboxes

Revenue Group - assigns the adjustment to the Revenue Group defined for adjustments.

Revenue Group - assigns the adjustment to the Revenue Group defined for adjustments.

Paidout - identifies the Transaction Code as a paidout.

Paidout - identifies the Transaction Code as a paidout.

Include in Deposit/CXL Rule - applies the adjustment to deposit/cancellation rules that are defined for the reservation.

Include in Deposit/CXL Rule - applies the adjustment to deposit/cancellation rules that are defined for the reservation.

Membership - includes membership points.

Membership - includes membership points.

Generates Inclusive - generates additional amounts (such as taxes) associated with the adjustment on the receipt or report.

Generates Inclusive - generates additional amounts (such as taxes) associated with the adjustment on the receipt or report.

Check No Mandatory - forces entry of the check number if the guest pays by check.

Check No Mandatory - forces entry of the check number if the guest pays by check.

Manual Posting - enables manual posting of the adjustment.

Manual Posting - enables manual posting of the adjustment.

Print Receipt - prints a receipt of the Service Recovery adjustment for signature.

Print Receipt - prints a receipt of the Service Recovery adjustment for signature.

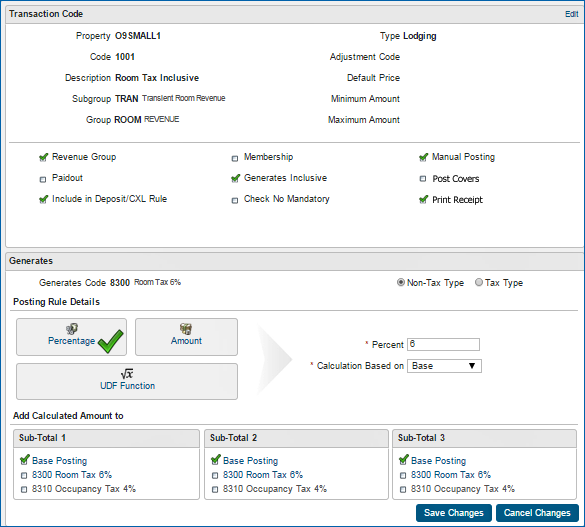

Creating Transaction Code Generates

The Generates feature automatically calculates additional charges such as taxes that are added to a guest's bill when a particular transaction code is selected for a posting. For example, a room charge might always generate a room tax charge. Generates posting rules can be set up as:

- a percentage of the room charge,

- a specified flat amount that is posted each time the room charge is posted,

- a user-defined formula; or

- a "tax type" that is controlled by several variables that determine if and how the generate is applied.

To create transaction code Generates:

- Enter or select (from a list of transaction codes) a Generates Code.

- Select either Non-Tax Type or Tax Type. If Tax Type is selected, the screen displays available tax type rules with the opportunity to modify them.

- Select and complete Posting Rule Details.

Determining Posting Rule Details

Determining Posting Rule Details

Complete the Posting Rule Details section by selecting the following:

Generate as a Percentage.

If selecting Percentage, enter the percentage amount. You must also specify the "Calculation Based on" value, which is the value against which the percentage should be applied. Usually the percentage is applied to the base amount of the posting ("Base"). However, you may also select the value stored in Sub-Total 1, Sub-Total 2, or Sub-Total 3 if you are applying tax on tax.

Generate as a Amount.

If selecting Amount, enter the local currency amount. This amount posts every time a posting is made against the main transaction code.

Generate as a UDF Function (User Defined Function).

If selecting UDF Function, enter a function statement to calculate the Generate. For example, if the generate should only post based on the room type on the reservation, you can enter a formula to indicate the validations. Amounts derived from a UDF are in local currency.

Determining Add Calculated Amount To

Determining Add Calculated Amount To

The Add Calculated Amount lets you store Posting Rule calculations in Sub-Total "buckets."

You can add as many generates to a transaction code, transaction group, or transaction subgroup as necessary. Furthermore, you can use the result of one generate calculation as a factor when calculating subsequent generates. For example, for calculating an occupancy tax that is based on the total that results from the posted charge plus a city tax. In this situation, the total posted amount resulting from the addition of the city tax can be stored in a "bucket" as a subtotal for calculation of the occupancy tax.

Select one or more of the "buckets" (Sub-Total 1, Sub-Total 2, Sub-Total 3) to store the results of a calculation for use by a subsequent generate calculation.

- You can view the calculations stored within each Sub-Total.

- The value of a specific Sub-Total bucket is cumulative if later generate calculations also store their results in the same Subtotal bucket.

- If you plan to use Sub-Totals in this way, the order in which you create generates is important in order to ensure Sub-Totals from one generate calculation are available for the next calculation.

Copyright © 2015, Oracle and/or its affiliates. All rights reserved.

Legal NoticesVersion 9.0.1.20

Transaction Code Field Explanations

Transaction Code Field Explanations

Determining Posting Rule Details

Determining Posting Rule Details Determining Add Calculated Amount To

Determining Add Calculated Amount To