, select Model Validation.

, select Model Validation.This module enables you to ensure that your models meet prescribed standards. OFS Market Risk Model Validation Module enables you to validate the historical VaR model. You can use Profit and Loss (P&L) attribution and back-testing to decide whether your trading desks are eligible to follow IMA capital requirements. The module provides computation Actual and Profit and Loss (P&L) attribution.

Topics:

· Navigate to the Model Validation Summary Window

· Search for a Business Definition

· Create and Execute a Business Definition

· Export a Business Definition

· Approve or Reject a Business Definition

· Delete a Business Definition

From the MRMM Home page, select Market Risk Measurement and Management, click Navigation Menu  , select Model Validation.

, select Model Validation.

Figure 47: Model Validation Summary Window

In the Search field, type the first few letters of the business definition name that you want to search. The summaries whose names consist of your search string are displayed in a tabular format.

Figure 48: Model Validation Summary Window - Search Box

From the breadcrumb on top, click the Model Validation Summary link to return to the summary window after viewing details of the business definition.

See the Page View Options section for details.

To define a new Model Validation - business definition, follow these steps:

1. In the Model Validation Summary window, click Add  . The definition window is displayed.

. The definition window is displayed.

Figure 49: Model Validation Definition Window

2. Populate the details mentioned in the following table. Fields marked in red asterisk (*) are mandatory.

Fields |

Description |

|---|---|

Name* |

Enter the name of the business definition. |

Description |

Provide a description of the business definition. |

Version |

Displays the workflow version of the business definition. |

Access Type |

Specify the access type |

Folder |

Select the folder. |

Portfolio |

Select the Portfolio from the drop-down list. |

Reporting Currency* |

The currency in which all the output for a given definition will be computed. Select the currency code from the drop-down list. |

Hypothetical* |

Select the business definition created in the module Market Risk - Historical Simulation, to be considered for Hypothetical from the drop-down list. Actual and Hypothetical P&L are computed using business definitions selected for Hypothetical. Actual P&L is the difference in portfolio value as of time t and time t-1, where t is any specified historical date. Additionally, Actual P&L incorporates the change in instrument data for calculating P&L. Actual P&L is available as a download in this release. Populate data into the stage table STG_MR_PORTFLO_ACT_PNL_VALUE. Hypothetical P&L for time t is the difference in portfolio value computed with market data as of time t and instrument data as of time t, and, portfolio value computed with market data as off time t+1 and Instrument data as of time t. Hypothetical P&L is available as a download in this release. Follow the below process to upload portfolio values to be considered for model validation: Populate data into the Fact table FCT_MR_PORTFOLIO_VALUE. NOTE: During execution, in the Date editor if you select the option Load Data from Stage Tables, then input is taken from these two tables. See the OFS MRMM Download specification document available in OHC Documentation Library for the column details in the FCT_MR_PORTFOLIO_VALUE table. |

Risk Theoretical* |

Select the definition to be considered for Risk Theoretical from the drop-down list. Populate data into the Fact table FCT_MR_PORTFOLIO_VALUE table. NOTE: During execution, in the Date editor if you select the option Load Data from Stage Tables, then input is taken from these two tables. This is the P&L calculated by the risk factors generated from the pricing models of the trading desk. Risk Theoretical P&L is available as a download in this release. |

Confidence Interval |

Confidence is the percentage value that you need to define the VaR numbers. Specify the confidence value required for calculating the output. |

Validation Period |

Specify the period of validation. |

Validation Unit |

Specify the validation unit from the drop-down list, whether Day, Month, or Year. |

3. Click Generate Grid. A table is generated with the field columns mentioned in the following table.

Figure 50: Backtesting Exception Probability and Multiplier

Fields |

Description |

|---|---|

Exception |

Displays the exceptions. This is the auto-populated number of exceptions starting with 0 and will keep on increasing |

Occurrence Probability |

Displays the exact probability of obtaining the corresponding number of exceptions. |

Type 1 Probability |

Probability of rejecting model (Type 1): This is a system computed column. Type 1 is the probability that using a given number of exceptions as the cut-off for rejecting a model will imply the rejection of an accurate model. Column is reverse-cumulative of Probability of occurrence (Column 2) starting with 100%. |

Type 2 Probability |

Probability of accepting model (Type 2): This is a system computed column. Type 2 is the probability that using a given number of exceptions as the cut-off for rejecting a model will imply acceptance of an inaccurate model Column is cumulative of Probability of occurrence (Column 2) starting from 0%. |

Multiplier |

Displays the multiplier value/multiplication factor for the capital which is sufficient to return the model to a 99th percentile standard. |

4. In the Backtesting Zone Classification pane, follow these steps:

a. Click Add

Figure 51: Backtesting Zone Classification

b. Specify details for the fields Zone, Color, Backtesting Start percentage, and Backtesting End percentage, as explained in the following table.

c. Click Delete  to remove an entry.

to remove an entry.

Fields |

Description |

|---|---|

Zone |

Specify the probability range for the three zones. NOTE: You must add one Zone with the range covering the number of days selected as specified in Validation Period and Validation Unit. |

Color |

Select the color you want to assign to the zone, from the drop-down list. |

Backtesting Start (%) |

Specify the value in percentage. |

Backtesting End (%) |

Specify the value in percentage. |

5. In the Profit Loss Attribution Test Zone Classification pane, follow these steps:

a. Click Add  .

.

Figure 52: Profit Loss Attribution Test Zone Classification

b. Specify details for the fields Zone, Color, Spearman Start, Spearmen End, KS Start, and KS End as explained in the following table.

c. Click Delete  to remove an entry.

to remove an entry.

Fields |

Description |

|---|---|

Include Default Zone |

This zone represents the catch-all scenario for one or both metrics. If the values do not fall under previously assigned zones, then they fall into this Default zone. You cannot add any values to the start and end limits for both KS Test and Spearman Test. |

Name |

This field is editable only if the Default Zone checkbox is checked. Assign a name to the default zone. |

Color |

This field is updated only if the Default Zone checkbox is checked. The color for the default zone is dark Amber. |

Zone |

Specify the probability range for the three zones. |

Color |

Specify the colors for the zones. |

Spearman Start |

Specify the value for Spearman Start. |

Spearman End |

Specify the value for Spearman End. |

KS Start |

Specify the value for KS Start. |

KS End |

Specify the value for KS End. |

NOTE:

The combination of Spearman’s start and end and KS start, and end should not overlap with previous or next zone.

6. Click Submit  to save and submit the definition for approval. A confirmation dialog box is displayed.

to save and submit the definition for approval. A confirmation dialog box is displayed.

Or,

Click Save  to update the definition before submitting it for approval.

to update the definition before submitting it for approval.

7. If you want to execute the business definition, follow the steps in the Execute a Business Definition section.

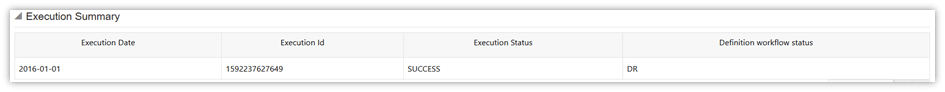

8. Execution Summary displays the execution history of the business scenarios. Select the execution to be marked as EOD execution. You can view details of the execution, such as Execution Date, Execution ID, Execution Status, and Definition Workflow Status in the Execution Summary table.

9. The definition can be viewed in the summary window. They are further used for in the analytics to generate reports.

To execute a business definition, follow these steps:

1. Click the business definition name in the Summary page. The definition window is displayed.

2. Click Edit  .

.

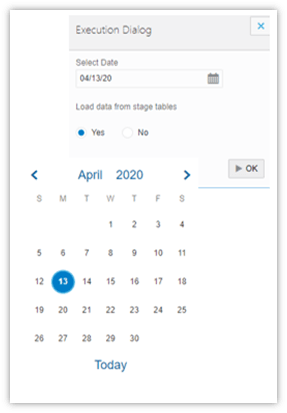

3. Click Execute  to trigger an Adhoc run. A pop-up message with a date-time editor is displayed.

to trigger an Adhoc run. A pop-up message with a date-time editor is displayed.

4. Specify the date on which the execution must be performed.

5. If you want to load trade and market data from stage tables, select Yes in the field Load Data From Stage Tables, else select No. Click OK  . The execution is triggered.

. The execution is triggered.

Figure 53: Model Validation Execution - Date-Time Editor

6. Click OK. A confirmation dialog box is displayed.

7. Click OK to confirm.

8. Execution Summary displays the execution history of the business scenarios. Select the execution to be marked as EOD execution. You can view details of the execution, such as Execution Date, Execution ID, Execution Status, and Definition Workflow Status in the Execution Summary table.

Figure 54: Model Validation Execution Summary

See the Edit a Business Definition section for details.

See the Export a Business Definition section for details.

See the Approve or Reject a Business Definition section for details.

See the Delete a Business Definition section for details.