Make Payment (Transfer Money)

Transfer Money enables the user to initiate payment from his bank account to any other bank account without visiting the bank, through digital banking. Payments are categorized on the basis of the transfer being made to an account within the bank, outside the bank and beyond geographical boundaries. When transfer is to an account within the bank it is an internal transfer. Transfer to an account outside the bank but within the country is called a Domestic transfer. A transfer to an account outside the country is called an International payment. This categorization takes place when a customer saves the payee bank account details during payee maintenance.

User can initiate a money transfer when the payees to whom transfers are required to be made are registered in the system.

Application provides a solution to the users through Transfer Money to cater their requirement of different types of payments. User is provided a single screen of Transfer money for their Own, Internal, Domestic or International payments.

Prerequisites:

- Transaction and account access is provided to corporate user

- Approval rule set up for corporate user to perform the actions

- Transaction working window is maintained

- Payees are maintained

- Purposes of Payments are maintained which are mandatory for Internal and Domestic Payment

- Transaction limits are assigned to user to perform the transaction

Features supported in application

Transfer money allows the user to make payments

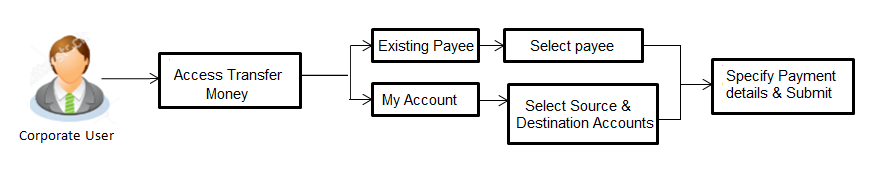

Workflow

![]() How to reach here:

How to reach here:

Dashboard > Toggle menu > Payments > Payments and Transfers > Transfer Money > Make Payment

OR

Dashboard > Quick Links > Fund Transfer

OR

Dashboard > Quick Links > Own Account Transfer

Make Payment - Existing Payee

Application provides an option to the user to initiate a payment to an existing payee. All account payees created by the logged in user and shared by other use rs of the Party![]() A party is any individual or business entity having a banking relationship with the bank., are listed for selection. Details of selected payee are auto populated on transaction screen. User needs to fill in payment details to initiate the transaction. User can also view the transaction limits associated with a current transaction.

A party is any individual or business entity having a banking relationship with the bank., are listed for selection. Details of selected payee are auto populated on transaction screen. User needs to fill in payment details to initiate the transaction. User can also view the transaction limits associated with a current transaction.

E-Receipt gets generated on successful completion of transaction in the Core Banking Application. E-Receipt also can be accessed from Activity Log detailed view.

![]() How to reach here:

How to reach here:

Dashboard > Toggle Menu > Payments > Payments and Transfers > Transfer Money > Make Payment

OR

Dashboard > Quick Links > Fund Transfer > Make Payment

To transfer the money to existing payee:

- In the Transfer Type field, select the Existing Payee option.

|

Field Name |

Description |

|---|---|

|

Transfer Type |

Payee to which transfer needs to be done. The options are:

|

|

Existing Payee Below fields appears if you select Existing Payee option in the Transfer Type field. |

|

|

Payee |

Payee to whom fund transfer needs to be done and the nickname to identify the account for fund transfer. |

|

Account Number |

The account associated with the payee along with the account nickname. |

|

Account Type |

Type of account associated with the payee. |

|

Account Name |

Name of the payee in the bank account. |

|

Payee Address |

Address of the payee in the bank account. This field appears for International type of payee. |

|

Bank Details |

Details of the payee 's bank account. Note: Bank Details will not be displayed for Internal type of Payee. |

|

Transfer From |

Source account with account nickname from which funds are to be transferred. For more information on Account Nickname, click here. |

|

Balance |

Net balance in the selected account. |

|

Amount |

Amount to be transferred along with the currency. Note: The currency for Amount gets defaulted as per payee in case of Internal/ Domestic payee. Whereas it allows to select different currencies in case of International Payee only. |

|

View Limits |

Link to view the transaction limits for the user. |

|

Transfer When |

Specify when to transfer funds. The options are:

|

|

Transfer Date |

Date of transfer. This field appears if you select the Later option from the Transfer When list. |

|

Purpose |

Purpose of transfer. If purpose of transfer is selected as ‘Other, an additional field is shown to the customer to enter the purpose. Note: This field is displayed only for Internal/ Domestic Payment. |

|

Correspondence Charges |

The party bearing the charges for transaction. The options are:

Note: This field appears only for International Payee. |

|

Transfer via Intermediary Bank |

Specify whether the fund transfer is to be done through intermediary bank. Note: This field appears only for International Payee. |

|

Pay Via |

The options are:

This field appears if you select Yes option from Transfer via Intermediary Bank field. |

|

SWIFT / National clearing code value |

SWIFT code /National Clearing code value. |

|

SWIFT code Look up Below fields appears if the SWIFT Code option is selected in Pay Via field. |

|

|

Lookup Swift Code |

Link to search the SWIFT code. |

|

SWIFT Code |

SWIFT code value. |

|

Bank Name |

Bank name to search the SWIFT code. |

|

Country |

Country name to search the SWIFT code. |

|

City |

City name to search the SWIFT code. |

|

SWIFT Code Lookup - Search Result |

|

|

Bank Name |

Name of the bank. |

|

Address |

Displays complete address of the bank. |

|

SWIFT Code |

SWIFT code /National Clearing code value. |

|

National clearing code Look up Below fields appears if the National clearing code option is selected in Pay Via field. |

|

|

Lookup National clearing code |

Link to search the National clearing code. |

|

NCC Type |

NCC type of the bank branch. |

|

NCC Code |

NCC code of the bank branch. |

|

Bank Name |

Name of the bank. |

|

City |

City to which the bank belongs. |

|

NCC Lookup - Search Result |

|

|

Bank Name |

Name of the bank. |

|

Branch |

Bank branch name. |

|

Address |

Address of the bank. |

|

NCC Code |

NCC code of the bank branch. |

|

Below fields appears if the Bank Details option is selected in Pay Via field. |

|

|

Bank Name |

Name of the bank. |

|

Bank address |

Complete address of the bank. |

|

Country |

Country of the bank. |

|

City |

City to which the bank belongs. |

|

Payment Details |

The details of the transfer. Note: This field is displayed only for International Payee. |

|

Add Payment Details |

The link to add more details of the transfer. Note: This field is displayed only for International Payee. |

|

Note |

Narrative for the transaction. |

- From the Payee list, select the appropriate payee. The account maintained under payee to transfer funds appears.

- From the Transfer From account list; select the account from which transfer needs to be done.

- From the Currency list, select the appropriate currency for the amount to be transferred. (Applicable for international payees only. For domestic and internal payees, currency gets defaulted.)

- In the Amount field, enter the transfer amount.

OR

Click the View Limits link to check the transfer limit. - In the Transfer When field, select the appropriate transfer date.

- If you select the Now option, transfer will be done on same day.

OR

If you select Later option in the Transfer When field, select the appropriate future date for transfer. - From the Correspondence Charges list, select the appropriate option.(Applicable for international payees only.)

- In the Transfer via Intermediary Bank field, select the appropriate option.(Applicable for international payees only.)

- If you have selected Yes option in the Transfer via Intermediary Bank field, select the appropriate network for payment in the Pay Via field.

-

- If you select Swift option:

- In the SWIFT code field, enter the SWIFT code or search and select it from the lookup.

- Click to fetch bank details based on Bank Code (BIC).

- If you select National Clearing code option:

- In the National Clearing code field, enter the National Clearing code or search and select it from the lookup.

- Click to fetch bank details based on Bank Code (BIC).

- If you select Bank details option:

- In the Bank Name field, enter the bank name.

- In the Bank Address field, enter the complete address of the bank.

- From the Country list, select the country of the bank.

- From the City list, select the city to which the bank belongs.

- From the Payment Details list, select the appropriate purpose of transfer.(Applicable for international payees only. )

- Click to initiate payment.

OR

Click to cancel the operation and navigate back to ‘Dashboard’. - The Make Payment - Review screen appears. Verify the details, and click .

OR

Click to navigate back to the previous screen.

OR

Click to navigate to Dashboard Screen. - The success message appears along with the reference number, host reference number, status, UETR number(Unique End-to-End Transaction Reference), Transfer To, Amount, Account Number, Account Type, Bank Details, Payment Details, Transfer From, Transfer When, Payee Address and Intermediary Bank Details.

Click Go To Dashboard to go to the Dashboard screen.

OR

Click Add Favorite to mark the transaction as favorite. The favorite transaction is added. For more information, click here.

OR

Click the e-Receipt link to download the electronic receipt. For more information, click here.

Make Payment - My Accounts

User can initiate a transfer within the accounts mapped to the logged in user. User can also view the transaction limits associated with a current transaction.

E-Receipt gets generated on successful completion of transaction in the Core Banking Application. E-Receipt can also be accessed from Activity Log detailed view.

To transfer the money to own account:

- In the Transfer Type field, select the My Accounts option.

|

Field Name |

Description |

|---|---|

|

Transfer Type |

Payee to which transfer needs to be done. The options are:

|

|

Transfer To |

Payee account where the funds need to be transferred along with the account nickname. (if the user has added a nickname, for the account). |

|

Balance |

Net balance in the selected account. |

|

Transfer From |

Source account from which the funds are to be transferred along with the account nickname (if the user has added a nickname, for the account). |

|

Balance |

Net balance in the selected account. |

|

Amount |

Amount to be transferred along with the currency. The currency gets defaulted on selection of beneficiary account number. |

|

View Limits |

Link to view the transaction limits for the user. |

|

Transfer When |

Specify when to transfer funds. The options are:

|

|

Transfer Date |

Date of transfer. This field is enabled if the Later option is selected in Transfer when field. |

|

Note |

Narrative for the transaction. |

- From the Transfer To list, select the own account where the funds need to be transferred.

- From the Transfer From account list, select the account from which transfer needs to be done.

- In the Amount field, enter the transfer amount.

OR

Click the View Limits link to check the transfer limit. - In the Transfer When field, select the appropriate transfer date.

- If you select the Now option, transfer will be done on same day.

OR

If you select Later option in the Transfer On field, select the appropriate future date. - Click to initiate payment.

OR

Click to cancel the operation and navigate back to ‘Dashboard’. - The Make Payment - Review screen appears. Verify the details, and click .

OR

Click to navigate back to the previous screen.

OR

Click to navigate to Dashboard Screen. - The success message appears along with the transaction reference number, host reference number, status and Transfer To, Amount, Transfer From and Transfer When.

Click Go To Dashboard to go to Dashboard screen.

OR

Click Add Favorite to mark the transaction as favorite. The favorite transaction is added. For more information, click here.

OR

Click Set Repeat Transfer to repeat the transaction. For more information, click here.

OR

Click the e-Receipt link to download the electronic receipt. For more information, click here.

FAQs

![]() Can I transfer the funds to my loan account, which I hold in same bank?

Can I transfer the funds to my loan account, which I hold in same bank?

![]() Can I set a future date for a fund transfer?

Can I set a future date for a fund transfer?

![]() What happens if the transaction amount is less than set Transaction Limit?

What happens if the transaction amount is less than set Transaction Limit?

![]() Can I make a payment to an account which is currently not registered as my payee?

Can I make a payment to an account which is currently not registered as my payee?

![]() Can I transfer the funds to any CASA

Can I transfer the funds to any CASA![]() Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money. available under party ID mapped to me by selecting My Accounts transfer?

Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money. available under party ID mapped to me by selecting My Accounts transfer?

![]() Can I transfer the funds to an account belongs to linked party?

Can I transfer the funds to an account belongs to linked party?