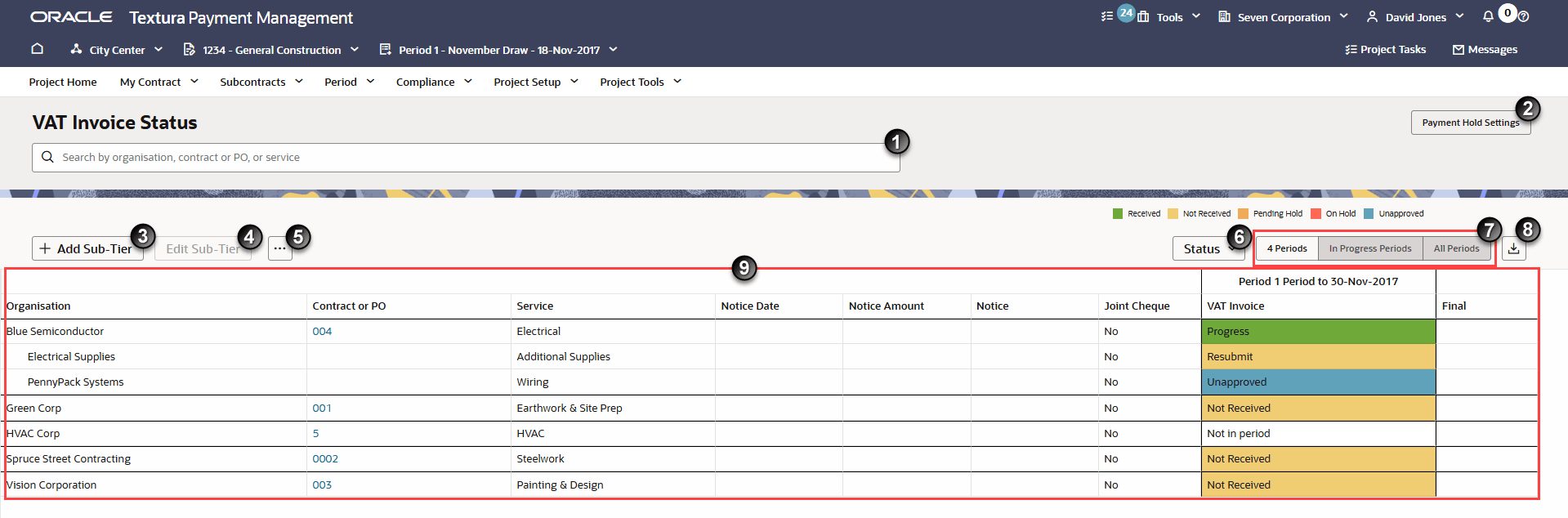

Working with the VAT Invoice Status Page for Main Contractors

- Search: Enter an organisation's name, contract, service, or status in the available field to find it in the table below.

- Payment Hold Settings Button: View the current payment hold settings for missing Sub-Tier VAT Invoices. Details open in a drawer on the right side of the page.

- Add Sub-Tier Button: Navigate to the Add Sub-Tier page to create a new VAT Invoice Only (VAT Sub) or Manual Sub-Tier. Either select the Add Sub-Tier button to add a Sub-Tier under your organisation or first select an organisation from the table to add a Sub-Tier under that organisation.

- Edit Sub-Tier Button: Only active after you select a Sub-Tier from the table. Edit Sub-Tier details from the Edit Sub-Tier page.

- More Menu: Access additional pages related to organisations working on the project. Select an organisation from the table to activate the options from this menu.

- Manage VAT Invoices: View and update VAT Invoice status across all periods in which the organisation participated on the project.

- Payment Status: Edit payment holds currently applied to the organisation.

- Attachments: Access and view attachments uploaded by the selected organisation.

- Status Button: Opens a drop-down list of filter options based on the current VAT Invoice status.

- Period Filters: By default, the table shows VAT Invoices for the previous four periods. You can optionally change the view to show the VAT Invoices for all in progress periods or all periods.

- Export Button: Download the details shown on the page as a CSV file.

- Organisation Table: Each organisation participating on the project displays in a table on the VAT Invoice Status page. Subcontractor rows are organised in alphabetical order with Sub-Tiers nested beneath their Prime Subcontractors. For more information on each table column, see VAT Invoice Status Fields Overview.

Last Published Friday, January 9, 2026