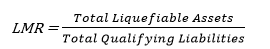

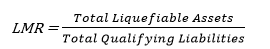

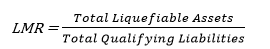

The LMR is a simplified form of the LCR for institutions designated as Category 2 by the Hong Kong Monetary Authority. It is a ratio of the amount of a category 2 institution’s liquefiable assets to the amount of the institution’s qualifying liabilities over a calendar month.

As prescribed by the HKMA, a Category 2 institution must maintain an LMR of not less than 25% on average in each calendar month.

Where:

Total Liquefiable Assets is the Sum of all Liquefiable Assets (Post Haircut) minus the Deductions from Liquefiable Assets (Post Haircut).

Total Qualifying Liabilities is the Sum of all Qualifying liabilities (Post Haircut) minus the Deductions from Qualifiable Liabilities (Post Haircut).

Topics:

· Prerequisites for Ratio Calculation

· Pre-configured Regulatory LMR Scenario as per HKMA

This section lists the intermediate calculations and results required to calculate the LMR.

Topics:

This computation reflects the net amount to be received by the bank in question from other banks at an aggregate level. If this resulting amount is positive, it indicates that the bank is to receive amounts from other banks and is therefore treated as an Asset. If this resulting amount is negative, it indicates that the bank owes the amount to other banks and is therefore treated as a Liability.

The computation is done as follows:

Standard Product type |

Standard Party Type (Counterparty) |

Measure |

Residual Maturity |

Example 1 |

Net Due From Banks - Example1 |

Example 2 |

Net Due From Banks - Example 2 |

|---|---|---|---|---|---|---|---|

Liabilities of the Institution to other banks |

|

|

|

|

|

||

Deposits |

All Banks excluding Central Bank |

EOP Balance |

<=1 month |

4000 |

1240 |

3000 |

-190 |

Borrowings |

Fair Value |

2300 |

1200 |

||||

Line of Credit received |

Drawn Amount |

110 |

400 |

||||

Securities Issued |

Fair Value |

3000 |

4000 |

||||

|

|||||||

Liabilities from banks to the Institution |

|

|

|

|

|||

Balances with banks |

All Banks excluding Central Bank |

EOP Balance |

<=1 month |

1000 |

1300 |

||

Non Marketable Debt Securities (Marketable Flag=No) |

Fair Value |

3500 |

4090 |

||||

Loans |

EOP Balance |

6000 |

2920 |

||||

Line of Credit |

Drawn Amount |

150 |

100 |

||||

NOTE:

1. This computation is done at a Legal Entity - Currency level.

2. Net Due from Banks is the (Total Liabilities from banks to the institution minus the Total Liabilities of the institution to other banks) in a one-month calendar period.

If Net due from banks is positive, a certain portion of this amount can be included in the Liquefiable Assets. This portion is limited to 40% of the Qualifying liabilities.

Computed Amount |

Example 1 |

Comments- Example 1 |

Example 2 |

Comments- Example 2 |

|---|---|---|---|---|

Net Due from Banks |

1240 |

-190 |

This sign signifies that the institution’s liabilities exceed its receivables from other banks. |

|

Qualifying Liabilities |

2000 |

|

||

Capped Net due from Banks |

800 |

This amount goes to the Liquefiable assets and receives the appropriate factor. |

|

|

Excess Net due from Banks |

440 |

This amount goes to the Qualifying liabilities and receives the appropriate factor. |

|

|

If Net due from Banks is negative, then it is only included in the denominator of LMR.

In Example 2:

Institution's one month liabilities to banks |

8600 |

This amount goes to the Qualifying Liabilities and receives the appropriate factor. |

|---|---|---|

Banks' one month liabilities to the institution |

8410 |

This amount goes to the Deductions from Qualifying Liabilities and receives the appropriate factor. |

See Credit Quality Grade for details.

For inclusion within the LMR, the grade/ratings of the issuer/guarantor/security should meet certain criteria. When these criteria are met, the Rating is deemed as Qualifying. The criteria are based mainly on the worst grade up to which the security can be included within the ratio. The criteria for an Issuer/Guarantor qualification and a Security rating qualification is specified in the following section.

The tables in this section list the criteria by which the security is Qualifying to be included in the LMR. For example: For a Security issued outside India, if the Grade is 1 or 2 in Long Term Ratings, then the security is Qualifying. This implies that Long Term Grade 3, 4, 5, and 6 are not qualifying.

The table which refers to an attribute called Qualifying rating, is marked Yes when either the Issue OR Issuer OR Guarantor is Qualifying

Topics:

· Qualifying Grade for a Security/Issue

· Qualifying Grade for an Issuer/Guarantor

Security is deemed to be qualifying for the context of LMR (Qualifying ECAI Issue-specific rating is Yes) if it satisfies the criteria in the following table.

Issuer Domicile |

Standard Party Type (Issuer OR Guarantor) |

Credit Quality Grade Instrument (Processing) |

Qualifying ECAI Issue Specific Rating |

|---|---|---|---|

Other than India |

|

1 |

Yes |

2 |

Yes |

||

1s |

Yes |

||

2s |

Yes |

||

India |

Other than Corporates |

1 |

Yes |

2 |

Yes |

||

1s |

Yes |

||

2s |

Yes |

||

India |

Corporates |

1 |

Yes |

2 |

Yes |

||

3 |

Yes |

||

1s |

Yes |

||

2s |

Yes |

||

3s |

Yes |

An issuer or guarantor is deemed to be qualifying for the context of LMR (Qualifying ECAI Issuer rating is Yes) if it satisfies the criteria in the following table.

Issuer Domicile |

Standard Party Type (Issuer OR Guarantor) |

Credit Quality Grade Issuer/ Guarantor (Processing) |

Qualifying ECAI Issuer Rating |

|---|---|---|---|

Other than India |

|

1 |

Yes |

2 |

Yes |

||

India |

Other than Corporates |

1 |

Yes |

2 |

Yes |

||

India |

Corporates |

1 |

Yes |

2 |

Yes |

||

3 |

Yes |

An account is deemed to be qualifying for the context of LMR (Qualifying ECAI rating is Yes) if either its issuer or guarantor or the issue satisfies the criteria in the following table.

Qualifying ECAI Issue Specific Rating |

Qualifying ECAI Issuer/Guarantor Rating |

Qualifying ECAI Rating (Derived) |

|---|---|---|

Yes |

Yes |

Yes |

Yes |

No |

Yes |

No |

Yes |

Yes |

No |

No |

No |

LMR is a ratio of assets over liabilities as prescribed in the HKMA guidelines. It considers certain assets and liabilities, referred to as liquefiable assets and qualifying liabilities.

Where:

The Constituents of the ratio are identified through pre-configured business rules. See the Regulation Addressed through Business Rules section for details.

The haircuts applicable to each asset or liability are applied through pre-configured business assumptions. See the Regulation Addressed through Business Assumptions section for details.

The list of preconfigured business assumptions and rules, as well as the corresponding reference to the regulatory requirement that it addresses, is provided in the following tables.

Topics:

· Regulation Addressed through Business Rules

· Regulation Addressed through Business Assumptions

.

The application supports multiple pre-configured rules and scenarios based on HKMA specified scenario parameters. The list of preconfigured business rules and the corresponding reference to the regulatory requirement that it addresses are provided in the following section:

NOTE:

This section provides contextual information about the business rules. For more detailed information, see the OFS LRS application (UI).

This list contains only the Rules which directly correspond to regulatory references. For the complete set of Rules, T2T and Functions, detailed Processes, and Tasks used in HKMA LCR, see the Run Chart.

|

|

|

|

|

Sl. No. |

Rule Name |

Rule Description |

Regulatory Requirement Addressed |

Regulatory Reference 1. HKMA Banking (Liquidity) Rules Capital

155 Sub leg Q |

|---|---|---|---|---|

1 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 1 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 1. |

This set of Rules updates the Credit Quality grade of the instrument, based on the issuer. This is done along with Grades 1 to 6. Grade 1 being the highest quality credit grade. |

Capital Rules - Schedule 6 |

2 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 2 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 2. |

||

3 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 3 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 3. |

||

4 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 4 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 4. |

||

5 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 5 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 5. |

||

6 |

LRM - HKMA LMR - Issuer Party Rating Classification - Grade 6 |

This rule updates the grade skey for the issuer based on the issuer type, issuer domicile and issuer rating as Grade 6. |

||

7 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 1 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 1. |

This set of Rules updates the Credit Quality grade of the instrument, based on the Guarantor. This is done along with Grades 1 to 6. Grade 1 being the highest quality credit grade. |

Capital Rules - Schedule 6 |

8 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 2 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 2. |

||

9 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 3 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 3. |

||

10 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 4 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 4. |

||

11 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 5 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 5. |

||

12 |

LRM - HKMA LMR - Guarantor Party Rating Classification - Grade 6 |

This rule updates the grade skey for the guarantor based on the guarantor type, guarantor domicile and guarantor rating as Grade 6. |

||

13 |

LRM - LMR - Qualifying Issuer Score |

This rule classifies the Issuer rating grade score as qualifying as per the HKMA guidelines. |

The HKMA guidelines set out the expectations for a 'Qualifying' issuer or guarantor or issue. For example, an issue (security) is qualifying if it has a credit quality grade of 1 or 2. This set of Rules recognize other such qualifying criteria and identify such accounts as qualifying, in accordance with LMR guidelines. |

Liquidity Rules - Schedule 5 |

14 |

LRM - LMR - Qualifying Guarantor Score |

This rule classifies the Guarantor rating grade score as qualifying as per the HKMA guidelines. |

||

15 |

LRM - LMR - Qualifying Issuer Instrument Score |

This rule updates the qualifying Issuer Instrument score based on credit quality grade as per the HKMA guidelines. |

||

16 |

LRM - LMR - Qualifying Guarantor Instrument Score |

This rule updates the qualifying Issue score based on credit quality grade as per the HKMA guidelines. |

||

17 |

LRM - LMR - Qualifying ECAI Rating |

This rule classifies the qualifying ECAI score based on qualifying issue score and qualifying party score as per the HKMA guidelines. |

||

18 |

LRM - HKMA LMR - Liquefiable Asset - Cash , Central Bank Reserves and Gold |

This rule reclassifies cash, central bank reserves, and Gold as a Liquefiable asset in accordance with the criteria required for Liquidity Maintenance Ratio as specified by HKMA. |

This set of Rules identifies the accounts which are eligible to be counted under 'Liquefiable assets' as per the LMR guidelines. |

Liquidity Rules Schedule 5, Table A (1) |

19 |

LRM - HKMA LMR - Securities issued by Sovereigns,Central Bank and PSE domiciled in Hong Kong |

This rule reclassifies Securities issued by Sovereigns, Central Bank, and PSE domiciled in Hong Kong, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.a.(i)) |

|

20 |

LRM - HKMA LMR - Securities guaranteed by Sovereigns, Central Bank and PSE domiciled in Hong Kong |

This rule reclassifies Securities guaranteed by Sovereigns, Central Bank, and PSE domiciled in Hong Kong, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.a.(i)) |

|

21 |

LRM - HKMA LMR - Export Bills and Residential Mortgage Loans |

This rule reclassifies the Export Bills drawn under Letters of Credit and Residential Mortgage Loans as Liquefiable assets, in accordance with the criteria specified by HKMA LMR. |

Liquidity

Rules Schedule 5, Table A (6.f) |

|

22 |

LRM - HKMA LMR - Securities from Banks and state governments |

This rule reclassifies Securities from Banks (central Banks excluded) and State Governments not domiciled in Hong Kong, in accordance with the criteria specified by HKMA LMR. |

Schedule 5, Table A (6.b) |

|

23 |

LRM - HKMA LMR - Asset Backed Securities and Other Securities |

This rule reclassifies Asset-Backed Securities, Residential Mortgage-Backed Securities, and other Securities as Liquefiable Asset in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.g) |

|

24 |

HKMA LMR - Securities issued by other Government entities maturing within 1 year |

This rule reclassifies Securities, maturing within 1 year, issued by Sovereigns, Central Bank, and PSE domiciled in Other Countries, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.b) |

|

25 |

HKMA LMR - Securities issued by other Government entities maturing beyond 1 year |

This rule reclassifies Securities, maturing beyond 1 year, issued by Sovereigns, Central Bank, and PSE domiciled in Other Countries, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.b) |

|

26 |

HKMA LMR - Securities guaranteed by other Government entities maturing within 1 year |

This rule reclassifies Securities, maturing within 1 year, guaranteed by Sovereigns, Central Bank, and PSE domiciled in Other Countries, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.b) |

|

27 |

HKMA LMR - Securities guaranteed by other Government entities maturing beyond 1 year |

This rule reclassifies Securities, maturing beyond 1 year, guaranteed by Sovereigns, Central Bank, and PSE domiciled in Other Countries, in accordance with the criteria specified by HKMA LMR. |

Liquidity Rules Schedule 5, Table A (6.b) |

|

28 |

LRM - HKMA LMR - Qualifying Liabilities for Central Banks |

This rule updates the F_QUALIFYING_LIABILITY_FLAG flag in the fsi_lrm_liabilities table for all the central bank parties. |

This set of Rules identifies the accounts which are eligible to be counted under 'Qualifying liabilities' as per the LMR guidelines. |

Liquidity Rules Schedule 5, Table C (1) |

29 |

LRM - HKMA LMR - Qualifying Liabilities for Other than Banks |

This rule updates the F_QUALIFYING_LIABILITY_FLAG flag in the fsi_lrm_liabilities table for all the parties other than the central bank and banks. |

Liquidity Rules Schedule 5, Table C (2) |

|

30 |

HKMA LMR - Reporting Line - Deductions from Liquefiable Assets |

This rule assigns the repline skey for the accounts that are applicable for deductions from the stock of Liquefiable Asset as per the HKMA LMR guidelines. |

These Rules identify deductions applicable to the Numerator and denominator of the LMR. |

Liquidity Rules Schedule 5, Table B (1) |

31 |

HKMA LMR - Reporting Line - Deductions from Qualifying Liabilities |

This rule assigns the repline skey for the accounts that are applicable for deductions from the stock of Qualifying Liabilities as per the HKMA LMR guidelines. |

Liquidity Rules Schedule 5, Table D |

|

32 |

LRM - HKMA LMR - Capped and Excess Net Due Amount Calculation |

This rule computes the Capped Net due Amount and Excess Net due amount and updates in the FCT_LRM_LE_SUMMARY table. If 'Net due from banks' is positive, a certain portion of this amount can be included in the Liquefiable Assets. This portion is capped to 40% of the Qualifying liabilities. After capping what amount is left from Net Due is considered as Excess Net due from Banks. |

This Rule identifies the Net Due from Banks, excess net due from banks, and capped amount to be included in the calculation of Liquidity Maintenance Ratio. |

Liquidity Rules Part 8, Paragraphs 43, 48 |

33 |

LRM - HKMA LMR - Total Liquefiable Asset and Total Qualifiable Liability Amount Calculation |

This rule computes the liquefiable asset amount post deductions, qualifying liability amount post deductions and updates in the FCT_LRM_LE_SUMMARY table. |

This Rule sums up all accounts under liquefiable assets and all accounts under qualifying liabilities as a final step before LMR computation. |

Liquidity Rules Part 8 Paragraphs 44 to 47 |

The application supports multiple pre-configured assumptions based on HKMA specified scenario parameters. The list of pre-configured business assumptions and the corresponding reference to the regulatory requirement that it addresses is provided in the following section:

Sl. No. |

Assumption Name |

Assumption Description |

Regulatory Requirement Addressed |

Regulatory Reference 1. HKMA Banking (Liquidity) Rules Capital

155 Sub leg Q |

|---|---|---|---|---|

1 |

LMR - Asset Haircut Assignment |

This assumption defines the haircuts applicable for Liquefiable Assets. |

This set of assumptions defines the regulatory haircuts for the constituents of the Liquidity Maintenance Ratio. |

Schedule 5, Table A |

2 |

LMR - Liability Haircut Assignment |

This assumption defines the haircuts applicable for Qualifying Liability. |

Schedule 5 Table C and D |

.