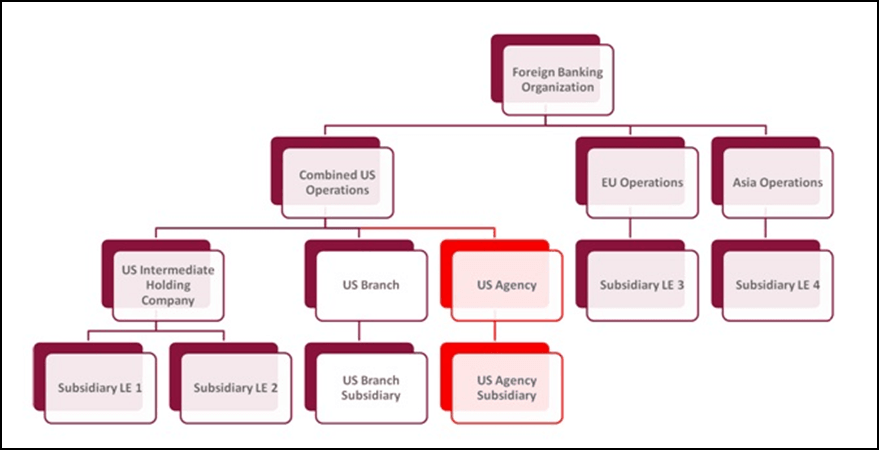

US Federal Reserve issued a notice of final rule, Liquidity Coverage Ratio: Liquidity Risk Measurement, Standards, and Monitoring, in November 2013 covering the requirements for the computation of Liquidity Coverage Ratio for US covered companies. These guidelines are similar to those issued by Bank for International Settlements (BIS), with some deviations based on the conditions under which the US banks operate. US Federal Reserve has prescribed two approaches for computing the Liquidity Coverage Ratio, each of which applies to banks of different sizes.

OFS Liquidity Coverage Ratio complies with the WW, Final Rule, and Liquidity Coverage Ratio: Liquidity Risk Measurement Standards, Sep 2014.

· Liquidity Coverage Ratio

The Liquidity Coverage Ratio applies to larger banks and requires the stock of Hiqh Quality Liquid Assets (HQLA) to be sufficient to cover the add-on approach over a liquidity horizon of 30 days. The regulator provides specific guidelines including assets into the stock of HQLA and provides the relevant haircuts. The computation of the denominator is based on an add-on approach using inflow and outflow rates specified by the regulator.

· Modified Liquidity Coverage Ratio

A new approach, the modified LCR calculation, is prescribed by US Federal Reserve for smaller banks, which requires the stock of HQLA to be sufficient to cover net cash outflows over a liquidity horizon of 30 days. These banks are required to compute a less stringent LCR, due to their relatively small size and lower complexity. The inflow and outflow rates for such banks are 70% of those prescribed under the LCR approach.

OFS LRCUSFR supports both these approaches for computing Liquidity Coverage Ratio as prescribed by the US Federal Reserve in its final rule; Regulation WW, Liquidity Coverage Ratio: Liquidity Risk Measurement, Standards, and Monitoring.

Topics:

· Inputs

· Preconfigured Regulatory LCR Scenario

· Modified Liquidity Coverage Ratio Calculation

· FR2052a and FR2052b Related Calculations

· Regulation YY Liquidity Risk Calculation

The LRRCUSFR application requires the following inputs for LCR calculation:

· Liquidity haircut, inflow percentage, and outflow percentage of the respective business assumption are preconfigured. However, you can change them, if required.

· Liquidity Horizon is specified as the Runtime parameter.

This section explains the process of calculating the Liquidity Coverage Ratio (LCR).

Topics:

· Determining the Maturity of Cash Flows

· Deposit Stability Identification

· Classifying Operational Account

· Calculating Contractually Required Collateral

· Calculating Excess Collateral

· Calculating Downgrade Impact Amount

· Calculating Net Derivative Cash Inflows and Outflows

· Calculating Twenty Four Month Look-back Amount

· Calculating Operational Amount

· Calculating HQLA Transferability Restriction

· Calculating Cash Inflows and Outflows

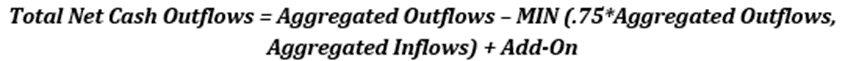

· Calculating Net Cash Outflows (NCOF)

· Consolidation as Per LCR Approach

The application supports an out-of-the-box Run for computing LCR as per the final Rule issued by the US Federal Reserve. This Run includes the regulatory scenario with associated HQLA haircuts, inflow and outflow rates preconfigured in the form of business assumptions.

Assets classified as available-for-sale or held-to-maturity are included in the stock of HQLA if they fulfill the following HQLA criteria:

· Are unencumbered.

· Meet the operational HQLA requirements.

· Are not client pool securities that are held in segregated accounts or cash received from a repurchase agreement on client pool securities held in a segregated account.

· If consolidated, then the portion of assets required to cover the consolidated subsidiary’s net cash outflow and an excess amount of assets having unrestricted transferability.

· An asset received under a re-hypothecation right where the owner has a right to withdraw the asset anytime during the liquidity horizon without remuneration.

· Assets which are held not to cover operational costs.

NOTE:

Available-for-Sale Security is a security that is purchased with the intent of selling it before its maturity or selling it within a short period if the security does not have a known maturity.

Held-to-Maturity Securities are securities that a bank intends to hold until maturity.

All assets, whether owned by the bank or received from counterparties as collateral, are classified as follows:

· Level 1 Assets

· Level 2A Assets

· Level 2B Assets

· Other Assets

Level 1, 2A, and 2B assets are considered high-quality liquid assets and are included as part of the stock of HQLA provided they meet the HQLA eligibility criteria set out by the US Federal Reserve. Assets are classified as HQLA based on the qualifying criteria set by the US Federal Reserve. The following steps are involved in identifying the asset level:

Topics:

· Identification of Assets as Liquid and Readily Marketable

· Treatment of Assets Issued by Financial Sector Entities

The application identifies liquid and readily marketable assets that meet the following criteria:

· It is traded in an active secondary market with more than two committed market makers.

· It has a large number of committed non-market maker participants on both the buying and selling sides of transactions.

· It has timely and observable market prices.

· It has high trading volumes.

An asset that is not liquid and readily marketable is not considered a high quality liquid asset.

Any asset whose issuer is either a financial sector entity or a consolidated subsidiary of a financial sector entity is classified as a non-HQLA asset and excluded from the stock of high-quality liquid assets. These attributes are captured at the standard party level.

1. Identification and Treatment of Level 1 Assets

The following criteria qualifies assets to be classified as Level 1 assets.

Level 1 assets are fully included as part of the stock of high-quality liquid assets provided, they meet the HQLA eligibility criteria. The application identifies the following as HQLA Level 1 assets:

a. Federal Reserve Bank Balances: Balances held by the Federal Reserve banks include reserve balance requirements, excess balances, and term deposits. Only excess balances and certain term deposits are included in the stock of Level 1 assets. To be included in the stock, term deposits should be held according to the terms and conditions that:

— explicitly and contractually permit such term deposits to be withdrawn upon demand before the expiration of the term

Or that,

— permit such term deposits to be pledged as collateral for the term or automatically-renewing overnight advances from a Federal Reserve Bank.

§ Reserve balance requirements are excluded from the stock as they must be maintained with the Federal Reserve Bank at all times.

§ Federal Reserve Bank balances include the central bank reserves held at a US Federal Reserve Bank directly by the bank or through a correspondent bank less any reserve balance requirement.

§ Additionally, central bank term deposits held by a bank directly or through a correspondent bank are included provided they fulfill the following criteria:

— It is withdrawn on-demand before maturity

— Or

— It is pledged as collateral for the term or automatically-renewing overnight advances from a Federal Reserve Bank.

§ The value of eligible term deposits that are included in the amount net of any withdrawal penalty.

b. Foreign Withdrawable Reserves: Reserves held in foreign central banks that have no transferability restrictions are included. Any reserves held by the bank in a foreign central bank that do not have restrictions on use and are freely withdrawable and denominated in the local currency of that foreign country, are included as Level 1 assets. The reserves include term deposits held at the central bank.

c. United States Government Securities: Securities issued by, or unconditionally guaranteed by the U.S Department of the Treasury for the timely payment of principal and interest are included. Additionally, securities issued by any other US government agency and explicitly guaranteed by the full faith and credit of the U.S. government, provided that they are liquid and readily-marketable.

d. Certain Sovereign and Multilateral Organization Securities: Securities issued or guaranteed by a sovereign entity, a central bank, the Bank for International Settlements, the International Monetary Fund, the European Central Bank and European Community, or a multilateral development bank are included in the securities if they fulfill the following conditions:

— Are assigned a 0% risk weight.

— Are liquid and readily marketable.

— Issued by an entity whose obligations have a proven record as a reliable source of liquidity in the repurchase or sales markets during stressed market conditions.

— Are not an obligation of a financial entity or its consolidated subsidiary.

e. Certain Foreign Sovereign Debt Securities: Debt securities issued by a foreign sovereign entity with a non 0% risk weight if they fulfill the following conditions:

— Are liquid and readily marketable.

— Are issued in the local currency of the foreign sovereign.

The legal entity holds the securities to cover its cash outflows in that jurisdiction.

2. Identification and Treatment of Level 2A Assets

The application identifies HQLA Level 2A Assets in the following manner:

a. U.S. GSE Securities: A security issued or guaranteed by a U.S. government-sponsored enterprise as to the timely payment of principal and interest, that is investment grade under 12 CFR part 1 as of the calculation date, provided the claim is senior to preferred stock.

b. Securities issued by or guaranteed by a US government-sponsored entity (GSE) as they have been assigned a 20% risk weight.

c. Securities issued by or guaranteed by a sovereign or multi-lateral development bank that are:

— Not included in Level 1 assets.

— Assigned a risk weight between 0% and 20%.

— Price has not decreased, or haircut increased by greater than 10% during a 30-calendar day period of significant stress.

— Not an obligation of a financial entity or its consolidated subsidiary.

NOTE:

The rule excludes covered bonds and securities issued by other Public Sector Enterprises (PSE’s) to be included in the stock even if they are assigned a 20% risk weight.

3. Identification and Treatment of Level 2B Assets

The application identifies the following as HQLA Level 2B Assets:

a. Publicly traded corporate debt securities that meet the following criteria:

— Considered investment-grade per the definition provided in 12 CFR part 1.

— Issued or guaranteed by an entity whose obligations have a proven record as a reliable source of liquidity in repurchase or sales markets during stressed market conditions. Reliability is proven if the price has not decreased or haircut increased by 20% over a 30-day stress period.

— Not an obligation of a financial sector entity and not an obligation of a consolidated subsidiary of a financial sector entity.

b. Publicly traded common equities that meet the following criteria:

— Included in Russell 100 Index or an index that the bank’s supervisor in a foreign jurisdiction recognizes for inclusion in Level 2B assets if the share is held in that jurisdiction.

— Issued in US Dollars or in the currency of the jurisdiction in which the bank operates and holds the common equity share to cover net cash outflows in that jurisdiction.

— Issued by an entity whose publicly traded common equity shares have a proven record as a reliable source of liquidity in repurchase or sales markets during stressed market conditions. Reliability is proven if the price has not decreased or haircut increased by 40% over a 30-day stress period.

— Not issued by a financial sector entity and not issued by a consolidated subsidiary of a financial sector entity.

— If held by a depository institution, is not acquired in satisfaction of a debt previously contracted (DPC).

— If held by a consolidated subsidiary of the bank, it includes the publicly traded common equity share in its Level 2B liquid assets only if the share is held to cover net cash outflows of its consolidated subsidiary in which the publicly traded common equity share is held.

c. U.S. general obligation municipal securities that meet the following criteria:

i. Is issued by, or guaranteed as to the timely payment of principal and interest by, a public sector entity.

ii. It is liquid and readily marketable.

iii. Considered investment-grade per the definition provided in 12 CFR part 1.

iv. Is issued or guaranteed by an entity whose obligations have a proven record as a reliable source of liquidity in repurchase or sales markets during stressed market conditions. Reliability is proven if the price has not decreased or haircut increased by 20% over a 30-day stress period.

v. It is not an obligation of a financial sector entity and not an obligation of a consolidated subsidiary of a financial sector entity.

NOTE:

A public sector entity is defined as any state, local authority, or other governmental subdivision below the U.S. sovereign entity level.

The maximum value of such securities issued by a single public sector entity than can be included in the stock of HQLA is the fair value up to two times the average daily trading volume during the previous four quarters of all general obligation securities issued by that public sector entity.

The U.S. Municipal Securities can be included as Level 2B Asset only to the extent of 5% of the total stock of HQLA.

The application identifies whether a bank’s asset or a mitigant received under re-hypothecation rights meets all the operational requirements and generally applicable criteria. If both conditions are met, then such an HQLA is marked as eligible HQLA and is included in the stock of HQLA.

Topics:

· Generally Applicable Criteria for Eligible HQLA

The application checks for the following operational criteria:

a. Operational Capability to Monetize HQLA

An asset can be considered HQLA only if the bank has demonstrated the operational capability to monetize such an asset. The application captures this information for each asset as a flag.

b. HQLA Under the Control of the Liquidity Management Function

To be considered eligible HQLA the asset is under the control of the management function of the bank that manages liquidity. The application captures this information for each asset as a flag.

c. Termination of Transaction Hedging HQLA

If an HQLA is hedged by a specific transaction, then the application considers the impact of closing out the hedge to liquidate the asset that is, the cost of terminating the hedge while computing the stock of HQLA. The hedge termination cost is deducted from the fair value of the asset and the difference is included in the stock of HQLA.

d. Policies and Procedures to Determine Eligible HQLA Composition

The banks that have established policies and procedures determine the composition of their eligible HQLA periodically. This is a qualitative criterion which banks have to ensure compliance with.

The application checks for the following criteria:

a. Unencumbered

The application looks at the encumbrance status and includes only those assets in the stock which are unencumbered. If partially encumbered, then the portion of the asset that is unencumbered is considered as HQLA and included in the stock.

b. Segregated Client Pool Securities

A segregated client pool security held by the bank or the cash received as part of a repo transaction where the underlying is a client pool security are not considered eligible HQLA and therefore excluded from the stock.

c. Maintenance of Eligible HQLA in the United States

A bank is generally expected to maintain an amount and type of eligible HQLA in the United States that is sufficient to meet its total net cash outflow amount in the United States.

d. Exclusion of Certain Re-hypothecated Assets

Any asset that a bank receives under a re-hypothecation right is not considered eligible HQLA if the counterparty or beneficial owner of the asset has a contractual right to withdraw the asset without an obligation to pay more than the minimum remuneration at any time within 30 calendar days. This exclusion also applies to any asset generated from another asset obtained under such a re-hypothecation right.

e. Exclusion of Assets Designated to Cover Operational Costs

Bank’s assets such as deposits held at other depository institutions to meet its operational costs such as wages, facility maintenance, and so on are excluded from HQLA as such assets are not available to cover the liquidity needs that arise during stress situations. The application assesses the operational deposit criteria for such assets and excludes them from the stock of HQLA.

All unencumbered assets classified as Level 1, Level 2A, or Level 2B, which meet the HQLA eligibility criteria, are included in the stock of high-quality liquid assets (SHQLA). The formula for calculating SHQLA is as follows:

NOTE:

All calculations are based on the market value of assets.

Topics:

· Calculating Liquid Asset Amount

· Calculating Unadjusted Excess HQLA

· Identifying Eligible HQLA on Unwind:

· Unwinding of Transactions Involving Eligible HQLA

· Calculating Adjusted Liquid Asset Amount

The application applies the relevant liquidity haircuts to the fair value of each eligible HQLA based on the haircuts specified as part of the business assumption. The sum of haircut adjusted fair value of all assets which are not ‘other assets’ and which are classified as ‘eligible HQLA’ comprises of the stock of unadjusted HQLA. The stock includes the bank’s assets which are unencumbered, meaning not placed as collateral; as well as assets received from counterparties where the bank has a re-hypothecation right and where such assets are not re-hypothecated.

1. Level 1 liquid asset amount

The Level 1 liquid asset amount equals the fair value of all Level 1 liquid assets held by the bank as of the eligible calculation date HQLA, less the amount of the reserve balance requirement less hedge termination costs (if any), less withdrawal penalty on time deposits (if any).

2. Level 2A liquid asset amount

The Level 2A liquid asset amount equals 85 percent of the fair value of all Level 2A liquid assets held by the bank as of the calculation date that are eligible HQLA, less hedge termination costs (if any).

3. Level 2B liquid asset amount

The Level 2B liquid asset amount equals 50 percent of the fair value of all Level 2B liquid assets held by the bank as of the calculation date that is eligible HQLA, less hedge termination costs (if any).

4. Level 2B PSE security liquid asset amount

The Level 2B liquid asset amount equals 50 percent of the fair value of all Level 2B PSE securities, to the extent of 2 times the average daily trading volumes of all US general obligation municipal bonds issued by each issuer, held by the bank as of the calculation date that is eligible HQLA, less hedge termination costs (if any).

The unadjusted excess HQLA is calculated based on the following formula:

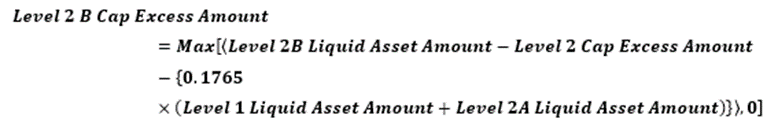

The formula for computing the cap excess amounts is as follows:

1. Calculation of Level 2 Cap Excess Amount

2. Calculation of Level 2B Cap Excess Amount

3. Calculation of Level 2B PSE Security Cap Excess Amount

The application identifies the assets that are placed as collateral which are eligible HQLA if they are not encumbered. Placed collateral is marked as eligible HQLA on unwinding if it fulfills all of the following criteria:

· Asset Level is a Level 1, 2A or 2B asset

· Meets HQLA Operational Requirements

· Meets Generally Applicable HQLA Criteria on Unwind

The application identifies all transactions maturing within the LCR horizon where HQLA is placed or received. These transactions include repos, reverse repos, secured lending transactions, collateral swaps, and so on. Such transactions are to be unwound that is, the original position is to be reversed and the cash or stock of HQLA has adjusted accordingly. This is done to avoid including any asset in the stock that should be returned to its owner before the end of the LCR horizon.

The formula for this calculation is as follows:

1. Adjusted Level 1 liquid asset amount

The formula for calculating the adjusted Level 1 liquid asset amount is as follows:

NOTE:

Adjustments relate to the cash received or paid and the eligible Level 1 asset posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

2. Adjusted Level 2A liquid asset amount

The formula for calculating the adjusted Level 2A liquid asset amount is as follows:

NOTE:

Adjustments relate to eligible Level 2A assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

3. Adjusted Level 2B liquid asset amount

The formula for calculating the adjusted Level 2B liquid asset amount is as follows:

NOTE:

Adjustments relate to eligible Level 2B assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

4. Adjusted Level 2B PSE security liquid asset amount

The formula for calculating the adjusted Level 2B PSE security liquid asset amount is as follows:

NOTE:

Adjustments relate to eligible Level 2B PSE securities posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

5. Calculation of Adjusted Excess HQLA

The adjusted excess HQLA is calculated based on the following formula:

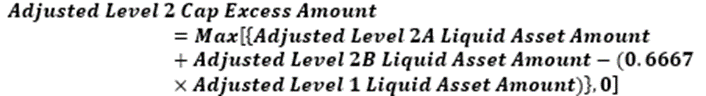

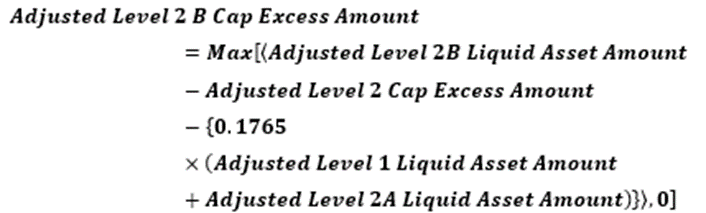

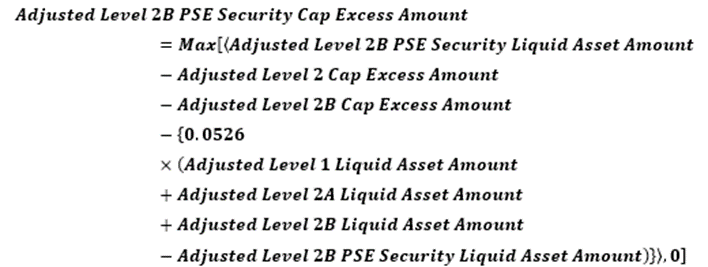

The formula for computing the adjusted cap excess amounts is as follows:

a. Calculation of Adjusted Level 2 Cap Excess Amount

b. Calculation of Adjusted Level 2B Cap Excess Amount

c. Calculation of Adjusted Level 2B PSE Security Cap Excess Amount

To calculate the Liquidity Coverage Ratio and the components thereof, a bank assumes an asset or transaction’s maturity is based on the following assumptions:

1. If an instrument or transaction is subject to outflow, then the earliest possible contractual maturity date or the earliest possible date the transaction occurs is considered. The application checks if the counterparty has an option to reduce maturity. The following options must be considered which results either in reducing or extending the maturity date:

a. If an investor or funds provider has an option that reduces the maturity, then the application considers the earliest date as the maturity date. If the option is exercised, then it means that the maturity date is equal to the earliest date or latest date.

b. If an investor or funds provider has an option that extends the maturity, then the application assumes that the investor or funds provider does not exercise the option to extend the maturity. This means that the maturity date equals to the original maturity date if the option is not exercised.

c. If a covered company holds an option to reduce the maturity of the transaction, the application assumes that the option is exercised. If the option is exercised, then it means that the maturity date is equal to the earliest date or latest date.

d. If a covered company holds an option to extend the maturity of the transaction, the application assumes that the option is not exercised by the covered company and calculates the maturity of the transaction. This means the existing maturity date continues.

The application considers the following exceptions to the rule in Step (d):

§ If a long term callable bond which is issued by a covered company has an original maturity greater than one year and the call option held by the covered company does not go into effect until at least six months after the issuance, the original maturity of the bond is considered for purposes of the LCR.

Or,

§ If the covered company holds an option permitting it to repurchase any of its obligation from a sovereign entity, a U.S. government-sponsored enterprise, or a public sector entity, then the original maturity of the obligation is considered for calculation of LCR.

e. If the covered company has an option that extends the maturity of an obligation it has issued, then the application does not exercise this option to extend the maturity. This means the extended maturity date is considered for computing LCR.

f. If an option is subject to a contractually defined notice period, then the application determines the earliest possible contractual maturity date regardless of the notice period. This means that the application considers the earliest date as the maturity date.

2. If an instrument or transaction is subject to inflows, then the application considers the latest possible contractual maturity date or the latest possible date the transaction occurs. The following options are considered, which results in increasing the maturity date:

a. If the borrower has an option which results in extending the maturity, then application assumes that the borrower exercises the option and consider to extend the maturity date to the latest possible date. This means that the maturity date is equal to the earliest date or latest date.

b. If the borrower has an option that reduces the maturity, then the application assumes that the borrower will not exercise the option to reduce the maturity. This means that the existing maturity date is continued.

c. If the covered company has an option that reduces the maturity, then the application assumes that it will not exercise the option to reduce the maturity. This means that the existing maturity date is continued.

d. If the covered company has an option that extends the maturity of an instrument or transaction, the application assumes that it will exercise the option to extend the maturity to the latest possible date. If the option is exercised, then it means that the maturity date is equal to the earliest date or latest date.

e. If any option is subject to a contractually defined notice period, then the application considers it while calculating maturity for Inflows.

3. The maturity date of secured lending transactions or inflow-generating asset exchanges is the later of the contractual maturity date of the secured lending transaction or inflow-generating asset exchange and the maturity date of the secured funding transaction or outflow-generating asset exchange for which the received collateral was used.

4. The maturity date for a transaction with financial sector entities and which is not an operational deposit is considered by the application to be the first calendar day after the calculation date for LCR.

5. Maturity for transactions related to broker-dealer segregated account inflow amount is considered by the application to be based on calculation performed by the broker-dealer for the release of assets to its customers. If a broker-dealer performs this calculation daily, then the inflow is considered by the application to be on the first day of the 30 calendar-day periods if a broker-dealer performs the calculation every week, then the inflow is considered on the date of the next regularly scheduled calculation.

NOTE:

The revised maturity is considered for the computation of LCR. The maturity computation for cash flows is calculated as part of the LRM application. However, an assumption is defined to move the cash flows of financial sector entities, which are not an operational deposit, for LCR calculation.

A stable deposit is a deposit whose entire outstanding balance is fully covered by deposit insurance provided by Federal Deposit Insurance Corporation (FDIC) of the USA and which satisfies one of the following conditions:

a. It is held in a transactional account by the depositor

Or

b. The depositor has an established relationship with the reporting legal entity.

The FDIC covers all deposit accounts, including checking and savings accounts, money market deposit accounts, and certificates of deposit. The standard insurance amount is $250,000 per depositor, per insured bank, for an ownership category. The application expects the limit to be provided at a customer-ownership category combination. This limit is allocated to the insurance eligible accounts based on a waterfall approach such that it maximizes insurance coverage from the perspective of deposit stability identification. Once the insurance limit is allocated, deposit stability is identified based on insurance coverage and other conditions. Only the fully covered accounts meeting the other stability criteria are considered stable deposits.

NOTE:

· Deposit Insurance Calculations are done following FDIC Part 370 guidelines. See the Deposit Insurance Calculations as per FDIC 370 section for details.

· An insurance eligible account means an account that is covered by the deposit insurance scheme.

· In the context of the US Federal Reserve on LCR, fully covered means that the entire outstanding balance of the deposit account must be covered by insurance.

The insurance limit captured at each customer-ownership category combination is allocated to multiple accounts in the decreasing order of the outstanding amount (including interest) of the accounts, provided it fully covers the outstanding amount of the account. The insurance coverage status is updated for each deposit account as follows:

· Fully Insured: Insured Amount = Outstanding Amount

· Partially Insured: Insured Amount greater than 0 and less than Outstanding amount

· Uninsured: Insured Amount = 0

Operational deposit means unsecured wholesale funding or a collateralized deposit that is necessary for the covered company to provide operational services as an independent third-party intermediary, agent, or administrator to the wholesale customer or counterparty providing the unsecured wholesale funding or collateralized deposit.

The deposits are classified as an operational deposit if designated as an operational deposit by the covered company and the deposit is used or either cash management, custody management, or clearing management and not used of prime brokerage or correspondent banking. The customer must hold the deposit at the covered company for the primary purpose of obtaining the operational services provided by the covered company. The related operational services must be performed according to a legally binding written agreement, and meet the following criteria:

a. The termination of the agreement must be subject to a minimum 30 calendar-day notice period.

or

b. As a result of the termination of the agreement or transfer of services to a third-party provider, the customer providing the deposit would incur significant contractual termination costs or switching costs (switching costs include significant technology, administrative, and legal service costs incurred in connection with the transfer of the operational services to a third-party provider).

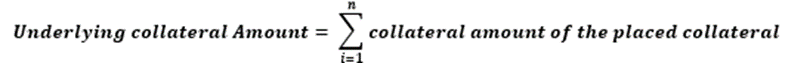

Contractually required collateral is the amount of collateral that is contractually due from one party to the other based on the current exposure and collateral position. This amount must be paid to the party soon and results in outflow for the party owing the collateral and inflow to the party to whom the collateral is due. It can be of two types based on the direction of the exposure, Excess Collateral Due or Excess Collateral Receivable.

Topics:

· Calculating Contractually Due Collateral

· Calculating Contractually Receivable Collateral

The application computes the value of the collateral that a bank is required to post contractually to its derivative counterparty, if one of the following conditions are met.

1. If the Secured Indicator is No, then the contractually due collateral is 0.

2. If the Secured Indicator is Yes and the CSA Type is One way, then the contractually due collateral is 0.

3. If the Secured Indicator is Yes, the CSA Type is Two way and Gross Exposure is greater than or equal to 0, then the contractually due collateral is 0.

4. If the Secured Indicator is Yes, the CSA Type is Two way and Gross Exposure is less than 0, the application computes the contractually due collateral as follows:

Where,

Threshold is the unsecured exposure that a party to a netting agreement is willing to assume before making collateral calls.

The contractually due collateral is assumed to be posted and therefore receives the relevant outflow rate specified by the regulator as part of the preconfigured business assumptions for LCR calculations.

The application computes the value of the collateral that a derivative counterparty is required contractually to post to the bank, if one of the following conditions are met.

1. If the Secured Indicator is No, then the contractually receivable collateral is 0.

2. If the Secured Indicator is Yes and the Gross Exposure is less than or equal to 0, then the contractually receivable collateral is 0.

3. If the Secured Indicator is Yes and the Gross Exposure is greater than 0, then the application computes the contractually receivable collateral as follows:

The contractually receivable collateral does not receive a pre-specified inflow rate from the regulator and is, therefore, excluded from the LCR calculations. However, the application computes this to generate reports.

Excess collateral is the value of collateral posted or received that is more than the collateral required based on the current levels of exposure and collateral position. This amount can be withdrawn by the party which has provided the collateral over its exposure and results in outflow to the party holding the excess collateral and an inflow to the party who has provided the excess collateral. It can be of two types, Excess Collateral Due or Excess Collateral Receivable.

Topics:

· Calculating Excess Collateral Due

· Calculating Excess Collateral Receivable

The application computes the value of the collateral that a derivative counterparty has posted to the bank, over the contractually required collateral, and therefore can be withdrawn by the counterparty, as follows:

1. If the Secured Indicator is No, then the excess collateral due is 0.

2. If the Secured Indicator is Y and the Gross Exposure are less than or equal to 0, the application computes the excess collateral due as follows:

Where,

Adjusted collateral received: Collateral received from the counterparty less customer withdrawable collateral

Customer withdrawable collateral: Collateral received under re-hypothecation rights that can be contractually withdrawn by the customer within the LCR horizon without a significant penalty associated with such a withdrawal.

3. If the Secured Indicator is Y and the Gross Exposure are greater than 0, the application computes the excess collateral due as follows:

The excess collateral due is assumed to be recalled by the counterparty and therefore receives the relevant outflow rate specified by the regulator as part of the preconfigured business assumptions for LCR calculations.

The application computes the value of the collateral that the bank has posted to its derivative counterparty, over the contractually required collateral, and therefore can be withdrawn by the bank, as follows:

1. If the Secured Indicator is No, then the excess collateral receivable is 0.

2. If the Secured Indicator is Y and the Gross Exposure are greater than or equal to 0, the application computes the excess collateral receivable as follows:

Where,

Adjusted collateral posted: Collateral posted by the bank less firm withdrawable collateral.

Firm withdrawable collateral: Collateral provided under re-hypothecation rights that can be contractually withdrawn by the bank within the LCR horizon without a significant penalty associated with such a withdrawal.

3. If the Secured Indicator is Y and the Gross Exposure are less than 0, the application computes the excess collateral receivable as follows:

The excess collateral receivable does not receive a pre-specified inflow rate from the regulator and is, therefore, excluded from the LCR calculations. However, the application computes this to a report.

This section details the calculation of downgrade impact amount for derivatives and for other liabilities.

Topics:

· Calculating Downgrade Impact Amount for Derivatives

· Calculating Downgrade Impact Amount for Other Liabilities

The application calculates the downgrade impact amount for derivatives if one of the following conditions are met.

1. If a downgrade trigger does not exist for the derivatives contract or netting agreement, the downgrade impact amount is 0.

2. If the Net Exposure is greater than 0, the downgrade impact amount is 0.

3. If the Net Exposure is less than or equal to 0, the downgrade impact amount is calculated as follows:

The application calculates the downgrade impact amount for other liabilities, including annuities, that have an associated downgrade, derivatives, if one of the following conditions are met.

1. If a downgrade trigger does not exist for the liability account, the downgrade impact amount is 0.

2. The downgrade impact amount for liabilities other than derivatives and securitizations is calculated as follows:

NOTE:

Any liability account that is triggered due to a particular level of rating downgrade has an outflow corresponding to a pre-specified percentage of the downgrade impact amount. For example, if a 3-notch downgrade is specified, then the downgrade impact amount will outflow only for those accounts that have a trigger of 1-notch, 2-notches, and 3-notches. If a 2-notch downgrade is specified, then the downgrade impact amount will outflow only for those accounts that have a trigger of 1-notch and 2-notches. The rating downgrade and the outflow percentage as specified by the regulator are part of the preconfigured business assumptions for LCR calculations.

This section details the cash flow netting calculations at the derivative contract level and netting agreement level.

Topics:

· Cash Flow Netting at Derivative Contract Level

· Cash Flow Netting at Netting Agreement Level

Cash flows from each derivative contract are netted as follows:

1. When cash inflows and outflows are denominated in the same currency and occur at the same time bucket, they are netted as follows:

a. The cash inflows and outflows are summed up and the net value is computed as follows:

b. If the net cash flow is positive and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash inflow.

2. When cash inflows and outflows are denominated in different currencies but settle within the same day, they are netted as follows:

a. The cash inflows and outflows are summed up after being converted to the reporting currency and the net value is computed.

b. If the net cash flow is positive and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash inflow.

3. When cash inflows and outflows are denominated in different currencies and do not settle within the same day, they are netted as follows:

a. The cash outflows from each derivative contract without an associated netting agreement are summed up and treated as net derivative cash outflows.

b. The cash inflows from each derivative contract without an associated netting agreement are summed up and treated as net derivative cash inflow.

NOTE:

If a derivative contract has a netting agreement associated with it, the cash flow is further netted across contracts at the netting agreement level.

For derivative contracts which have a netting agreement associated with them, the net cash flows computed at the derivative contract level are further netted across multiple contracts under the same netting agreement as follows:

1. For derivative contracts that belong to a single netting agreement, whose payment netting agreement flag is Yes, they are netted across multiple contracts under the same netting agreement as follows:

a. The cash inflows and outflows occurring in each time bucket, denominated in each currency, are summed up across all contracts whose payment netting agreement flag is Yes, and the net value is computed.

b. If the net cash flow is positive, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative, the value is treated as net derivative cash inflow.

2. For derivative contracts that belong to a single netting agreement, whose payment netting agreement flag is No, they are netted across multiple contracts under the same netting agreement as follows:

a. The cash outflows occurring in each time bucket, denominated in each currency, are summed up separately for each derivative contract whose payment netting agreement flag is No and treated as net derivative cash outflow.

b. The cash inflows occurring in each time bucket, denominated in each currency, are summed up separately for each derivative contract whose payment netting agreement flag is No and treated as net derivative cash inflow.

NOTE:

Cash flow netting for netting agreements is done separately for each currency. Cash flows are not netted across currencies. Instead, the inflows and outflows converted into the reporting currency are summed up separately to report the net derivatives cash inflow and net derivatives cash outflow at an entity level.

The application computes the 24-month look-back amount to define outflows due to increased liquidity needs, related to market valuation changes on derivatives, as follows:

· The Mark-to-Market (MTM) value of collateral outflows and inflows due to valuation changes on derivative transactions are captured at a legal entity level. The values over a 24-month historical time window from the “As of Date” are identified.

· The application computes the largest 30-day absolute net collateral flow occurring within each rolling 30-day historical time window as follows:

a. The net Mark-to-Market collateral change is computed for each day within a particular 30-day historical time window as follows:

b. The cumulative net Mark-to-Market collateral change is computed for each day within a particular 30-day historical time window as follows:

Where,

i: Each day within a particular 30-day historical time window

n: Each 30-day historical time window

c. The absolute net Mark-to-Market collateral change is computed for each day within the rolling 30-day historical time window as follows:

d. The largest 30-day absolute net collateral flow occurring within the rolling 30-day historical time window is identified as follows:

NOTE:

Steps (a) to (d) are repeated for each rolling 30-day historical time window.

e. The 24-month look-back amount is calculated as follows:

NOTE:

1. This calculation is done for each legal entity separately.

2. The largest 30-day absolute net collateral flow is computed in 30-day blocks on a rolling basis. For example, the first 30-day block is As of Date to As of Date - 29; the second 30-day block is As of Date - 1 to As of Date - 30 and so on.

3. The 24-month look-back amount is computed as the maximum of the largest absolute net collateral flow during all rolling 30-day periods in every 24 months.

The 24-month look-back calculations are illustrated in the following table considering a 34-day historical time window rather than 24-months. This results in five rolling 30-day windows.

Rolling 30-Day Period |

Day |

Mark-To-Market Collateral Outflows Due To Derivative Transaction Valuation Changes (a) |

Mark-To-Market Collateral Inflows Due To Derivative Transaction Valuation Changes (b) |

Net Mark-To-Market Collateral Change (c = a - b) |

Cumulative Net Mark-To-Market Collateral Change (d = Cumulative c) |

Absolute Net Mark-To-Market Collateral Change [e = Abs (d)] |

|---|---|---|---|---|---|---|

As of Date to As of Date - 29 |

As of Date |

65 |

14 |

51 |

51 |

51 |

As of Date - 1 |

65 |

9 |

56 |

107 |

107 |

|

As of Date - 2 |

74 |

83 |

-9 |

98 |

98 |

|

As of Date - 3 |

71 |

97 |

-26 |

72 |

72 |

|

As of Date - 4 |

84 |

89 |

-5 |

67 |

67 |

|

As of Date - 5 |

8 |

57 |

-49 |

18 |

18 |

|

As of Date - 6 |

40 |

59 |

-19 |

-1 |

1 |

|

As of Date - 7 |

42 |

87 |

-45 |

-46 |

46 |

|

As of Date - 8 |

100 |

6 |

94 |

48 |

48 |

|

As of Date - 9 |

41 |

30 |

11 |

59 |

59 |

|

As of Date - 10 |

45 |

9 |

36 |

95 |

95 |

|

As of Date - 11 |

9 |

32 |

-23 |

72 |

72 |

|

As of Date - 12 |

59 |

67 |

-8 |

64 |

64 |

|

As of Date - 13 |

61 |

10 |

51 |

115 |

115 |

|

As of Date - 14 |

22 |

36 |

-14 |

101 |

101 |

|

As of Date - 15 |

63 |

81 |

-18 |

83 |

83 |

|

As of Date - 16 |

36 |

3 |

33 |

116 |

116 |

|

As of Date - 17 |

61 |

22 |

39 |

155 |

155 |

|

As of Date - 18 |

94 |

37 |

57 |

212 |

212 |

|

As of Date - 19 |

3 |

18 |

-15 |

197 |

197 |

|

As of Date - 20 |

13 |

27 |

-14 |

183 |

183 |

|

As of Date - 21 |

24 |

56 |

-32 |

151 |

151 |

|

As of Date - 22 |

57 |

75 |

-18 |

133 |

133 |

|

As of Date - 23 |

66 |

87 |

-21 |

112 |

112 |

|

As of Date - 24 |

33 |

71 |

-38 |

74 |

74 |

|

As of Date - 25 |

29 |

30 |

-1 |

73 |

73 |

|

As of Date - 26 |

64 |

25 |

39 |

112 |

112 |

|

As of Date - 27 |

54 |

39 |

15 |

127 |

127 |

|

As of Date - 28 |

51 |

6 |

45 |

172 |

172 |

|

As of Date - 29 |

35 |

31 |

4 |

176 |

176 |

|

As of Date - 1 to As of Date - 30 |

As of Date - 1 |

65 |

9 |

56 |

56 |

56 |

As of Date - 2 |

74 |

83 |

-9 |

47 |

47 |

|

As of Date - 3 |

71 |

97 |

-26 |

21 |

21 |

|

As of Date - 4 |

84 |

89 |

-5 |

16 |

16 |

|

As of Date - 5 |

8 |

57 |

-49 |

-33 |

33 |

|

As of Date - 6 |

40 |

59 |

-19 |

-52 |

52 |

|

As of Date - 7 |

42 |

87 |

-45 |

-97 |

97 |

|

As of Date - 8 |

100 |

6 |

94 |

-3 |

3 |

|

As of Date - 9 |

41 |

30 |

11 |

8 |

8 |

|

As of Date - 10 |

45 |

9 |

36 |

44 |

44 |

|

As of Date - 11 |

9 |

32 |

-23 |

21 |

21 |

|

As of Date - 12 |

59 |

67 |

-8 |

13 |

13 |

|

As of Date - 13 |

61 |

10 |

51 |

64 |

64 |

|

As of Date - 14 |

22 |

36 |

-14 |

50 |

50 |

|

As of Date - 15 |

63 |

81 |

-18 |

32 |

32 |

|

As of Date - 16 |

36 |

3 |

33 |

65 |

65 |

|

As of Date - 17 |

61 |

22 |

39 |

104 |

104 |

|

As of Date - 18 |

94 |

37 |

57 |

161 |

161 |

|

As of Date - 19 |

3 |

18 |

-15 |

146 |

146 |

|

As of Date - 20 |

13 |

27 |

-14 |

132 |

132 |

|

As of Date - 21 |

24 |

56 |

-32 |

100 |

100 |

|

As of Date - 22 |

57 |

75 |

-18 |

82 |

82 |

|

As of Date - 23 |

66 |

87 |

-21 |

61 |

61 |

|

As of Date - 24 |

33 |

71 |

-38 |

23 |

23 |

|

As of Date - 25 |

29 |

30 |

-1 |

22 |

22 |

|

As of Date - 26 |

64 |

25 |

39 |

61 |

61 |

|

As of Date - 27 |

54 |

39 |

15 |

76 |

76 |

|

As of Date - 28 |

51 |

6 |

45 |

121 |

121 |

|

As of Date - 29 |

35 |

31 |

4 |

125 |

125 |

|

As of Date - 30 |

93 |

68 |

25 |

150 |

150 |

|

As of Date - 2 to As of Date - 31 |

As of Date - 2 |

74 |

83 |

-9 |

-9 |

9 |

As of Date - 3 |

71 |

97 |

-26 |

-35 |

35 |

|

As of Date - 4 |

84 |

89 |

-5 |

-40 |

40 |

|

As of Date - 5 |

8 |

57 |

-49 |

-89 |

89 |

|

As of Date - 6 |

40 |

59 |

-19 |

-108 |

108 |

|

As of Date - 7 |

42 |

87 |

-45 |

-153 |

153 |

|

As of Date - 8 |

100 |

6 |

94 |

-59 |

59 |

|

As of Date - 9 |

41 |

30 |

11 |

-48 |

48 |

|

As of Date - 10 |

45 |

9 |

36 |

-12 |

12 |

|

As of Date - 11 |

9 |

32 |

-23 |

-35 |

35 |

|

As of Date - 12 |

59 |

67 |

-8 |

-43 |

43 |

|

As of Date - 13 |

61 |

10 |

51 |

8 |

8 |

|

As of Date - 14 |

22 |

36 |

-14 |

-6 |

6 |

|

As of Date - 15 |

63 |

81 |

-18 |

-24 |

24 |

|

As of Date - 16 |

36 |

3 |

33 |

9 |

9 |

|

As of Date - 17 |

61 |

22 |

39 |

48 |

48 |

|

As of Date - 18 |

94 |

37 |

57 |

105 |

105 |

|

As of Date - 19 |

3 |

18 |

-15 |

90 |

90 |

|

As of Date - 20 |

13 |

27 |

-14 |

76 |

76 |

|

As of Date - 21 |

24 |

56 |

-32 |

44 |

44 |

|

As of Date - 22 |

57 |

75 |

-18 |

26 |

26 |

|

As of Date - 23 |

66 |

87 |

-21 |

5 |

5 |

|

As of Date - 24 |

33 |

71 |

-38 |

-33 |

33 |

|

As of Date - 25 |

29 |

30 |

-1 |

-34 |

34 |

|

As of Date - 26 |

64 |

25 |

39 |

5 |

5 |

|

As of Date - 27 |

54 |

39 |

15 |

20 |

20 |

|

As of Date - 28 |

51 |

6 |

45 |

65 |

65 |

|

As of Date - 29 |

35 |

31 |

4 |

69 |

69 |

|

As of Date - 30 |

93 |

68 |

25 |

94 |

94 |

|

As of Date - 31 |

51 |

97 |

-46 |

48 |

48 |

|

As of Date - 3 to As of Date - 32 |

As of Date - 3 |

71 |

97 |

-26 |

-26 |

26 |

As of Date - 4 |

84 |

89 |

-5 |

-31 |

31 |

|

As of Date - 5 |

8 |

57 |

-49 |

-80 |

80 |

|

As of Date - 6 |

40 |

59 |

-19 |

-99 |

99 |

|

As of Date - 7 |

42 |

87 |

-45 |

-144 |

144 |

|

As of Date - 8 |

100 |

6 |

94 |

-50 |

50 |

|

As of Date - 9 |

41 |

30 |

11 |

-39 |

39 |

|

As of Date - 10 |

45 |

9 |

36 |

-3 |

3 |

|

As of Date - 11 |

9 |

32 |

-23 |

-26 |

26 |

|

As of Date - 12 |

59 |

67 |

-8 |

-34 |

34 |

|

As of Date - 13 |

61 |

10 |

51 |

17 |

17 |

|

As of Date - 14 |

22 |

36 |

-14 |

3 |

3 |

|

As of Date - 15 |

63 |

81 |

-18 |

-15 |

15 |

|

As of Date - 16 |

36 |

3 |

33 |

18 |

18 |

|

As of Date - 17 |

61 |

22 |

39 |

57 |

57 |

|

As of Date - 18 |

94 |

37 |

57 |

114 |

114 |

|

As of Date - 19 |

3 |

18 |

-15 |

99 |

99 |

|

As of Date - 20 |

13 |

27 |

-14 |

85 |

85 |

|

As of Date - 21 |

24 |

56 |

-32 |

53 |

53 |

|

As of Date - 22 |

57 |

75 |

-18 |

35 |

35 |

|

As of Date - 23 |

66 |

87 |

-21 |

14 |

14 |

|

As of Date - 24 |

33 |

71 |

-38 |

-24 |

24 |

|

As of Date - 25 |

29 |

30 |

-1 |

-25 |

25 |

|

As of Date - 26 |

64 |

25 |

39 |

14 |

14 |

|

As of Date - 27 |

54 |

39 |

15 |

29 |

29 |

|

As of Date - 28 |

51 |

6 |

45 |

74 |

74 |

|

As of Date - 29 |

35 |

31 |

4 |

78 |

78 |

|

As of Date - 30 |

93 |

68 |

25 |

103 |

103 |

|

As of Date - 31 |

51 |

97 |

-46 |

57 |

57 |

|

As of Date - 32 |

12 |

31 |

-19 |

38 |

38 |

|

As of Date - 4 to As of Date - 33 |

As of Date - 4 |

84 |

89 |

-5 |

-5 |

5 |

As of Date - 5 |

8 |

57 |

-49 |

-54 |

54 |

|

As of Date - 6 |

40 |

59 |

-19 |

-73 |

73 |

|

As of Date - 7 |

42 |

87 |

-45 |

-118 |

118 |

|

As of Date - 8 |

100 |

6 |

94 |

-24 |

24 |

|

As of Date - 9 |

41 |

30 |

11 |

-13 |

13 |

|

As of Date - 10 |

45 |

9 |

36 |

23 |

23 |

|

As of Date - 11 |

9 |

32 |

-23 |

0 |

0 |

|

As of Date - 12 |

59 |

67 |

-8 |

-8 |

8 |

|

As of Date - 13 |

61 |

10 |

51 |

43 |

43 |

|

As of Date - 14 |

22 |

36 |

-14 |

29 |

29 |

|

As of Date - 15 |

63 |

81 |

-18 |

11 |

11 |

|

As of Date - 16 |

36 |

3 |

33 |

44 |

44 |

|

As of Date - 17 |

61 |

22 |

39 |

83 |

83 |

|

As of Date - 18 |

94 |

37 |

57 |

140 |

140 |

|

As of Date - 19 |

3 |

18 |

-15 |

125 |

125 |

|

As of Date - 20 |

13 |

27 |

-14 |

111 |

111 |

|

As of Date - 21 |

24 |

56 |

-32 |

79 |

79 |

|

As of Date - 22 |

57 |

75 |

-18 |

61 |

61 |

|

As of Date - 23 |

66 |

87 |

-21 |

40 |

40 |

|

As of Date - 24 |

33 |

71 |

-38 |

2 |

2 |

|

As of Date - 25 |

29 |

30 |

-1 |

1 |

1 |

|

As of Date - 26 |

64 |

25 |

39 |

40 |

40 |

|

As of Date - 27 |

54 |

39 |

15 |

55 |

55 |

|

As of Date - 28 |

51 |

6 |

45 |

100 |

100 |

|

As of Date - 29 |

35 |

31 |

4 |

104 |

104 |

|

As of Date - 30 |

93 |

68 |

25 |

129 |

129 |

|

As of Date - 31 |

51 |

97 |

-46 |

83 |

83 |

|

As of Date - 32 |

12 |

31 |

-19 |

64 |

64 |

|

As of Date - 33 |

34 |

36 |

-2 |

62 |

62 |

The largest 30-day absolute net collateral flow for each rolling 30-day period and the 24-month look-back value (in this example, the 34-day look-back value) is computed as follows:

Rolling 30-Day Period |

Largest 30-Day Absolute Net Collateral Flow [f = Max (e)] |

24 Month Look-back Value [Max (f)] |

|---|---|---|

As of Date to As of Date - 29 |

212 |

212 |

As of Date - 1 to As of Date - 30 |

161 |

|

As of Date - 2 to As of Date - 31 |

153 |

|

As of Date - 3 to As of Date - 32 |

144 |

|

As of Date - 4 to As of Date - 33 |

140 |

The regulator prescribed lower outflow rate for operational deposits should be applied only to the portion of the EOP balance that is truly held to meet operational needs. The application supports a new methodology to compute the operational portion of the EOP balance of operational deposits. The following steps are involved in computing the operational balance:

1. All deposits classified as operational as per regulatory guidelines are identified. This is a separate process in LRM.

2. The EOP balances of eligible operational accounts are obtained over a 90-day historical window including the As of Date , for example As of Date - 89 days. To identify historical observations, the f_reporting_flag must be updated as ‘Y’ for one execution of the Run per day in the LRM Run Management Execution Summary UI. The application looks up the balance for such accounts against the Run execution for which the Reporting Flag is updated as “Y” for each day in the past.

NOTE:

The historical time window is captured as a parameter in the SETUP_MASTER table. The default value is 90 days which can be modified by the user. To modify this value, update the value under the component code DAYS_HIST_OPER_BAL_CALC_UPD

3. A rolling 5-day average is calculated for each account over the historical window.

4. The average of the 5-day rolling averages computed in Step 3 is calculated.

5. The operational balance is calculated as follows:

NOTE:

The calculation of the operational balance can be either a direct download from the staging tables or through the historical balance approach.

NOTE:

The operational balance calculation based on historical lookback is optional. You can choose to compute the operational balances using this method or provide the value as a download. To provide the value as a download, update the value in the SETUP_MASTER table under the component code HIST_OPERATIONAL_BAL_CALC_UPD as N. If the value is ‘Y’ then the value would be calculated through historical balance approach.

6. The non-operational balance is calculated as follows:

7. The operational insured balance is calculated as follows:

The insured and uninsured balances are calculated as part of a separate process , for example the insurance allocation process which is explained in detail in the relevant section under each jurisdiction.

8. The operational uninsured balance is calculated as follows:

9. The non-operational insured balance is calculated as follows:

10. The non-operational uninsured balance is calculated as follows:

The operational deposit computation process is illustrated in the following table, assuming a 15-day historical window instead of 90-days and for the “As of Date” 28th February 2017. The historical balances for 15-days including the “As of Date” are provided as follows.

Clients With Operational Accounts |

Eligible Operational Accounts |

Historical Time Window |

As of Date |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/14/2017 |

2/15/2017 |

2/16/2017 |

2/17/2017 |

2/18/2017 |

2/19/2017 |

2/20/2017 |

2/21/2017 |

2/22/2017 |

2/23/2017 |

2/24/2017 |

2/25/2017 |

2/26/2017 |

2/27/2017 |

2/28/2017 |

||

A |

10001 |

102,000 |

102,125 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |

103,000 |

103,125 |

103,250 |

103,375 |

103,500 |

103,625 |

103,750 |

10296 |

23,500 |

23,550 |

23,600 |

23,650 |

23,700 |

23,750 |

23,800 |

23,850 |

23,900 |

23,950 |

24,000 |

24,050 |

24,100 |

24,150 |

24,200 |

|

B |

31652 |

65,877 |

59,259 |

59,234 |

59,209 |

59,184 |

59,159 |

59,134 |

59,109 |

59,084 |

59,059 |

59,034 |

59,009 |

58,984 |

58,959 |

58,934 |

11. The rolling averages and cumulative average are computed as follows:

Clients with Operational Accounts |

Eligible Operational Accounts |

5-day Rolling Average |

Cumulative Average (a) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/18/2017 |

2/19/2017 |

2/20/2017 |

2/21/2017 |

2/22/2017 |

2/23/2017 |

2/24/2017 |

2/25/2017 |

2/26/2017 |

2/27/2017 |

2/28/2017 |

|||

A |

10001 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |

103,000 |

103,125 |

103,250 |

103,375 |

103,500 |

95136 |

|

10296 |

23,600 |

23,650 |

23,700 |

23,750 |

23,800 |

23,850 |

23,900 |

23,950 |

24,000 |

24,050 |

24,100 |

22721 |

B |

31652 |

60,553 |

59,209 |

59,184 |

59,159 |

59,134 |

59,109 |

59,084 |

59,059 |

59,034 |

59,009 |

58,984 |

56931 |

12. The operational and non-operational balances are computed as follows:

Clients with Operational Accounts |

Eligible Operational Accounts |

Current Balance (b) |

Operational Balance (c = a - b) |

Non-Operational Balance |

Insured Balance |

Uninsured Balance |

Insured Operational Balance |

Uninsured Operational Balance |

Insured Non-Operational Balance |

Uninsured Non-Operational Balance |

|---|---|---|---|---|---|---|---|---|---|---|

A |

10001 |

103,750 |

95,136 |

8,615 |

100,000 |

3,750 |

95,136 |

|

4,865 |

3,750 |

10296 |

24,200 |

22,721 |

1,480 |

|

24,200 |

|

22,721 |

|

1,480 |

|

B |

31652 |

58,934 |

56,931 |

2,003 |

58,934 |

|

56,931 |

|

2,003 |

|

NOTE:

· Negative historical balances are replaced by zero for this computation.

· For operational accounts that have an account start date greater than or equal to historical days including the “As of Date”, missing balances are replaced by previously available balance.

· For operational accounts that have an account start date less than the historical days including the “As of Date”, the following occurs:

1. Missing balances between the account start date and “As of Date” are replaced by the previously available balance.

2. The rolling average is calculated only for the period from the account start date to the “As of Date”

· The methodology to compute operational balance is optional. This can be turned On or Off using the SETUP_MASTER table, where component code = HIST_OPERATIONAL_BAL_CALC_UPD. The option to provide the operational balance as a download is supported by the application.

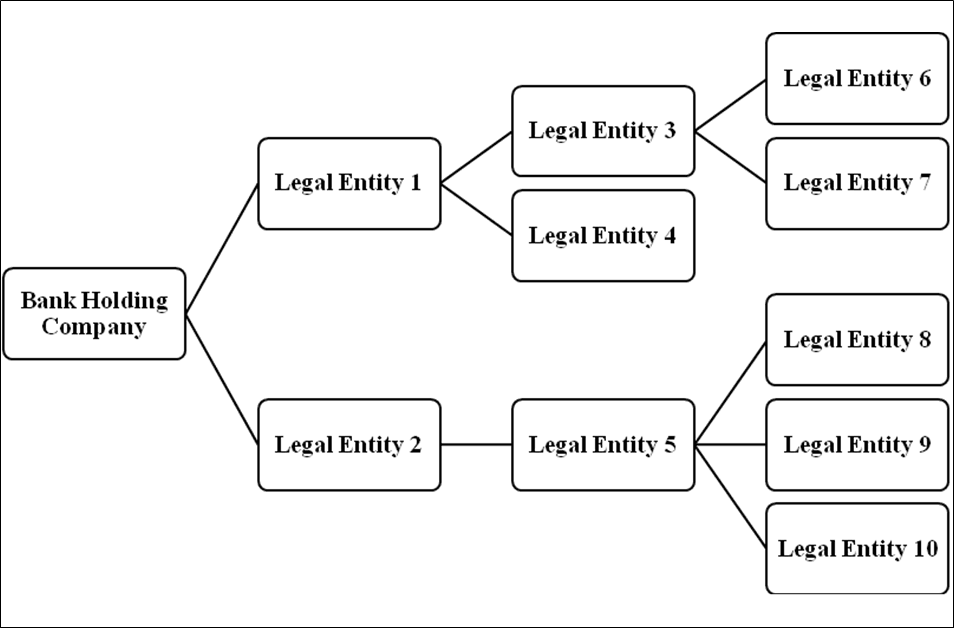

Regulators across jurisdictions recognize the existence of liquidity transfer restrictions, for banks that operate in multiple jurisdictions. Such transfer restrictions have implications for the group-wide consolidated LCR calculations and hence must be treated appropriately. In the LCR consolidation process, LRRCUSFR includes the restricted HQLA from a subsidiary in the consolidated stock of HQLA only to the extent of that subsidiary’s liquidity needs such as its net cash outflow, per the regulatory requirements. The treatment of transferability restriction during consolidation is as follows:

1. The net cash outflows are computed for a subsidiary, on a consolidated basis. The consolidation entity is the subsidiary itself in this case. If the subsidiary is a leaf level entity, then the net cash outflow is calculated on a standalone basis.

2. The restricted and unrestricted stock of Level 1, Level 2A and Level 2B is computed for the subsidiary on a consolidated basis. The application captures the HQLA transferability restriction at an account level through the flag F_TRANSFERABILITY_RESTRICTION.

3. The application checks whether the stock of restricted Level 1 assets is greater than the net cash outflows. If yes, it includes the stock of restricted Level 1 assets in the calculation of its immediate parent entity’s stock of HQLA up to the extent of its net cash outflows computed as part of step 1. If no, the entire stock of restricted Level 1 assets is included in the consolidated calculations.

4. The application checks whether the stock of restricted Level 1 + Level 2A assets is greater than the net cash outflows. If yes, it includes the stock of restricted Level 2A assets in the calculation of its immediate parent entity’s stock of HQLA up to the extent of its net cash outflows computed as part of step 1 less stock of restricted Level 1 asset. If no, the entire stock of restricted Level 2A assets is included in the consolidated calculations.

5. The application checks whether the stock of restricted Level 1 + Level 2A + Level 2B assets is greater than the net cash outflows. If yes, it includes the stock of restricted Level 2B assets in the calculation of its immediate parent entity’s stock of HQLA up to the extent of its net cash outflows computed as part of step 1 less stock of restricted Level 1 + Level 2A assets. If no, the entire stock of restricted Level 2B assets is included in the consolidated calculations.

6. The unrestricted Level 1, 2A, and 2B assets are included fully in the calculation of its immediate parent entity’s stock of HQLA.

7. Steps 1 to 6 are repeated for each sub-consolidation level within the organization structure of the consolidation entity until the consolidation entity itself.

NOTE:

1. The allocation of restricted assets is done in the descending order of asset quality to maximize the stock of HQLA.

2. This calculation is part of the LCR consolidation process. For a complete view of the process, see the Consolidation section.

Net cash outflow is derived from cash inflow and cash outflow.

NOTE:

· This section details the cash inflows and outflows that are included as part of the regulatory LCR computation as per US Federal Reserve requirements. The associated regulatory inflow and outflow rates to determine the cash flows are included in the denominator.

· The inflow and outflow rates are specified as part of the business assumption definition UI. You can define and maintain multiple business assumptions with different rates and can apply them to compute the LCR and other liquidity metrics under various scenarios.

This section includes information about cash flow exclusions.

Topics:

The following steps describe the cash flow computation.

1. Cash Inflow Exclusions

The US Federal Reserve explicitly excludes the following cash flows from the denominator of LCR/modified LCR:

a. The deposits held by the bank, at other banks, for its operational purposes, that is, the bank’s operational deposits.

b. Amounts that the bank would receive from derivative transactions due to forward sale of mortgage loans or any derivatives that are mortgage commitments or pipeline.

c. Undrawn amount of funding credit and liquidity lines received by the bank.

d. The fair value of any asset included in the bank’s stock of HQLA as well as any inflows received from or concerning such assets. For example, inflows received from HQLA assets maturing within 30 days.

e. Any cash flows from a non-performing asset or any asset that is expected to be non-performing within the LCR horizon.

f. Cash flows from any account that does not have a contractual maturity or from an account whose maturity date is beyond the liquidity horizon.

g. Any inflows or outflows from intragroup transactions are excluded. These include transactions between the following:

— The legal entity at the level of which consolidation is being carried out that is, consolidation level and its subsidiaries.

— Any two subsidiaries in the immediate organization structure of the consolidation level entity.

2. Net Derivative Cash Inflow

Net derivative cash flows refer to the cash inflows and outflows obtained from derivative contracts and their underlying collateral. These cash inflows include all payments that the bank is expected to receive from its counterparty as well as any collateral that is due to be received from the counterparty within the LCR horizon. If an ISDA master netting agreement is in place, then the payments and collateral due to the counterparty during the LCR horizon are off-set against the cash inflows. If the net exposure value is positive, it is considered a derivatives cash outflow and included in the outflow part of the denominator.

Such inflows and outflows are offset against each other at a netting agreement level provided the payment netting indicator is Yes.

The process of computing the derivative cash inflows and outflows is provided as follows:

a. The application checks if the payment netting indicator is Yes for a given netting agreement. If Yes, sum all cash outflows (negative cash flows) and inflows (positive cash flows) denominated in a particular currency, occurring on each date from the instruments which are part of a particular netting agreement and the underlying collateral.

— If the sum of cash flows is negative, then it is considered net derivative cash outflows.

— If the sum of cash flows is positive, then it is considered net derivative cash inflows.

b. The application checks if the payment netting indicator is No for a given netting agreement. If No, then

— Sum all cash outflows denominated in a particular currency, occurring on each date from the instruments which are part of a particular netting agreement and the underlying collateral. This is considered net derivative cash outflow.

— Sum all cash inflows denominated in a particular currency, occurring on each date from the instruments which are part of a particular netting agreement and the underlying collateral. This is considered net derivative cash inflow.

— The net derivative cash outflow at a legal entity level equals the sum of all derivative cash outflows computed in step 1(a) and 2(a).

— The net derivative cash outflow at a legal entity level equals the sum of all derivative cash outflows computed in step 1(b) and 2(b).

3. Retail Cash Inflow Amount

The cash inflows from retail customers or counterparties include contractually payable amounts multiplied by the regulator-specified inflow rate.

4. Unsecured Wholesale Cash Inflow Amount

Unsecured wholesale cash inflows include amounts contractually due from wholesale customers or counterparties, regulated and non-regulated financial companies, investment companies, non-regulated funds, pension funds, investment advisers, or identified companies, or from a consolidated subsidiary of any of the foregoing, or central banks.

5. Securities Cash Inflow Amount

The contractual payments due to the bank from non-HQLA securities that it owns are included as part of cash inflows.

6. Secured Lending and Asset Exchange Cash Flows

Inflows from secured lending transactions maturing within the LCR horizon are based on the collateral securing such transactions. The inflow rates increase in inverse proportion to the quality of the collateral and are related to the liquidity haircuts specified for such assets.

Inflows from asset exchanges are determined based on the difference between the quality of the assets received and posted. If the assets to be posted by the bank to the counterparty at the maturity of the transaction are of lower quality than the assets that will be received from the counterparty, such asset exchanges result in cash inflows to the bank.

The inflow and outflow rates are specified as part of the business assumptions UI.

7. Segregated Account Inflow Amount

A Covered Company’s broker-dealer segregated account inflow amount is the fair value of all assets released from broker-dealer segregated accounts maintained per statutory or regulatory requirements for the protection of customer trading assets, provided that the calculation of the broker-dealer segregated account inflow amount, for any transaction affecting the calculation of the segregated balance (as required by applicable law), is consistent with the following:

§ In calculating the broker-dealer segregated account inflow amount, the covered company must calculate the fair value of the required balance of the customer reserve account as of 30 calendar days from the calculation date by assuming that customer cash and collateral positions is changed consistent with the outflow and inflow calculations.

§ If the fair value of the required balance of the customer reserve account as of 30 calendar days from the calculation date, as calculated consistent with the outflow and inflow calculations, is less than the fair value of the required balance as of the calculation date, the difference is the segregated account inflow amount.

§ If the fair value of the required balance of the customer reserve account as of 30 calendar days from the calculation date, as calculated consistent with the outflow and inflow.

8. Other Cash Inflow Amounts

A Covered Company’s inflow amount as of the calculation date includes zero percent of other cash inflow amounts which are other than the inflows included in the following: Excluded Amount for Intragroup Transactions

The inflow amounts mentioned do not include amounts arising out of transactions between the following:

§ The Bank and a consolidated subsidiary of the bank; or

§ A consolidated subsidiary of the bank and another consolidated subsidiary of the bank.

All intragroup transactions mentioned above are eliminated to compute the Inflow Amount.

The cash outflow calculation process is explained as follows:

1. Retail Funding Outflow

The retail funding outflow amount includes outflows concerning deposits and other unsecured funding from retail customers, regardless of the maturity of the transaction. These exclude brokered deposits. Retail funding is further classified as stable and less stable based on the regulatory guidelines and receives run-off rates based on this classification. See the Deposit Stability Identification section for details.

· Classifying small business customers as retail customers

A business customer is treated as a retail customer if the following conditions are met:

§ The banks manage its transactions with the business customer, including deposits, unsecured funding, and credit facility and liquidity facility transactions, in the same way, it manages its transactions with individuals;