Setting Up Calculation Rules

To set up calculation rules, use the Calculation Rules Table (CALC_RULES_TABLE) component.

This section provides an overview of calculation rules and discusses how to define calculation rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CALC_RULES_TABLE |

Define calculation rules by specifying salary, age, and service as of dates, as well as coverage, calculation, and rounding options for the rule. |

You use calculation rules to define how deductions are calculated for each benefit plan. Calculation rules relate only to rate-based plans or plans that require a compensation base, not a coverage base. When determining calculation rules, you need to understand:

Compensation base versus annual benefits base rate.

(USF) Compensation base.

As-of dates.

Compensation Base Versus Annual Benefits Base Rate

Calculation rules use an employee's compensation as part of the definitions. If you are going to base the employee's compensation on an amount other than the employee's regular compensation rate, you can enter an amount in the Annual Benefits Base Rate field on the Compensation page of the Job Data component.

The term Base Benefits is a generic reference to the compensation to be used, whether it is the annual compensation rate on the employee's job record or an alternate annual benefit base rate, and whether it is a single rate from a single job record or an aggregate across multiple jobs.

If a calculation rule specifies that the ABBR should be used, but the employee has not been assigned an ABBR, the system uses the employee's regular compensation rate instead.

(USF) Compensation Base

The compensation base is set through the Personnel Action Request (PAR) process. You can:

Use the adjusted regular compensation amount provided in the Expected Pay page, accessed from the Compensation Data page of the PAR component. The regular compensation amount is the base pay for the employee's compensation frequency with locality or LEO (law enforcement officer) adjustments.

Override the FEGLI base rate.

The system uses the regular adjusted compensation amount for benefit processing. The exception to this rule is FEGLI plans: you can have the system use a different base rate when processing FEGLI plans by overriding the FEGLI base. The FEGLI base mirrors the quoted total pay until it is overridden.

As-Of Dates

The Calculation Rules Table has several as-of-date rules that you can define to control the calculation of age, service, and benefits base. These rules give flexibility in defining the reference date the system uses for interval calculations, such as age and service, or flexibility in the determination of the effective date when retrieving the base compensation data. The following rules are available:

As of the current pay run's pay-end date (or as of the current processing date for those applications that are not based on pay runs.)

As of the current pay run's check issue date.

As of a specific month and day for the current year. This is often used to freeze compensation at the point of open enrollment, typically 01/01 of the year, or to prevent unexpected midyear changes due to temporal events.

As of a specific month and day for the previous year.

The Age As-Of rule has the following additional options:

As of the next pay run's pay end date. This is mainly used by USF users to protect age from changing mid pay-period.

As of date of the original enrollment in a benefit plan, date of first uninterrupted enrollment. This is mainly used by long-term care plans, for which costs are fixed at the point of enrollment.

If you use Multiple Jobs functionality, you must also tell the system which jobs to use when calculating the employee's earnings.

Use the Calculation Rules Table page (CALC_RULES_TABLE) to define calculation rules by specifying salary, age, and service as of dates, as well as coverage, calculation, and rounding options for the rule.

Navigation

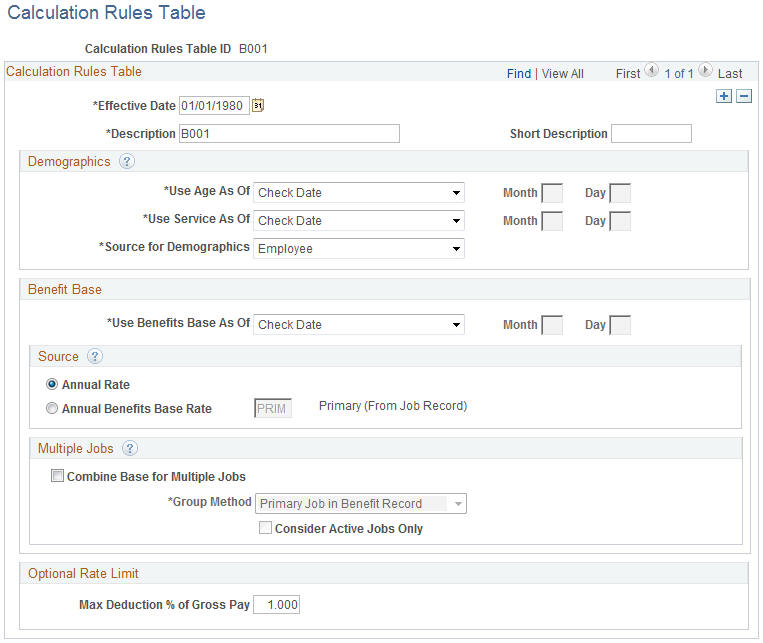

Image: Calculation Rules Table page

This example illustrates the fields and controls on the Calculation Rules Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Effective Date |

Must be the same as or prior to the effective dates of the one or more benefit program and benefit plan combinations that you associate the calculation rules with. |

Demographics

|

Field or Control |

Definition |

|---|---|

| Use Age As Of |

Used to calculate rates for life plans that you associate with age-graded rates. |

| Use Service As Of |

Used to calculate rates for plans that you base on months of service. |

| Source for Demographics |

Designate whose personal information to use. Values are:.

If the system cannot locate a birth date for a dependent or spouse, it generates a warning that a birth date was not located and uses the employee's age instead, while still retaining the dependent's sex and smoker status. |

Benefit Base

|

Field or Control |

Definition |

|---|---|

| Use Benefits Base As Of |

Enter the date to use when retrieving the employee's salary if the system needs to use an employee's salary to determine a rate (for example, a compensation-banded rate table or a percent-of-salary rate table). |

Source

|

Field or Control |

Definition |

|---|---|

| Annual Rate |

Select to make calculations using the regular compensation base entered on the Job Data - Compensation page. |

| Annual Benefits Base Rate |

Select to make calculations using an annual benefit base rate (ABBR.) The ABBR selected can be either the primary ABBR found on the Job Data - Benefit Program Participation page or any alternate ABBR from the ABBR Update page. Note: Set a maximum benefits base rate by assigning each employee an ABBR that is not higher than the desired maximum. Note: For federal users, ABBR corresponds to the Total Pay field on the Expected Pay page of the PAR Compensation Data component. |

Multiple Jobs

|

Field or Control |

Definition |

|---|---|

| Combine Base for Multiple Jobs |

Select if you want to aggregate salary from multiple jobs as a basis for a rate determination. Selecting this rule activates the Group Method options. |

| Group Method |

If you selected Combine Base for Multi Jobs, select the group method to use for selecting jobs to contribute to the total benefit base. Choose from:

|

| Consider Active Jobs Only |

If you selected Combine Salary for Multi Jobs, select this option to have the system look only at jobs with a status of Active in the Job Data components. |

Optional Rate Limit

|

Field or Control |

Definition |

|---|---|

| Max Deduction % of Gross Pay (maximum deduction percentage of gross pay) |

If you have employees in Hawaii, state laws mandate that employers charge no more than 1.5% of gross wages for employee-only coverage. Use this field to establish a calculation rule with the maximum deduction percent of gross pay set to a value of 1.5 or lower. This rule will be attached to the cost row of the benefit plan coverage code associated with employee-only coverage. This deduction calculation is performed when:

The maximum deduction percent of gross pay calculation looks like this: Deduction = (Max Percent of Gross Pay) × (Federal Taxable Gross Pay) ÷ 100. The smaller deduction appears on the paycheck. |