Setting Up Retroactive Benefits and Deductions

This section lists prerequisites and discusses how to set up retroactive benefits and deductions using the Retro Ben/Ded Program (RETRO_DED_TABLE) and Retro Ben/Ded Mass Request (RETRODED_MASS_RQST) components.

To set up retroactive benefits and deductions, you:

Activate retroactive benefits and deductions on the Installation page.

Define retroactive benefits and deductions programs.

If you are creating mass requests, define the retroactive benefit deduction selection criteria.

The Retroactive Benefit and Deduction Mass Request feature enables you to create a large number of requests using a batch process. This is necessary when you retroactively update system-level pages that affect multiple employees. Changes to the following system-level pages could generate mass retroactive benefit and deduction requests:

Deduction Table.

General Deduction Table.

Most benefit plan design tables (such as the Life and AD/D Plan Table).

Calculation Rules Table.

All rate tables.

Note: Because the Retroactive Benefit and Deduction feature involves PeopleSoft Payroll for North America processes in the calculation of retroactive benefits and deductions and the loading of retroactive benefit and deduction totals to payroll, it is unavailable to those users who do not currently implement Payroll for North America

Deductions based on earnings (such as garnishments or savings plan deductions) are not included in the retroactive benefits and deductions process. They are handled as part of the Payroll for North America adjustment process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RETRODED_PGM_TBL |

Define high-level information for your organization's retroactive benefit and deduction programs. |

|

|

RETRODED_MASS_RQST |

Set up your mass retroactive benefit and deduction programs by assigning them a Mass Retro Request ID and by defining detailed information. To set up a new mass retroactive deduction and benefit program, enter a Mass Retro Request ID to open the page. The system uses the Mass Retro Request ID to generate mass retroactive benefit and deduction requests and to calculate the retroactive benefit and deduction earnings based on those requests. |

Before you can define retroactive benefits and deduction programs, you must:

Activate retroactive benefits and deductions on the Installation table.

Set up core tables and benefit plans.

See Setting Up Implementation Defaults.

See Understanding the Core Tables for PeopleSoft Manage Base Benefits.

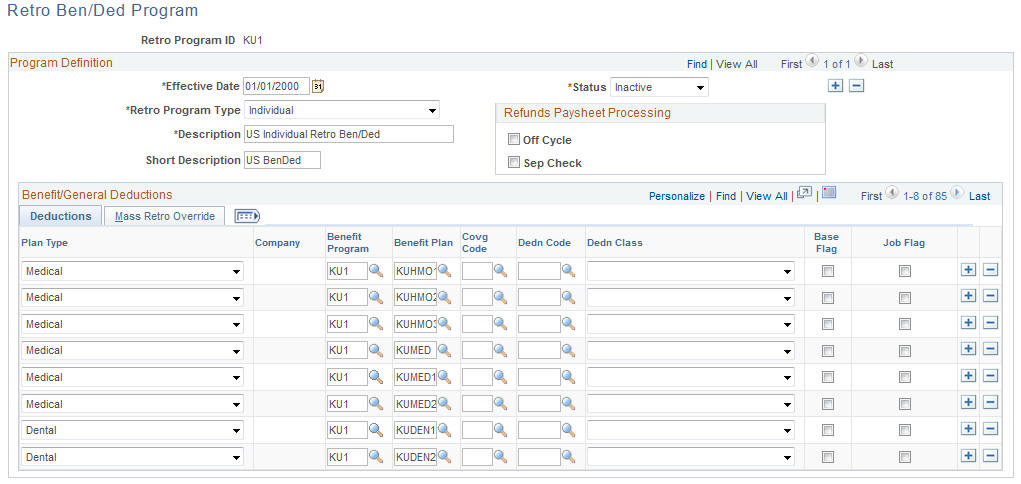

Use the Retro Ben/Ded Program (retroactive benefit/deduction program) page (RETRODED_PGM_TBL) to define high-level information for your organization's retroactive benefit and deduction programs.

Navigation

Image: Retro Ben/Ded Program page

This example illustrates the fields and controls on the Retro Ben/Ded Program page. You can find definitions for the fields and controls later on this page.

Program Definition

|

Field or Control |

Definition |

|---|---|

| Retro Program ID (retroactive program identification) |

When you first select this page from the menu, enter a new or current Retro Program ID. This ID links the retroactive benefit and deduction requests to a specific retroactive benefit and deduction program, which helps the system identify which benefits or deductions are eligible for retroactive processing. |

| Retro Program Type (retroactive program type) |

The system assigns each retroactive benefit and deduction program a Retro Program type of Individual or Mass. Individual programs apply to all of the employees and companies in your database; therefore, define only one individual program for that database. Mass programs apply to different groups of employees; therefore, you can define multiple mass programs with different Retro Program IDs for the same database. |

Warning! If you change the Retro Program ID after retroactive benefit and deduction processing begins, improper retroactive benefit and deduction calculations will result.

Refunds Paysheet Processing

|

Field or Control |

Definition |

|---|---|

| Off Cycle |

This check box enables you to manage your onetime deduction refunds. In the event of a refund, the Off-Cycle field controls whether the retroactive benefit and deduction calculation program will create new onetime deduction refunds as an off-cycle deduction or an on-cycle deduction. Generally, use off-cycle or separate check processing of retroactive benefits and deductions only when you are processing retroactive pay in the same cycle as regular pay. If you select Off-Cycle, the system treats each retroactive deduction associated with this program as an off-cycle onetime deduction refund, and delivers the refunds to your employees in checks that are separate from their regular paychecks. If you do not select Off-Cycle, the system treats the retroactive deductions associated with the program as on-cycle deductions and combines employee refunds with their regular paychecks. Note: When you load your retroactive benefits or deductions to employee paysheets, the On-Cycle or Off-Cycle selection for the Retro Ben/Ded Payroll Load run control must match the On-Cycle or Off-Cycle selection for this field. |

| Sep Check (separate check) |

Select to indicate that the onetime deduction refund records associated with the retroactive benefit or deduction will be loaded to a separate check on the employee paysheets. |

Deductions Tab

|

Field or Control |

Definition |

|---|---|

| Base Flag |

Select to have the system process retroactive benefits or deductions when the request is triggered by a change in the annual benefits base rate. |

| Job Flag |

Select to have the system process retroactive benefits or deductions for individual retroactive benefit and deduction programs when the request is triggered by a change in the compensation rate or any of its related fields. |

Mass Retro Override Tab

If you are setting up a mass retroactive benefit and deduction program, complete the Start Date Ovrd for Mass Retro (start date override for mass retroactive benefit/deduction) and End Date Ovrd for Mass Retro (end date override for mass retroactive benefit/deduction) fields to override the process start date and process end date for the requests that are created.

Refunds Versus Deductions

The system loads refunds to employee paysheets only. In situations in which the retroactive benefit and deduction process finds that employees owe additional payments, the system collects these funds through the PeopleSoft Payroll for North America arrears adjustment process. The system drops all employee retroactive benefits and deductions into the arrears balance using arrears adjustments. If enough money is available, the system collects the amounts during the current payroll run, according to the arrears rules that you defined for that deduction.

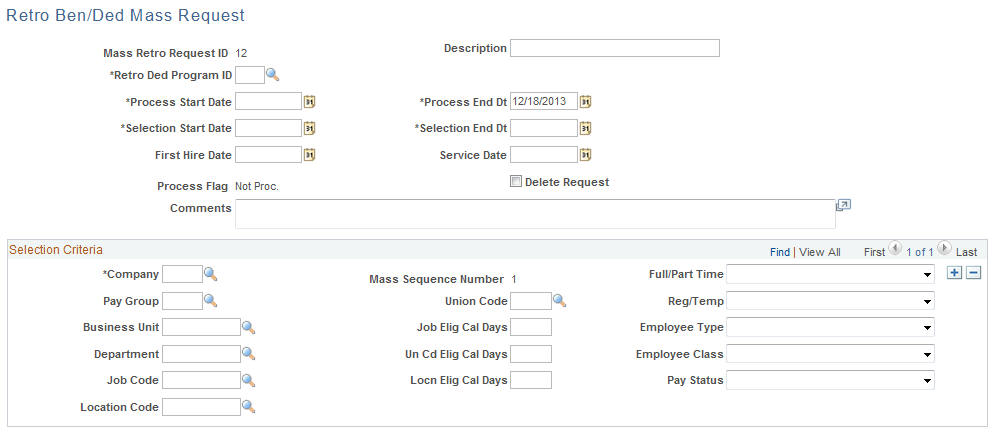

Use the Retro Ben/Ded Mass Request (retroactive benefit/deduction mass request) page (RETRODED_MASS_RQST) to set up your mass retroactive benefit and deduction programs by assigning them a Mass Retro Request ID and by defining detailed information.

To set up a new mass retroactive deduction and benefit program, enter a Mass Retro Request ID to open the page. The system uses the Mass Retro Request ID to generate mass retroactive benefit and deduction requests and to calculate the retroactive benefit and deduction earnings based on those requests.

Navigation

Image: Retro Ben/Ded Mass Request

This example illustrates the fields and controls on the Retro Ben/Ded Mass Request. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Description |

Enter a description that explains the purpose of this mass retroactive benefit and deduction ID. |

| Retro Ded Program ID (retroactive deduction benefit/deduction program ID) |

Select an appropriate ID from the list. Only those retroactive benefit and deduction programs defined for Mass processing appear. |

| Process Start Date and Process End Dt (process end date) |

Define the period during which the mass request calculates retroactive benefits or deductions. The process end date is automatically set to today's date when a new mass request ID is created. The process start date becomes the effective date of the generated requests, except for cases in which the selected employee begins to meet the criteria at some point after the start date, in which case that latter date is used as the effective date of the request. |

| Selection Start Date and Selection End Dt (selection end date) |

During the processing period set up by the process start and end dates, the system searches employee records that are active between the selection start and selection end dates for the information specified in the Selection Criteria group box. |

| First Hire Date |

(Optional) Use to select employees who have a hire date on the Employment Table that is before or equal to this date. If this field is blank, the system creates requests for employees who have a hire date before or equal to the selection end date. |

| Service Date |

Functions the same way as the Hire Date field except that it refers back to the Employment Table's Service Date field. |

| Delete Request |

Use this check box to stop the mass retro benefit and deduction process if you have not yet run the calculation process for your Mass Retro ID. When you run the Mass Retro batch process, it deletes every Mass Request ID and related request that has this check box selected and has not yet been through the calculation process. |

| Comments |

Describe the need for the particular mass retroactive benefit and deduction program that you are creating. |

Selection Criteria

The fields in this group box define the types of employees that the Mass Retro batch process looks for. You can set up multiple rows of selection criteria for your mass retroactive benefit and deduction program to open up a new one.

|

Field or Control |

Definition |

|---|---|

| Company |

Use this required field to indicate the company whose employees you want to process. You can have multiple rows of selection criteria with the same company if you want to change the values of the other fields. |

| Mass Sequence Number |

Each time that you enter a new row of selection criteria, the mass sequence number will be incriminated by one. |

| Business Unit |

You must define a business unit before entering Department, Job Code, and Location Code values. |

| Department, Job Code, and Location Code |

These fields are linked to the Business Unit field. |

| Reg/Temp (regular/temporary), Full/Part Time, Employee Type, Employee Class, and Pay Status |

(Optional) Specify additional selection criteria using valid values from the list boxes. |

Enter the other selection criteria as necessary. Values for all selection criteria fields that are blank will be selected by the system. If you want to use more than one of the available values of a particular field in your selection request, enter an additional row.

The three Elig Cal Days (eligible calculation days) fields are linked to the Job Code, Location Code, and Union Code fields. They each enable you to create selection requests for employees who have been assigned a specific job code, location, or union code for a specific number of days. For each Elig Cal Days field, the system looks at the effective date of the selected job record.