Building Benefit Programs with the Benefit Program Table

To set up benefit programs for automation, use the Benefit Program Table (BEN_PROG_DEFN) component.

This section provides an overview of building benefit programs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BEN_PROG_DEFN1 |

Define benefit program information. |

|

|

BEN_PROG_DEFN2 |

Set up plan types and options for the benefit program and add important information about plan types, including event and eligibility rules. |

|

|

BEN_PROG_DEFN3 |

Calculate costs and credits by linking rate and calculation rules to a benefit program and plan type. |

|

|

Benefit Program/Plan/Options |

RUNCTL_BAS_PGM |

For a specified benefit program, print program-level information (effective date and status, program type, age criteria, COBRA, FMLA, and FSA parameters, and self-service configuration) along with the plan-level and option-level structure (event rules, eligibility rules, coverage levels, and deduction codes). |

|

Benefit Program Costs |

RUNCTL_BAS_PGM |

For a specified benefit program, print the program description along with the cost and credit structure for all of the offered options (deduction and earnings codes, rate information, and calculation rules). |

Building benefit programs through PeopleSoft Benefits Administration is the same process as with the base benefit process. When you create a benefit program through Benefits Administration, the program type will be Automated and a number of fields will be available for use that would otherwise (in the case of a Manual benefit program) be closed to the entry of data.

Important! If you're planning to set up an automated benefit program that will be used for automatic benefits eligibility and enrollment processing, you must go to the Installation Table - Products page and select Benefits Administration before creating the program. You can't create an automated benefits program until Benefits Administration is selected.

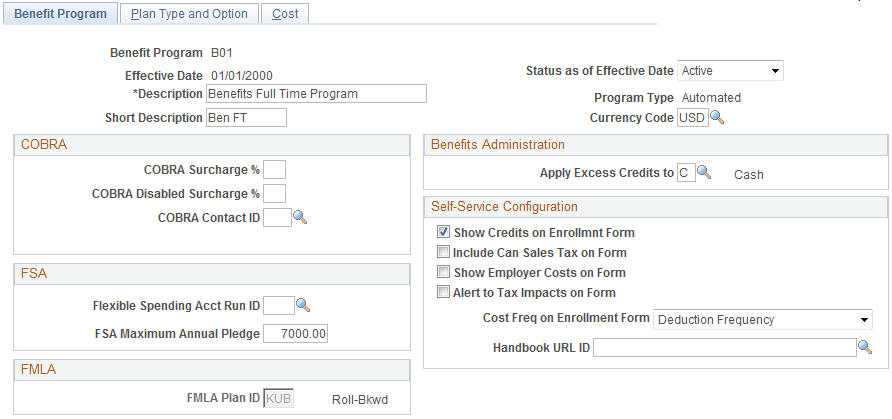

Use the Benefit Program Table - Benefit Program page (BEN_PROG_DEFN1) to define benefit program information.

Navigation

Image: Benefit Program Table - Benefit Program page

This example illustrates the fields and controls on the Benefit Program Table - Benefit Program page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Effective Date |

The date the row in the table becomes effective. This date determines when you can view and change information. |

| Status as of Effective Date |

Indicates whether a row in the table is Active or Inactive. Processes ignore benefit programs designated as Inactive, even if the effective date defines the program as current. |

| Program Type |

The type of program can be Manual or Automated. If you are using only the Manage Base Benefits business process, this option is automatically set to Manual. If you activate Benefits Administration on the Installation Table, it is automatically set to Automated. |

| Currency Code |

The type of currency that is used for this program's benefit and deduction calculations. |

COBRA

This group box defines the rules regarding the surcharge amounts that your organization imposes on COBRA (Consolidate Omnibus Budget Reconciliation Act) plans.

|

Field or Control |

Definition |

|---|---|

| COBRA Surcharge % (COBRA surcharge percentage) |

Enter the percentage amount of the benefit cost that you want added to the benefit cost. For example, if the cost of medical coverage is 100 USD and the COBRA surcharge % is 30%, the cost for medical coverage for someone on COBRA would be 130 USD. |

| COBRA Disabled Surcharge % (COBRA disabled surcharge percentage) |

If you want a different percentage amount for a disabled person, enter that percentage amount. If you leave the field blank, the surcharge amount entered in the COBRA Surcharge % field will be applied to a disabled person with COBRA coverage. |

FSA

For FSA (flexible spending account) Administration users. Use this group box to set up your organization's business rules for flexible spending accounts.

|

Field or Control |

Definition |

|---|---|

| Flexible Spending Acct Run ID (flexible spending account run ID) |

For FSA Administration users. Enter the FSA run ID that you created on the FSA Run Table. |

| FSA Maximum Annual Pledge |

Enter the maximum amount that an employee can contribute across all flexible spending accounts within the Benefit Program for a plan year. |

FMLA

Use this group box to define the rules for processing under FMLA (Family Medical Leave Act).

|

Field or Control |

Definition |

|---|---|

| FMLA Plan ID (FMLA plan identification) |

Enter the FMLA plan ID that you created on the FMLA Plan Table. |

Benefits Administration

This group box is available if Benefits Administration is activated on the Installation Table. If you are using flexible credits, it is used to define how the system will process excess flexible credit amounts when an employee does not designate a rollover election during benefit enrollment.

|

Field or Control |

Definition |

|---|---|

| Apply Excess Credits to |

The system can convert excess flexible credit amounts to: C (Cash) D (FSA-Dependent Care) F (Forfeit Excess Credit) H (FSA-Health Care) R (FSA Retirement Counseling) S (Savings-401(k)) |

Self-Service Configuration

Use this group box to define the rules for displaying and processing the PeopleSoft Benefits Self Service application pages.

|

Field or Control |

Definition |

|---|---|

| Show Credits on Enrollmnt Form (show credits on enrollment form) |

Select if you want credit amounts to appear on the enrollment form. If you do not offer flexible credits, you may not want this heading to appear on the form. |

| Include Can Sales Tax on Form (include Canadian sales tax on form) |

Select if you want Canadian sales tax information to appear on the Benefits Self Service Enrollment Summary page. |

| Show Employer Costs on Form |

Select to display the employer's contributions (costs) on the enrollment form |

| Alert to Tax Impacts on Form |

Select to alert the employee to any potential tax impacts (due to the employer's contributions) on the enrollment form. Most typically, this would be if a T-Tax (imputed income) component existed. |

| Cost Freq on Enrollment Form (cost frequency on enrollment form) |

This defines how the cost of the benefits appears on the enrollment form. Values are Annual: Displays the costs as annual amounts. Deduction: Displays the costs as per-pay-period amounts. |

| Handbook URL ID (handbook uniform resource locator identification) |

Enter the URL ID that connects to your benefit handbook. URL IDs are set up in the URL Table. Note: The URL entered in this field displays as a link in the Resources group box in the fluid Benefits Enrollment page. Only one handbook can be assigned per benefit program. |

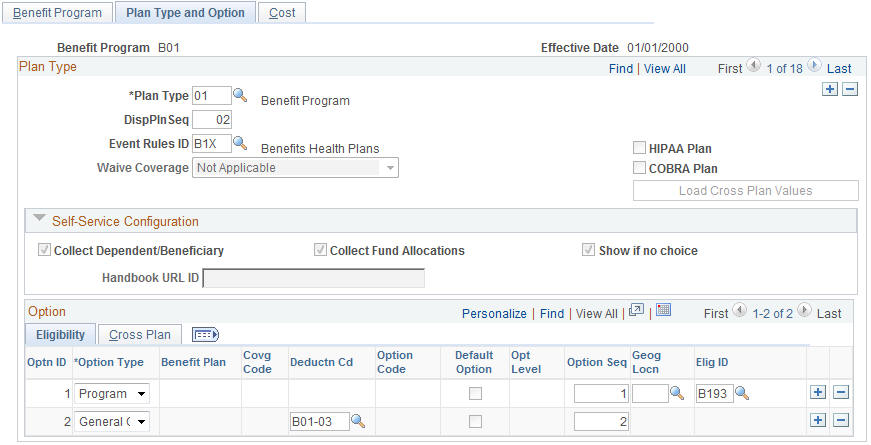

Use the Benefit Program Table - Plan Type and Option page (BEN_PROG_DEFN2) to set up plan types and options for the benefit program and add important information about plan types, including event and eligibility rules.

Navigation

Image: Benefit Program Table - Plan Type and Option page

This example illustrates the fields and controls on the Benefit Program Table - Plan Type and Option page. You can find definitions for the fields and controls later on this page.

Use this page to set up the basic plan types for your benefit program.

Use the Self-Service Configuration group box to define the rules for displaying enrollment and plan information on the fluid Benefits plan type pages.

|

Field or Control |

Definition |

|---|---|

| Collect Dependent/Beneficiary |

Select this check box when you want the system to collect information pertaining to dependents and benefits and display that information on the fluid Benefit Summary and the plan enrollment pages. This works in conjunction with the Ignore Dep/Ben Edits check box on the Event Rules page. |

| Collect Fund Allocations |

When this check box is selected, the system collects the information pertaining to savings plans and displays that information on the fluid Benefit Summary and the plan enrollment pages. |

| Show if no choice |

This check box controls whether a plan type appears on the enrollment when the employee has no option to choose and cannot waive out of the option. A good example is paid vacation. Employees receive the benefit, but you don't display it on the enrollment form. If the check box is selected, the system displays the plan type in the enrollment form summary. When the check box is deselected, the system will not display the plan type. This setting is not relevant to 6x plans (flexible spending accounts) and 9x plans (vacation buy/sell), which are always shown in self-service. |

| Handbook URL |

If you have a special handbook for this plan type, you can enter the URL ID. URL IDs are set up in the URL Table. |

This table displays the field requirements for the Plan Type level of the Plan Type and Option page for the Benefit Program row (Plan Type 01) and the Benefit Plan rows (Plan Types 1x-9x):

|

Field |

Values |

Values |

Values |

|---|---|---|---|

|

Plan Type |

01 |

1-5x, 7-9x |

6x |

|

Display Sequence |

Required; default is Plan Type. Must be unique within the benefit program. |

Required; default is Plan Type. Must be unique within the benefit program. |

Required; default is Plan Type. Must be unique within the benefit program. |

|

Event Rules ID |

Required |

Required |

Required |

|

Waive Coverage |

Not available for selection |

Allowed, but default is N (not allowed). |

Allowed, but default is N (not allowed). |

After you set up a plan type on the Plan Type and Option page, select the plan options that you want to associate with the plan type.

Associating Plan Options with Plan Types

Use the Benefit Program Table - Plan Type and Option page and the Eligibility tab in the Option group box to set up the options within a plan type.

When you create a new option row by clicking the Insert Row button, the system automatically assigns the option a unique option ID value. You cannot update this value.

The first value that you enter for a new option row is the option type. Select from one of the following valid values:

|

Values |

Plan Type |

|---|---|

|

P (program) |

Required for automated benefit programs. It is allowed for the Benefit Program row (plan type 01) only, and only one is allowed per benefit program. |

|

G (general credit) |

Optional, allowed for most plan types except 4x–9x. Only one is allowed per plan type. |

|

O (option) |

At least one is required per plan type except for the Benefit Program row (plan type 01), where it is not allowed. |

|

W (waive) |

Only one is allowed per plan type. It follows the waive coverage rule setup at the plan-type level. |

Note: The manner in which you complete the rest of a given option row depends on the plan type to which the row belongs and the option type of that row.

Field Requirements for the Option Grid by Plan and Option Type

This table describes field requirements for the Option Grid by Plan and Option type:

|

Field |

Values |

Values |

Values |

Values |

|---|---|---|---|---|

|

Plan Type |

01 |

01−3x |

1x−9x |

1x−9x |

|

Option Type |

P - Program |

G - General Credit |

W - Waive Controlled by waive coverage. |

O - Option |

|

Benefit Plan |

Not allowed |

Required for plan types 2x−3x. |

Required for plan types 2x−3x, when you want a credit for the waive election. Not allowed for other plan types. |

Required |

|

Covg Code (coverage code) |

Not allowed |

Not allowed |

Not allowed |

Required for plan type 1x. Not allowed for other plan types. |

|

Deductn Code (deduction code) |

Not allowed |

Required |

Required for plan types 1x−3x if you want a credit for the waive election. Not allowed for other plan types. |

Required |

|

Option Code |

Not allowed |

Not allowed |

Required |

Required |

|

Default Option |

Not allowed |

Not allowed |

Allowed |

Allowed for plan types 1x−3x, 5x, 7x, and 8x. For 2x, you cannot define options that require coverage to be specified at the employee level as default options. Only the Waive option is allowed as the default for plan types 4x, 6x, and 9x. Options requiring proof are not allowed as defaults. |

|

Opt Level (option level) |

Not allowed |

Not allowed |

Not allowed |

Required |

|

Option Seq (option sequence) |

Required |

Required |

Required |

Required |

|

Geog Locn (geographic location) |

Allowed |

Not allowed |

Not allowed |

Allowed |

|

Elig ID (eligibility rules ID) |

Required |

Not allowed |

Not allowed |

Required |

Option Type Designations Allowed Per Plan Type

This table describes option type designations allowed per plan type:

|

Plan Type |

Option Type Allowed |

|---|---|

|

01 (Benefit Program) |

G, P |

|

1x–3x |

G, W, O |

|

4x–9x |

W, O |

Setting Up the Benefit Program Row (Plan Type 01)

Access the Benefit Program Table - Plan Type and Option page: Eligibility tab.

A Benefit Program row is required for all automated benefit programs. The eligibility rules established for plan type 01 govern the entire benefit program.

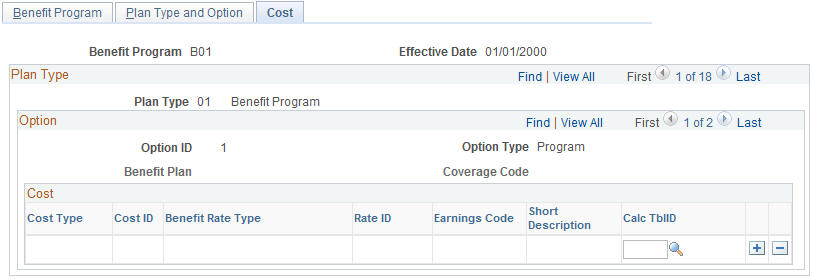

Use the Benefit Program Table - Cost page (BEN_PROG_DEFN3) to calculate costs and credits by linking rate and calculation rules to a benefit program and plan type.

Navigation

Image: Benefit Program Table - Cost page

This example illustrates the fields and controls on the Benefit Program Table - Cost page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Cost Type |

Each option can have one price element defined, while options and general credits can have multiple credit elements defined. Select from the following values: Price: The system calculates deductions for employees who select this option according to the deduction code that you identify for this benefit option. Credit: The system calculates earnings for employees who select this option according to the earnings code that you identify for this benefit option. The system assigns the frequency of the additional pay based on the deduction code that you identify for this benefit option. |

Note: You can also go to the Benefit Program row (plan type 01) and use the Cost page to define general flexible credits for the Benefit Program.

|

Field or Control |

Definition |

|---|---|

| Benefit Rate Type |

Enter which table to use to determine rates for the cost or credit entry. |

| Rate lID |

Indicate the appropriate rate table because multiple tables may exist. In the case of credits, only the Employee Portion is picked up and reflected as the credit amount. |

| Earnings Code |

Tells the system how to calculate the flexible credit earnings for a participant. This option is not applicable for Price rows. |

| Calc TblID (calculation rules table ID) |

Indicates an applicable calculation rule, which references what dates and rules to apply to determine age, service, and compensation amounts for the purpose of rate calculation. Calculation rules are also used to determine what point in time to use to determine the calculation of service for service step calculations. |

Warning! The earn code for each benefit plan type within a benefit program must be unique. Otherwise, flexible credits might not start and end correctly during Benefits Administration processing.

Rate and Calculation Rules Requirements

This table describes rate and calculation rules requirements:

|

Plan Type Series |

Rate Table Required? |

Calculation Rules Required? |

Comments |

|---|---|---|---|

|

01 |

Yes |

Yes |

Earnings codes are also required for credits. |

|

Ax |

Yes |

Yes |

|

|

1x |

Yes |

||

|

2x |

Yes |

Yes |

|

|

3x |

Yes |

Yes |

|

|

4x |

Not Allowed |

Yes |

The calculation rules support the service step calculation and provide a placeholder for possible future functionality. |

|

5x–9x |

Not Allowed |

Not Allowed |

Not Used |

Note: In almost all cases, agencies in the U.S. Federal Government do not use general credits and do not use the cost type of credit when designing benefit programs.