Reconciling STP Data

STP Reconciliation process provides reconciliation between Single Touch Payroll (STP) output files and existing Payment summary data.

In Single Touch Payroll (STP), a Payroll Event (PAYEVNT & PAYEVNTEMP) is created and submitted to ATO each time employees are paid. Before submitting the data to ATO, employers need to check and confirm that the Payroll Event totals match with their payroll results on a Period to Date (PTD) and a Year to Date (YTD) basis. Using the STP Reconciliation process employers can generate reports and perform distinct function to compare values reported in the PAYEVNTEMP file to actual payroll result values at payee level.

Once STP Preparation process is complete, you can run the PSM Data Creation process, which also generates the data for STP reconciliation /comparision. The Create Payment Summary Data process updates the data in the respective staging tables as defined in the configuration. PS Queries are used to compare STP and PSM results.

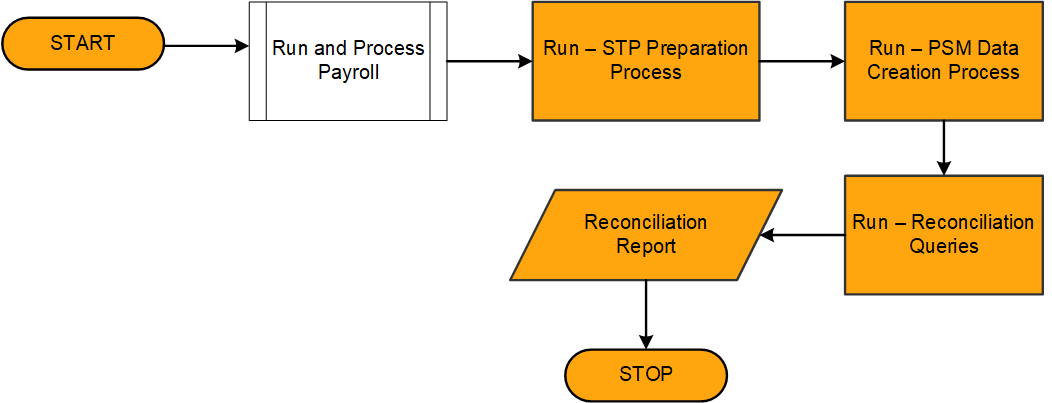

Image: STP Reconciliation Process Flow

This image illustrates the STP Reconciliation Process Flow.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_RC_FBT_COLLEC |

To modify the given personal information of an employee after the end of fiscal year. |

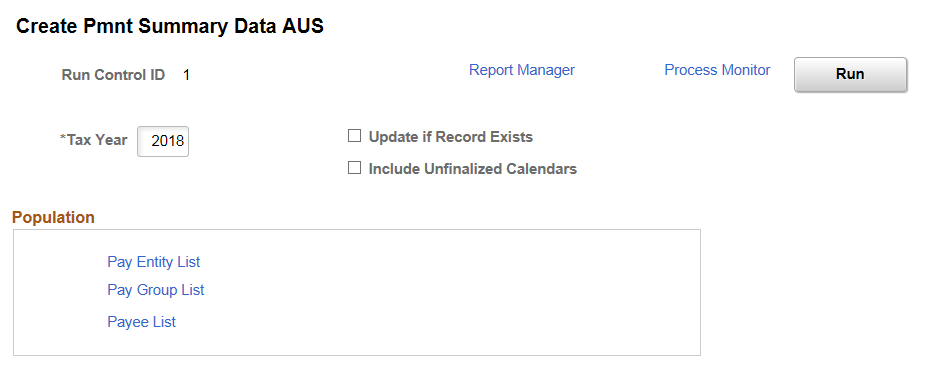

Use the Create Pmnt Summary Data AUS page (GPAU_RC_FBT_COLLEC) to generate data for reconciliation/comparing with STP data. This process generates a payee's payment summary information.

Navigation

Image: Create Pmnt Summary Data AUS Page

This example illustrates the Create Pmnt Summary Data AUS Page.

|

Field or Control |

Definition |

|---|---|

| Tax Year |

Enter the tax year. |

| Update if Record Exists |

Select this check box if you want to update the records. This is applicable only if you are running the process for finalized payroll calendars. |

| Include Unfinalized Calendars |

Select this check box to run Create Payment Summary Data process for the open payroll calendars. Note: Use the option to include unfinalized calendars only if you are generating payment summary for reconciling STP. If the Payment Summary is generated for the formal year-end reporting, it should be based on finalized results. |

| Pay Entity List, Pay Group List and Payee List |

Enter the payee population based on which the data is generated. It can be pay entity, pay group, or payee list. |

PS Queries

Once the Create Payment Summary Data process updates the data in the respective staging tables as defined in the configuration, the following PS Queries are run to compare STP and PSM results.

|

Query Name |

Purpose |

|---|---|

|

GPAU_STP_RECON_GROSS_TAX |

Reconcile Gross and Tax of INB Payees |

|

GPAU_STP_RECON_GROSS_TAX_FRGN |

Reconcile Gross and Tax of Foreign Payees |

|

GPAU_STP_RECON_ALLOW |

Reconcile Allowances |

|

GPAU_STP_RECON_DED |

Reconcile Deductions |

|

GPAU_STP_RECON_ETP |

Reconcile Termination Payments |