Updating STP Event AUS

STP Update Event process is used to report changes to employee data previously reported to the ATO. Any changes made to report employee data for the prior financial year must only be submitted through the update event.

Update event must include latest Year to Date (YTD) value for all payments (including each Employment Termination Payment (ETP) by payment date and code) made in the financial year. It is just not sufficient to include only the changed values.

Update Event should not be used to update:

Employer Total Gross Payments and Total PAYGW Amounts

Onboarding section (which contains the employee withholding details and declaration)

Employer pay period totals for gross payments and PAYG withholding cannot be included in an update event, as there is no associated payment to the employee when changes are reported through the update event.

Note: The Update Event and Payee Overrides are using the same component and the values derived from the same set of records. The difference is that Update Event Date field will be displayed when the user selects the Update Event radio button, whereas it is not applicable for Payee Override. Also, Onboarding tab is not editable for Update Event, whereas user can edit the same in case of Payee Override.

This topic discusses how to run STP Update Event process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPAU_STP_PERS_DTL |

To modify the given personal information of an employee after the end of fiscal year. |

|

|

GPAU_STP_WAGES_TAX |

To modify the given earnings information of an employee after the end of fiscal year. |

|

|

GPAU_STP_ALLOW |

To modify the allowance related values of an employee after the end of fiscal year. |

|

|

GPAU_STP_DED |

To modify the given deductions of an employee after the end of fiscal year. |

|

|

GPAU_STP_SUPER_ENT |

To modify the superannuation contribution tuple data of an employee after the end of fiscal year. |

|

|

GPAU_STP_ONBRD |

To view the given onboarding information of an employee. |

|

|

GPAU_STP_RUNCTL |

To generate Pay Event or Update Event file. |

As a user, follow the given steps to update STP Event:

Select the Employee for whom the update event is to be executed.

Update Event should always be submitted against the last Pay Event

Add a new row by clicking “+”

Select the Update Event Radio Button

Update Event Date – This field is enabled once the user selects Update Event Radio Button. This is a mandatory field and the same is used as an indicator to generate the Update Event File.

Incorporate the necessary correction or updates to the respective Personal and Payroll fields and save the page once the required data is entered.

Note: Any data entered using this component will not cascade to Payroll, user need to take care of the same.

No Negative values will be allowed to enter, as Year to Date cannot be negative.

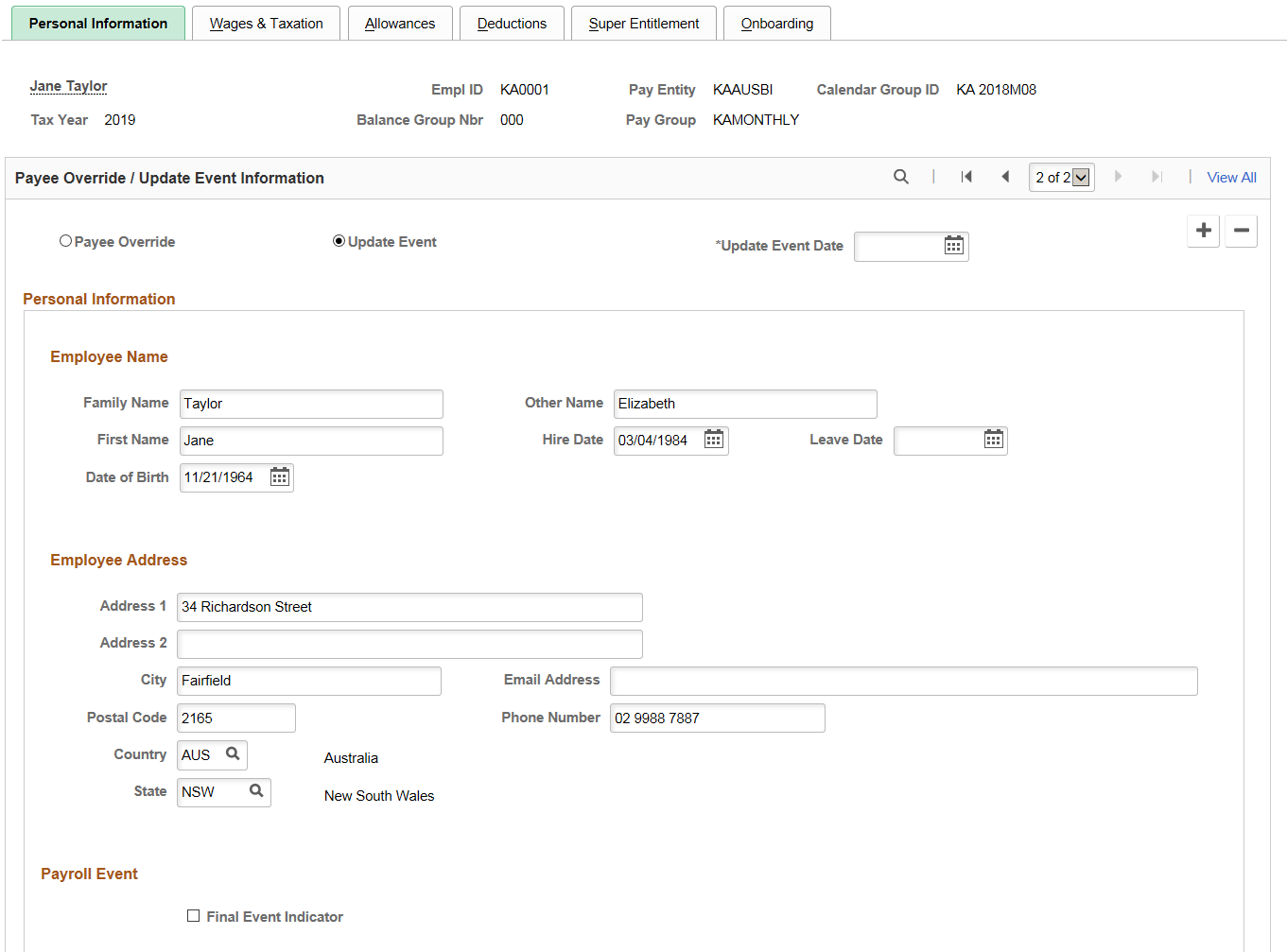

Use the Personal Information page (GPAU_STP_PERS_DTL) to update the personal information of the employee. Based on the selected calendar group id for which the amendments to be done, the system populates the values submitted in the original file.

Navigation

Image: Personal Information Page

This example illustrates the Personal Information Page.

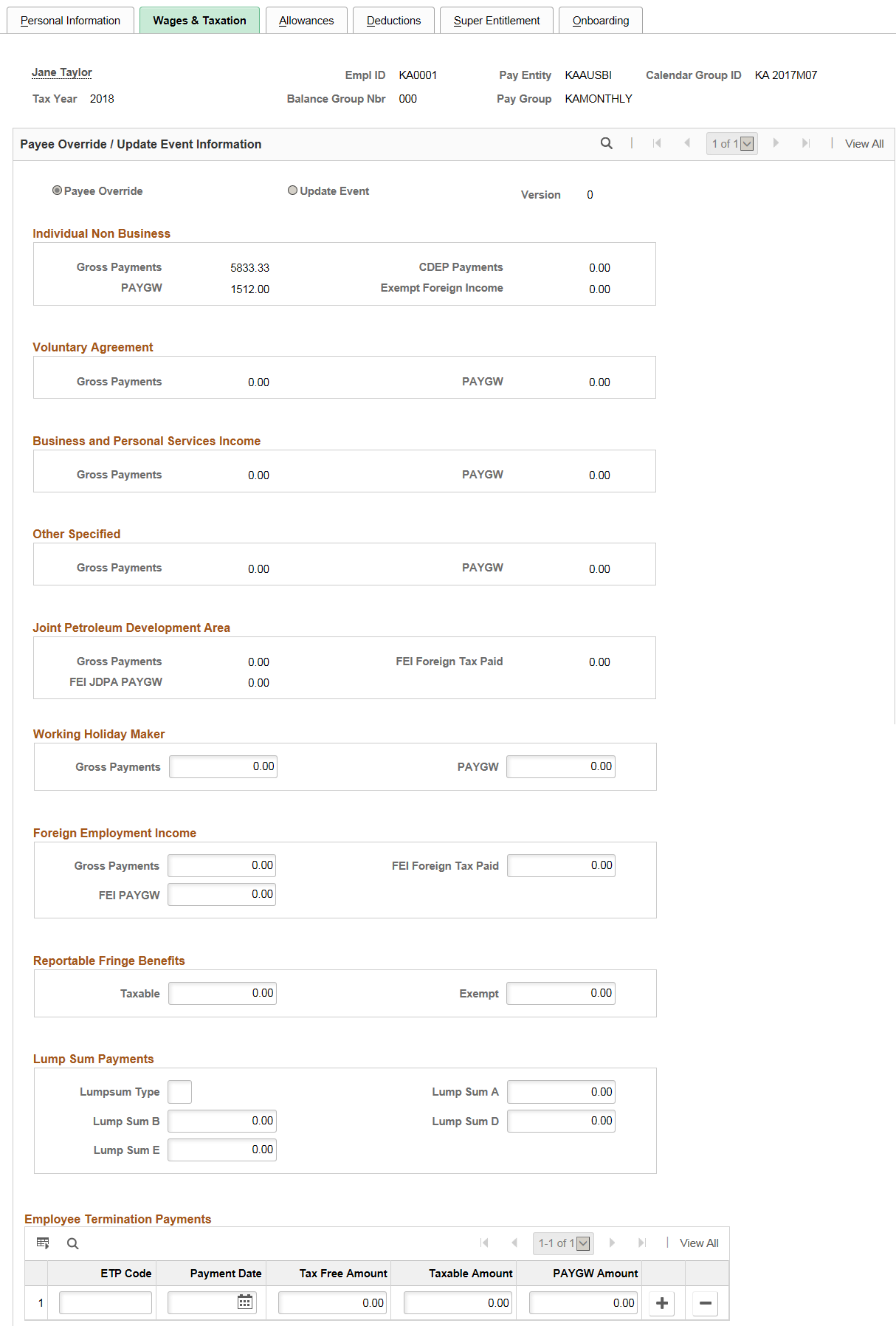

Use the Wages & Taxation page (GPAU_STP_WAGES_TAX) to update the earnings information of the employee. Based on the selected calendar group id for which the amendments to be done, the system populates the values submitted in the original file.

Navigation

Image: Wages & Taxation Page

This example illustrates the Wages & Taxation Page.

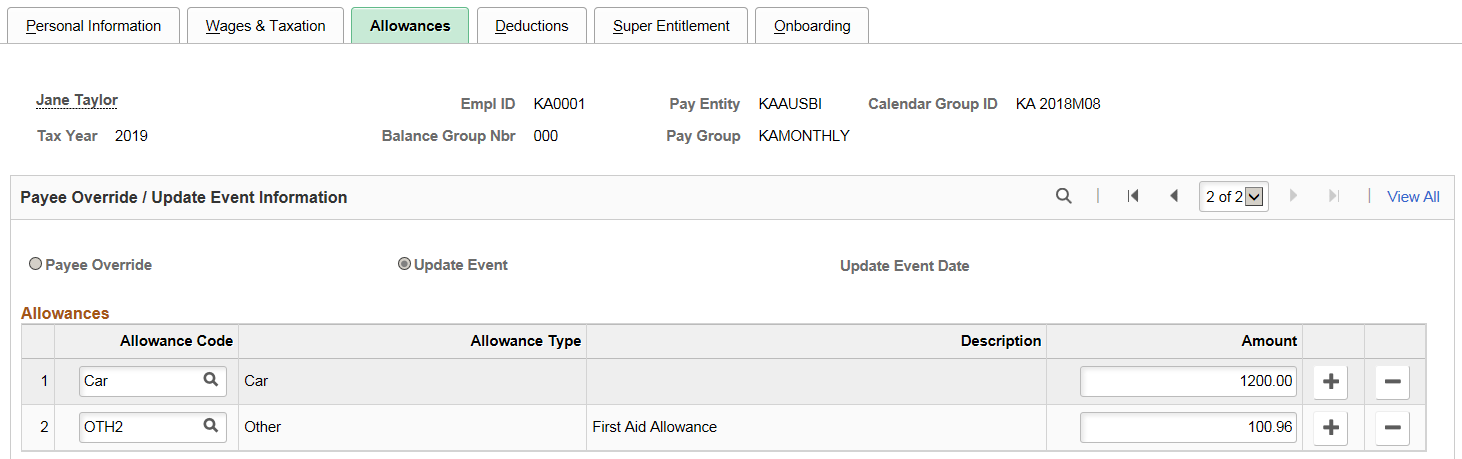

Use the Allowances page (GPAU_STP_ALLOW) to update the allowance related information of the employee. Based on the selected calendar group id for which the amendments to be done, the system populates the values submitted in the original file.

Navigation

Image: Allowances Page

This example illustrates the Allowances Page.

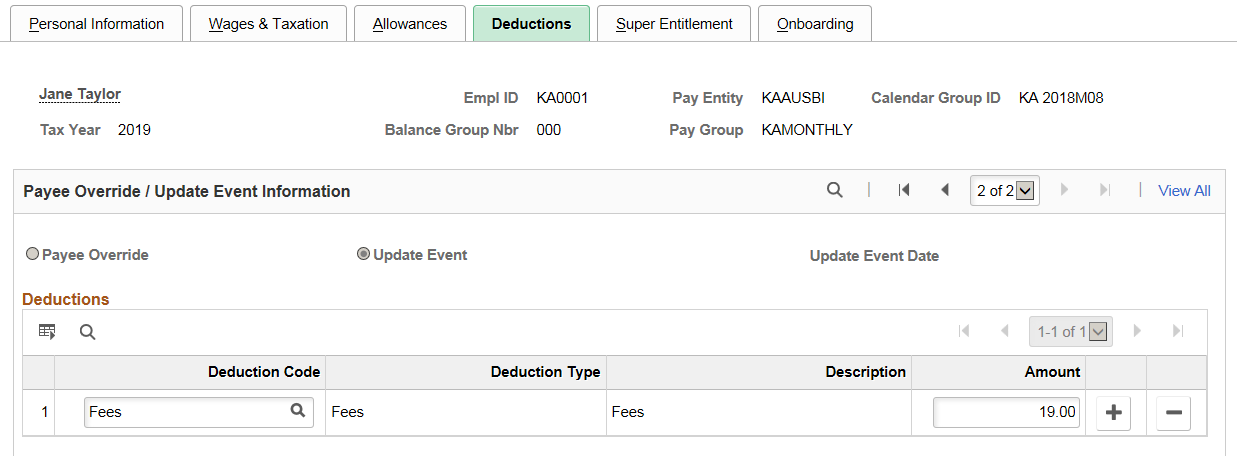

Use the Deductions page (GPAU_STP_DED) to update deductions such as Union Fees & Workplace Giving of the employee. Based on the selected calendar group id for which the amendments to be done, the system populates the values submitted in the original file.

Navigation

Image: Deductions Page

This example illustrates the Deductions Page.

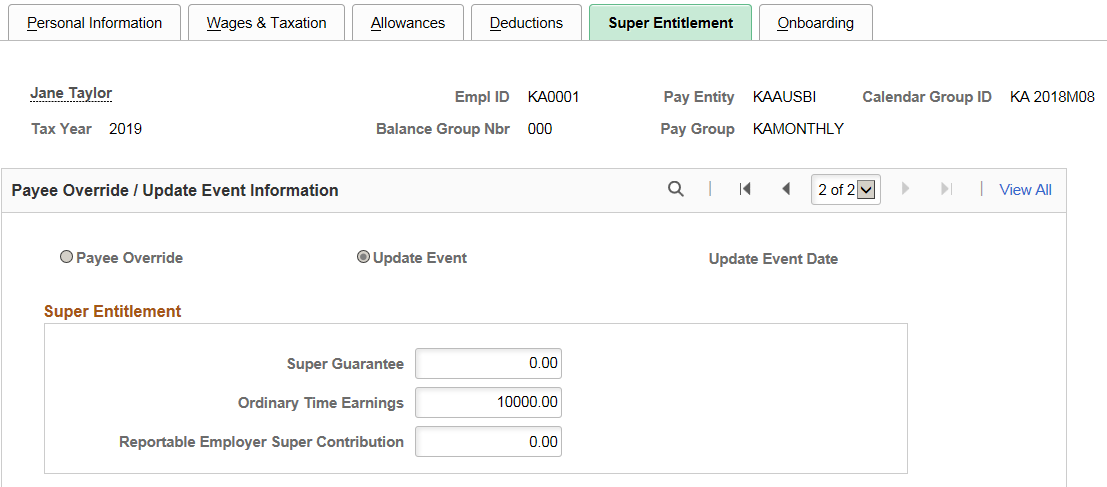

Use the Super Entitlement page (GPAU_STP_SUPER_ENT) to update Superannuation Contribution Tuple data. Based on the selected calendar group id for which the amendments to be done, the system populates the values submitted in the original file.

Navigation

Image: Super Entitlement Page

This example illustrates the Super Entitlement Page.

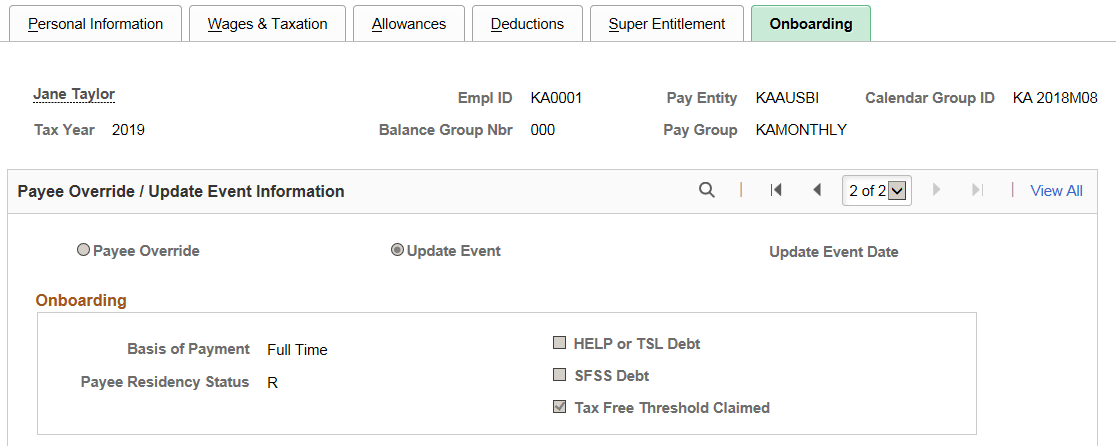

Use Onboarding Page page (GPAU_STP_ONBRD) to view the Employee TFN onboarding information. This is a read only page and cannot be updated as part of Update Event process.

Note: Onboarding page is editable for Payee Override process.

Navigation

Image: Onboarding Page

This example illustrates the Onboarding Page.

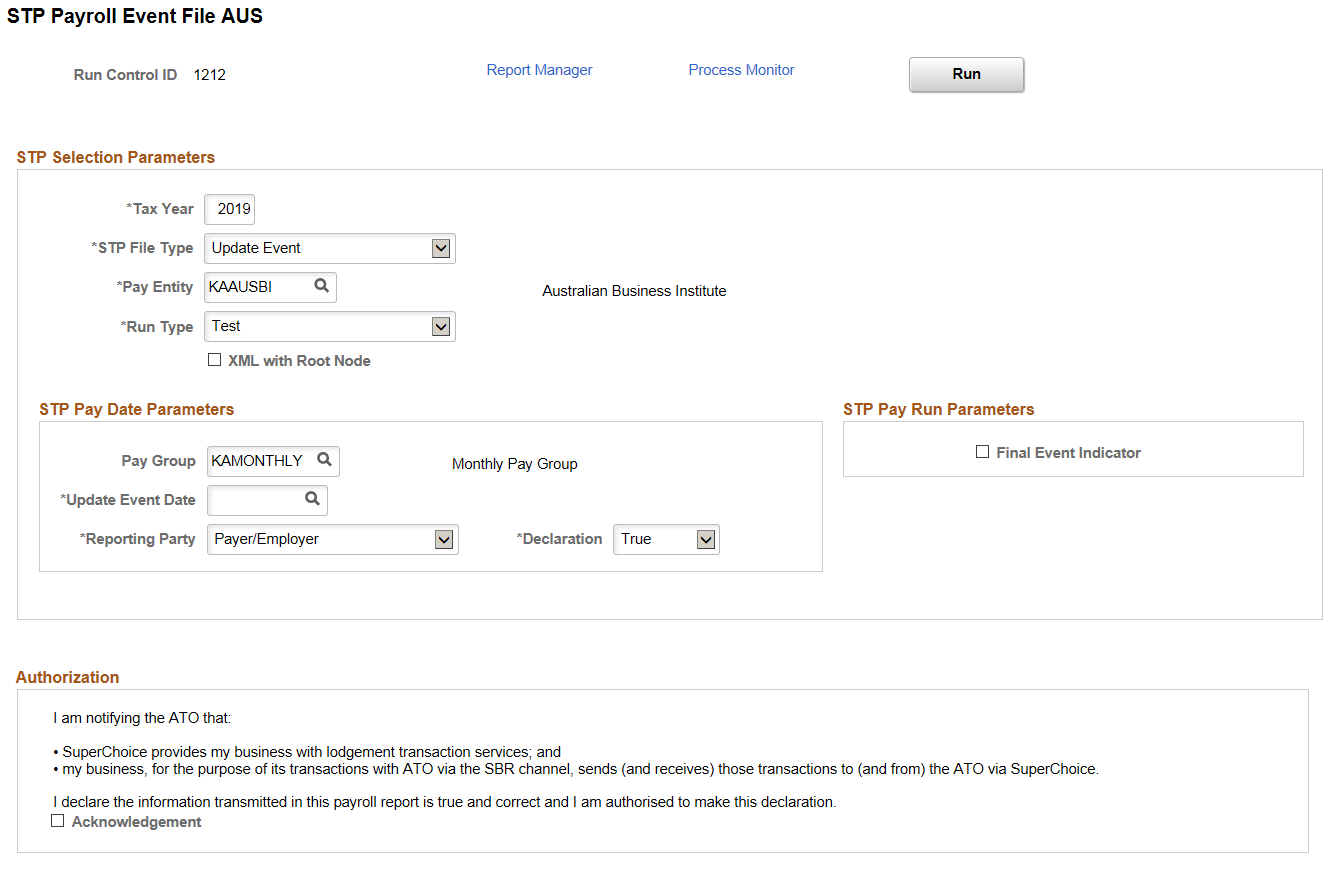

Use the STP Payroll Event File AUS page (GPAU_STP_RUNCTL) to generate or update Pay Event files. For more information on how to generate pay event file, see Generating Pay Event File

Navigation

Image: STP Payroll Event File AUS Page

This example illustrates the fields and controls on the STP Payroll Event File AUS Page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Tax Year |

Enter the Fiscal Year for which the update event is processed. For example, enter, "2017" for 2016-17 Tax Year. |

| STP File Type |

Select the STP file type. Available options are:

|

| Pay Entity |

Select the pay entity, for which the employer would like to generate Payroll Event (PAYEVNT & PAYEVNTEMP). |

| Run Type |

Select the Run Type. Available options are:

|

| XML with Root Node |

Select the checkbox if you want to generate a temporary XML file with Root Node, which can be viewed in a browser, with the ability to export to excel. Note: This option is for easier validation. The Final XML file to be submitted to the authorities should be generated without a Root node, which is a non-standard XML structure and thereby does not open properly in a normal browser; instead, the file can be opened and reviewed in text editors, such as Notepad, Notepad++ or Text Pad. |

| Pay Group |

Select the paygroup if you want to generate the file for a particular pay group. For example, if there are pay groups for Weekly and Monthly, employers would be able to generate the separate file for each pay group. |

| Update Event Date |

Select the date on which the update event is carried out for the employees. |

| Reporting Party |

Select the Reporting Party. Available options are:

|

| Declaration |

Select the option as True or False to indicate whether the terms stated in the Declaration Text have been accepted or declined. |

| Final Event Indicator |

An employer is required to make a declaration to the ATO, that they have provided all the information for each employee for a financial year, by providing the finalization indicator as a part of an employee’s Single Touch Payroll report. Select this check box if you want to include this indicator in the final output. |