Assigning Court-Ordered Garnishments

This topic discusses how to:

Add court order assignments.

Define court order details.

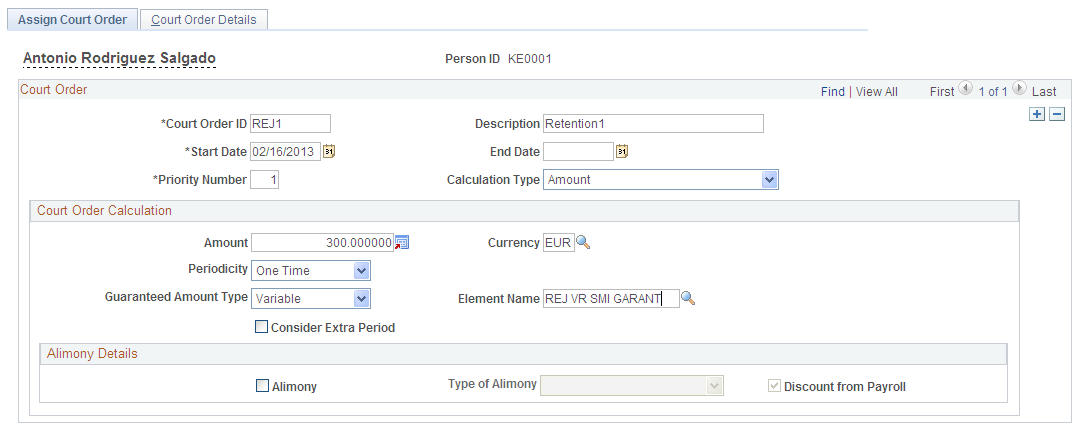

Use the Assign Court Order page (GPES_GRN_DATA) to add court order assignments.

Navigation

Image: Assign Court Order page

This example illustrates the fields and controls on the Assign Court Order page. You can find definitions for the fields and controls later on this page.

Court Order

|

Field or Control |

Definition |

|---|---|

| Court Order ID |

Enter the unique code for the court order. This is the user key that the system uses for accumulators that determine the recovered amount and pending amount to deduct. |

| Description |

Enter a description of the court order. |

| Start Date |

Enter the date on which the court order takes effect. |

| End Date |

Enter the date to stop the court order. |

| Priority Number |

Set the priority for the garnishment. If more than one court order is assigned to a payee, the priority numbers determine the order in which they are calculated. The lower the priority number, the higher priority the court order has. |

| Calculation Type |

Select the method by which the system calculates the court order. Values are: Amount: Select to calculate the court order as a fixed amount that can be deducted either one time only or once per month between the start date and end date. Based on Ranges of SMI (based on ranges of salario minimo interprofesional): Select to calculate the court order as a fixed amount to be deducted as soon as possible, but with respect to article 607 of Ley de Enjuiciamiento Civil. Percentage: Select to calculate the court order as a percentage of a specific element. Other: Select to calculate the court order using a set of rules that you define. Note: The value that you select in this field affects the fields and group boxes that are available on the rest of the Assign Court Order page. |

Court Order Calculation

Use the fields in this group box to define how the system calculates the court order.

Note: The fields that are available in this group box depend on the value that you select in the Calculation Type field.

|

Field or Control |

Definition |

|---|---|

| Amount |

Enter the monetary amount of the court order. |

| Currency Code |

Enter the currency of the amount. |

| Percentage |

Enter the percentage that the system applies to the specified base element to determine the amount of the court order deduction. |

| Base Element Type |

Enter the type of element that the system uses for the base amount when applying the value you enter in the Percentage field. Values are: Accumulator, Earnings, Formula, and Variable. |

| Element Name |

Enter the element that the system uses for the base amount for the court order. |

| Amount Type |

Select Formula to specify the type of element that the system uses to calculate the court order amount. |

| Element Name |

Enter the formula that the system uses to calculate the court order amount. |

| Guaranteed Amount Type |

Select the type of element the system uses to determine a guaranteed minimum net amount. Values are: Accumulator, Formula, and Variable. |

| Element Name |

Enter the element that determines the guaranteed minimum net amount for the court order. For example, if the court order guaranteed the salario minimo interprofesional (SMI), you could enter the variable REJ VR SMI GARANT in this field because it represents the SMI for payees. |

| Periodicity |

Enter the frequency of the court order deduction. Values are: One time: Select to deduct the court order amount only once. If you select this value, the system does not calculate the garnishment after the date you enter in the End Date field. Recurrent: Select to deduct the court order amount monthly between the start date and end date. If you select this value, the system stops deducting the garnishment amount after the date you enter in the End Date field. The system might still calculate the deduction for an unrecovered amount that corresponds to a previous month. |

| Consider Extra Period |

Select to include the court order in extra period processing. |

Alimony Details

|

Field or Control |

Definition |

|---|---|

| Alimony |

Select to designate the court order as a pension for a spouse or children. This means that the deducted amount with affect the payee's tax calculation because it reduces the payee's withholding percentage. |

| Type of Alimony |

Specify whether the alimony if for Spouse Support or Children Support. |

| Discount from Payroll |

Select to indicate that the court order is managed by the payee outside the PeopleSoft Global Payroll for Spain system. Note: If you do not select this check box, the system does not perform net validation on the court order. |

SMI Scale Range

Use the %Scale1 through %Scale5 fields to enter the percentages that the system applies to the five ranges of SMI. The system populates these fields with default regulatory values. You can reduce the values, but only by 10-15%.

Note: The SMI Scale Range group box appears only if you select the Based on Ranges of SMI value in the Calculation Type field.

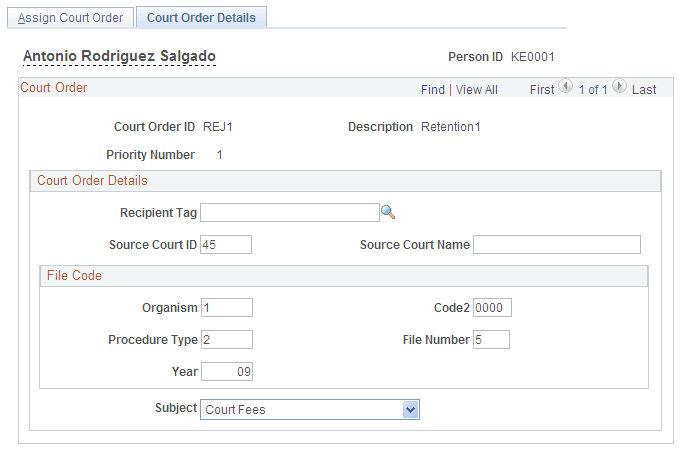

Use the Court Order Details page (GPES_GRN_CRTORDDTL) to define court order details.

Navigation

Image: Court Order Details page

This example illustrates the fields and controls on the Court Order Details page. You can find definitions for the fields and controls later on this page.

Court Order Details

|

Field or Control |

Definition |

|---|---|

| Recipient Tag |

Select the ID of the recipient of the court order deduction. Only recipients assigned to the employee are available to select in this field. |

| Source Court ID and Source Court Name |

Enter the ID and name of the court that issued the court order. |

| Subject |

Select a reason for the court order. |

File Code

Use the fields in this group box to define the values of the different sections of the court order file code. The file code ensures that banking files that include this court order are transferred to the correct judicial body.