Assigning Recipients to Deductions and Payees

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GP_RCP_PYE |

Link an individual recipient to a deduction and a payee. Override the general recipient of a deduction for a specific payee. |

|

|

GP_RCP_PYE_SP |

Define a new recipient's bank account information. |

|

|

GP_RCP_DED |

Link a general recipient to a deduction. |

After defining recipients, you assign them to deductions and payees. Where to assign recipients depends on the type of deduction.

When assigning recipients, you'll do the following:

Link individual recipients to deductions and payees through the payee-level Deduction Recipients page.

Link general recipients to deductions through the Recipient page of the Deduction component.

The topics below discuss each recipient type in detail.

Individual Recipients

If you have a deduction whose recipient is unique by payee, such as a garnishment deduction that goes to an individual, you assign a recipient on the payee-level Deduction Recipients page.

Note: The payee-level Deduction Recipients page is found under Global Payroll & Absence Mgmt, Payee Data, Net Pay/Recipient Elections, Add Deduction Recipients and is discussed in this topic.

General Recipients

If you have a deduction whose recipient is a general entity, such as an insurance payment that goes to an insurance carrier, you establish the recipient information on the deduction definition, telling the system to sum up the amounts from all payees who have this deduction and send the total to one recipient.

When you link a general recipient to a deduction, you choose between:

Selecting the recipient by recipient ID.

Selecting a formula that determines which general recipient receives the deduction.

The formula is resolved during the Calculate phase of the batch process, when the deduction is resolved. The result is stored in the Earnings and Deductions results table. When you run the banking process, the system retrieves the recipient ID from the results table.

Note: You can override the general recipient of a deduction for a particular payee, on the payee-level Deduction Recipients page.

The Recipient page in the Deduction component is discussed in another topic in this product documentation.

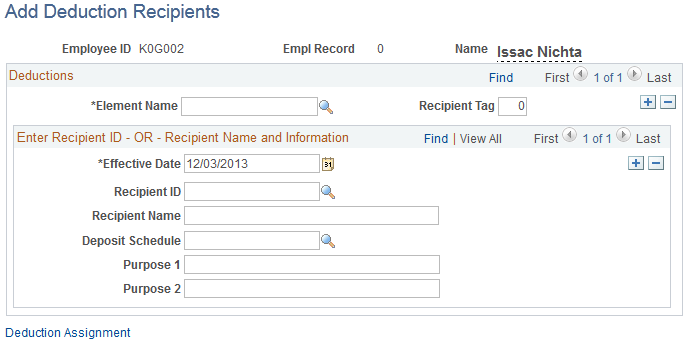

Use the Add Deduction Recipients page (GP_RCP_PYE) to link an individual recipient to a deduction and a payee.

Override the general recipient of a deduction for a specific payee.

Navigation

Global Payroll & Absence Mgmt, Payee Data, Assign Earnings and Deductions, Element Assignment By Payee

Click the Deduction Recipients link on the Element Assignment By Payee page.

Click the Edit Recipients link on the Payee Assignment By Element page - Recipient tab.

Image: Add Deduction Recipients page

This example illustrates the fields and controls on the Add Deduction Recipients page.

|

Field or Control |

Definition |

|---|---|

| Element Name |

Select the deduction for which to define recipient information. |

| Recipient Tag |

Enter the recipient tag. Tags are used for multiple resolution of deductions and single resolutions of deductions for Individual Recipients. A given payee could have one or more recipient tags and the tags are associated either with a recipient ID or with a recipient name. Tags are numeric. A Recipient Tag that is associated with an 'Individual' Deduction Recipient must have a value greater than zero. This will ensure the zero Recipient Tag is available if the General Deduction Recipient needs to be assigned to this employee along with individual recipients. The system will add the amount that resolves when there is no earning or deduction assignment. |

| Recipient ID |

Select the recipient ID for a predefined recipient (recipients are set up using the Deduction Recipients component). To define a new recipient, leave this field blank and complete the Recipient Name field. When you select an existing recipient, the system displays the recipient name next to the Recipient ID field. Click the recipient name link to access the Define Deduction Recipients component (RECIPIENT) where you can view and update the recipient's details. |

| Recipient Name and Bank Account Information |

If you want define a new recipient, enter the name of the recipient. When you complete this field, the system displays the Bank Account Information link. Click this link to access the Information for Recipient page where you enter the payment method and the recipient's bank account information. |

| Deposit Schedule |

Select a deposit schedule for the recipient. |

| Purpose 1 and Purpose 2 |

Enter information that's included on the bank transfer file, such as bank routing numbers or names. |

| Deduction Assignment |

Click the Deduction Assignment link to access the Earning/Deduction Assignment page. |

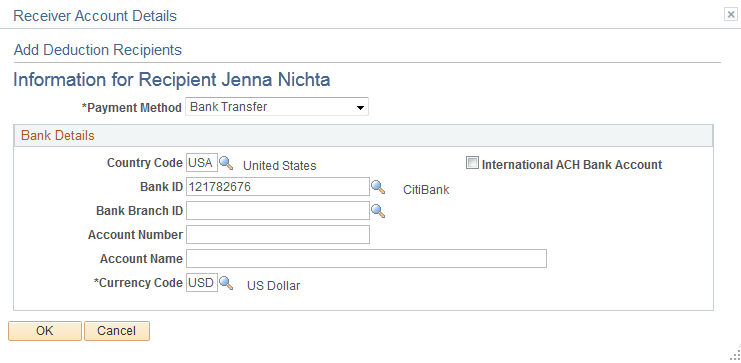

Use the Information for Recipient page (GP_RCP_PYE_SP) to define a new recipient's bank account information.

Navigation

Click the Bank Account Information link on the Add Deduction Recipients page.

Image: Information for Recipient page

This example illustrates the fields and controls on the Information for Recipient page.

The fields on this page are identical to those on the Define Deduction Recipients page.

Use the Recipient page (GP_RCP_DED) to link a general recipient to a deduction.

Navigation

Select the deduction recipient to link a general recipient to a deduction.