Defining Recipients

To define deduction recipients and to select recipients' deposit schedules, use the Deduction Recipients (RECIPIENT) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RECIPIENT |

Define general and individual recipients for deductions. |

|

|

Recipient Address Page |

RECIPIENT_ADR_SP |

Define recipients' address information. |

|

RECIPIENT_DEP_INFO |

Select recipients' deposit schedule. |

Recipients are entities or individuals who receive voluntary and statutory deductions that are withheld from payees. Global Payroll recognizes two types of recipients:

General recipient, such as a government agency.

Receives the amount that's withheld from all payees who have a specific deduction.

Individual recipient, such as a spouse who receives child support payments.

Receives the amount that's withheld from one or more payees.

Note: A general recipient is often an entity and an individual recipient is often a person, but this isn't a requirement.

Each recipient has a disbursement schedule. You can create unique deposit schedules to identify deposit dates.

Note: Before you can define a recipient, you must first define general bank information on the Bank Table page.

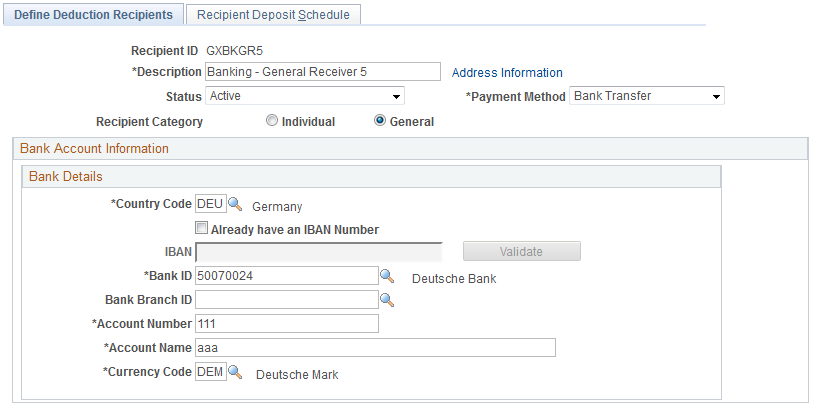

Use the Define Deduction Recipients page (RECIPIENT) to define general and individual recipients for deductions.

Navigation

Image: Define Deduction Recipients page

This example illustrates the fields and controls on the Define Deduction Recipients page.

|

Field or Control |

Definition |

|---|---|

| Address Information |

Click the Address Information link to access the Recipient Address page, where you'll define country and address information for the recipient. |

| Payment Method |

Select the payment method. Options are Bank Transfer, Cash, Check, Postal Order and Wire Transfer. Note: Bank account information only becomes available when Bank and Wire Transfer are selected. |

Recipient Category

|

Field or Control |

Definition |

|---|---|

| Individual |

Select if the recipient receives an amount, such as a court order deduction, that is withheld from one or more payees. |

| General |

Select if the recipient receives the amount withheld from all payees who have a particular deduction. General recipients, such as local and national governments for taxes, insurance companies for insurance benefits, and unions for union dues, are entities that receive an amount that might include many payee values. |

Bank Details

|

Field or Control |

Definition |

|---|---|

| Country Code |

Select the country for the payee's bank account. |

| Already have an IBAN Number |

Select to indicate that the payee has an IBAN. When you select this check box, the Bank ID, Bank Branch ID, and Account Number fields become display-only and the IBAN field and Validate button become available. If you deselect this check box for a payee who already has an IBAN entered and validated in the IBAN field, the system alerts you that this action will result in clearing the IBAN and bank account detail fields. You can click OK to continue, or Cancel to leave the check box selected. Note: This check box appears on this page only when the IBAN Enabled check box is selected and the IBAN Required check box is deselected on the IBAN Country Setup page. |

| IBAN (International Bank Account Number) |

Enter the IBAN for the payee. This field is editable only if you select the Already have an IBAN Number check box or if the IBAN Required check box is selected on the IBAN Country Setup page. |

| Validate |

Click to validate the number entered in the IBAN field. The validation process alerts you if there is an error in the entered IBAN. In addition, the validation process populates the Bank ID, Bank Branch ID, and Account Number fields based on the entered IBAN. This button is available only if you select the Already have an IBAN Number check box or if the IBAN Required check box is selected on the IBAN Country Setup page. |

| Bank ID, Bank Branch ID, and Account Number |

When the Already have an IBAN Number check box is selected or if the IBAN Required check box is selected on the IBAN Country Setup page, these fields are not editable. The system populates them based on the entered IBAN when you click the Validate button. Note: For German accounts with an IBAN, the Bank Branch ID field remains editable. For accounts without an IBAN, manually enter values in the Bank ID, Bank Branch ID, and Account Number fields. Note: Not all countries require branch ID information. |

| Account Name |

Enter the account name for the person. |

| Currency Code |

Select the code of the currency in which the account is maintained. The code you enter in this field is for informational purposes only and is not used by the banking process. |

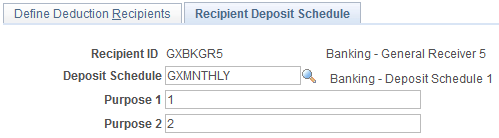

Use the Recipient Deposit Schedule page (RECIPIENT_DEP_INFO) to select recipients' deposit schedule.

Navigation

Image: Recipient Deposit Schedule

This example illustrates the fields and controls on the Recipient Deposit Schedule.

|

Field or Control |

Definition |

|---|---|

| Deposit Schedule |

Select the deposit schedule that specifies the recipient's payment frequency. Define deposit schedules on the Deposit Schedules page. |

| Purpose 1 and Purpose 2 |

Enter information that's included on the bank transfer file, such as bank routing numbers or names. |