Viewing and Defining Social Security Ceilings, Rates, and Bases

This topic discusses how to view and define social security ceilings, rates and bases.

To view social security contribution elements, use the Contribution Elements ESP component (GPES_SS_CONTRB). To define social security reduction and reduction data, use the Reductions ESP component (GPES_SS_BONIF). To view reduction elements, use the Reduction Elements ESP component (GPES_SS_BNF_DEF).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_SS_CNTB_BSE |

Obtain information about key elements used in the social security process. |

|

|

GPES_SS_BNF |

View and define the employer's social security reductions. |

|

|

GPES_SS_BNF_DTA |

View and define the employer's social security reduction data. |

|

|

GPES_SS_BNF_DEF |

Obtain information about key accumulators used in the social security reduction process. |

|

|

GP_ELM_DFN_SOVR |

Override the value of a bracket, date, duration, formula, or variable element that is used in the definition of the take element. |

|

|

GP_ABS_TAKE8 |

Select the user-defined fields that can be overwritten by a system element during processing. |

To view and define ceilings, rates, and other calculation values:

View and define social security ceilings.

To view or update ceilings and the minimum hourly rate associated with the general scheme (delivered by PeopleSoft Global Payroll for Spain), use the Scheme page in HR. To define values for other schemes, enter the Scheme page in add mode, and supply the required data.

View and define the maximum and minimum social security bases, as well as the minimum hourly rate.

Most common contingency bases are calculated in relation to a maximum and minimum funding base or are derived from a minimum hourly rate (in the case of part-time employees). To view or update the maximum base, the minimum base, or the hourly rate for the general scheme, use the Work Group page in HR. If you are defining values for a different scheme, enter the component in add mode and supply the required data.

View and define rates used in the contribution calculation.

When you have reviewed the ceilings and bases used to calculate social security contributions, use the Contribution page in PeopleSoft HR to view or update the contribution rates and percentages for the general scheme. If you are defining values for a different scheme, enter the component in add mode and supply the required data.

View key elements used in the social security calculation.

When you have viewed or defined data on the Scheme, Work Group, and Contribution pages, use the Contribution Elements ESP page to obtain information about deductions, key accumulators, and variables used in the social security process.

View and maintain information related to contribution reductions.

In some cases, employers may be granted a reduction in the amount of their social security contributions if they hire older employees or employees with qualifying disabilities. Reductions are assigned to employees in three ways:

Assigning a reduction to the payee's SSN via the Establishment page.

Assigning a reduction to a contract type via the Define Contract Types page.

Assigning a reduction directly to the employee's contract data via the Contract Data ESP page.

To set up and maintain the correct reduction percentage, as well as the duration of the reduction, use the Reduction and Reduction Data pages.

View key elements related to the employer's social security reduction.

When you have viewed, modified, or entered new reduction information on the Reduction and Reduction Data pages, use the Reduction Elements page to obtain information about key accumulators used to calculate and store the amount of the employer reductions.

Use the Contribution Elements ESP page (GPES_SS_CNTB_BSE) to obtain information about key elements used in the social security process.

Navigation

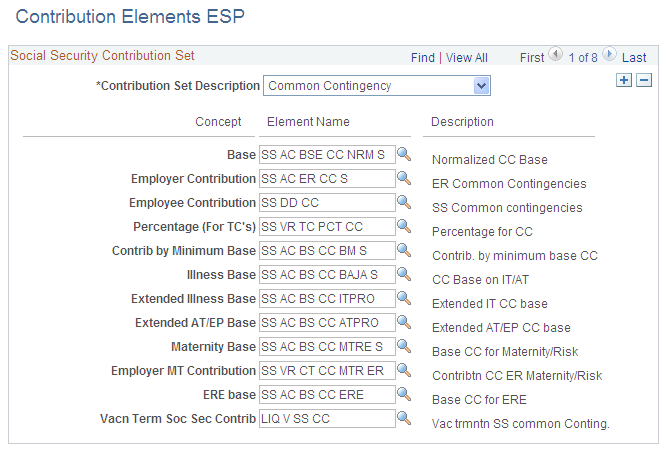

Image: Contribution Elements ESP page

This example illustrates the fields and controls on the Contribution Elements ESP page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Base |

Displays the accumulator that stores the funding base used in the social security calculation. |

| Employer Contribution |

The accumulator that stores the employer's contribution to social security. |

| Employee Contribution |

The accumulator that stores the employee's contribution to social security. |

| Percentage (For TC's) |

The variable that stores the total contribution percentages (employee plus employer percent) that must be recorded in the TC reports. |

| Contrib by Minimum Base (contribution by minimum base) |

The accumulator that stores the contribution base corresponding to the period that contributes by minimum base. |

| Illness Base |

The accumulator that stores the contribution base corresponding to sick days. |

| Extended Illness Base |

The accumulator that stores the contribution base corresponding to the period affected by extended illness absence. |

| Extended AT/EP Base |

The accumulator that stores the contribution base corresponding to the period affected by extended AT/EP absence. |

| Maternity Base |

The accumulator that stores the employee's maternity base. |

| Employer MT Contribution (employer maternity contribution) |

The variable that stores the employer's contribution for maternity or pregnancy risk benefits. |

| ERE Base |

The accumulator that stores the contribution base corresponding to the period affected by ERE. |

| Vac. Trmntn. Soc. Sec. Contrib (vacation termination social security contribution) |

The deduction that stores the contributions related to paid vacations for terminated employees. |

Use the Reduction page (GPES_SS_BNF) to view and define the employer's social security reductions.

Navigation

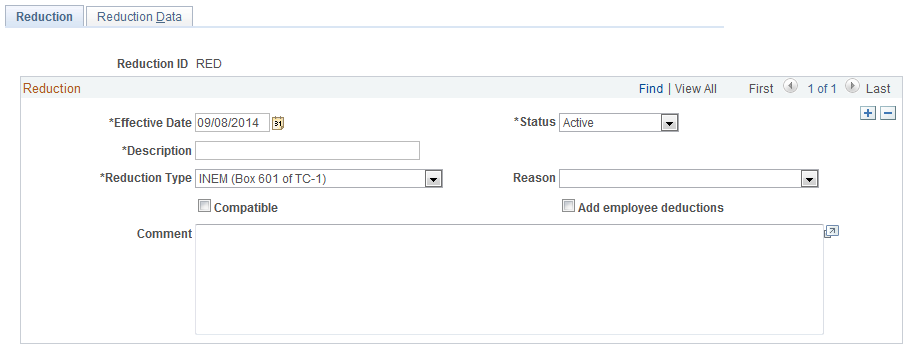

Image: Reduction page

This example illustrates the fields and controls on the Reduction page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Reduction ID |

The reduction ID identifies the specific reduction rule that applies to an employee. When accessing this page, select an ID and view (or modify) the existing data, or enter a new ID and define the reduction associated with that ID. |

| Compatible |

Select to designate the reduction as compatible with any other reductions assigned to a payee (concurrent reductions). The system calculates and applies all compatible reductions for a payee. If you deselect the check box, the system considers the reduction incompatible. The system calculates all incompatible reductions assigned to a payee, but applies only the one that is most beneficial to the employer. If a payee has both compatible and incompatible reductions, the system applies all compatible reductions, but applies only the incompatible reduction that is most beneficial to the employer. |

| Reduction Type |

The reduction type identifies the categorization for a specific social security reduction to be applied to an employee. Possible values are:

Note: The reduction types INEM (Box 601 of TC-1) Catastrophe, INEM 60 Years Old and Research Staff are currently inactive. |

| Reason |

Enter the reason for the reduction. This field is available only if you select reduction type INEM (Box 601 of TC-1). Employers are entitled to a reduction if they hire unemployed people with unlimited contracts before December 31st, 2009. In this situation, in addition to entering a value in the Reason field, you need to enter the remaining unemployment benefit by overriding the variable SS VR UNEMP BNFT for the hiring month. |

| Group |

Specify the collective to which the reduction applies. The system displays this field only if you select reduction type RD 5/2006 or SS (box 209 of TC-1) or SS Flat Amount. |

| Add employee deductions |

Select this check box to identify a reduction that applies to both and employer and employee contributions. This only applies to reductions defined as percentage. |

Use the Reduction Data page (GPES_SS_BNF_DTA) to view and define the employer's social security reduction data.

Navigation

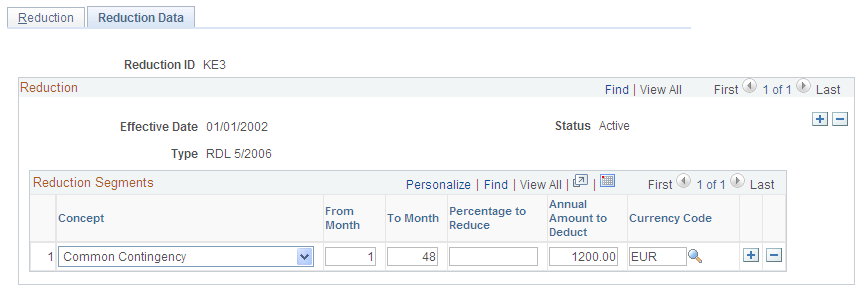

Image: Reduction Data page

This example illustrates the fields and controls on the Reduction Data page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Concept |

Identify the type of contribution (common contingency, FOGASA, temporary disability, and so on) to which the reduction defined in the Reduction Percentage , From Month, and To Month fields applies (see the following description). |

| From Month and To Month |

Define a reduction with a limited duration. Use the From Month field to identify the first month of the reduction; use the To Month field to identify the last month of the reduction. The actual calendar month on which the reduction begins or ends is based on the contract begin date identified on the Contract Data page in PeopleSoft HR. For example, in the preceding example, the value of the From Month field is 1 and the value of the To Month field is 999. This means that beginning with the month of the initial contract (for example, 1/1/1990), the reduction applies for 999 months. If the start date had been 4 and the To Month date had been 6, the reduction would not begin until April (three months after the contract begin date) and would end after the month of June (five months after the month that the contract started). If you enter 1 in the From Month field and 999 in the To Month field, the system assumes that the duration of the contract is unlimited. Note: Do not use 0 as the From Month value. Instead use 1. |

| Percentage to Reduce |

View, modify, or define the percentage amount of the reduction that applies to the contribution type identified in the Concept field. |

| Annual Amount to Deduct |

View, modify, or define the exact flat amount of the reduction that applies to the contribution type identified in the Concept field. For monthly employees, the system divides this annual rate by 360 and multiplies the resulting value by the contributed days on the payroll. For daily employees, the system divides the annual rate by the annual calendar days and then multiplies the resulting value by the contributed days on the payroll. For part-time employees, the system reduces the reduction amount based on the FTE value assigned to the employee. The FTE field value represents the reduction of the work schedule. |

Use the Reduction Elements page (GPES_SS_BNF_DEF) to obtain information about key accumulators used in the social security reduction process.

Navigation

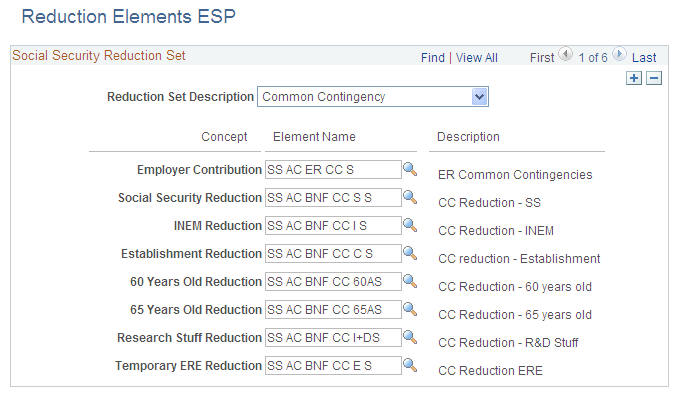

Image: Reduction Elements ESP page

This example illustrates the fields and controls on the Reduction Elements ESP page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Employer Contribution |

The accumulator that stores the amount of the employer's contribution to social security for each contribution type, common contingency, permanent disability D & S, professional training, and FOGASA. To calculate the employer reductions, PeopleSoft Global Payroll for Spain applies the reduction percentages defined on the Reduction Data page to the amount in this accumulator. |

| Social Security Reduction |

The accumulator that stores the employer reductions that are managed by social security for each contribution type (common contingency, permanent disability D & S, professional training, and FOGASA). |

| INEM Reduction |

The accumulator that stores the employer reductions managed by INEM for each contribution type (common contingency, permanent disability D & S, professional training, and FOGASA). |

| Establishment Reduction |

The accumulator that stores the employer reductions managed by INEM in case a catastrophe occurs to a company establishment. |

| 60 Years Old Reduction |

The accumulator that stores the employer reductions for employees older than 60. |

| 65 Years Old Reduction |

The accumulator that stores the employer reductions for employees older than 65. |

| Research Stuff Reduction |

The accumulator that stores the employer reductions for employees that are categorized as research staff (personal investigador). |

| Temporary ERE Reduction |

The accumulator that stores the employer reductions for employees affected by temporary ERE. |

According to the INEM, "The suspension of the application of reductions implies the suspension of the calculation of the period of the reductions." This refers to periods of absence, such as maternity leave, in which the employee stops contributing to Social Security and the system likewise does not calculate reductions. In these cases, the period of absence should be excluded from the reduction period and therefore the end date of the reduction should be extended. PeopleSoft Global Payroll for Spain enables you to set up reduction extensions at the absence take level. To accomplish this you must:

Override the variable SS VR EXT F RED with a value of S at the absence take level so that the system extends the reduction duration when an absence event is defined:

Access the Absence Takes - Supporting Element Overrides page

On the Elements/Dates tab, enter an element type of Variable and an element name of SS VR EXT F RED.

Select the begin date as the effective date of this extension setup. Starting from this date, the absence take being updated will extend the reduction calculation. Be aware that if you select a date in the past, it might affect future retroactivity calculations because the system might produce results that are different than those previously calculated.

On the Values tab, enter a character value of S.

Confirm that you are storing the value of the User Defined Character 1 result field:

Access the Absence Takes - User Defined Result Fields page

If the configuration type User Defined Character 1 is not already listed in the User Defined Result Fields group box, add it.