(ESP) Setting Up Spanish Workforce Tables

To set up Spanish workforce tables, use the Social Security Country Code (SOCS_CNTRY_ESP), Industry Activity (INDUSTRY_ACT_ESP), Insurance Company (INSUR_COMPANY_ESP), Social Security Risk Code (SOCS_RISKCD_ESP), Social Security Scheme (SOCS_SCHEME_ESP), Social Security Occupation Cd (SOCS_OCCUPATN_ESP), Social Security Company Setup (SOCS_SETUP_ESP), Social Security Data (SSEC_DATA_ESP), and Hiring Center Table (HIRING_CENTER_ESP) components.

If your organization does business in Spain, you must set up several tables to track information required by the Spanish government for Spanish workers.

These topics discuss how to set up Spanish workforce tables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SOCS_CNTRY_ESP |

Enter country codes valid for social security reporting purposes. |

|

|

INDUSTRY_ACT_CD_ESP |

Enter industry activity codes and descriptions. The industry activity code helps determine the employer social security number. |

|

|

INSUR_COMP_CD_ESP |

Enter insurance company descriptions and address information |

|

|

SOCS_RISKCD_ESP |

View the risk codes that can apply to employees in your organization. |

|

|

SOCS_SCHEME_ESP |

Review or define maximum and minimum social security ceilings, as well as review or define the minimum hourly rate for each social security scheme. |

|

|

SOCS_WRKGRP_ESP |

Define maximum and minimum social security bases by work group, as well as the minimum hourly rate used to calculate the base for part-time employees. |

|

|

SOCS_CONTRIB_ESP |

Define the contribution rates and percentages for both employees and employers used in the social security calculation. |

|

|

Social Security Occupation Cd Page (social security occupation code) |

SOCS_OCCUPATN_ESP |

Define social security occupation codes. |

|

SOCS_SETUP_ESP |

Enter specific company information, including data needed for social security purposes. |

|

|

SOCS_SETUP_2_ESP |

Enter pay type and specific bank information. |

|

|

SOCS_DATA_ESP |

Define a time limit for transferring FDI medical report data to the social security agency. |

|

|

HIRING_CENTER_ESP |

Define the hiring centers you will attach to employee personnel records on the Contract Data page. You connect every Spanish employee with a hiring center. |

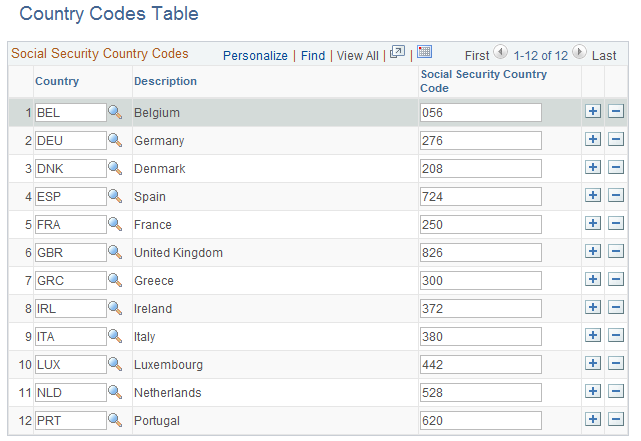

Use the Country Codes Table page (SOCS_CNTRY_ESP) to enter country codes valid for social security reporting purposes.

Navigation

Image: Country Codes Table page

This example illustrates the fields and controls on the Country Codes Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Country |

Enter the standard ISO country code. |

| Social Security Country Code |

Enter the country code used for social security processing. |

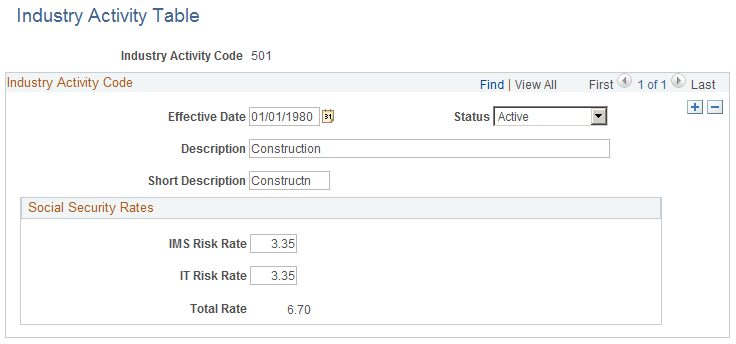

Use the Industry Activity Table page (INDUSTRY_ACT_CD_ESP) to enter industry activity codes and descriptions.

The industry activity code helps determine the employer social security number.

Navigation

Image: Industry Activity Table page

This example illustrates the fields and controls on the Industry Activity Table page. You can find definitions for the fields and controls later on this page.

Enter the effective date, status, description, and short description of the industry activity.

Social Security Rates

Enter percentages for Invalidez, Muerte y Supervivencia (IMS) and Incapacidad Temporal (IT) risks. For payees with no assigned occupational code, PeopleSoft Global Payroll for Spain uses these percentages to calculate IMS and IT contributions.

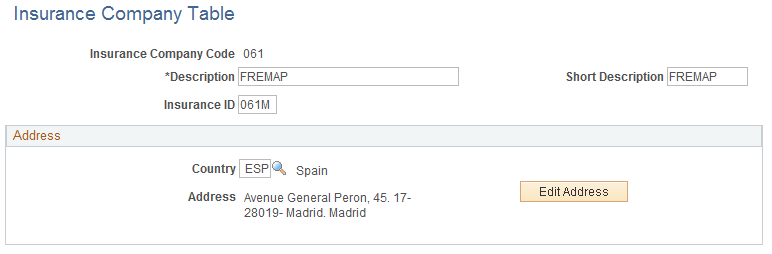

Use the Insurance Company Table page (INSUR_COMP_CD_ESP) to enter insurance company descriptions and address information.

Navigation

Image: Insurance Company Table page

This example illustrates the fields and controls on the Insurance Company Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Edit Address |

Click to enter or modify address information. |

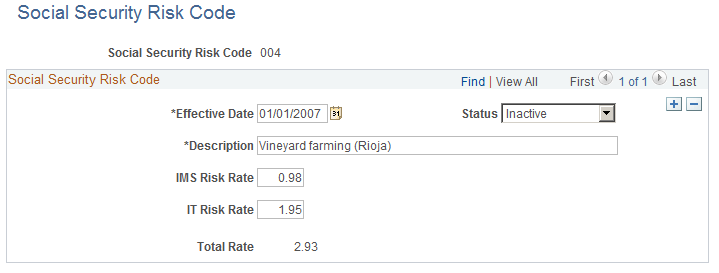

Use the Social Security Risk Code page (SOCS_RISKCD_ESP) to view the risk codes that can apply to employees in your organization.

Navigation

Image: Social Security Risk Code page

This example illustrates the fields and controls on the Social Security Risk Code page. You can find definitions for the fields and controls later on this page.

Note: The Spanish government requires employers to assign jobs a social security risk code that rates the risk of illness, accident, or death connected with that type of job.

The PeopleSoft system delivers all social security risk codes as system data.

|

Field or Control |

Definition |

|---|---|

| Social Security Risk Code |

The code that you entered to access this page. This is the code defined on this page. |

| IMS Risk Rate (Riesgo de Invalidez/Muerte/ Supervivencia) |

Displays the IMS risk rate that applies to this social security risk code. The Spanish government assigns IMS risk rate codes that assess the risk of work-related disability, death, or survival. |

| IT Risk Rate (Riesgo de Incapacidad Temporal) |

Displays the IT risk rate that applies to this social security risk code. The Spanish government assigns IT risk rate codes to assess the risk of work-related temporary disability, such as respiratory problems for miners or injuries for construction workers. |

| Total Rate |

The system automatically calculates the total rate, the sum of the IMS risk rate, and the IT risk rate. |

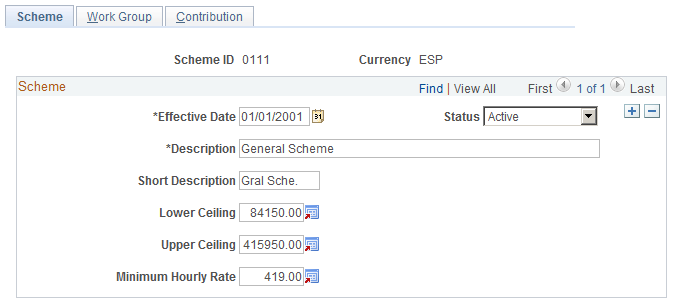

Use the Scheme page (SOCS_SCHEME_ESP) to review or define maximum and minimum social security ceilings, as well as review or define the minimum hourly rate for each social security scheme.

Navigation

Image: Scheme page

This example illustrates the fields and controls on the Scheme page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Lower Ceiling |

Enter the lower ceiling amount used to calculate the professional contingencies funding base. |

| Upper Ceiling |

Enter the upper ceiling amount used to calculate the professional contingencies funding base. |

| Minimum Hourly Rate |

Enter the amount used to calculate the professional contingencies funding base in the case of employees working part-time. Important! To trigger the correct part-time calculation of the base, you must specify whether the employee is working on a full or part-time basis in the Full/Part field on the Job Information page. |

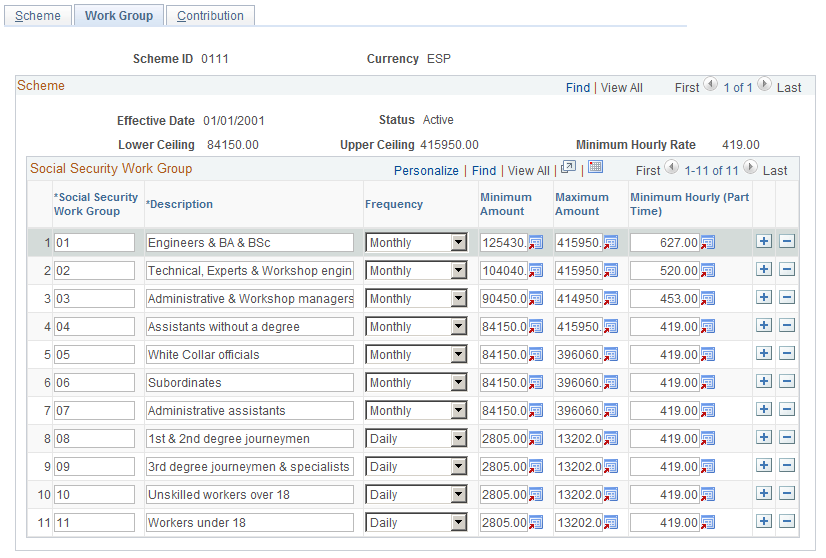

Use the Work Group page (SOCS_WRKGRP_ESP) to define maximum and minimum social security bases by work group, as well as the minimum hourly rate used to calculate the base for part-time employees.

Navigation

Image: Work Group page

This example illustrates the fields and controls on the Work Group page. You can find definitions for the fields and controls later on this page.

Once you've reviewed the ceilings and hourly rate on the Scheme page, use the Work Group page to view and update the maximum and minimum bases for regular employees, and the minimum hourly rate used to calculate the funding base for part-time employees. If you need to define rates and percentages for schemes other than the general scheme, you can do so on this page as well.

|

Field or Control |

Definition |

|---|---|

| Social Security Work Group |

All employees who contribute to social security must be assigned to social security work groups (also known as contribution groups) based on their level of education, professional skills, and job title. The SS Work Group field displays the numerical code for each group. |

| Frequency |

This field displays an M (Monthly) or a D (Daily), depending on whether members of the social security work group have their contributions calculated on a daily basis or a monthly basis. |

| Minimum Amount |

Enter the minimum amount used to calculate the common contingencies funding base. |

| Maximum Amount |

Enter the maximum amount used to calculate the common contingencies funding base. |

| Minimum Hourly (Part Time) |

Enter the minimum hourly rate used to calculate the common contingencies funding base for part-time employees. Important! To trigger the correct part-time calculation of the base, you must specify whether the employee is working on a full or part-time basis in the Full/Part field on the Job Information page. |

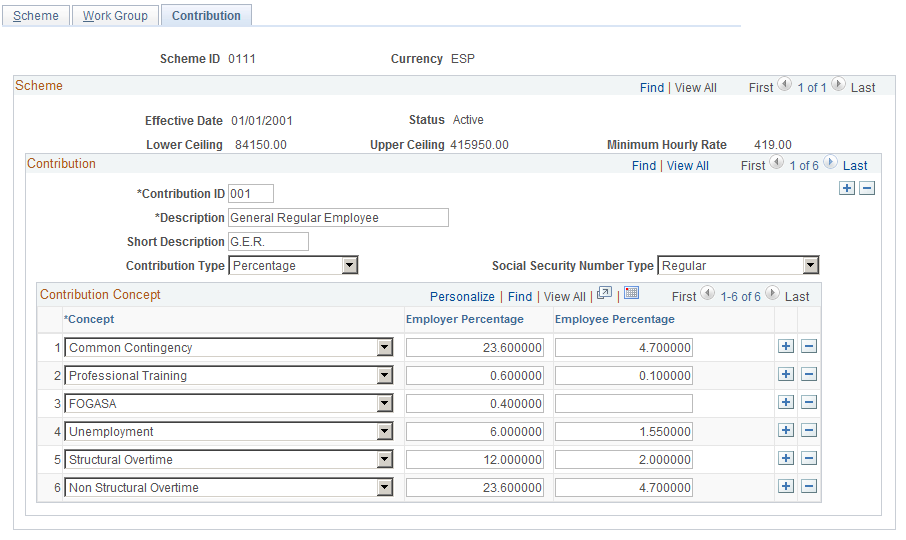

Use the Contribution page (SOCS_CONTRIB_ESP) to define the contribution rates and percentages for both employees and employers used in the social security calculation.

Navigation

Image: Contribution page

This example illustrates the fields and controls on the Contribution page. You can find definitions for the fields and controls later on this page.

If you need to define rates and percentages for schemes other than the general scheme, you can do so on this page.

|

Field or Control |

Definition |

|---|---|

| Contribution ID |

In PeopleSoft Global Payroll for Spain, there are multiple contribution IDs for each scheme ID, and each contribution ID is associated with its own rates and percentages. To view the different contribution ID classes and their corresponding rates or percentages, use the scroll arrows in the Contribution and Contribution Concepts scroll areas. Possible values for the contribution ID are:

Note: You must associate individual employees with a Scheme and SS Contribution ID on the Contract Data page. |

| Social Security Number Type |

Select one of the following values:

|

| Contribution Type |

Select Percentage if you will be entering percentages in the Employer Percentage or Employee Percentage fields. If you select Percentage, the Employer and Employee Rate fields become unavailable for data entry. Select Rate if you will be entering rates in the Employer or Employee Rate fields. If you select Rate, the Employer and Employee Percentage fields become unavailable for data entry. Important! You should always select Percentage for regular employees, and Rate for apprentices and trainees. |

| Concept |

Indicates the type of contributions for which the system displays corresponding employee or employer contribution rates or percentages in the Contribution-Concepts grid. Possible values are:

|

| Employer Rate |

Displays the employer contribution rate associated with the concept listed in the left-hand column of the grid. If you are defining a new rate, enter the rate in this field. Note: Only contributions of apprentices and trainees are based on fixed rates. |

| Employer Percentage |

Displays the employer contribution percentage associated with the concept listed in the left-hand column of the grid. Social security contributions of regular employees are calculated as percentages of a funding base. If you are defining a new percentage, enter the percentage in this field. |

| Employee Rate |

Displays the employee contribution rate associated with the concept listed in the left-hand column of the grid. If you are defining a new rate, enter the rate in this field. |

| Employee Percentage |

Displays the employee contribution percentage associated with the concept listed in the left-hand column of the grid. Social security contributions of regular employees are calculated as percentages of a funding base. If you are defining a new percentage, enter the percentage in this field. |

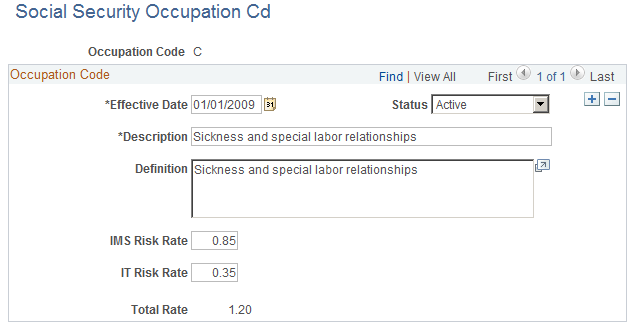

Use the Social Security Occupation Cd (social security occupation code) page (SOCS_OCCUPATN_ESP) to define social security occupation codes.

Navigation

Image: Social Security Occupation Cd (social security occupation code) page

This example illustrates the fields and controls on the Social Security Occupation Cd (social security occupation code) page. You can find definitions for the fields and controls later on this page.

Enter the effective date, status, description, and short description of the occupation code.

Enter percentages for Invalidez, Muerte y Supervivencia (IMS) and Incapacidad Temporal (IT) risks. PeopleSoft Global Payroll for Spain uses these percentages to calculate IMS and IT contributions.

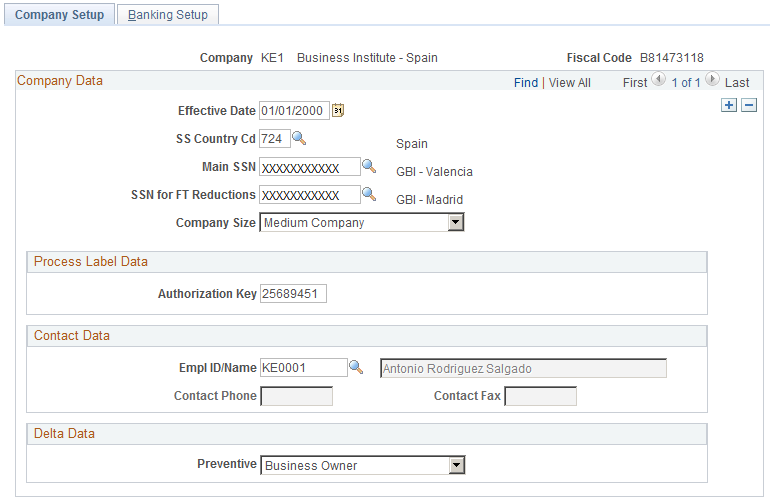

Use the Company Setup page (SOCS_SETUP_ESP) to enter specific company information, including data needed for social security purposes.

Navigation

Image: Company Setup page

This example illustrates the fields and controls on the Company Setup page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| SS Country Cd (social security country code) |

Enter the social security country code for the company. |

| Authorization Key |

Enter the authorization code to access Winsuite provided by the Social Security General Treasury. |

Delta Data

|

Field or Control |

Definition |

|---|---|

| Preventive |

Identify the kind of labor risk prevention management that the company uses. Valid values are:

|

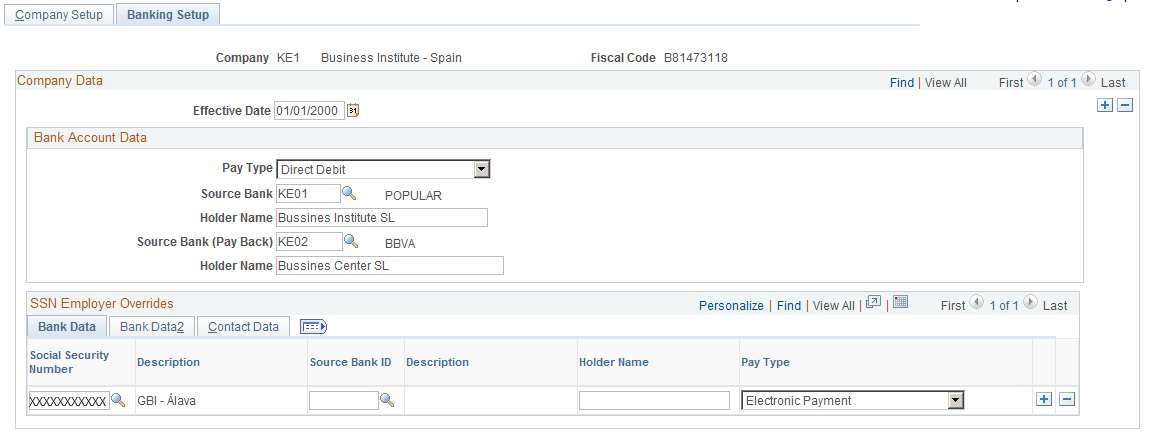

Use the Banking Setup page (SOCS_SETUP_2_ESP) to enter pay type and specific bank information.

Navigation

Image: Banking Setup page

This example illustrates the fields and controls on the Banking Setup page. You can find definitions for the fields and controls later on this page.

Bank Account Data

|

Field or Control |

Definition |

|---|---|

| Source Bank ID |

Enter the name of the bank the company uses to pay social security contributions. |

| Holder Name |

Enter the name the company uses at the bank. |

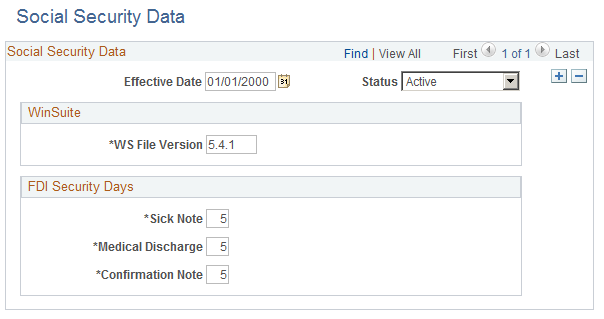

Use the Social Security Data page (SOCS_DATA_ESP) to define a time limit for transferring FDI medical report data to the social security agency.

Navigation

Image: Social Security Data page

This example illustrates the fields and controls on the Social Security Data page. You can find definitions for the fields and controls later on this page.

Note: If your organization uses Global Payroll for Spain, do not use this page to define FDI parameters. Intead, use the Social Security Data page in the GPES_SOCS_DATA_ESP component.

See Generating the FDI Medical Report Text File.

|

Field or Control |

Definition |

|---|---|

| WS File Version |

This field identifies the version of the Winsuite software used by the social security agency for reporting. As this software is updated, you must update the file version. |

| Sick Note |

Specify the time limit (in days) for transferring sick note data to the social security agency following receipt of the note from an employee. |

| Medical Discharge |

Specify the time limit (in days) for transferring medical discharge data to the social security agency following receipt of a discharge note from an employee. |

| Confirmation Note |

Specify the time limit (in days) for transferring confirmation note data to the social security agency following receipt of the note from an employee. |

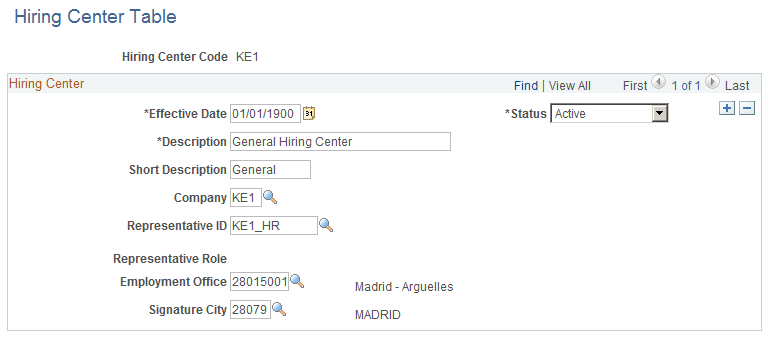

Use the Hiring Center Table page (HIRING_CENTER_ESP) to define the hiring centers you will attach to employee personnel records on the Contract Data page.

You connect every Spanish employee with a hiring center.

Navigation

Image: Hiring Center Table page

This example illustrates the fields and controls on the Hiring Center Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Hiring Center Code |

The hiring center code that you entered to access this page. |

| Company, Representative ID, and Representative Role |

Select the company and representative ID of the person who is responsible for signing employment contracts at this hiring center. The role displays a description of the ID you designated in the Representative ID field. |

| Employment Office |

Enter a description of the employment office for this hiring center. |

| Signature City |

Spanish contracts must be stamped with the date and the name of the city where the contract was signed. Enter the city's name here. |