Preparing for Income Tax Withholding

This section provides overviews of income tax withholding preparation and dependent deductions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_IT_PYE_TAX |

Enter employee income tax data, such as salary payer number, employee type, and disability information. |

|

|

GPJP_IT_DEP_TAX |

Enter dependent tax data. |

Enter the following data into the system before processing income tax withholding:

Enter income tax data for each employee on the Maintain Income Tax Data JPN page.

Enter dependent data.

Enter dependent identification, relationship to employee, and birth date on the Dependent Data pages in PeopleSoft HR.

Specify whether the dependent is subject to deduction, whether he or she is a parent living with the payee, and the disability type on the Maintain Dep Tax Data JPN page.

Global Payroll for Japan recognizes three types of employees from the standpoint of withholding tax. The employee's type is determined by which Dependent Deduction report the employee submits to the organization.

|

Type of Dependent Deduction Report Submitted |

Maintain Income Tax Data JPN Page: Income Tax Type field |

Dependent Tax Page |

|---|---|---|

|

Dependent Deduction report for primary salary. |

Select KOU. |

Enter the dependent data as submitted on the Dependent Deduction report. |

|

Dependent Deduction report for secondary salary. |

Select OTSU. |

Enter the dependent data as submitted on the Dependent Deduction report. |

|

No Dependent Deduction report submitted. |

Select OTSU. |

Do not enter any dependent tax information. |

Note: The system processes dependent deductions based on the combinations in the preceding table. If you select OTSU as the tax type and define dependent deductions on the Maintain Dep Tax Data JPN page, the system assumes that the deductions are for a secondary salary and calculates deductions accordingly. Do not enter dependent deduction information if you did not receive a Dependent Deduction report from the payee.

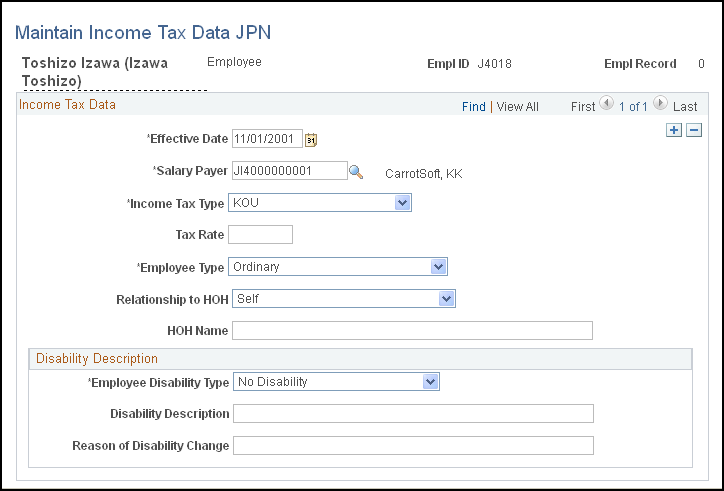

Use the Maintain Income Tax Data JPN page (GPJP_IT_PYE_TAX) to enter employee income tax data, such as salary payer number, employee type, and disability information.

Navigation

Image: Maintain Income Tax Data JPN page

This example illustrates the fields and controls on the Maintain Income Tax Data JPN page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Income Tax Type |

Select from the following values: Designated Rate, KOU, and OTSU. For employees with multiple jobs, KOU can be selected only once across all employment records. Otherwise, the system generates an error message. As the system doesn't allow multiple employment records with tax type KOU at the same time, you have to update the current KOU record to a non-KOU value and then update the non-KOU record to KOU. If the employee type is not KOU, the employee can't update this dependent data on the self-service pages. |

| Tax Rate |

Enter a value here only if you select Designated Rate for the income tax type. For example, enter 0.2 if the designated tax rate is 20 percent. |

| Relationship to HOH (relationship to head of household) |

Select the relationship of the employee to the head of the household. If the employee is the head of household, select Self. |

| HOH Name (head of household's name) |

If the employee is not the head of the household, enter the name of the person who is. |

Disability Information

Enter or edit disability information that is provided by employees on the Dependent Deduction report.

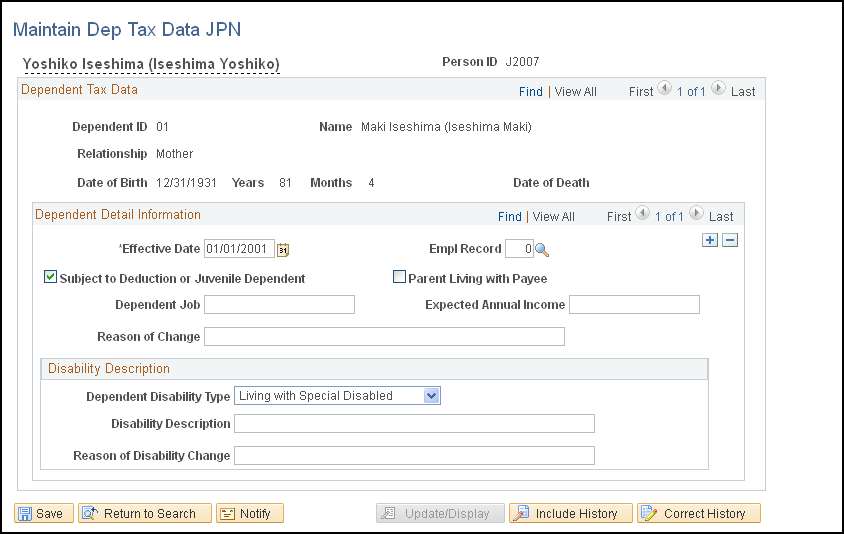

Use the Maintain Dep Tax Data JPN page (GPJP_IT_DEP_TAX) to enter dependent tax data.

Navigation

Image: Maintain Dep Tax Data JPN page

This example illustrates the fields and controls on the Maintain Dep Tax Data JPN page. You can find definitions for the fields and controls later on this page.

The selections you make on this page determine the personal exemptions for income tax during year-end processing, as well as for withholding income tax. The application determines the exemptions based on the dependent's birth date and relationship to the payee.

|

Information from Dependent Tax Table |

Age as of Base Date |

Applicable Personal Exemption |

|---|---|---|

|

Relationship is Spouse and Subject to Deduction is selected. |

Equal to or more than 70. |

Elderly Spouse |

|

Relationship is Spouse and Subject to Deduction is selected. |

Less than 70. |

Ordinary Spouse |

|

Relationship is other than Spouse, Subject to Deduction is selected and Parent Living with Payee is selected. |

Equal to or more than 70. |

Elderly Parent Living with Payee |

|

Relationship is other than Spouse, Subject to Deduction is selected and Parent Living with Payee is selected. |

Less than 70. |

Ordinary Dependent |

|

Relationship is other than Spouse, Subject to Deduction is selected, and Parent Living with Payee is not selected. |

Equal to or more than 70. |

Elderly Dependent |

|

Relationship is other than Spouse and Subject to Deduction is selected. |

Equal to or more than 16 and less than 23. |

Specified Dependent |

|

Relationship is other than Spouse and , Subject to Deduction is selected. |

Equal to or more than 23, and less than 70. |

Ordinary Dependent |

|

Relationship is other than Spouse and Subject to Deduction is selected. |

Less than 16. |

Ordinary Dependent |

|

Any combination other than those specified in this table. |

Any age. |

Not Applicable |

Dependent Detail Information

You must link the dependent tax data with an employment record number. If the employee has multiple jobs, the employment record number that is linked to the tax type KOU on the Maintain Income Tax Data JPN page defaults to the Empl Rcd Nbr field. If no employment record number is linked to tax type KOU, zero is defaulted.

Note: If the relationship of the dependent is changed to ExSpouse in HR, you should deselect the Subject to Deduction check box on this page.

Note: For a newborn child, enter the child’s birth date in the Effective Date field. This ensures that the system calculates taxes properly for the year in which the child was born.

Disability Description

Enter or edit disability information that is provided by employees on the Dependent Deduction report.

Deleting Dependent Tax Data

If dependent tax data exists on this page, it will be orphaned if the dependent data is deleted from the Dependent Information page, unless service operation DEPBEN_SYNC is enabled.