Understanding the Pay Calculation Business Process

This topic discusses:

Business process summary.

General processing information.

Deduction priority and deduction classification.

(USA) Insufficient net pay and pay calculation.

(CAN) Insufficient net pay and pay calculation.

(USA) Fair Labor Standards Act (FLSA) calculations.

Imputed income for group-term life insurance calculations.

In Payroll for North America, pay calculation is an iterative process. You can run and rerun calculations repeatedly until you're confident that the payroll data is correct. Here are the basic steps:

Enter employee payroll information, create paysheets, and make updates and adjustments for the pay period.

(Optional) Identify and fix potential errors using the Precalculation Audit Report (PAY035).

Run the Pay Calculation COBOL SQL process (PSPPYRUN).

Review calculation results and check for errors.

Check payroll error messages online or print the Payroll Error Messages report (PAY011).

View the results of paycheck earnings, deductions, and taxes using the Paycheck pages and various standard reports that you can print to verify the results of the pay calculation.

Make adjustments on the paysheets.

Repeat these steps until you're confident that the payroll data is correct, then run the final calculation and confirm pay.

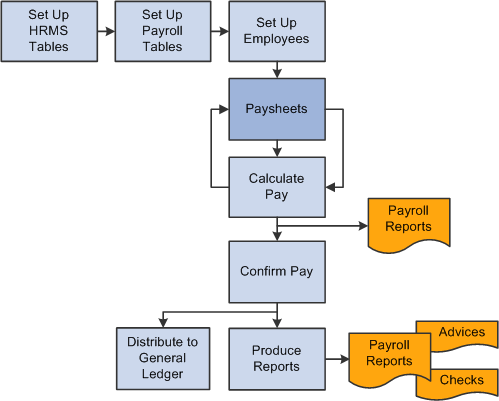

This diagram illustrates where pay calculation fits into the payroll process from setting up PeopleSoft HR tables to producing payroll reports, advices and checks:

Image: Illustration showing how pay calculation fits into the payroll process from setting up PeopleSoft HR tables to producing payroll reports, advices and checks

This diagram illustrates where pay calculation fits into the payroll process from setting up PeopleSoft HR tables to producing payroll reports, advices and checks.

The steps for processing an off-cycle payroll are similar to the steps for processing a normal on-cycle payroll. Specify off-cycle processing run parameters.

This topic discusses:

Pay information processed.

Calculation processing description.

Calculation processing options.

Pay Information Processed

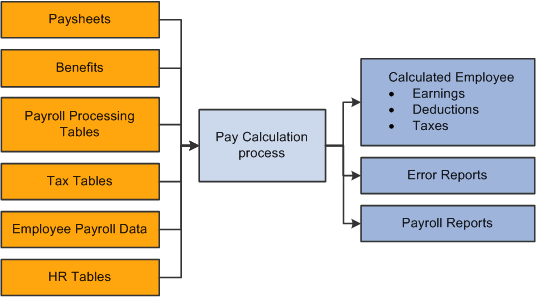

Pay calculation processes information that you set up in PeopleSoft HCM and Payroll for North America setup tables and employee setup tables, as well as additional information that is provided on paysheets.

This diagram shows what payroll and HCM information is used in the pay calculation process:

Image: Illustration showing what payroll and HCM information is used in the pay calculation process

This diagram shows what payroll and HCM information is used in the pay calculation process.

Calculation Processing Description

During the pay calculation, the system determines earnings, deductions, taxes, and net pay for all employees with pay earnings in a payline marked OK to Pay.

The system processes one company at a time, and within each company, every pay group that is assigned to that pay run ID. As it processes each pay group, the system indicates the number of checks to be calculated and how many have already been calculated.

The system commits the calculations after processing the number of employees that are specified in the Installation table. In other words, it updates the physical database with the results of the calculations.

Note: Any online change to an employee's pay data that deletes rows or alters an OK to PAY check box may not be reflected in an updated paysheet. In these cases, you must verify that the paysheet reflects the desired change and, if it does not, change the paysheet directly.

Off-Cycle Processing

Off-cycle payroll processing refers to calculating and creating a paycheck for one or more employees outside the normally scheduled (on-cycle) payroll run for their pay group. You typically use off-cycle payroll processing to create checks for the following employees:

Employees who are being terminated.

New hires that were not entered into the system in time for the last on-cycle payroll run.

Employees who received an incorrect payroll check during a normal payroll.

The steps for processing an off-cycle payroll are similar to the steps for processing a normal on-cycle payroll. Specify off-cycle processing run parameters.

Calculation Processing Options

To make the pay calculation as efficient as possible, the system contains safeguards and options. For example, you can specify whether to:

Calculate pay in preliminary or final mode.

Calculate for all employees, or only for employees with changes to their payroll data.

Transfer calculation errors if you use the Continue with Errors feature.

See Continue with Errors.

You can select any combination of options, and you can run payroll calculation as many times as you need in any mode. The only restriction is that before transferring errors, you must recalculate for all employees to ensure that untransferrable errors are corrected.

Warning! You must correct all pay calculation errors that are not included in the Continue With Errors definition before beginning the pay confirmation.

The system uses the deduction priority number and deduction classification to determine the order in which it takes deductions in a pay calculation. Define deduction priority numbers on the Deduction Table - Setup page and deduction classifications on the Deduction Table - Tax Class page.

The deduction priority and deduction classification function in a pay calculation as follows:

The system builds a temporary table that enables it to run calculations and store information.

The system stores the deduction code, classification (before-tax, after-tax, or taxable benefit), priority number, and deduction amount in the table.

For example, Mark receives 401(k), medical, dental, and life insurance benefits. He also contributes a portion of his earnings to union dues and a charity. The system interprets the information and stores it in a temporary table:

Type

Deduction Amount

Classification

Priority

401(k)

7%

Before-tax

5

Medical

100 USD (flat amount)

Before-tax

7

Dental

50 USD (flat amount)

Before-tax

8

Life insurance

100 USD (flat amount)

Before-tax

6

Union dues

2%

After-tax

9

Charity

25 USD (flat amount)

After-tax

10

The system locates all deductions (not including taxes) and calculates their value.

The system calculates the value of the deduction, based on gross earnings or a special accumulator.

Note: Taxes are not included with deductions. Although taxes reduce gross pay, they are distinct in their categorization.

Mark receives 2000 USD in gross earnings. The system calculates the deductions, based on the 2000 USD gross earnings:

Type

Deduction Amount

Classification

Priority

401(k)

7% × 2000 USD = 140 USD

Before-tax

5

Medical

100 USD

Before-tax

7

Dental

50 USD

Before-tax

8

Life insurance

100 USD

Before-tax

6

Union dues

2% × 2000 USD = 40 USD

After-tax

9

Charity

25 USD

After-tax

10

The system calculates the employee's taxable gross income.

To calculate an employee's taxable gross income, the system locates only those deductions with before-tax classifications and subtracts them from the gross income.

Note: The system does not actually deduct anything from the employee's gross income; it only runs a calculation.

Type

Deduction Amount

Classification

Priority

401(k)

Subtract 140 USD

Before-tax

5

Medical

Subtract 100 USD

Before-tax

7

Dental

Subtract 50 USD

Before-tax

8

Life insurance

Subtract 100 USD

Before-tax

6

Total deduction: 390 USD

2000 USD (gross income) − 390 USD (total of all before-tax deductions) = 1610 USD (taxable gross income).

Note: Seriously consider the deduction priority of before-tax deductions, because it affects the tax calculation.

The system calculates taxes, based on the taxable gross income:

Type

Priority

Deduction Amount

Federal tax

1

31% × 1610 USD = 499.10 USD

State tax

2

12% × 1610 USD = 193.20 USD

Local tax

3

3% × 1610 USD = 48.30 USD

Note: As you assign deduction priorities, remember that PeopleSoft assigned priorities for federal, state or provincial, and local taxes on payroll tax tables. These taxes have a higher priority to ensure that taxes take precedence over other deductions.

See (USA) Setting Up the Company Local Tax Table(CAN) Setting Up the Canadian Company Tax Table

The system withholds taxes, before-tax deductions, and after-tax deductions from gross pay.

The system calculates only the deductions. After the system completes these calculations, it withholds all of the deductions and taxes from an employee's gross pay in sequential order, using deduction priority numbers.

The system withholds all of Mark's precalculated deductions and taxes from his 2000 USD gross pay as follows:

Type

Classification

Priority

Sequence

Withholding Amount

Federal tax

NA

1

First

499.10 USD

State tax

NA

2

Second

193.20 USD

Local tax

NA

3

Third

48.30 USD

401(k)

Before-tax

4

Fourth

140 USD

Life insurance

Before-tax

5

Fifth

100 USD

Medical

Before-tax

6

Sixth

100 USD

Dental

Before-tax

7

Seventh

50 USD

Union dues

After-tax

8

Eighth

40 USD

Charity

After-tax

9

Ninth

25 USD

Total withholdings: 1195.60 USD

2000 USD (gross income) − 1195.60 USD (total of all withholdings) = 804.40 USD (net pay).

Note: At this point, the system takes deductions that have both a before-tax and after-tax classification in the following order: before-tax deduction, then after-tax deduction.

The final result is the employee's net pay.

At times, there might be insufficient net pay to cover all withholdings during pay calculation. If the system encounters such a deficiency during pay calculation, it identifies the first deduction that it cannot completely withhold and recalculates new tax values to compensate for the lack of net pay.

Using the previous example, suppose Mark has insufficient net pay to cover all withholdings during pay calculation. The system withholds all of the deductions and taxes from an employee's gross pay, in sequential order, using deduction priority numbers. In this example, Mark has insufficient net pay to withhold all deductions starting with his 401(k):

|

Type |

Classification |

Priority |

Deduction Sequence |

Amount To Withheld |

Actual Amount Withheld |

|---|---|---|---|---|---|

|

Federal tax |

NA |

1 |

First |

241.50 USD |

499.10 USD |

|

State tax |

NA |

2 |

Second |

161 USD |

193.20 USD |

|

Local tax |

NA |

3 |

Third |

48.30 USD |

−48.30 USD |

|

401(k) |

Before-tax |

4 |

Fourth |

140 USD |

−70 USD |

|

Life insurance |

Before-tax |

5 |

Fifth |

100 USD |

0 USD |

|

Medical |

Before-tax |

6 |

Sixth |

100 USD |

0 USD |

|

Dental |

Before-tax |

7 |

Seventh |

50 USD |

0 USD |

|

Union dues |

After-tax |

8 |

Eighth |

40 USD |

0 USD |

|

Charity |

After-tax |

9 |

Ninth |

25 USD |

0 USD |

|

|

|

|

|

Total withholdings: 810.60 USD |

|

Using this example, the system takes the following steps when encountering insufficient pay during pay calculation:

The system encounters a deduction that it cannot completely withhold and identifies it for tax recalculation.

In the example, 401(k) is the first deduction to have insufficient funds for complete withholding. If you selected the Partial Deductions Allowed check box on the Deduction Table - Process page, the system takes as much of the deduction as it can—in this case 70 USD—and moves the remaining unpaid balance to arrears. Therefore 70 USD goes into arrears, and the system notes that Mark paid 70 USD to the 401(k) deduction.

The system also identifies all deductions subsequent to the partial deduction and moves the unpaid balances to arrears.

In the example, the system identifies the life insurance, medical, and dental deductions and sends a total of 250 USD (in before-tax deductions) to arrears. It also notes that Mark paid 0 USD for each of these deductions.

The system recalculates taxable gross income.

The system calculates taxable gross income by locating all before-tax deductions and subtracting them from Mark's gross income. It calculates all before-tax deductions by a percentage of Mark's gross income or a flat amount.

This time, however, instead of using the original percentage or flat amount to calculate before-tax deductions, the system uses the amount that it noted in the previous steps (the actual amount Mark paid toward those deductions):

Type

Deduction Amount (Amount Noted By The System)

Classification

Priority

401(k)

70 USD

Before-tax

4

Life insurance

0 USD

Before-tax

5

Medical

0 USD

Before-tax

6

Dental

0 USD

Before-tax

7

Total Deduction: 70 USD

Originally, the system subtracted 390 USD (the original total of all before-tax deductions) from Mark's gross income to arrive at his taxable gross income. However, using the amounts noted from previous steps (the amount Mark actually paid towards the deductions), it only subtracts 70 USD from his gross income. Therefore, the system arrives at a new taxable gross income that is larger than the original.

The system calculates taxes, based on the new taxable gross income.

The taxes calculated from the new, larger taxable gross income are higher than the first time.

Note: The remaining steps are documented in the Running Pay Calculation section.

For Canadian processing, if a before-tax deduction results in insufficient net pay, the deduction calculation process restarts and processes each deduction in sequential order, based on the deduction priority number. If there is insufficient net pay to cover a before-tax deduction entirely, the deduction is ignored. No partial before-tax deduction amounts are processed.

The FLSA and Alternative Overtime appendix includes examples of calculations.

Group-term life insurance setup instructions include examples of calculations.