Defining Disposable Earnings for Garnishments

To define disposable earnings for garnishments, use the Disposable Earnings Defn (GARNISH_DE_DEFN) and Disposable Earnings Defn CAN (GARNISH_DE_DEFN_CN) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GARNISH_DE_DEFN |

Review and update disposable earnings definitions. |

|

|

Load Deductions to Reduce DE Page (load deductions to reduce earnings definition) |

GARN_DE_SEC |

Load deductions into the Disposable Earnings Definition page by plan type, or by plan type and benefit plan. |

|

Disposable Earnings Defn Rpt Page (disposable earnings definition report) |

PRCSRUNCNTL |

Generate PAY716 that lists information from the Disposable Earnings Definition table, where you define disposable earnings that are subject to garnishment and garnishment exemption parameters. |

Disposable earnings are the earnings subject to garnishment. What constitutes disposable earnings varies according to the governing jurisdiction (that is, federal, state, provincial, or local authority). For example, a disposable earnings definition might specify the calculation of an employee's gross earnings minus all federal and state taxes and health insurance premiums.

Note: Use the calculation formula to define which taxes subtract from the disposable earnings.

See Setting Up Garnishment Rules.

PeopleSoft maintains and delivers the standard federal and state disposable earnings definitions with Payroll for North America.

Important! The PeopleSoft-maintained garnishment disposable earnings definitions are complete as delivered except for deductions to include or exclude when determining the disposable earnings subject to garnishment. During the implementation process, enter the deductions pertaining to specific disposable earnings definitions.

Note: Courts and other authorized jurisdictions frequently issue garnishment orders defining disposable earnings definitions that are different from standard definitions. In such a case, use the Disposable Earnings Definition page to establish a record of the court's individual definition. You are responsible for maintaining these records.

(USA) U.S. Federal Tax Levies

For U.S. federal tax levies, the Internal Revenue Service defines disposable earnings as gross earnings minus voluntary and involuntary deductions in existence when the employer receives the garnishment order. Therefore, you can apply only involuntary increases in those existing deductions to the disposable earnings calculation for garnishments of this type.

PeopleSoft provides FEDTAXLEVY as the DE definition ID for federal tax levies and for state tax levies for which the same rules apply.

Note: For the DE definition ID FEDTAXLEVY, use the Deductions Reducing DE (deductions reducing disposable earnings) group box to identify only those deductions that you cannot apply to the disposable earnings calculation.

(CAN) Canadian Federal Disposable Earnings Definitions

PeopleSoft provides and maintains two Canadian federal disposable earnings definitions:

FEDERALCAN: Includes taxable benefits and subtracts statutory deductions (that is, income tax, Canada and/or Quebec Pension Plan [CPP/QPP], and Employment Insurance [EI]).

FEDCANEXBN: Excludes taxable benefits and subtracts statutory deductions (that is, income tax, CPP/QPP, and EI) .

Use the Disposable Earnings Definition page (GARNISH_DE_DEFN) to review and update disposable earnings definitions.

Navigation

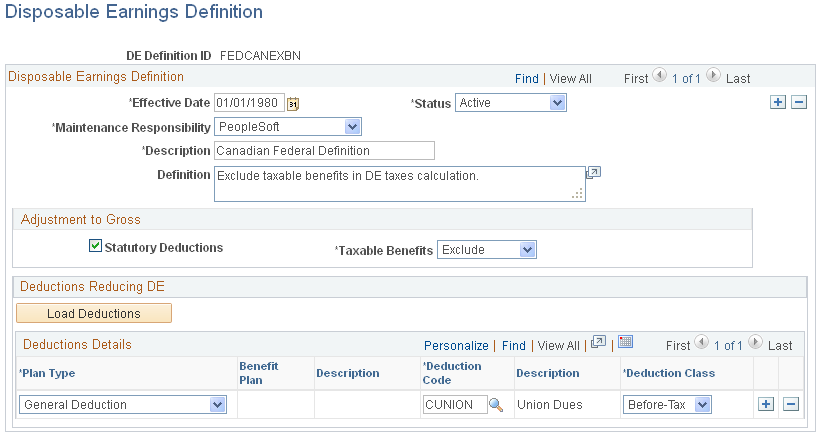

Image: Disposable Earnings Definition page

This example illustrates the fields and controls on the Disposable Earnings Definition page.

|

Field or Control |

Definition |

|---|---|

| DE Definition ID (disposable earnings definition ID) |

This ID links the garnishment disposable earnings definition to the applicable Garnishment Rules table. |

(CAN) Adjustment to Gross

The fields in this group box appear on the page for Canadian users only. They are for information only.

Deductions Reducing DE

Some court orders require that you subtract deductions from the employee's gross pay to arrive at disposable earnings. Use this group box to enter deductions to use when calculating disposable earnings.

Note: During the implementation process, enter the deductions to reduce the disposable earnings subject to garnishment.

|

Field or Control |

Definition |

|---|---|

| Load Deductions |

Select to access the Load Deductions to Reduce DE page, where you can load deductions into the Deductions Details grid by plan type, or by plan type and benefit plan. Note: You cannot use this option to load general deductions. You must enter general deductions into the Deduction Details grid manually. |

| Deductions Details |

You can manually enter deductions using the editable fields in this grid. General deductions must be manually entered. If you load deductions using the Load Deductions option, the system replaces the existing deductions having the same selection criteria. After loading deductions using the Load Deductions button, you can delete any of the loaded deductions that are not appropriate. You can also add additional deductions manually or by using the Load Deductions option again. Note: After loading and editing the deductions, you must save the page. |

Use the Load Deductions to Reduce DE (load deductions to reduce earnings definition) page (GARN_DE_SEC) to load deductions into the Disposable Earnings Definition page by plan type, or by plan type and benefit plan.

Navigation

Select Load Deductions on the Disposable Earnings Definition page.

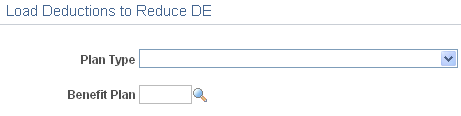

Image: Load Deductions to Reduce DE page

This example illustrates the fields and controls on the Load Deductions to Reduce DE (earnings definition) page.

To load deductions:

Select a plan type or combination of plan type and benefit plan.

The system selects all deductions in the plan type or benefit plan that:

Are active as of the effective date of the DE definition.

Have deduction classification After Tax or Before Tax.

Select OK to load deductions that meet the criteria into the Garnishments DE Deduction table (GARN_DE_DED) and into the grid on the Disposable Earnings Definition page, where you can further edit the list.

Select the Load Deductions option on the Disposable Earnings Definition page to return to this page to select and load deductions from additional plan types or benefit plans.