Defining Earnings Accrual Classes

To set up earnings accrual classes, use the Earnings Accruals USF (GVT_ERN_ACR_CLASS) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GVT_ERN_ACR_CLASS |

Define accrual class properties and key features, including the rules for calculating leave based on time in service and frequency of accrual. |

|

|

GVT_ERN_ACR_CLASS2 |

Establish rules for applying ceilings and carryover limits to earnings accrual classes. |

|

|

GVT_ERN_ACR_CLASS3 |

Apply expiration and termination rules to earnings accrual classes. |

|

|

GVT_ERN_ACR_CLASS4 |

Create a schedule for granting leave based on length of service. Establish the hours, months, years, or pay periods that members of the accrual class must work to receive a specified amount of leave. |

|

|

GVT_ERN_ACR_CLASS5 |

Select the earnings codes that add to, or subtract from, leave balances for the class, and specify how the hours that are associated with these earnings codes affect various balances that track and store leave time (such as hours taken, hours earned, and service hours). |

|

|

GVT_ERN_ACR_CLASS6 |

Define the sequence and the accrual classes to which each earnings accrual class cascades. |

Payroll for North America provides streamlined processing and reporting of all U.S. federal government leave accrual, usage, transfer, and adjustment activity that affects an employee's leave balances. The system uses accrual classes to track the expiration dates of accrued leave line items, applying leave usage to the oldest line items first and disposing of expired leave balances by the method that you specify for the class. The system supports all leave plans and transfer programs that are currently authorized for federal agencies.

Before you begin defining accrual classes:

Decide how to convert the processing rules, earnings limits, and other criteria governing leave at your agency into earnings accrual classes.

You might want many accrual classes or just a few, depending on how you define the parameters for different leave types, such as annual leave, sick leave, and compensatory time.

For example, you can create a rule limiting certain employees to no more than 240 hours of annual leave, and a rule that allows another group of employees to earn up to 360 hours of leave. Each of these rules requires a different accrual class.

Establish a naming convention for accrual classes so that you can designate and quickly identify different classes for sick leave, compensatory time, military leave, and so on.

Become familiar with the relationship between earnings codes and accrual classes.

To define accrual classes:

Set up and define the earnings codes to associate with each earnings accrual class.

Define the parameters of each earnings accrual class in one of the following ways:

A set of rules determining the rate at which employees accrue leave based on years of service.

A set of rules for applying ceilings, carryover limits, and expiration dates to accrued leave, and for disposing of excess leave when one exceeds these limits.

A set of rules to determine how to process, track, and accumulate leave balances.

Relationship Between Earnings Codes and Accrual Classes

Every type of leave (such as annual leave or shore leave), is represented in the system by one or more earnings codes, as used on paysheets at the employee level. An accrual class enables you to set limits and parameters for leave earnings represented by an earnings code. This includes expiration periods for leave, leave ceilings, and carryover limits.

Earnings codes are central to their associated earnings classes. By themselves, however, earnings codes don't indicate how to handle leave when one reaches a ceiling or expiration, the order in which the system uses leave earnings, and so on. You can link this kind of information to an earnings code only by associating it with an accrual class.

Earnings codes tell the system what to pay employees if you decide to convert leave to pay upon expiration or termination, or when one exceeds ceiling and carryover limits.

Accrual classes indicate how to process and accumulate leave earnings represented by different earnings codes for individual employees in that class. For example, if you define an accrual class for annual leave, you might:

Define an earnings code for leave hours taken.

Specify that the system adds this time to the accumulation of service hours that are used to calculate leave accrual rates.

When you define an accrual class for one type of leave, you must specify how earnings codes for other types of leave or work time affect accrual balances for employees in the class. For example, if you define an accrual class for annual leave, you might specify another type of leave taken by your employees (such as sick leave or compensatory time) to add to the accumulation of service hours on which annual leave is based.

Annual Leave Entitlement Calculation

The following table lists the formulas that are used to calculate accrual-specific entitlements. You must select the Annual Entitlement check box on the Earnings Accruals USF - Class page for this calculation to occur:

|

Leave |

Accrual Unit |

Accrual Frequency |

Formula |

Time Accrued |

|---|---|---|---|---|

|

Annual Full-Time (FT) |

Year |

Hours/Pay Period |

((remaining pay periods in the year) × accrual rate) + year-to-date accrual balance + last pay period If service is between 3 and 15 years, the formula is: ((remaining pay periods in the year) × accrual rate) + year-to-date accrual balance + last pay period + 4 |

0−3 years of service: ½ day (4 hours) for each pay period, except based on service. 3−15 years of service: ¾ day (6 hours) for each pay period, except 1¼ days (10 hours) in last pay period. 15+ years of service: 1 day (8 hours) for each pay period. |

|

Annual Part-Time (PT) |

Year |

Hours/Hour |

((remaining pay periods in the year) × accrual rate × standard hours) + year-to-date accrual balance |

0−3 years of service: 1 hour for each 20 hours in pay status. 3−15 years of service: 1 hour for each 13 hours in pay status. 15+ years of service: 1 hour for each 10 hours in pay status. |

|

Sick FT |

Years |

Hours/Pay Period |

((remaining pay periods in the year) × accrual rate) + year-to-date accrual balance |

½ day (4 hours) for each biweekly pay period. |

|

Sick FT |

Years |

Hours/Hour |

((remaining pay periods in the year) × accrual rate × standard hours) + year-to-date accrual balance |

1 hour for each 20 hours in a pay status. |

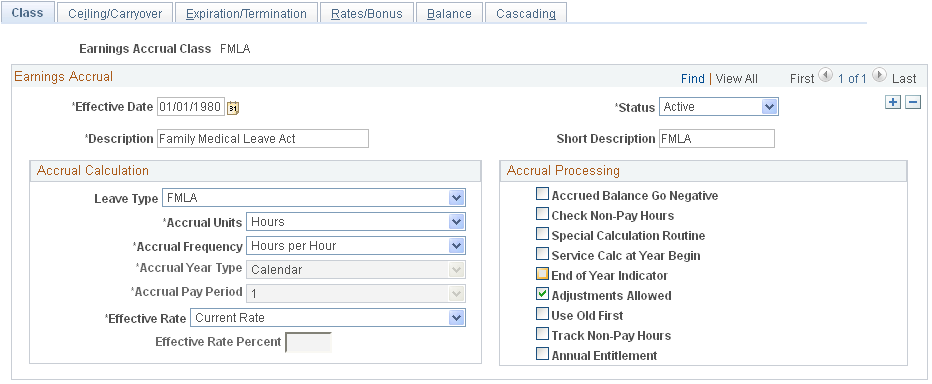

Use the Earnings Accruals USF - Class page (GVT_ERN_ACR_CLASS) to define accrual class properties and key features, including the rules for calculating leave based on time in service and frequency of accrual.

Navigation

Image: Earnings Accruals USF - Class page

This example illustrates the fields and controls on the Earnings Accruals USF - Class page.

Accrual Calculation

This information enables the system to record the frequency of accrual and the units of leave time earned by members of the accrual class.

|

Field or Control |

Definition |

|---|---|

| Leave Type |

Note: Although you can define many different types of leave in the Earnings Accrual Class component, different accrual types require different rules. For example, because compensatory time does not accrue at regular rates based on years of service, you do not use the Earnings Accruals USF - Rates/Bonus page to link compensatory time earnings to service time. However, you do use this page for annual leave, which does vary according to years of service. |

| Accrual Units |

Select the unit of time that the system uses to track, store, and quote the service intervals on which it bases accruals: Hours, Months, or Years. Note: This value becomes the default on the Rates/Bonus page, where you associate accrual rates to time in service. |

| Accrual Frequency |

Select the rate at which leave is earned and tabulated: Hrs/Year (hours/year): When you select this value, the Accrual Year Type field becomes available for entry. Hrs/Hour (hours/hours): Select this value to have employees earn leave at a rate of hours each hour. Hrs/Month (hours/month): When you select this value, the Accrual Pay Period field becomes available for entry. Hours/Pay Pd (hours/pay period): Select this value to have employees earn leave at a rate of hours in each pay period. Hrs/Week (hours/week): Select this value to have employees earn leave at a rate of hours each week. Note: This value becomes the default on the Rates/Bonus page. |

| Accrual Year Type |

Select the type of dates to use as the beginning and ending dates of the year: Calendar: The calendar year normally begins January 1 and ends December 31. Fiscal: The fiscal year normally begins October 1 of a year and ends September 30 of the following year. Leave: The leave year normally begins with the first full pay period that begins and ends within the calendar year. However, because the length of the leave year is 26 pay periods, the end date falls within the following year. Pay: The pay year normally begins with the first full pay period that begins and ends within the calendar year, and it ends with the last pay period that begins and ends in the year. Note: Before using these accrual year types, you must define them in the Pay Calendar table. You can modify the standard definitions as needed. |

| Accrual Pay Period |

Select the pay period in which you want to grant leave earnings. For example, if the month contains multiple pay periods and you decide to distribute earnings after the first week, enter any value from 2 to 5 in the Accrual Pay Period field (with 2 indicating week two, 3 indicating week three, and so on). The default is 1 (week one). |

| Effective Rate |

Select the disposition of excess leave balances: Current Rate, Rate Earned, or Current Rate Percent. Convert leave to pay using the pay rate in effect when the leave was originally accrued, the current rate of pay at the time of expiration, or a percentage of the current rate. When you select Current Rate Percent, the Effective Rate Percent field becomes available for entry. |

| Effective Rate Percent |

Enter the percentage to use as the basis of calculations. |

Accrual Processing

Use this group box to indicate how to process, calculate, and adjust accruals, and to establish a schedule for disposing of dated leave balances.

|

Field or Control |

Definition |

|---|---|

| Accrued Balance Go Negative |

For your information only. |

| Check Non-Pay Hours |

Select to tabulate the number of nonpay hours to determine whether to grant accrual earnings. For example, suppose the standard hours for an employee are 80 hours per pay period. The employee has 70 nonpay hours going into a new pay period and takes an additional 10 hours of nonpaid time. The system adds the total number of nonpay hours (80), determines that this number equals the total of standard hours, and blocks any additional leave accrual for that pay period. |

| Special Calculation Routine |

Not currently used by U.S. federal government customers. |

| Service Calc at Year Begin (service calculation at year begin) |

Select to calculate leave hours according to length of service as of January 1 of the current year. To calculate leave hours according to the length of service as of the leave accrual process date, deselect this check box. The system uses the service date in the employee's Job Data component for this calculation. |

| End of Year Indicator |

Select to expire restored leave at the end of the expiration year (Dec. 31). For example, if you restore an employee's leave on Jan. 15, 1998 and the leave expires in 24 months, the system extends the expiration date beyond the two-year limit to the end of the year in which the leave expires (December 31, 2000). This is for restored leave only. |

| Adjustments Allowed |

Select to adjust leave at the line-item level on the Accrual Ledger page. Otherwise, the Accrual Adjustment button is not available. |

| Use Old First |

Select when processing ceilings, carry overs, and expirations. The system reviews historic rows of leave and uses the oldest available leave first. |

| Track Non-Pay Hours |

Select to track nonpay hours for a WGI. Nonpaid hours will be tracked on the accrual non pay ledger. |

| Annual Entitlement |

Select to activate the annual entitlement calculation. After each pay period, the system calculates the employee's annual accrual entitlement balance along with the next pay period's accrual. This provides the information to determine how many leave hours employees can use before exceeding their full annual accrual entitlement. The number of hours to which an employee is entitled for the remainder of the year appears on the Accrual Summary page. Calculation formulas are provided in the overview. |

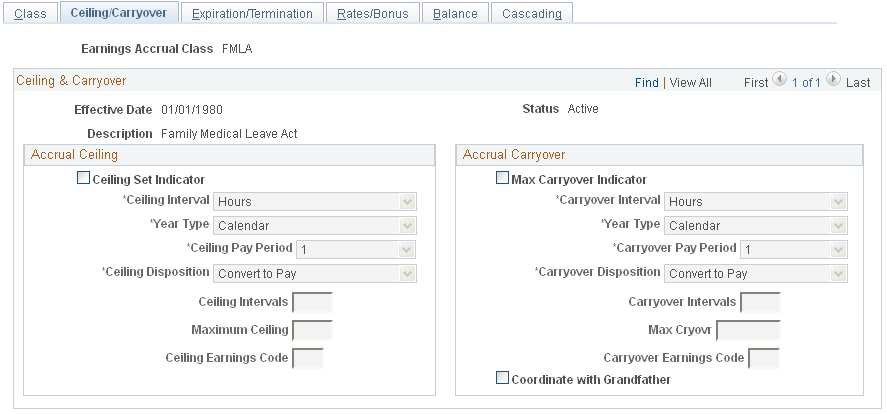

Use the Ceiling/Carryover page (GVT_ERN_ACR_CLASS2) to establish rules for applying ceilings and carryover limits to earnings accrual classes.

Navigation

Image: Ceiling/Carryover page

This example illustrates the fields and controls on the Ceiling/Carryover page.

Accrual Ceiling

Use this group box to place limits on total leave earnings and to specify how to handle excess accruals. Establishing a leave ceiling enables you to limit leave earnings and to trigger various actions when the ceiling has been reached, including the conversion of leave to pay.

|

Field or Control |

Definition |

|---|---|

| Ceiling Set Indicator |

Select to activate the fields in the Accrual Ceiling group box. |

| Ceiling Interval |

Select the interval with which to measure the maximum amount of leave time that members of an accrual class can accumulate: Hours, Months, Pay Period, or Years. When you select Months, the Ceiling Pay Period field becomes available for entry. When you select Years, the Year Type field becomes available for entry. |

| Ceiling Pay Period |

Select the week of each month in which you apply the accrual ceiling and determine the disposition of excess leave (1 represents week one, 2 represents week two, and so on). |

| Ceiling Disposition |

Specify how to handle excess leave accruals: Allowed to Exceed: Select to disregard ceilings that are applied at an earlier date. Convert to Other: Select to convert excess leave to other types of leave. For example, if you place a ceiling on leave accruals, you can convert excess earnings into another leave type by entering its corresponding earnings code in the Ceiling Earnings Code field. However, this value is not supported by an automated process. Configuration is required to implement this feature. Convert to Pay: Select to convert excess leave to pay by creating an Additional Pay record, either at the rate earned or at the current rate that is specified on the Earnings Accruals USF - Class page. The system creates a ledger entry to record the reduction of hours and updates the accruals summary. The resulting payment appears as additional pay on the paysheets. When you select this value, the Ceiling Earnings Code field becomes available for entry. Forfeit: Select to reduce excess accruals and create a ledger entry to record the forfeiture. You immediately lose excess leave. Use or Lose: Select to reduce excess accruals and create a ledger entry to record the forfeiture. You immediately lose excess leave. |

| Ceiling Intervals |

Not currently used by U.S. federal government customers. |

| Maximum Ceiling |

Enter the maximum number of hours, months, years, or pay periods of leave time that an employee in the accrual class can accumulate, depending on the unit of measurement that is specified in the Ceiling Intervals field. |

| Ceiling Earnings Code |

Specify how to compensate employees in an accrual class when leave is converted to pay. Define earnings codes in the Earnings tables. |

Accrual Carryover

Use this group box to specify the carryover limits and tell the system what operations to perform when one exceeds the limit. Establishing a carryover limit enables you to control the amount of leave employees can carry over from one period to another and to trigger other operations, such as the conversion of excess carryover to pay.

|

Field or Control |

Definition |

|---|---|

| Max Carryover Indicator (maximum carryover indicator) |

Select to activate the fields in the Accrual Carryover group box. |

| Carryover Interval |

Select the interval with which to measure the amount of leave employees in the accrual class can carry over from one period to another: Hours, Months, Pay Period, or Years. When you select Months, the Carryover Pay Period field becomes available for entry. When you select Years, the Year Type field becomes available for entry. |

| Carryover Pay Period |

Select the week of each month in which you apply the accrual carryover and determine the disposition of excess leave (1 represents week one, 2 represents week two, and so on). |

| Carryover Disposition |

Specify how to handle excess leave accruals: Allowed to Exceed: Select to disregard carryover limits that are applied at an earlier date. Convert to Other: Select to convert excess leave to other types of leave. For example, if you apply a carryover limit to leave earnings, you can convert excess earnings into another leave type by entering its corresponding earnings code in the Carryover Earnings Code field. However, this value is not supported by an automated process. Configuration is required to implement this feature. Convert to Pay: Select to convert excess carryover to pay by creating an Additional Pay record, either at the rate earned or at the current rate that is specified on the Earnings Accruals USF - Class page. The system creates a ledger entry to record the reduction of hours and updates the accrual summary. The resulting payment appears as additional pay on the paysheets. When you select this value, the Carryover Earnings Code field becomes available for entry. Forfeit: Select to reduce excess leave and create a ledger entry to record the forfeiture. You immediately lose excess leave. Use or Lose: Select to reduce excess leave and create a ledger entry to record the forfeiture. You immediately lose excess leave. |

| Carryover Intervals |

Not currently used by U.S. federal government customers. |

| Max Cryovr (maximum carryover) |

Enter the maximum number of hours, months, years, or pay periods of leave time that an employee in the accrual class can carry over, depending on the unit of measurement that is specified in the Carryover Intervals field. |

| Carryover Earnings Code |

Specify how to compensate employees in an accrual class when converting leave to pay. Define earnings codes in the Earnings tables. |

| Coordinate with Grandfather |

Select if employees can use grandfathered leave earnings that put them above the carryover limit for their accrual class. For example, if an employee moves from an accrual class that carries a higher carryover limit than is permitted for individuals in the current class, the system checks the Enrollment page for the correct carryover limit for this employee. Employees are eligible to receive a personal carryover limit on the Enrollment page that remains in effect until their leave earnings fall within the carryover limit for the rest of their accrual class. So, an employee entering an accruals class with excess leave isn't forced to lose it, and the system coordinates leave usage so that it uses the oldest leave first. Note: After you enter the original amount of an employee's grandfathered leave on the Enrollment page, view the grandfathered leave balance on the Accrual Summary page. |

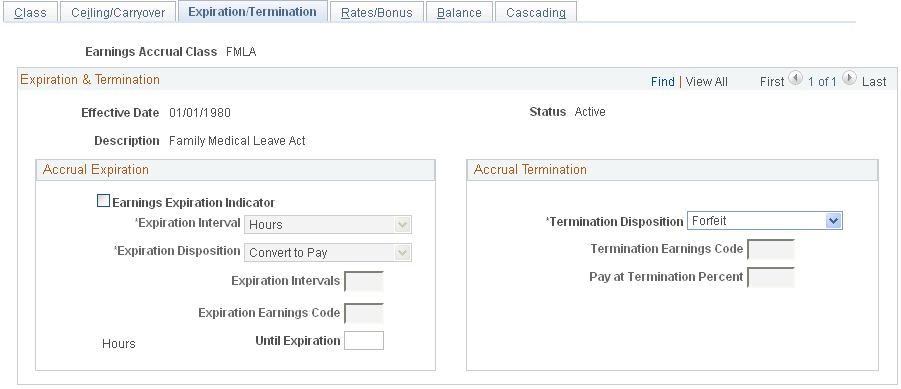

Use the Expiration/Termination page (GVT_ERN_ACR_CLASS3) to apply expiration and termination rules to earnings accrual classes.

Navigation

Image: Expiration/Termination page

This example illustrates the fields and controls on the Expiration/Termination page.

Accrual Expiration

Use this group box to specify the maximum amount of time that can pass before one must use, forfeit, or convert accrued leave to pay.

|

Field or Control |

Definition |

|---|---|

| Earnings Expiration Indicator |

Select to activate the fields in the Accrual Expiration group box. |

| Expiration Interval |

Select the interval with which to measure the expiration period. This value is the default unit of measurement for the Until Expiration field. |

| Expiration Disposition |

Specify how to handle leave upon expiration: Convert to Other: Select to convert expired leave to other types of leave. For example, if you apply an expiration date to leave earnings, you can convert this leave into another leave type by selecting its corresponding earnings code. However, this value is not supported by an automated process. Configuration is required to implement this feature. Convert to Pay: Select to convert expired leave to pay by creating an Additional Pay record, either at the rate earned or at the current rate that is specified on the Earnings Accruals USF - Class page. The system creates a ledger entry to record the reduction of hours and updates the accrual summary. The resulting payment appears as additional pay on the paysheets. When you select this value, the Expiration Earnings Code field becomes available for entry. Forfeit: Select to reduce expired leave and create a ledger entry to record the forfeiture. You immediately lose excess leave. |

| Expiration Intervals |

Not currently used by U.S. federal government customers. |

| Expiration Earnings Code |

Specify how to compensate employees in an accrual class when converting leave to pay. Define earnings codes in the Earnings table. |

| Until Expiration |

Enter the number of hours, months, years, or pay periods until leave expires. The default unit of measurement comes from the Expiration Interval field. |

Accrual Termination

|

Field or Control |

Definition |

|---|---|

| Termination Disposition |

Specify how to handle leave upon termination: Convert to Pay: Select to convert unused leave to pay by creating an Additional Pay record, either at the rate earned or at the current rate that is specified on the Earnings Accruals USF - Class page. The system creates a ledger entry to record the reduction of hours and updates the accrual summary. To complete the payout procedure, you must enter this information in the Final Check Program Table component (TERM_PGM_TBL). Forfeit: Select to record forfeited accruals and create a ledger entry to record the termination. You lose any unused leave. |

| Termination Earnings Code and Pay at Termination Percent |

Specify the earnings for which employees in an accrual class are eligible when converting accruals to pay. If your policy is to convert leave to pay at a percentage of the rate that is represented by the earnings code, enter the percent in the Pay at Termination Percent field. |

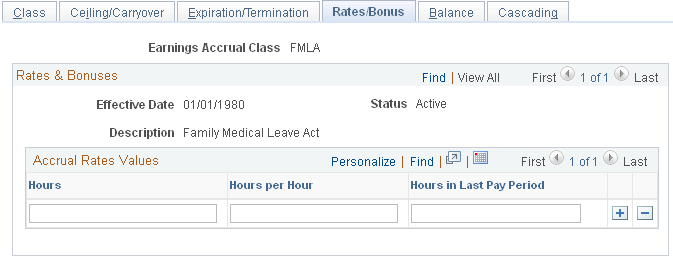

Use the Rates/Bonus page (GVT_ERN_ACR_CLASS4) to create a schedule for granting leave based on length of service.

Navigation

Image: Rates/Bonus page

This example illustrates the fields and controls on the Rates/Bonus page.

Establish the hours, months, years, or pay periods that members of the accrual class must work to receive a specified amount of leave.

Accrual Rates Values

The default time period that is displayed in this group box—in this case hours—comes from the Accrual Units field on the Earnings Accruals USF - Class page. For example, if you selected Hours as the accrual units on the Earnings Accruals USF - Class page, you measure service time in hours on the Rates/Bonus page.

|

Field or Control |

Definition |

|---|---|

| Hours |

Enter the length of service. The accrual unit (hours, months, or years) that displays at the top of this column comes from the Accrual Units field on the Earnings Accruals USF - Class page. |

| Hours per Hour |

Enter the number of hours that accrue per month, year, or pay period. The accrual rate (hours per month, hours per pay period, hours per year, or hours per hour) that displays at the top of this column comes from the Accrual Frequency field on the Earnings Accruals USF - Class page. |

| Hours in Last Pay Period |

Specify a fixed number of leave hours to distribute in the last pay period of the year, independent of the amount that you grant automatically to members of the accrual class. |

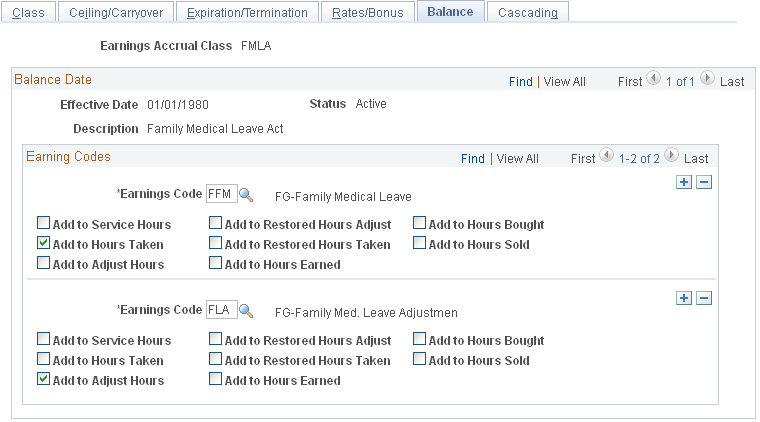

Use the Earnings Accruals USF - Balance page (GVT_ERN_ACR_CLASS5) to select the earnings codes that add to, or subtract from, leave balances for the class, and specify how the hours that are associated with these earnings codes affect various balances that track and store leave time (such as hours taken, hours earned, and service hours).

Navigation

Image: Earnings Accruals USF - Balance page

This example illustrates the fields and controls on the Earnings Accruals USF - Balance page.

|

Field or Control |

Definition |

|---|---|

| Earnings Code |

Select an earnings code for which you want to keep a leave balance. |

| Add to Service Hours |

Select to add to the accumulation of service hours on which accrual rates are based. To view the total service hours for an employee in the accrual class, use the Accrual Summary page. To adjust service hours for an employee, use the Accrual Ledger page. |

| Add to Hours Taken |

Select to add to the accumulation of hours taken. To view the total hours taken for an employee in the accrual class, use the Accrual Summary page. To adjust service hours for an employee, use the Accrual Ledger page. |

| Add to Adjust Hours |

Select to specify the capability to adjust accrual balances by addition or subtraction, though you don't actually make the adjustment here. When you enter adjustment data using paysheets, the system accepts positive or negative hours. To view the total hours adjusted year-to-date, use the Accrual Summary page. Note: You cannot enter or alter adjusted hours directly through the Accrual Ledger page; they become part of the Leave Accruals Processing COBOL SQL process (FGPACCRL) through paysheets. |

| Add to Restored Hours Adjust |

Select to add to the balance of adjusted restored hours. To view the balance of adjusted restored hours, use the Restored Hours page. Note: You cannot enter or alter restored hours directly through the Restored Hours page; they become part of the Leave Accruals Processing process through paysheets. You can change only the expiration date of restored leave on the Restored Hours page. |

| Add to Restored Hours Taken |

Select to add to the balance of restored hours taken. To view the balance of restored hours taken, use the Restored Hours page. |

| Add to Hours Earned |

Select to add leave to the accumulation of hours earned. To view the total of hours earned, use the Accrual Summary page. To adjust hours earned for an employee, use the Accrual Ledger page. |

| Add to Hours Bought |

Not currently used by U.S. federal government customers. |

| Add to Hours Sold |

Not currently used by U.S. federal government customers. |

Note: Many of these check boxes are replicated in the Earnings Code table. If you use accrual classes to place limits on earnings codes and to specify how to accumulate the hours that are associated with them, use the check boxes on this page, rather than those in the Earnings Code table.

Example 1

Each check box on the Earnings Accruals USF - Balance page represents a balance to which you can add for:

Tracking earnings.

Recording leave hours taken, time in service, and so on.

This enables you to specify:

How the system tracks and processes an earnings code for the accrual type in the accrual class (annual leave, for example).

How the hours that are associated with that code affect accrual rates and other earnings criteria for employees in this class.

For example, select the Add to Service Hours and Add to Hours Taken check boxes for the FAL earnings code (a code representing annual leave hours for the ANN360 accrual class). The system adds together the annual leave taken and the accumulation of service hours on which accrual rates are based.

Example 2

Because earnings codes representing other types of leave or work time also affect leave accruals for employees in the ANN360 accrual class, the leave plan administrator specifies how hours that are associated with these codes affect balances for employees in the class. In the following example, the system combines hours that are associated with the earnings code for religious comp time-off and are added to the service hours on which annual leave rates are based. Hours that are associated with the earnings code for regular earnings have been added to the accumulation of service time.

For example, select the Add to Service Hours check box for regular earnings and religious comp time-off. If employees in the ANN360 accrual class receive 0.02 hours of leave time for every hour of regular time that they work (accrual frequency is hours per hour), and the employees work 30 hours of regular time and take 10 hours of religious comp time-off, the system:

Adds 40 service hours to their leave plans.

Updates their leave earnings, causing the leave accrual program to accrue 0.8 hours of vacation time.

Note: This example involves proration, because the system calculates the number of leave hours to grant based on the actual number of service hours. Proration occurs only when the accrual frequency is hours per hour. Other accrual frequencies do not involve proration if the employee works fewer than the normal number of service hours. For example, if the accrual frequency is hours per pay period, the employee receives the full accrual for the pay period if the employee is in an active pay status for any number of hours during that pay period.

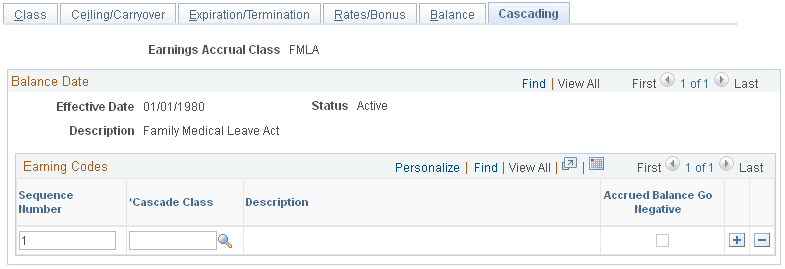

Use the Cascading page (GVT_ERN_ACR_CLASS6) to define the sequence and the accrual classes to which each earnings accrual class cascades.

Navigation

Image: Cascading page

This example illustrates the fields and controls on the Cascading page.

|

Field or Control |

Definition |

|---|---|

| Cascade Class |

Enter the cascading class from which the system draws hours to prevent the earnings accrual class from becoming negative. During leave accrual processing, the system automatically decrements hours from the lowest sequenced cascading class until it exhausts that accrual class. For example, to have employees exhaust annual leave and then exhaust restored leave and sick leave before their annual leave becomes negative, define restored leave and sick leave as cascading classes for the annual leave earnings accrual class. |

| Accrued Balance Go Negative |

Select for the highest sequenced class only. You cannot save this page unless you let the highest sequenced class become negative. |