Establishing Earnings Codes

To set up earnings codes, use the Earnings Table (EARNINGS_TABLE) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EARNINGS_TABLE1 |

Define parameters and rules for calculating earnings. Also specify the effects on Fair Labor Standards Act (FLSA) regular rate calculations, and define retro pay processing options. |

|

|

EARNINGS_TABLE2 |

Enter special options and tax methods for earnings codes. |

|

|

GVT_EARNINGS_SEC |

(USF) Specify additional earnings code settings. |

|

|

EARNINGS_TABLE3 |

Specify whether an earnings code is based on other earnings and define special earnings calculation formats that control how the pay calculation handles the earnings code and what results the earnings code produces. |

|

|

EARNINGS_TABLE4 |

Define how earnings codes affect leave accruals and special accumulators. |

|

|

GVT_EARNINGS_TBL5 |

(USF) Select the corresponding earning process type to include the earnings code in pay limit calculations. |

|

|

Earnings Report Page |

PRCSRUNCNTL |

Generate PAY712, which is a report that lists earnings types and their payroll characteristics. |

Determine the different types of earnings that your organization requires, and decide which three-character earnings code to assign to each one (such as REG, VAC, and HOL).

At a minimum, you must define earnings codes for regular and overtime pay. You might also define earnings codes for sick pay, holiday pay, vacation pay, or company-specific functions, such as:

Regular earnings that are normally associated with a regular salary or regular hours worked.

Regular earnings that are typically taxed by all taxing entities and consist of a simple rate-multiplied-by-time calculation, or a flat amount.

Earnings that use a slightly different method of calculation.

For example, overtime, double-time, or triple-time earnings codes apply a multiplication factor to the earnings.

Earnings to handle accrual accounting.

To track holidays, vacation and sick leave, jury duty, personal time off, and so on for leave accruals, define earnings codes for these leave categories and report applicable hours.

Nonhour-related earnings, such as bonuses, commissions, or automobile allowances.

Differentiation between earnings that should or should not be taxed, such as automobile allowances or expense advances.

Earnings for accumulation of hours and dollars in other special accumulator balances.

For example, certain earnings are eligible for retirement programs, while other earnings are not.

Earnings resulting from late paperwork or collective bargaining to calculate through the Retroactive Pay Calculations COBOL SQL process (PSPRPEXT).

Earnings codes for paying retro pay earnings.

Important! Oracle delivers two earnings codes, $AC and $NA, that the system uses during retro pay processing. You will never explicitly reference these codes, nor will you see them referenced on any pages outside of the Earnings Table component, but they are critical to the retro pay process. Do not modify, remove, or inactivate either of these earnings codes.

Using a Worksheet to Map Earnings Codes

We suggest that you create a worksheet to map out your needs. For example:

|

Earnings Type |

Earnings Code |

Earnings Profile |

Tax Method |

Other Considerations |

|---|---|---|---|---|

|

Regular |

REG |

Add to gross pay |

Annualized |

Adds to leave accruals Savings plan accumulators |

|

Vacation |

VAC |

Add to gross pay shift differential |

Annualized |

Subtracts from leave accruals |

|

Sick |

SCK |

Add to gross pay shift differential |

Annualized |

Subtracts from leave accruals |

|

Holiday |

HOL |

Add to gross pay shift differential |

Annualized |

Statutory |

|

Bonus |

BON |

Add to gross pay |

(USA) Supplemental (or Special Supplemental in California) (CAN) Bonus |

|

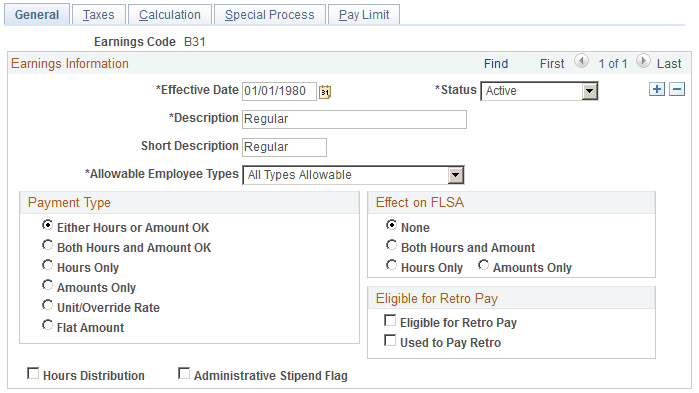

Use the Earnings Table - General page (EARNINGS_TABLE1) to define parameters and rules for calculating earnings.

Also specify the effects on Fair Labor Standards Act (FLSA) regular rate calculations, and define retro pay processing options.

Navigation

Image: Earnings Table - General page

This example illustrates the fields and controls on the Earnings Table - General page.

|

Field or Control |

Definition |

|---|---|

| Short Description |

Enter a meaningful name that your employees recognize. The check printing processes print this name on payslips. |

| Allowable Employee Types |

The paysheet uses allowable employee types to determine which employees are eligible for this earnings code. |

Payment Type

Use this group box to specify the types of payment information that you can enter on an employee's paysheet for this earnings code.

|

Field or Control |

Definition |

|---|---|

| Unit/Override Rate |

When you select this option, a blank field appears where you enter the new rate, which the system uses to calculate the earnings amount. This overrides the hourly rate in the employee's Job record. You must enter the number of units, or hours worked, in the Hours field on the paysheet, but you do not need to change the hourly rate on the paysheet. You can use earnings codes based on the unit or override rate for piecework earnings. For example, you pay 2 USD for each door that an employee fastens on a new vehicle. You define an earnings code, ASM, and enter 2 in the Unit/Override Rate field. During the first pay period, an employee fastens 428 doors. On the employee's paysheet, you insert an Other Earnings entry with the code ASM and enter 428 in the Hours field. The system calculates the earnings as 2 USD × 428, or 856 USD. If you set up an earnings code for shift pay that uses the unit/override rate and is based on a single earnings code, you must ensure that you include the shift earnings code on each payline that contains the earnings on which it is based. For example, if the shift earnings is based on the REG earnings, and if you add an additional REG payline to the paysheet, you must manually add the shift earnings code to that payline as well. |

| Flat Amount |

When you select this option, a blank field appears where you enter the flat amount. The system uses the flat amount from the Earnings table instead of the rate in the employee's Job record. To give multiple employees a flat amount of additional pay, make blanket changes to the flat amount in the Earnings table instead of maintaining multiple Additional Pay records at the employee level. |

(USA) Effect on FLSA

Specify the effect on the FLSA rate calculation.

Note: You must also assign each earnings code to an FLSA category of regular, overtime, or excluded on the Earnings Table - Calculation page.

See Overview of FLSA Calculations.

Note: Effect on FLSA is also used when setting up earnings codes for tip allocation and for the calculation of Oregon's Workman's compensation.

Eligible for Retro Pay

|

Field or Control |

Definition |

|---|---|

| Eligible For Retro Pay |

Select this check box if payees can receive retro pay for the earnings code. Selecting this check box enables you to include the earnings code in a retro pay program. |

| Used to Pay Retro |

Select this check box if the earnings code is used to pay retroactive earnings. Selecting this check box enables you to associate this earnings code with a retro-eligible earnings code when you set up a retro pay program. |

Additional Page Elements

|

Field or Control |

Definition |

|---|---|

| Hours Distribution |

Select this check box to distribute standard hours to a nonregular earnings code according to the parameters on the Job Data - Earnings Distribution page. This check box controls the distribution of standard hours to nonregular earnings codes for salaried employees whose job earnings distribution type is either by amount or by percent. The distributed hours are based on a proration of the employee's total standard hours defined in the Job Data component (JOB_DATA). These hours appear on Paycheck Inquiry pages and in the payroll registers. Note, however, that hours are not displayed on paychecks for salaried employees. The system automatically processes and displays the distribution of standard hours to the regular earnings code, regardless of the hours distribution setting. Note: For earnings codes with a payment type of amounts only or flat amount, deselect the Hours Distribution check box. These payment types do not calculate or display hours. For example, a salaried employee has 80 standard hours per biweekly pay period. The job earnings distribution information specifies a 50 percent distribution to a regular earnings code (REG) and a 50 percent distribution to a nonregular earnings code (STD). The STD earnings code has a payment type of Either Hours or Amounts OK.

Note: (CAN) To accumulate the hours that are distributed to nonregular earnings codes and report them as EI hours, you must select the Hours Distribution check box for those earnings codes. The system sets a salaried employee's EI hours to zero if none of the earnings codes on that employee's job earnings distribution page specify hours distribution. To maintain the integrity of EI hours processing and reporting, ensure that you correctly define the hours distribution definitions that are associated with each earnings code. |

| (E&G, CAN) Administrative Stipend Flag |

Select this check box to indicate that this earnings code is an administrative stipend. The system uses this information, in conjunction with the Job Earnings Distribution table, to distribute administrative stipend earnings for the Statistics Canada Academic Teaching Survey. |

Use the Earnings Table - General page and the Earnings Table - Calculation page to specify the earnings codes in the company that are affected by FLSA regulations, and to assign the earnings codes to FLSA categories. Only these two pages in the Earnings Table component (EARNINGS_TABLE) effect FLSA payment.

The following steps are required, but not necessarily in this order.

Complete the Earnings Table - General page.

Complete the Earnings Table - Calculation page.

Completing the Earnings Table - General Page

Use the Effect on FLSA (effect on Fair Labor Standards Act) group box to specify whether the hours and/or amount affect FLSA regular rate calculations. For regular pay, the calculation includes both hours and amount. For shift pay only, the calculation includes amount only, because the hours are already recorded in the regular pay.

Completing the Earnings Table - Calculation Page

Assign each earnings code to a FLSA category (regular, overtime, or excluded). If the FLSA category is overtime, the Regular Pay Included? check box becomes available for entry.

Select the Regular Pay Included? check box if the multiplication factor for the overtime earnings is greater than 1.0. This depends on the company's business rules. Some companies include all straight time pay with the overtime calculation, while other companies separate straight time pay from the premium portion of overtime.

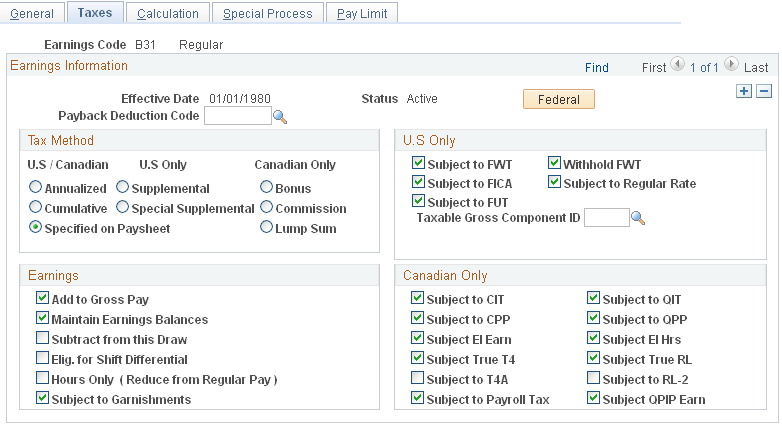

Use the Earnings Table - Taxes page (EARNINGS_TABLE2) to enter special options and tax methods for earnings codes.

Navigation

Image: Earnings Table - Taxes page

This example illustrates the fields and controls on the Earnings Table - Taxes page.

Earnings Information

|

Field or Control |

Definition |

|---|---|

| (USF) Federal |

Select this button to access the Additional Earnings page. |

| Payback Deduction Code |

Use this field when setting up a payback earnings code to use for payback situations such as pay advance or negative adjustment. In this field, enter the payback deduction code that corresponds with the payback earnings code. If you enter a deduction code in this field, the system will automatically create an arrears balance assigned to that deduction code for the earnings amount that you enter with the corresponding payback earnings code on the paysheet. |

Tax Method

Use this group box to select the tax calculation method. For example, for a U.S. bonus earnings, select a supplemental option; for a Canadian bonus earnings, select the Bonus option.

Note: You can assign only one tax method to each earnings code. Multi-country employers must define separate earnings codes to apply country-specific tax methods.

Note: If you select a tax method other than Specified on Paysheet when you set up the earnings code on this page, you cannot override the tax method on paysheets—for all other tax methods, the system calculates according to the tax method selected on this page, even if you select a different method on the paysheet.

Before completing this group box, review the overview information about tax methods:

CAN:

USA:

|

Field or Control |

Definition |

|---|---|

| Annualized |

Select this option to annualize the earnings, calculate tax on the annualized amount, and divide the tax by the number of pay periods in the year. The result is the withholding for the pay period. This is the most common tax method. |

| Cumulative |

(USA) Select this option to add together the YTD earnings and the earnings for this pay period, annualize the result, and calculate the annualized tax. The system de-annualizes the tax by dividing it by the number of tax periods on the paysheet. If the result is greater than the YTD withholding, the difference becomes the withholding for the pay period. Use this option for employees whose wages vary significantly from pay period to pay period, such as salespeople on commission. |

| Specified on Paysheet |

Select this option to instruct the system to use the tax method specified on the paysheet. The default method on the paysheet is annualized, which you can override on the paysheet if you set up the earnings code's tax method as Specified on Paysheet. Note: If you select a tax method other than Specified on Paysheet when you set up the earnings code on this page, you cannot override the tax method on system generated paysheets—the system calculates according to the tax method selected on this page. However, if you add a payline manually to a system generated paysheet, you can select any tax method. |

| (USA) Supplemental |

Select this option for earnings codes that identify supplemental wages. Do not use it for bonus and stock option payments if you have employees in California. Indicate whether supplemental wages are paid with regular pay or as separate pay on the Federal/State Tax Table - General page. Note: Set up a special accumulator for supplemental payments and associate it with all earnings codes that you designate for supplemental or special supplemental tax method. |

| (USA) Special Supplemental |

Select this option for bonus and stock option payments if you have employees in California. These payments in California are subject to a higher supplemental withholding rate than other types of supplemental wage payments such as commissions and overtime pay. If you have employees in California and other states, use the Special Supplemental option. When you use this option to pay bonuses to an employee not in California, the system automatically calculates the tax using the supplemental method. This enables you to set up one bonus earnings code for all U.S. employees. |

| (CAN) Bonus |

Select this option to calculate taxes on irregular payments, such as bonus payments. The system calculates tax differently, depending on whether the payment is included with other earnings or paid in a separate check. |

| (CAN) Commission |

Select this option to use amounts from the Commission group box (Income, Expenses, and RPP/RRSP Limit [Registered Pension Plan/Registered Retirement Savings Plan limit] fields) on the Canadian Income Tax Data page and the Quebec Income Tax Data page. If these amounts are not entered, the system calculates tax using the annualized tax method, resulting in a higher amount of tax withheld. The commission tax method calculates the taxes on commissions differently, depending upon whether you are calculating CIT or QIT. Note: Commission income and expenses amounts from the Canadian Income Tax Data page and the Quebec Income Tax Data page represent the total annual estimated earnings and expenses reported by employees on the Revenue Canada Statement of Remuneration and Expenses and Revenue Quebec Statement of Commissions and Expenses for source deduction purposes. |

| (CAN) Lump Sum |

Select this option to determine the withholding for the period using the corresponding taxable gross rates from the Federal CIT Lump-Sum Rates group box or the Quebec (QIT) Lump-Sum Rates group box on the Tax Rates, Credits and Other page. |

(USA) U.S. Only

Before completing this group box, review the overview information about U.S. Taxes.

See (USA) U.S. Tax Specification.

|

Field or Control |

Definition |

|---|---|

| Subject to FWT (subject to federal withholding tax), Subject to FICA (subject to Federal Insurance Contributions Act), and Subject to FUT (subject to federal unemployment tax) |

Specify the effect that the earnings code has on the corresponding taxable grosses. The system maintains separate accumulators for each of the taxable grosses. Note: A Taxable Gross Definition Table entry is always required when you want to stop state or local income tax withholding on a particular earnings, regardless of whether or not the state or locality follows the federal rule for including the amount in taxable income, and regardless of whether or not you have selected this check box for the earnings. |

| Withhold FWT (withhold federal withholding tax) |

This check box is selected by default, indicating that the earnings code is subject to federal income tax withholding. If you deselect this check box, you can still add to the earnings to the taxable gross, but withholding isn't taken for this earnings code. For example, tuition reimbursement is an earnings code that adds to taxable gross, but is not subject to withholding. Normally, this check box should be selected to prevent underwithholding. Most earnings are taxable for FWT, FICA, and FUT, but deselect these check boxes for nontaxable earnings codes (such as expense reimbursements and salary advances). Note: For states and localities, use the Taxable Gross Definition table to specify whether withholding on a taxable gross component follows the rule that you select here. Regardless of federal withholding, you must have a taxable gross component ID for any earnings code for which you do not withhold state or local income tax. |

| Taxable Gross Component ID |

Payroll for North America normally sets the taxable gross used for calculating state and local income tax withholding to the same value as the taxable gross for federal withholding. It also sets the taxable gross for state unemployment and disability to the same value as the taxable gross for federal unemployment. However, some states and localities don't follow federal rules for the taxability of all types of wages. Select a value to override the federal rules for taxability: 125, 401K, GTL (group-term life), or TIP. The taxable gross component ID code defines a taxable gross base—different from federal—to use when calculating state and local taxes. This code points to information in the Taxable Gross Definition table, which:

PeopleSoft maintains state and local taxable grosses that have been adjusted for 401(k), Thrift Savings Plan, Section 125, group life plans, and Federal Employee Group Life Insurance (FEGLI) plans. You can add entries to the Taxable Gross Definition table for other types of earnings that need adjusting. PeopleSoft also maintains a taxable gross definition called TIP for employers of tipped people. Important! The taxable gross component ID must be unique! If it is not unique, it can cause incorrect taxable grosses. Note: You must define a taxable gross component ID in the Taxable Gross Definition table before entering it in the Earnings table. |

| (E&G) Income Code (for 1042-S) |

Specify a nonresident alien income code for 1042-S processing. Values come from the Income Code Table Page. |

Earnings

|

Field or Control |

Definition |

|---|---|

| Add to Gross Pay |

Select this check box to indicate that an employee receives actual dollars for this earnings code. Most, but not all, earnings add to gross pay. For example, some earnings don't actually consist of dollars paid, such as the value of a company-supplied automobile. Because the company supplies the employee with a car—not with the money to buy one—you do not add these earnings to the gross income. However, the value of the car must appear as taxable wages, and you must track it for the reporting on W-2 or T4. To define this auto earnings code, deselect the Add to Gross Pay check box, and select the appropriate U.S. or Canadian subject to tax check boxes. For an expense advance, however, select the Add to Gross Pay check box, but do not select a subject to tax check box. |

| Maintain Earnings Balances |

Select this check box to automatically maintain YTD, quarter-to-date, and month-to-date earnings balances. Select this check box for all earnings codes. |

| Subtract from this Draw |

This check box is for your information only. |

| Elig. for Shift Differential (eligible for shift differential) |

Select this check box if the earnings code is for shift pay and you're using the pay group setID and Shift table method of calculating shift pay. If an employee is assigned to a shift, the system checks each earnings code that is eligible for shift differential and performs the calculation based on the routines selected in the Shift table and on the shift to which the employee is assigned. You can also specify shift differentials at the employee level. |

| Hours Only (Reduce from Reg Pay) |

Select this check box to have hours or earnings entered for the earnings code reduce the employee's regular pay by an equivalent number of hours entered on the paysheets. Use this check box for earnings codes such as holiday, sick leave, and vacation leave. Hours posted to the earnings code reduce regular hours for hourly employees (or regular earnings for salaried employees) by the number of hours entered during the payroll calculation run. How you use this check box depends on how you report time. You typically use positive time entry for hourly employees, so in effect their hours are already reduced. For example, you might enter 32 hours of regular pay and eight hours of vacation pay on an hourly employee's paysheet. For exception hourly and salaried employees, you typically enter only exception pay, but not regular pay. If a salaried employee takes eight hours off in a given week, you only enter eight hours of vacation time on paysheets. For different employee types, you can establish some earnings codes that use this feature and others that don't. |

| Subject to Garnishments |

Select this check box to include the earnings code in garnishment processing. |

(CAN) Canadian Only

Before completing this group box, review the overview information about Canadian taxes.

See (CAN) Canadian Tax Specification.

Warning! It is imperative that you define all earnings that are subject to CIT, T4A, QIT, and RL-2 withholding before they are paid to employees. To ensure that all amounts are allocated to the proper accumulators, you must complete this setup before running the first payroll of the new tax year.

|

Field or Control |

Definition |

|---|---|

| Subject to CIT (subject to Canadian income tax), Subject to QIT (subject to Quebec income tax), Subject to CPP (subject to Canada Pension Plan (CPP)), and Subject to QPP (subject to Quebec Pension Plan) |

Most earnings are taxable for CIT, EI, and CPP, but deselect these check boxes for nontaxable earnings (such as expense reimbursements, uniform allowances, auto reimbursements, and so on). If the company is in Quebec, most earnings also reflect QIT and QPP. |

| Subject EI Earn (subject to Employment Insurance earnings) and Subject EI Hrs (subject to Employment Insurance hours) |

Select the Subject EI Earn check box if the amount that is associated with an earnings code is subject to EI premiums and insurability. Select the Subject EI Hrs check box if EI reporting requires the hours associated with an earnings code. This information is for the Record of Employment. When setting up earnings subject to EI, you must determine whether to accumulate both the dollars and hours, or just the dollars. To accommodate the accumulation of dollars, but not hours, the system segregates EI options by hours and earnings when multiple earnings codes representing the same hours (and subject to EI) are paid in conjunction with one another. This applies to premiums or differentials that are paid in conjunction with regularly paid work hours. For example, if you define shift premiums as earnings codes in the Earnings table, but pay them in conjunction with regular pay, use the following EI tax options:

|

| Subject True T4 |

Select this check box if the earnings represent the accumulation of total federal employment income for Canada. |

| Subject True RL |

Select this check box if the earnings represent the accumulation of total provincial employment income for Quebec. |

| Subject to T4A and Subject to RL-2 |

Specify whether the earnings are subject to T4A or RL-2 withholding. This ensures that the appropriate amount of tax appears on the T4A and RL-2 year-end slips. The system automatically selects the Subject to CIT check box (for T4A) or the Subject to QIT check box (for RL-2) when you save the record. Note: You must define earnings codes subject to T4A and RL-2 withholding in the T4A and RL-2 Tax Form Definition tables before running the year-end process for that tax year. You can reclassify the same earnings code between T4 and T4A (or RL-1 and RL-2) earnings before running payrolls in the new tax year. A mid-year reclassification of earnings, however, requires that you define a separate earnings code to allocate the earnings to the correct T4 and T4A (or RL-1 and RL-2) accumulators. |

| Subject to Payroll Tax |

Select this check box if the earnings are subject to the Northwest Territories or Nunavut payroll tax. By default, the system calculates and withholds a 1 percent payroll tax on specified remuneration paid to employees for work performed in the Northwest Territories or Nunavut. A Northwest Territories or Nunavut employee whose total Northwest Territories or Nunavut earnings do not total more than 5,000 CAD for the calendar year are not subject to this tax. To stop the tax withholding for these exempt employees, select the Payroll Tax Exempt check box on the Canadian Income Tax Data page. |

| Subject to QPIP Earn (Subject to Quebec Parental Insurance Plan Earning) |

Deselect the check box if the earnings is not subject to QPIP. |

Note: Because the system maintains separate accumulators for each of these taxable grosses, consider each option individually when determining whether to select a check box.

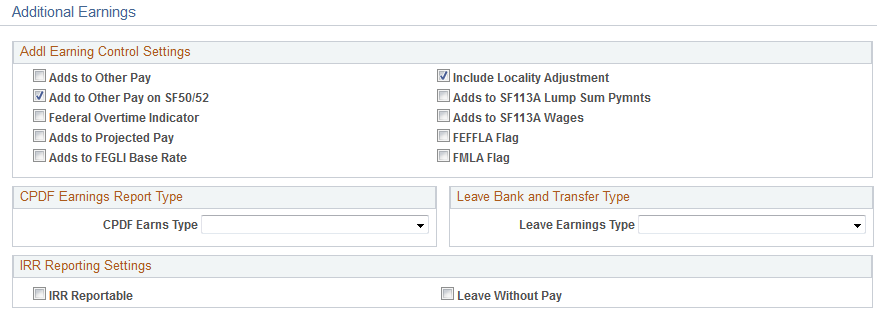

(USF) Use the Additional Earnings page (GVT_EARNINGS_SEC) to specify additional earnings code settings.

Navigation

Select the Federal button on the Earnings Table - Taxes page.

Image: Additional Earnings page

This example illustrates the fields and controls on the Additional Earnings page.

Addl Earning Control Settings

|

Field or Control |

Definition |

|---|---|

| Adds to Other Pay |

Select if the earnings adds to other pay in the employees Job - Compensation Data - Other Earnings page. |

| Adds to Projected Pay |

Select to include the earnings in total Projected/Future pay for annual total pay cap limitations. Note: For an earnings code (including regular earnings codes) to be included in Projected/Future pay, the Adds to Projected Pay check box must be selected. When no Adds to Projected Pay check boxes are selected, the system reverts to using the employee’s regular biweekly pay for projected and future pay calculation. For information on how the system calculates annual total pay caps and limits, see Understanding Annual Total Pay Caps and Limits Calculation. |

| Adds to FEGLI Base Rate (adds to Federal Employee Group Life Insurance base rate) Federal Employee Group Life Insurance (FEGLI) setting up earnings codes |

Select if earnings add to FEGLI base rate calculation. |

| FMLA Flag (Family Medical Leave Act flag) |

Select if the earning code is for the FMLA. |

| Federal Overtime Indicator |

Select if the earnings code is used to pay federal overtime. |

| Add to Other Pay on SF50/52 |

Select if the earnings code adds to other pay on the SF50 or SF52. |

| FEFFLA Flag (Federal Employees Family Friendly Leave Act flag) |

Select if this earning code is for the FEFFLA. |

CPDF Earnings Report Type

|

Field or Control |

Definition |

|---|---|

| CPDF Earns Type (Central Personnel Data File earnings type) |

If additional earnings for this earnings code are reportable to the CPDF, select the CPDF earnings code: Not Rpted (not reported), Retn Allow (retention allowance), Staff Diff (staffing differential), or Suprv Diff (supervisory differential). |

Leave Bank and Transfer Type

|

Field or Control |

Definition |

|---|---|

| Leave Earnings Type |

Select a value if you're defining an earnings code to use with a leave transfer program type. Valid values are: Donate to Bank: For donor activity in Leave Bank Transfer programs. Donate to Emergency: For donor activity in Emergency Leave Transfer programs. Donate to Recipient: For donor activity in Voluntary Leave Transfer programs. Receive from Bank: For recipient activity in Leave Bank or Emergency Leave Transfer programs. Receive from Donor: For recipient activity in Voluntary Leave Transfer programs. |

IRR Reporting Settings

|

Field or Control |

Definition |

|---|---|

| IRR Reportable (Individual Retirement Record reportable) |

Select this check box if additional earnings for this earnings code are associated with basic compensation and are IRR reportable. |

| Leave Without Pay |

Select this check box if additional earnings for this earnings code are considered leave without pay on the IRR. These earnings are reported on the Leave Audit SF1150 report (FGSF1150). |

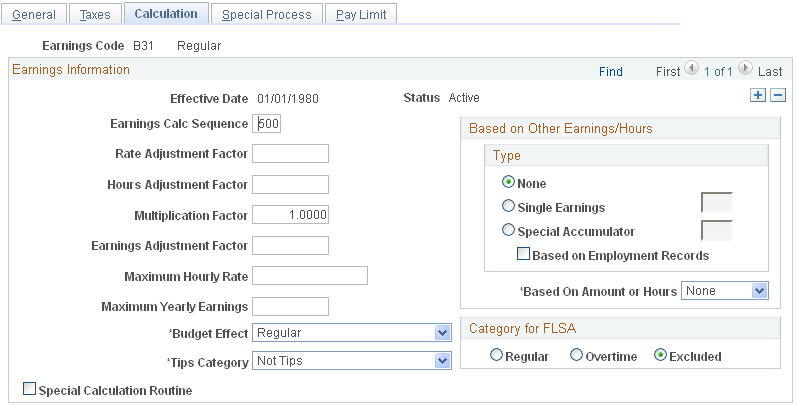

Use the Earnings Table - Calculation page (EARNINGS_TABLE3) to specify whether an earnings code is based on other earnings and define special earnings calculation formats that control how the pay calculation handles the earnings code and what results the earnings code produces.

Navigation

Image: Earnings Table - Calculation page

This example illustrates the fields and controls on the Earnings Table - Calculation page.

|

Field or Control |

Definition |

|---|---|

| Earnings Calc Sequence (earnings calculation sequence) |

Enter a number to indicate the order in which to process earnings during payroll calculation. Lower sequence numbers result in a higher processing priority for the earnings code. Earnings that are based on other earnings or special accumulators will be calculated first, before limits are applied. Earnings will be reduced in the Earnings Calculation Sequence from lower in the sequence to higher in the sequence, until the amount exceeding the pay cap limit has been reduced in full, or until all earnings eligible for reduction have been reduced to zero, whichever condition is met first. Calculation sequence is important when one earnings calculation is dependent on another. For example, regular earnings must have a lower sequence number than any earnings codes that reduce regular earnings (that is, earnings designated to have hours only reduced from regular pay). For example:

(USF) Calculation sequence is important. When a pay limit is reached and more than one earnings code is included in the limit, and both are reducible, the earnings code with the highest processing priority is depleted before the next earnings code is reduced. Also, for Danger Pay limits, you must set up the Service Need Differential (SND) earnings with a lower Earnings Calc Sequence number than danger allowance to ensure the SND earnings is reduced or eliminated before the danger allowance earnings. For example, if Service Need Differential sequence is 501 and danger allowance sequence is 600, the Service Need Differential will be depleted before danger allowance is reduced. |

| Rate Adjustment Factor |

Enter a dollar amount to adjust the hourly rate that is associated with an earnings code. For example, if a union negotiates a 0.30 USD per hour cost of living adjustment, enter 0.3 in this field for any applicable earnings, such as regular, overtime, vacation leave, and sick leave. Employees receiving these types of earnings get 0.30 USD per hour in addition to the compensation rate specified in their Job records. |

| Hours Adjustment Factor |

Enter a positive or negative number to adjust the number of hours that are associated with an earnings code, such as 40 hours for regular. For example, Jan was a nurse at Diablo Hills Hospital where she was paid for a full 40-hour week. However, because she was required to record her lunch hours, her time cards showed that she worked only 37.5 hours a week—the actual number of hours that was entered on her paysheets. To set up this salary structure, enter an hours adjustment factor of 2.5. |

| Multiplication Factor |

For hourly earnings, enter the number by which you multiply earnings, such as 1.5 for overtime, or 2.0 for double time. To calculate alternative overtime, the system uses the multiplication factor specified for the overtime earnings code on the Earnings table instead of the fixed 0.5 used in federal FLSA calculation. Note: The use of negative multiplication factors in Alternative Overtime calculation will not work. Any multiplication factors other than the values needed to comply with Alternative Overtime regulations will result in incorrect calculations. A warning will be generated during batch processing in Payroll Error Messages if earnings codes are set up with negative multiplication factors. |

| Earnings Adjustment Factor |

Enter a flat amount that does not affect pay rate or hours. Use this field for earnings codes for which the dollar amount always remains the same for all employees, such as a 100 CAD holiday bonus. When you define this type of earnings, set the multiplication factor to zero. |

| Maximum Hourly Rate |

This field is for your information only. |

| Maximum Yearly Earnings |

To set a yearly ceiling on the earnings code, enter the maximum yearly earnings. You cannot pay more than this amount to any employee in a year. Note: Use this field with individual earnings codes only—not special accumulators. |

| Budget Effect |

This field is for your information only. |

| (USA) Tips Category |

Specify how tips affect taxable gross: Compulsory Gratuity: Select this value if the earnings code represents mandatory service charges that are added to a bill or fixed by the employer that the customer must pay (for example, gratuities required for banquet service). Gratuities are excluded from the tip minimum wage calculation, but included in determining the FLSA rate used for overtime pay calculations. Not Tips: Select this value if the earnings code does not represent earnings subject to tipping or reported tips for calculating tip credit. This is the default value. Reported Tips: Select this value if the earnings code represents cash or charge tips that your employees report. Other Sys Calc'd Tips (other system calculated tips): Select this value if the earnings code represents amounts used to bring employee earnings up to minimum wage when the cash wage plus tips is less than minimum wage. Tip Allocation: Select this value if the earnings code represents system-calculated amounts of tips allocated to employees. Tip Credit: Select this value if the earnings code represents system-calculated amounts of tip credit. |

| Special Calculation Routine |

Select this check box if you have modified the COBOL code to perform a calculation routine. Note: Before you modify the COBOL code, discuss the proposed alterations with your PeopleSoft account executive. |

Based on Other Earnings/Hours

Use this group box to designate earnings codes based on other earnings codes or special accumulators. The system can calculate earnings as a percentage of another earnings code, a rate multiplied by a single hour, or a rate multiplied by a group of hours. You might use this feature to keep shift earnings separate from regular earnings by creating a separate earnings code for shift earnings, based on a percentage of regular earnings.

If you set up an earnings code for shift pay that uses the unit/override rate and is based on a single earnings code, you must ensure that you include the shift earnings code on each payline that contains the earnings on which it is based. For example, if the shift earnings is based on the REG earnings, and if you add an additional REG payline to the paysheet, you must manually add the shift earnings code to that payline as well.

|

Field or Control |

Definition |

|---|---|

| Single Earnings and Special Accumulator |

Select an option to indicate the type of other earnings on which the earnings code is based, and enter an earnings code or special accumulator code in the associated field. |

| Based on Employment Records |

Select this check box to base the earnings on the specified earnings code or special accumulator for the employment record being processed. Deselect the check box when the earnings code is based on the combined earnings or special accumulator for all of an employee's jobs. |

| Based on Amount or Hours |

Specify how to calculate earnings: None: The default. Amount: The system calculates the earnings by applying the multiplication factor to the current period amount for the earnings code or special accumulator code specified. For example, to calculate the earnings code that you're setting up as 4 percent of a specified earnings code, enter a multiplication factor of .04. Hours: The system calculates the earnings by multiplying the current period hours for the specified earnings code or special accumulator code by the hourly rate on the paysheet entry. Then it applies the multiplication factor. For example, to calculate a bonus earnings code as ten percent of the employee's regular pay, select the Single Earnings type option and enter the earnings code REG. Specify that the calculation is based on amount, and enter .1 as the multiplication factor. |

(USA) Category for FLSA

|

Field or Control |

Definition |

|---|---|

| Regular |

Select this option if these earnings are not overtime and are used in the calculation of the FLSA rate. |

| Overtime and Regular Pay Included |

Select this option if this earnings code has an effect on overtime or alternative overtime pay. When selected, the system displays a Regular Pay Included check box. If the multiplication factor for overtime is .9 or less, deselect this check box. If the multiplication factor is 1.1 or greater, select this check box. |

| Excluded |

Select this option if these earnings have no effect on the FLSA calculation. |

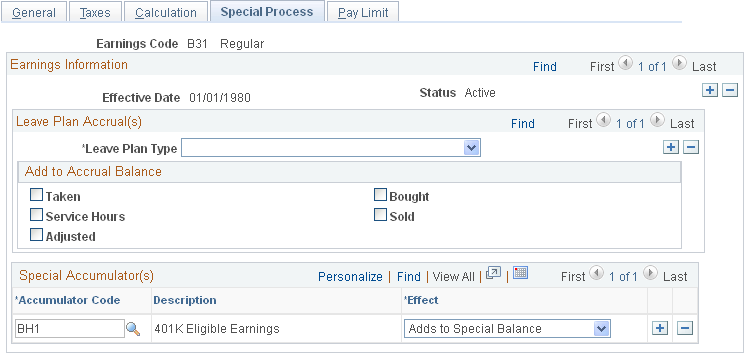

Use the Earnings Table - Special Process page (EARNINGS_TABLE4) to define how earnings codes affect leave accruals and special accumulators.

Navigation

Image: Earnings Table - Special Process page

This example illustrates the fields and controls on the Earnings Table - Special Process page.

Leave Plan Accrual(s)

Use this group box to indicate how the hours for each earnings code affect leave plans. Employees can accrue time using the number of hours they've worked (service hours) or the length of time they've worked for the company (based on the service date in the Job Data component). Set up the accrual method in the Leave Plan table in the Benefits component.

Add to Accrual Balance

|

Field or Control |

Definition |

|---|---|

| Taken |

Select this check box for earnings codes (such as vacation or sick) that subtract from the leave plan balance. The system updates the unprocessed data on the Leave Accruals page by adding to the leave plan balance for hours taken, but it does not update the hours taken from the actual leave plan balance until you run the leave accrual program. |

| Service Hours |

Select this check box if the leave plan accrues based on the number of hours an employee has worked (service hours). The system adds the hours that are associated with the earnings code to an employee's service hours that are maintained on the leave plan accrual balances. However, if the employee is not enrolled in that leave plan, the system does not update the service hours fields in leave accruals. For example, suppose a company's employee leave plan offers 0.02 hours of vacation time for every hour of regular time and overtime that employees work. In this case, select the Service Hours check box for regular and overtime earnings codes to show that they add to the accrual balance for the employee leave plan. If Jan has 30 hours of regular and 10 hours of overtime earnings, the system adds 40 service hours to her leave plan. It also updates the leave accruals unprocessed data for her leave plan, and accrues 0.8 hours of vacation time when the leave accrual program is run. Note: If you base your leave plan on months of service, the leave accrual program does not use the service hours accumulated by payroll. Instead, it uses the service date in the Employee record to accrue hours for your leave plan. |

| Adjusted |

Select this check box if you are defining the earnings code only to add hours to, or subtract hours from, an employee's accrual balances. When you perform the actual adjustments on paysheets, the system accepts positive or negative hours. For example, Jessica Morris, came to CCB from her former company with an intercompany transfer agreement. As part of the agreement, CCB let her carry over 25 hours of vacation time from her old company. To do this, the payroll clerk added 25 hours of accrual adjustment time to Jessica's paysheet. The system—looking at the Earnings table already set up for this type of situation (with Adjusted selected for the VAC leave plan type)—did the rest. |

| Bought and Sold |

If your company has a vacation buy or sell plan, select a check box to indicate that the earnings code affects vacation hours bought or sold. Use deductions to handle the actual buying and selling and earnings codes to handle the accruals. For example, Theresa bought 20 hours of vacation time. The payroll clerk added the hours using an earnings code defined with the VAC leave plan type and the Bought check box selected. He used a deduction to take the money that Theresa used to buy the vacation time. If an employee sells vacation time, subtract from the accrual balance using an earnings code defined with the VAC leave plan type and the Sold check box selected. Use a negative deduction to give the employee the money. |

Note: You must run the leave accrual program before the system recognizes or reports any leave accrual information that you define for your company and specific employees.

Special Accumulator(s)

|

Field or Control |

Definition |

|---|---|

| Accumulator Code |

Use special accumulators to roll together earnings codes to use later in deduction earning calculations or for tracking supplemental wages for tax purposes. Before you enter this code, define the special accumulator code in the Special Accumulator table. |

| Effect |

Select a value to designate how the earnings affects the special accumulator:

|

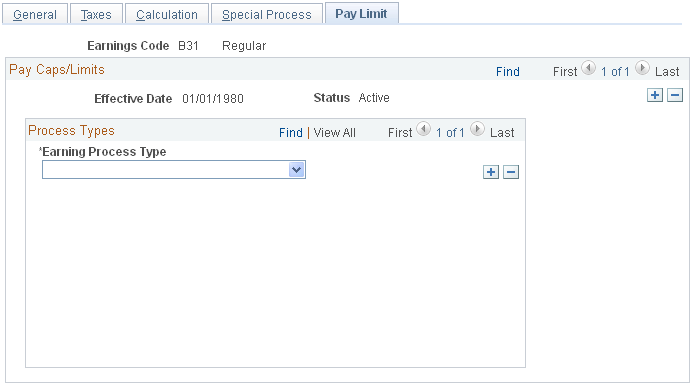

(USF) Use the Earnings Table - Pay Limit page (GVT_EARNINGS_TBL5) to select the corresponding earning process type to include the earnings code in pay limit calculations.

Navigation

Image: Earnings Table - Pay Limit page

This example illustrates the fields and controls on the Earnings Table - Pay Limit page.

|

Field or Control |

Definition |

|---|---|

| Earning Process Type |

To include the earnings code in pay limit calculations, select the applicable process types: Danger Pay: Earnings are capped to a defined percentage of Basic Pay per period. Overtime: Base pay plus overtime is subject to a pay period limit. Overtime hourly rate is subject to an hourly rate limit. Pay Cap - Basic Pay: The sum of base pay, law enforcement officer pay, and locality pay is subject to a defined limit. Pay Limit - Premium Pay: Earnings are subject to a pay period limit. Pay Limit - Total Annual: Total annual earnings are subject to an annual pay limit. Note: To learn more about each earning process type and determine the order in which their pay limits and caps are processed, see Understanding Pay Caps and Limits. |