(USA) Updating the Taxable Gross Definition Table

To update the Taxable Gross Definition Table, use the Taxable Gross Definition Table component (TAXGR_DEFIN_TBL).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAXGR_DEFIN_TBL |

Set up a taxable gross definition, which defines the taxability and withholding for specific earnings or deduction types that must be treated differently at the state or local level than at the federal tax level. |

|

|

Taxable Gross Definition Rpt Page |

PRCSRUNCNTRL |

Run TAX706 to print information from the Taxable Gross Definition Table, which contains definitions that the system uses during payroll calculation to determine state and local taxable grosses that deviate from the normal federal withholding. It specifies the base for taxable gross and indicates modifications to that base. |

Taxing jurisdictions may have different rules as to whether a given type of earnings or deduction should be taxed, and whether or not the tax should be withheld at the time of payment. The Taxable Gross Definition table defines the taxability for specific earnings or deduction types that must be treated differently at the state or local level than at the federal tax level. It also enables you to specify whether the state and local income tax withholding follows the same rules as federal withholding.

This topic discusses:

Taxability.

Withholding.

Delivered entries on the Taxable Gross Definition table.

Example of setting up an earning with state tax withholding but without federal tax withholding.

Reference table of taxability and withholding setup.

Taxability

PeopleSoft Payroll for North America tracks these differences in taxability by documenting where the taxable wage definition of a particular jurisdiction differs from a standard definition for the following basic payroll tax types:

Withholding

Unemployment

Disability

For each of these tax types, certain earnings and deductions are taxable at the state or local level, while others are not. What is taxable differs for each tax, so we have a separate standard definition for each type. Because most states and localities follow federal guidelines for taxing earnings, we use Federal income tax withholding, Federal unemployment, and FICA as the standard taxes from which to develop these rules.

The system automatically maintains federal taxable grosses, FWT, FICA, and FUT based on these entries in the Earnings Table and Deduction Table:

|

Deduction Table |

Earnings Table |

|---|---|

|

Deduction classification = Taxable |

Subject to FWT |

|

Effect on FICA gross |

Subject to FICA |

|

Effect on FUT gross |

Subject to FUT |

Normally, the system calculates state and local taxes using the following taxable grosses:

|

Calculation |

Taxable Gross Used |

|---|---|

|

State withholding taxes (SWT) |

FWT gross |

|

State unemployment taxes (SUT) |

FUT gross |

|

State disability insurance (SDI) |

FUT gross |

|

Local withholding taxes (LWT) |

FWT gross |

PeopleSoft uses the FUT gross as the starting point for SDI because most states do not publish any separate definition of subject wages for SDI. Instead, states treat the definition of wages for SDI purposes as the same as the definition of wages for SUI purposes. Since SUI wages are based on FUT wages, and SDI subject wages are the same as SUI wages, FUT is the starting point for determining both SUI and SDI wages.

You can override or establish exceptions to the federal definitions of taxable gross for the following taxable grosses:

State withholding

State unemployment

State disability

Local withholding

When a state or locality declares that taxability of a certain earnings or deduction is different from one of these federal standards, a rule must be placed in the Taxable Gross Definition table indicating the deviation. The system uses the rules stored in the Taxable Gross Definition table to adjust the taxable gross for the states and localities that deviate from the federal norm.

For each of these taxable gross definitions, identify a Taxable Gross Component ID and assign it to the various states or localities affected.

Withholding

When you set up earnings and taxable benefits that are federally taxable, you specify whether or not that amount should also be subject to federal income tax withholding using:

The Subject to FWT field on the Earnings Table - Taxes page.

The Withhold FWT field on the Deduction Table – Tax Effect page.

Use the Withholding Follows Fed Rules (withholding follows federal rules) field on the Taxable Gross Definition Tbl page (TAXGR_DEFIN_TBL) to specify whether the state and local income tax withholding follows the same rules as federal withholding.

Note: You must create a Taxable Gross Definition table entry when you want to stop state or local income tax withholding on a particular earnings or taxable benefit. This is true regardless of whether or not the state or locality follows the federal rule for including the amount in taxable income, and regardless of whether or not you have selected to withhold federal income tax on the earnings or taxable benefit.

Delivered Entries on the Taxable Gross Definition Table

PeopleSoft delivers several entries on the Taxable Gross Definition table. These entries are delivered with the Plan Type element blank and the Deduction Code set to $DFLT. You must review these entries and determine if you need to create new plan-specific entries for your implementation.

Do not make modifications to the delivered entries. You can use the delivered entries as guides if you need to add additional taxable gross definitions.

The delivered sample entries are:

125: Section 125 cafeteria plan.

401K: 401(K) savings plan.

401R: Employer 401(K) savings plan match.

ACT: Adult child taxability.

DPB: Domestic partner benefits

GTL: Group-term life.

HSA: Health savings account.

HSR: Health savings account employer contribution.

SSS or SSP: Same-sex spouse.

TIP: Reported tips for an employee.

For Section 125 cafeteria plans, the taxable gross definitions are for employee deductions only. You may have to set up your own entries to process specific parts of your plan. In some states, the taxability of deductions depends on whether the employee has the option of receiving cash. Review the definitions in this table carefully with regard to your particular 125 plans.

For more information about the delivered samples, see the Deduction Table - Tax Effect page, Taxable Gross Comp ID field description in the Setting Up Deductions topic.

How Taxable Gross Definitions Affect Earnings and Deductions

The standard definition of taxability of an earnings or deduction type is determined by entries on the Earnings and Deduction tables. When establishing an entry on these tables, you specify if the earning or deduction is to be taxed for FWT, FUT, and FICA. Any earnings and deductions you marked as taxable are totaled during payroll processing to determine an employee's taxable gross for each of the standard tax types. For earnings or deduction types that increase or decrease the state or local taxable grosses compared to the federal taxable gross, enter a taxable gross component ID that identifies which rules on the Taxable Gross Definition table to use.

For example, Pennsylvania considers employee before-tax 401(k) contributions taxable for state withholding, whereas they are not taxed at the federal level. Therefore, you must have a Taxable Gross Definition for 401(k) deductions that indicate to the payroll calculation programs that when taxable gross for withholding is determined, 401(k) deductions should be included as earnings for Pennsylvania (but not for federal) withholding purposes.

Example of Setting Up an Earning with State Tax Withholding but Without Federal Tax Withholding

Take a hypothetical example of moving expenses in the state of Pennsylvania. This example assumes the following:

Certain types of moving expense reimbursement payments that you make to Pennsylvania employees are includable in taxable gross at both the federal and state level.

Federal regulations do not require that federal income tax be withheld from these moving expense reimbursement payments.

Pennsylvania regulations do require that Pennsylvania income tax be withheld from these amounts at the time of payment.

In this case, state withholding does not follow the federal rules.

The following table illustrates these assumptions:

|

Taxing Jurisdiction |

Include in Taxable Gross? |

Withholding Required? |

|---|---|---|

|

Federal |

Yes |

No |

|

Pennsylvania |

Yes |

Yes |

To define the moving expense earnings with the proper tax and withholding effects:

Define a Taxable Gross Component ID (here named MOV) to identify these moving expense reimbursement payments that require different tax treatments at the federal and state levels.

This table shows the relevant page elements and values on the Taxable Gross Definition Table page:

Page Element

Value

Explanation

Taxable Gross

Withholding

Base Gross

FWT

Taxable Gross Component ID

MOV

Withholding Follows Fed Rules

deselect the check box.

You do not want state tax withholding to follow the selection you will make for the Subject to FWT check box on the Earnings Table - Taxes page for these moving expense reimbursement amounts. You do not want federal income tax withheld on this earnings type, but you do want Pennsylvania income tax withheld.

Tax Gross Effect

No Effect

The earnings type is to be included in both the federal and Pennsylvania taxable grosses.

Enter the Taxable Gross Component ID when you set up the earnings on the Earnings Table - Taxes page.

This table shows the relevant page elements and values for setting up this moving expense reimbursement earning on the Earnings Table - Taxes page:

Page Element

Value

Explanation

Earnings Type

MOV

Earnings Description

Mov Exp Reimb – No Fed W/H

Moving expense reimbursement without federal withholding

Tax Method

Annualized

Subject to FWT

Selected

Taxable Gross Component ID

MOV

You must set up the taxable gross component ID before you can select it on this page.

Add to Gross Pay

Selected

Maintain Earnings Balances

Selected

Reference Table of Taxability and Withholding Setup

Use the table below to look up the table entries for any combination of federal and state/local taxing options that you might need for a particular earnings or taxable benefit. The table lists the correct values for the relevant fields on the Earnings table, Deduction table, and Taxable Gross Definition table.

|

Row |

Earnings Table - Taxes page: |

Deduction Table - Tax Effect page: |

State/local tax treatment you want: |

State/local withholding treatment you want: |

Taxable Gross Definition Table: |

Taxable Gross Definition Table: |

Taxable Gross Definition Table: |

|---|---|---|---|---|---|---|---|

|

Subject to FWT |

Withhold FWT |

Subject to state/local tax? |

Withhold SWT/LWT? |

Entry required? |

Tax Gross Effect |

Withholding Follows Federal Rules |

|

|

1 |

Yes |

Yes |

Yes |

Yes |

No |

NA |

NA |

|

2 |

Yes |

Yes |

Yes |

No |

Yes |

No effect |

No (deselected) |

|

3 |

Yes |

Yes |

No |

No |

Yes |

Subtracts from |

NA (check box does not apply) |

|

4 |

Yes |

No |

Yes |

No |

Yes |

No effect |

Yes (select) |

|

5 |

Yes |

No |

No |

No |

Yes |

Subtracts from |

NA (check box does not apply) |

|

6 |

Yes |

No |

Yes |

Yes |

Yes |

No effect |

No (deselected) |

|

7 |

No |

No |

Yes |

No |

Yes |

Adds to |

Yes (select) |

|

8 |

No |

No |

No |

No |

No |

NA |

NA |

|

9 |

No |

No |

Yes |

Yes |

Yes |

Adds to |

No (deselected) |

Row 6 contains the setup values for the MOV earnings described in the example.

Use the Taxable Gross Definition Table page (TAXGR_DEFIN_TBL) to set up a taxable gross definition, which defines the taxability and withholding for specific earnings or deduction types that must be treated differently at the state or local level than at the federal tax level.

Navigation

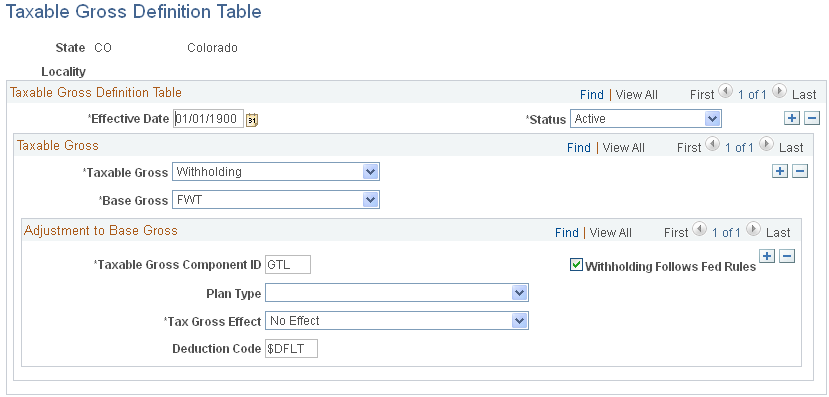

Image: Taxable Gross Definition Table page

This example illustrates the fields and controls on the Taxable Gross Definition Table page.

Taxable Gross

|

Field or Control |

Definition |

|---|---|

| Taxable Gross |

Select Disability, Unemployment, or Withholding to identify the type of taxable gross you're defining. |

| Base Gross |

Select either FUT (Federal Unemployment Tax) for unemployment and disability, or FWT (Federal Withholding Tax) for withholding. (FICA is not currently used as a base gross.) |

Adjustment to Base Gross

This scroll area lists the specific components for which adjustments are necessary.

|

Field or Control |

Definition |

|---|---|

| Taxable Gross Component ID |

The taxable gross component ID you specify must be unique in what it represents (for example, 401k, GTL, 125, SSS, and so forth). If it is not unique, it can cause the taxable grosses to be incorrect. |

| Withholding Follows Federal Rules |

This check box is selected by default. Deselect it if the withholding associated with the taxable gross component ID does not follow the same rules as federal withholding. This check box appears only if you select Withholding in the Taxable Gross field. This check box applies only to earnings and taxable benefit amounts identified by a taxable gross component ID. It has no effect on the processing of any before-tax deductions (such as 401(k) and Sec 125 amounts) for which there may also be entries on the Taxable Gross Definition table. |

| Tax Gross Effect |

This field controls the effect on the gross. It can either add to the gross, subtract from it, or have no effect. |

| Plan Type and Deduction Code |

Some states do not recognize certain before-tax benefits deductions. They require specific before-tax deductions to be included in taxable gross wages. Use these fields to identify such plans to the system by plan type and deduction code on the Taxable Gross Definition record for the applicable states. |